Global Industrial Controller Market

Market Size in USD Billion

CAGR :

%

USD

152.66 Billion

USD

262.27 Billion

2024

2032

USD

152.66 Billion

USD

262.27 Billion

2024

2032

| 2025 –2032 | |

| USD 152.66 Billion | |

| USD 262.27 Billion | |

|

|

|

|

Global Industrial Controller Market Analysis

The global industrial controller market is witnessing significant growth, driven by advancements in automation, IoT integration, and Industry 4.0 adoption. These controllers play a crucial role in optimizing manufacturing processes across industries such as automotive, energy, food & beverage, and pharmaceuticals, ensuring precision, efficiency, and real-time monitoring. The increasing demand for smart factories, coupled with the need for cost reduction, operational safety, and predictive maintenance, is fueling market expansion. In addition, the rise of AI-driven automation, edge computing, and cybersecurity solutions is shaping the future of industrial controllers, enabling seamless data processing and connectivity. As industries continue to embrace digital transformation, the market is poised for sustained growth, with a strong focus on scalability, interoperability, and sustainability.

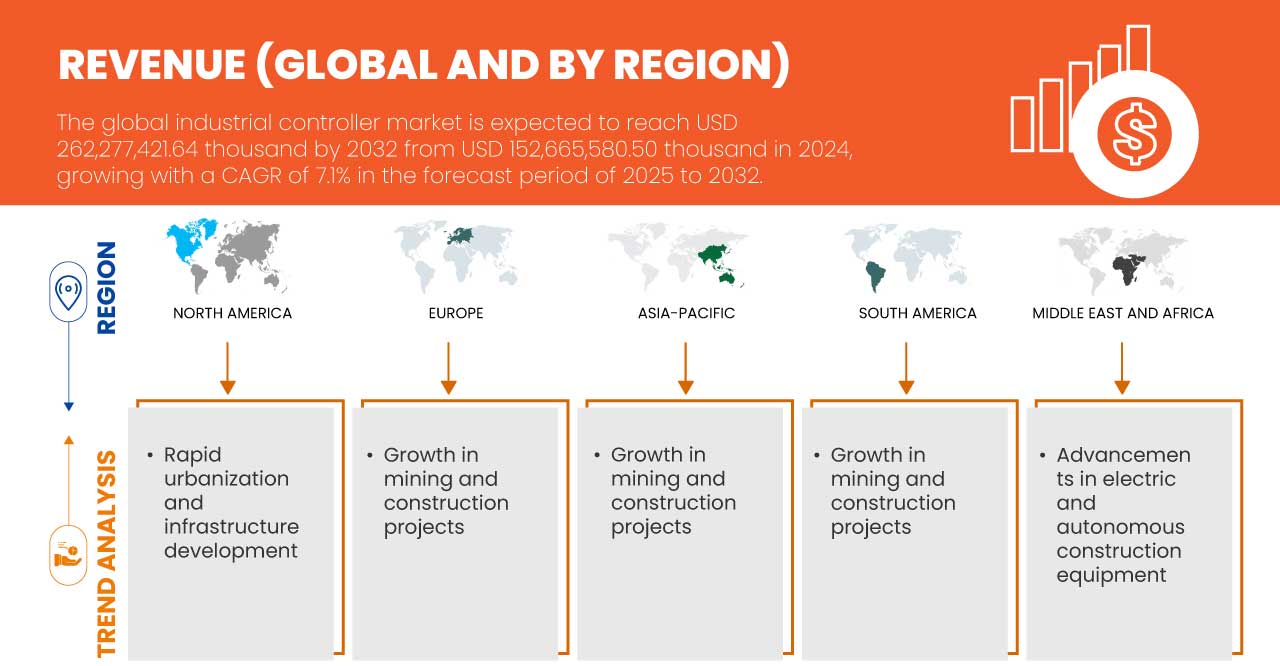

Global Industrial Controller Market Size

Data Bridge Market Research analyses that the global industrial controller market is expected to reach USD 262.27 billion by 2032 from USD 152.66 billion in 2024 growing with a CAGR of 7.1% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Global Industrial Controller Market Trends

“Edge Computing Enhances Industrial Controller Data Processing Speed”

Edge computing revolutionizes industrial controller data processing by shifting computation from centralized cloud servers to the network's edge, near data generation points. This proximity dramatically reduces latency, enabling real-time analysis crucial for time-sensitive industrial operations. Localized processing empowers swift decision-making, optimizing operational efficiency and minimizing costly downtime. By processing data on-site, edge computing alleviates network congestion and strengthens cybersecurity by reducing data transmission to external systems. This localized approach supports advanced predictive maintenance, allowing for proactive identification and resolution of potential equipment failures. As industries embrace automation and IoT, edge computing becomes vital for optimizing performance, ensuring responsiveness, and enhancing overall system reliability.

Report Scope and Global Industrial Controller Market Segmentation

|

Report Metric |

Global Industrial Controller Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of Middle East & Africa |

|

Key Market Players |

ABB (Switzerland), Siemens (Germany), Hitachi Industrial Equipment Systems Co., Ltd (Japan), Honeywell International Inc. (U.S.), Schneider Electric (France), Mitsubishi Electric Corporation (Japan), GE Grid Solutions, LLC (U.S.), Emerson Electric Co. (US), OMRON Corporation (Japan), Kawasaki Heavy Industries, Ltd (Japan), JTEKT Electronics India Pvt. Ltd. (Tokyo), Rockwell Automation (U.S.), YOKOGAWA ELECTRIC CORPORATION (Japan), DELTA ELECTRONICS, INC (Taiwan), AUDUBONCOMPANIES (U.S), ASROCK INDUSTRIAL (Taiwan), IDEC Corporation (Japan), Red Lion (U.S.), Ascon Tecnologic (Italy), WEINTEK USA. (U.S), ANAHEIM AUTOMATION, INC. (U.S), South Shore Controls, Inc (U.S), NATIONAL INSTRUMENTS CORP. (U.S.), META THERM FURNACE PVT LTD (India) |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Global Industrial Controller Market Definition

An industrial controller is a specialized automation device used to monitor, control, and optimize industrial processes and machinery in manufacturing, energy, transportation, and other industries. It ensures precision, efficiency, and reliability by processing real-time data and executing programmed instructions. Industrial controllers include Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems, each designed for specific automation tasks. These controllers integrate with sensors, actuators, and communication networks to enable seamless industrial operations, improve safety, reduce downtime, and support digital transformation through IoT and Industry 4.0 technologies

Global Industrial Controller Market Dynamics

Drivers

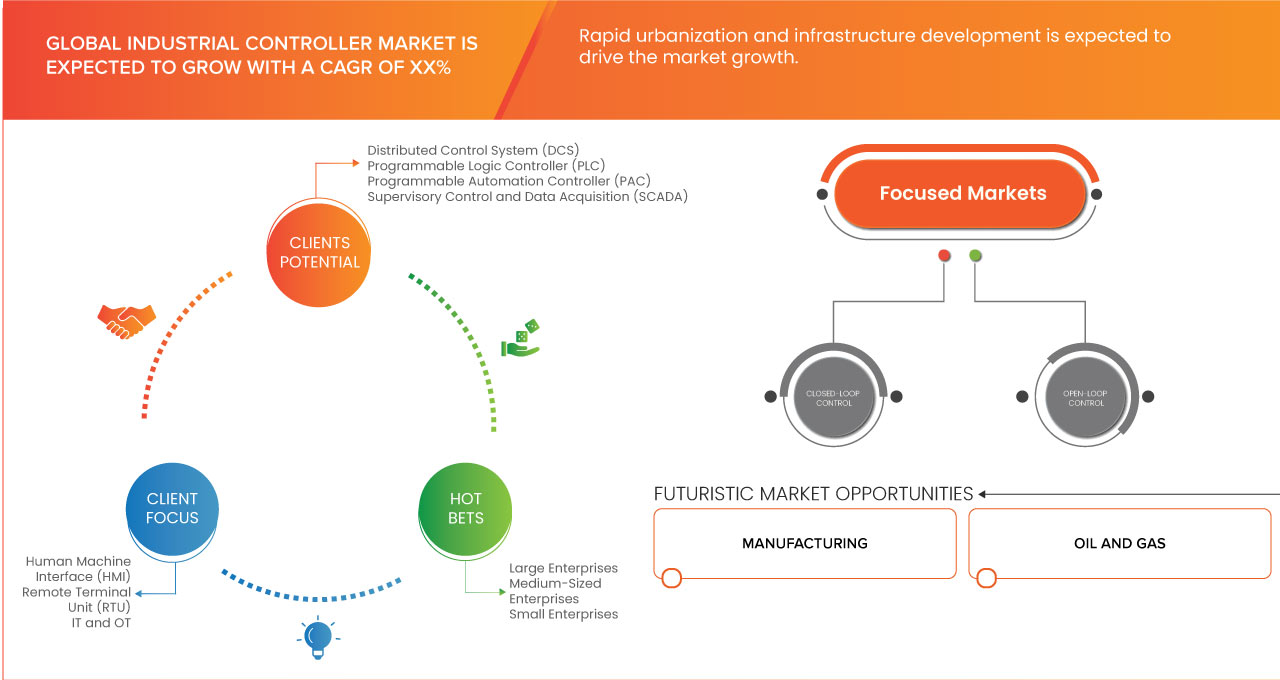

- Rapid Urbanization and Infrastructure Development

The growing expansion of manufacturing facilities worldwide is driving demand for industrial controller systems to enhance automation, efficiency, and process control. As industries adopt smart manufacturing and Industry 4.0 technologies, the need for Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), and Supervisory Control and Data Acquisition (SCADA) systems is increasing. These controllers optimize operations, reduce downtime, and improve productivity, making them essential for modern manufacturing environments. In addition, the rise of IoT-enabled automation and real-time monitoring further accelerates market growth, as industries seek advanced control solutions to streamline production and ensure operational reliability.

For Instance,

- In September 2024, according to a blog published by Fictiv, the number of enterprises in the manufacturing market is projected to grow to 6.14 million by 2029, reflecting a 2.15% CAGR. Between 2024 and 2029, material products and medical devices are expected to see the highest growth (16.7% increase each), followed by consumer goods and industrial products (10.8% each), while automotive products will grow by 7.1%. The 11.2% overall growth from 2024 to 2029 is more than double the 5.1% increase from 2018 to 2024, highlighting the rapid expansion of manufacturing. This surge in enterprises will drive higher demand for industrial controller systems, as manufacturers seek to enhance automation, efficiency, and process control to support the growing industry

Growing Need for Real-Time Monitoring Boosts Smart Control System Adoption

The increasing demand for real-time monitoring in industrial operations is driving the adoption of smart control systems, enhancing efficiency, predictive maintenance, and process optimization. Manufacturing is integrating PLCs, DCS, and SCADA systems with IoT and AI to enable instant data analysis, remote monitoring, and automated decision-making. This shift reduces downtime, improves safety, and ensures compliance with stringent operational standards. As manufacturing and infrastructure sectors prioritize data-driven control solutions, the global industrial controller market is witnessing significant growth, fueled by advancements in connectivity, edge computing, and smart automation technologies.

For instance,

- In February 2024, according to the blog published by Endeavor Business Media, LLC, the integration of PLCs and camera systems is enhancing automation in quality control, driven by the need for real-time monitoring in industrial environments. Advanced image comparison algorithms, pattern recognition techniques, and barcode or QR-code readers are being embedded into PLC programming, ensuring faster and more accurate inspections. Bosch Rexroth’s ctrlX OS further supports this shift by providing an app-based approach to industrial automation, enabling seamless integration of motion control, PLCs, IoT applications, and AI-driven vision systems

Opportunities

- Cloud-Based Analytics Optimize Real-Time Industrial Controller Insights

By leveraging cloud computing, businesses can process vast amounts of data from industrial controllers, gaining actionable insights with minimal latency. This facilitates improved decision-making, reduces downtime, and supports scalable operations. As industries increasingly adopt IoT and AI-driven automation, cloud-based analytics provide a competitive edge by ensuring seamless data integration, remote monitoring, and adaptive control strategies, driving innovation and operational excellence.

For instance,

- In May 2024, according to an article published by Endeavor Business Media, LLC, the OPC Foundation launched an IT/cloud initiative to enhance interoperability across IT and cloud platforms using OPC UA, enabling advanced data analytics, digital twins, and AI applications. Supported by major cloud providers such as AWS and Microsoft, this initiative optimizes OPC UA for cloud-based applications, reducing costs and improving usability. This presents a key market opportunity, as cloud-based analytics enhance real-time industrial controller insights by ensuring seamless data integration, AI-driven analytics, and secure, standardized communication, enabling predictive maintenance, improved efficiency, and smarter industrial automation

Growing Adoption of Modular and Scalable Controllers

The growing adoption of modular and scalable controllers presents a significant market opportunity by enabling flexible, cost-effective, and future-proof automation solutions. Industries can easily upgrade and expand their control systems without extensive overhauls, improving operational efficiency and reducing downtime. With the increasing demand for adaptable automation in manufacturing, energy, and industrial sectors, companies investing in modular controllers can offer enhanced customization, seamless integration with cloud-based analytics, and better performance optimization, positioning themselves for long-term growth in the evolving digital landscape.

For instance,

- In September 2024, according to the blog published by WTWH Media LLC, Applied Motion Products (AMP) introduced the CPBD-A-C remote control module, enhancing the flexibility and usability of its CSM34 Conveyor Smart Motor. This module enables remote configuration of motion profiles, real-time system monitoring, and manual conveyor adjustments, eliminating the need for operators to be physically near the motor. With integrated controls, a status display, and push-button functionality, it streamlines conveyor operations while reducing wiring complexity. This aligns with the growing adoption of modular and scalable controllers in the market, presenting significant opportunities by allowing industries to optimize automation processes with adaptable, easily upgradable, and cost-efficient solutions

Restraints/Challenges

- Cyber Threats Increase Industrial Controller System Vulnerabilities

As industrial systems become more interconnected through IoT and cloud-based control solutions, they become prime targets for cyberattacks, including ransomware, data breaches, and system disruptions. These vulnerabilities can lead to severe financial losses, production halts, and compromised safety in critical industries such as oil and gas, manufacturing, and power generation. Additionally, the high costs associated with implementing robust cybersecurity measures and compliance with evolving regulations create further challenges for market growth. The increasing sophistication of cyber threats continues to erode confidence in industrial automation, deterring businesses from fully embracing advanced control technologies.

For instance,

- In July 2024, according to an article published by TechTarget, Inc., Dragos researchers identified a new industrial control system-specific malware, FrostyGoop, which exploits the Modbus transmission control protocol to attack operational technology environments. The malware, linked to a January attack on a Ukrainian energy provider, disrupted heating for over 600 buildings by manipulating Enco controllers through Modbus commands. With over 46,000 systems worldwide using the Modbus protocol, FrostyGoop presents a significant cybersecurity threat, as it remains undetectable by antivirus software and does not require prior system compromise

Semiconductor Shortages Delay Controller Manufacturing And Supply Chains

The ongoing semiconductor shortages have significantly impacted controller manufacturing and disrupted supply chains, posing a major challenge to the market. With critical components in short supply, production delays have increased, leading to extended lead times and higher costs for manufacturers and end-users. This bottleneck affects various industries relying on advanced controllers for automation, limiting their ability to scale operations efficiently. As demand for controllers continues to rise, companies must navigate supply chain constraints, explore alternative sourcing strategies, and invest in long-term solutions to mitigate the risks associated with semiconductor shortages.

For instance,

- In April 2024, according to an article published by The Indian Express [P] Ltd., a powerful 7.4 magnitude earthquake in Taiwan raised fresh concerns about semiconductor shortages, potentially impacting controller manufacturing and global supply chains. Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest contract chipmaker, temporarily halted production at some of its plants but managed to resume over 70% of operations within the same day. This highlights the persistent vulnerability of global supply chains to natural disasters, reinforcing the need for diversified sourcing strategies and resilient manufacturing ecosystems to mitigate such challenges

In an increasingly interconnected global market, semiconductor shortages continue to pose significant challenges to controller manufacturing and supply chains. Disruptions in mature process node production, rising demand across industries, and geopolitical factors have created supply constraints that impact industrial automation, automotive, and other critical sectors. Delays in chip availability can lead to production slowdowns, increased costs, and reduced scalability for manufacturers relying on these components. As demand surges and supply remains uncertain, businesses must adopt proactive strategies, including supply chain diversification, strategic partnerships, and investment in alternative technologies, to mitigate risks and ensure long-term stability.

Global Industrial Controller Market Scope

The global industrial controller market is segmented into six notable segments based on the type, components, control, network type, enterprise size, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

Components

- Human Machine Interface (HMI)

- Remote Terminal Unit (RTU)

- IT And OT

- By Type

- Hardware Systems

- Software Systems

- By Type

- Programmable Automation Controller

- Control Loop

- Others

Control

- Closed-Loop Control

- Open-Loop Control

- On-Off Control

- Feed-Forward Control

Network Type

- Ethernet For Control Automation Technology (ETHERCAT)

- Modbus

- Common Industrial Protocol (CIP)

- Process Filed Bus (Profibus)

- By Type

- RTU To MTU

- MTU To MTU

- RTU To RTU

- By Type

- Open Platform Communication (OPC)

- By Operating System

- DCOM

- Com

- Ole

- By Operating System

- Distributed Network Protocol (Dnp3)

- Building Automation And Control Networks (BACNET)

Enterprise Size

- Large Enterprises

- Medium-Sized Enterprises

- Small Enterprises

Application

- Manufacturing

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Oil And Gas

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By End-User Process

- Refining And Processing

- Production And Extraction

- Transportation And Storage

- Drilling And Exploration

- By Deployment Type

- On-Shore Deployment

- Off-Shore Deployment

- By Function

- Process Automation And Control

- Real-Time Monitoring And Data Acquisition

- Operational Efficiency And Optimization

- Safety And Risk Management

- By Type

- Energy And Utilities

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Automotive

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Food Processing And Beverages

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Water And Wastewater

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Aerospace And Aviation

- By Type

- Distributed Control System (DCS)

- Programmable Logic Controller (PLC)

- Programmable Automation Controller (PAC)

- Supervisory Control And Data Acquisition (SCADA)

- By Type

- Others

Global Industrial Controller Market Regional Analysis

The global industrial controller market is segmented into six notable segments based on the type, components, control, network type, enterprise size, and application

The countries covered in the Industrial Controller Market report as U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Brazil, Argentina, rest of South America. U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and rest of Middle East & Africa

Asia Pacific is expected to dominate the global industrial controller market due to due to its rapid industrialization, strong manufacturing base, and significant investments in automation and smart factories. The region's expanding consumer electronics, automotive, and semiconductor industries further fuel demand for advanced industrial controllers.

North America is the fastest growing region in the global industrial controller market due to significant investments in technology and renewable energy further boost its leadership in adopting and expanding industrial controller solutions.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Industrial Controller Market Share

Industrial controller market competitive landscape provides details of the competitor. details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Global Free Space Optical Communication Market.

Global Industrial Controller Market Leaders Operating in the Market are:

- ABB (Switzerland)

- Siemens (Germany)

- Hitachi Industrial Equipment Systems Co., Ltd (Japan)

- Honeywell International Inc. (U.S.)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- GE Grid Solutions, LLC (U.S.)

- Emerson Electric Co. (US)

- OMRON Corporation (Japan)

- Kawasaki Heavy Industries, Ltd (Japan)

- JTEKT Electronics India Pvt. Ltd. (Tokyo)

- Rockwell Automation (U.S.)

- YOKOGAWA ELECTRIC CORPORATION (Japan)

- DELTA ELECTRONICS, INC (Taiwan)

- AUDUBONCOMPANIES (U.S)

- ASROCK INDUSTRIAL (Taiwan)

- IDEC Corporation (Japan)

- Red Lion (U.S.)

- Ascon Tecnologic (Italy)

- WEINTEK USA. (U.S)

- ANAHEIM AUTOMATION, INC. (U.S)

- South Shore Controls, Inc (U.S)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- META THERM FURNACE PVT LTD (India)

Latest Developments in Global Industrial Controller Market

- In May 2024, Siemens introduced the Simatic Automation Workstation at Automate 2024, a software-defined solution replacing PLCs, HMIs, and edge devices with a centralized system. Ford Motor Company will be the first to deploy it. This innovation strengthens Siemens' Industrial Controller portfolio by enhancing IT-OT integration, security, and scalability, offering manufacturers greater flexibility and efficiency in automation

- In October 2024, Emerson has finalized its USD 8.2 billion acquisition of National Instruments (NI), incorporating NI into its new Test & Measurement segment and further solidifying its leadership in global automation. This move benefits NI by expanding the market reach of its industrial controller offerings through enhanced product synergies with Emerson’s automation portfolio and improved access to high-growth industrial software and control solutions

- In April 2024, Siemens unveiled the Simatic S7-1200 G2 controller at Hannover Messe 2024, its first new generation in a decade. Launching in winter 2024, it offers enhanced motion control, flexible safety, and improved performance, integrating with Siemens Xcelerator. This strengthens Siemens' Industrial Controller lineup by bridging OT and IT, boosting efficiency, and enabling smarter automation

- In October 2023, Emerson has finalized its USD 8.2 billion acquisition of National Instruments (NI), incorporating NI into its new Test & Measurement segment and further solidifying its leadership in global automation. This move benefits NI by expanding the market reach of its industrial controller offerings through enhanced product synergies with Emerson’s automation portfolio and improved access to high-growth industrial software and control solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL INDUSTRIAL CONTROLLER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL

4.2.2 ECONOMIC

4.2.3 SOCIAL

4.2.4 TECHNOLOGICAL

4.2.5 ENVIRONMENTAL

4.2.6 LEGAL

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 GLOBAL INDUSTRIAL CONTROLLER MARKET: IMPORT-EXPORT SCENARIO

4.5.1 IMPORT TRENDS: KEY PLAYERS AND MARKET DYNAMICS

4.5.2 EXPORT SCENARIO: GLOBAL SUPPLY CHAIN AND TRADE FLOW

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 GLOBAL MARKET FEEDBACK TO THE O-PAS STRUCTURE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 MANUFACTURING EXPANSION INCREASES CONTROLLER SYSTEM DEMAND

5.1.2 GROWING NEED FOR REAL-TIME MONITORING BOOSTS SMART CONTROL SYSTEM ADOPTION

5.1.3 INDUSTRIAL ROBOTS RELY ON SOPHISTICATED AUTOMATION CONTROLLERS FOR OPTIMAL PERFORMANCE

5.1.4 IOT-ENABLED CONTROLLERS IMPROVE REAL-TIME PROCESS MONITORING

5.2 RESTRAINTS

5.2.1 CYBER THREATS INCREASE INDUSTRIAL CONTROLLER SYSTEM VULNERABILITIES

5.2.2 FREQUENT SOFTWARE UPDATES CAUSE OPERATIONAL DISRUPTIONS

5.3 OPPORTUNITIES

5.3.1 EDGE COMPUTING ENHANCES INDUSTRIAL CONTROLLER DATA PROCESSING SPEED

5.3.2 CLOUD-BASED ANALYTICS OPTIMIZE REAL-TIME INDUSTRIAL CONTROLLER INSIGHTS

5.3.3 GROWING ADOPTION OF MODULAR AND SCALABLE CONTROLLERS

5.4 CHALLENGES

5.4.1 SEMICONDUCTOR SHORTAGES DELAY CONTROLLER MANUFACTURING AND SUPPLY CHAINS

5.4.2 HUMAN-MACHINE COLLABORATION RISKS INCREASE WORKPLACE SAFETY CONCERNS

6 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY TYPE

6.1 OVERVIEW

6.2 DISTRIBUTED CONTROL SYSTEM (DCS)

6.3 PROGRAMMABLE LOGIC CONTROLLER (PLC)

6.4 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

6.5 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

7 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS

7.1 OVERVIEW

7.2 HUMAN MACHINE INTERFACE (HMI)

7.3 REMOTE TERMINAL UNIT (RTU)

7.4 IT AND OT

7.4.1 IT AND OT, BY TYPE

7.4.1.1 HARDWARE SYSTEMS

7.4.1.2 SOFTWARE SYSTEMS

7.5 PROGRAMMABLE AUTOMATION CONTROLLER

7.6 CONTROL LOOP

7.7 OTHERS

8 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY CONTROL

8.1 OVERVIEW

8.2 CLOSED-LOOP CONTROL

8.3 OPEN-LOOP CONTROL

8.4 ON-OFF CONTROL

8.5 FEED-FORWARD CONTROL

9 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE

9.1 OVERVIEW

9.2 ETHERNET FOR CONTROL AUTOMATION TECHNOLOGY (ETHERCAT)

9.3 MODBUS

9.4 COMMON INDUSTRIAL PROTOCOL (CIP)

9.5 PROCESS FILED BUS (PROFIBUS)

9.5.1 PROCESS FILED BUS (PROFIBUS), BY TYPE

9.5.1.1 RTU TO MTU

9.5.1.2 MTU TO MTU

9.5.1.3 RTU TO RTU

9.6 OPEN PLATFORM COMMUNICATION (OPC)

9.6.1 OPEN PLATFORM COMMUNICATION (OPC), BY OPERATING SYSTEM

9.6.1.1 DCOM

9.6.1.2 COM

9.6.1.3 OLE

9.7 DISTRUBUTED NETWORK PROTOCOL (DNP3)

9.8 BUILDING AUTOMATION AND CONTROL NETWORKS (BACNET)

10 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISES

10.3 MEDIUM-SIZED ENTERPRISES

10.4 SMALL ENTERPRISES

11 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 MANUFACTURING

11.2.1 MANUFACTURING, BY TYPE

11.2.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.2.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.2.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.2.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.3 OIL AND GAS

11.3.1 OIL AND GAS, BY TYPE

11.3.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.3.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.3.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.3.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.3.2 OIL AND GAS, BY END-USER PROCESS

11.3.2.1 REFINING AND PROCESSING

11.3.2.2 PRODUCTION AND EXTRACTION

11.3.2.3 TRANSPORTATION AND STORAGE

11.3.2.4 DRILLING AND EXPLORATION

11.3.3 OIL AND GAS, BY DEPLOYMENT TYPE

11.3.3.1 ON-SHORE DEPLOYMENT

11.3.3.2 OFF-SHORE DEPLOYMENT

11.3.4 OIL AND GAS, BY FUNCTION

11.3.4.1 PROCESS AUTOMATION AND CONTROL

11.3.4.2 REAL-TIME MONITORING AND DATA ACQUISITION

11.3.4.3 OPERATIONAL EFFICIENCY AND OPTIMIZATION

11.3.4.4 SAFETY AND RISK MANAGEMENT

11.4 ENERGY AND UTILITIES

11.4.1 ENERGY AND UTILITIES, BY TYPE

11.4.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.4.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.4.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.4.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.5 AUTOMOTIVE

11.5.1 AUTOMOTIVE, BY TYPE

11.5.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.5.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.5.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.5.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.6 FOOD PROCESSING AND BEVERAGES

11.6.1 FOOD PROCESSING AND BEVERAGES, BY TYPE

11.6.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.6.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.6.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.6.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.7 WATER AND WASTEWATER

11.7.1 WATER AND WASTEWATER, BY TYPE

11.7.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.7.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.7.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.7.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.8 AEROSPACE AND AVIATION

11.8.1 AEROSPACE AND AVIATION, BY TYPE

11.8.1.1 DISTRIBUTED CONTROL SYSTEM (DCS)

11.8.1.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.8.1.3 PROGRAMMABLE AUTOMATION CONTROLLER (PAC)

11.8.1.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

11.9 OTHERS

12 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY REGION

12.1 OVERVIEW

12.2 ASIA-PACIFIC

12.3 NORTH AMERICA

12.4 EUROPE

12.5 MIDDLE EAST AND AFRICA

12.6 SOUTH AMERICA

13 GLOBAL INDUSTRIAL CONTROLLER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ABB

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 SIEMENS

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 HONEYWELL INTERNATIONAL INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 SCHNEIDER ELECTRIC

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ANAHEIM AUTOMATION, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ASCON TECNOLOGIC

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ASROCK INDUSTRIAL.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 AUDUBON COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DELTA ELECTRONICS, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 EMERSON ELECTRIC CO.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 GE VERNOVA (AS A PART OF GENERAL ELECTRIC COMPANY)

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 BUSINESS PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 IDEC CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 BRAND PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 JTEKT ELECTRONICS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 KAWASAKI HEAVY INDUSTRIES, LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 META THERM FURNACE PVT LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MITSUBISHI ELECTRIC CORPORATION

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 NATIONAL INSTRUMENTS CORP.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 OMRON CORPORATION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENTS

15.2 RED LION

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ROCKWELL AUTOMATION

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 SOUTH SHORE CONTROLS, INC

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 WEINTEK USA

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 YOKOGAWA ELECTRIC CORPORATION

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 PRODUCT PORTFOLIO

15.24.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COMPARISON TABLE

TABLE 2 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 GLOBAL DISTRIBUTED CONTROL SYSTEM (DCS) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 GLOBAL PROGRAMMABLE LOGIC CONTROLLER (PLC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 GLOBAL PROGRAMMABLE AUTOMATION CONTROLLER (PAC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 GLOBAL SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 8 GLOBAL HUMAN MACHINE INTERFACE (HMI) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 GLOBAL REMOTE TERMINAL UNIT (RTU) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 GLOBAL IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 GLOBAL IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 GLOBAL PROGRAMMABLE AUTOMATION CONTROLLER IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 GLOBAL CONTROL LOOP IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 GLOBAL OTHERS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 16 GLOBAL CLOSED-LOOP CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 GLOBAL OPEN-LOOP CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 GLOBAL ON-OFF CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 GLOBAL FEED-FORWARD CONTROL IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 GLOBAL ETHERNET FOR CONTROL AUTOMATION TECHNOLOGY (ETHERCAT) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 GLOBAL MODBUS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 GLOBAL COMMON INDUSTRIAL PROTOCOL (CIP) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 GLOBAL PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 GLOBAL PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 GLOBAL OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 GLOBAL OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 28 GLOBAL DISTRIBUTED NETWORK PROTOCOL (DNP3) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 GLOBAL BUILDING AUTOMATION AND CONTROL NETWORKS (BACNET) IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 31 GLOBAL LARGE ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 GLOBAL MEDIUM-SIZED ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 GLOBAL SMALL ENTERPRISES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 GLOBAL MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 GLOBAL MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 GLOBAL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 GLOBAL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GLOBAL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 40 GLOBAL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 GLOBAL OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 42 GLOBAL ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 GLOBAL ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GLOBAL AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 GLOBAL AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 GLOBAL FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 GLOBAL FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 GLOBAL WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 GLOBAL WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 GLOBAL AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 51 GLOBAL AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 GLOBAL OTHERS IN INDUSTRIAL CONTROLLER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 GLOBAL INDUSTRIAL CONTROLLER MARKET, BY REGION 2018-2032, USD (THOUSAND)

TABLE 54 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 CHINA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 JAPAN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 JAPAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 105 JAPAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 JAPAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 107 JAPAN ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 JAPAN AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 JAPAN FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 JAPAN WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 JAPAN AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 114 SOUTH KOREA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 116 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 SOUTH KOREA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 SOUTH KOREA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 119 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 120 SOUTH KOREA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 121 SOUTH KOREA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 SOUTH KOREA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 SOUTH KOREA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 SOUTH KOREA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH KOREA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDIA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDIA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 133 INDIA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 INDIA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 135 INDIA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 INDIA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 INDIA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 138 INDIA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 139 INDIA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 INDIA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 INDIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 INDIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 143 INDIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 INDIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 145 INDIA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 INDIA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 INDIA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 INDIA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 INDIA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 152 TAIWAN IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 154 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 TAIWAN PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 TAIWAN OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 157 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 158 TAIWAN INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 159 TAIWAN MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 TAIWAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 TAIWAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 162 TAIWAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 TAIWAN OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 164 TAIWAN ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 TAIWAN AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 TAIWAN FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 TAIWAN WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 TAIWAN AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 171 AUSTRALIA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 173 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 AUSTRALIA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 AUSTRALIA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 176 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 177 AUSTRALIA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 178 AUSTRALIA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 AUSTRALIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 AUSTRALIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 181 AUSTRALIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 AUSTRALIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 183 AUSTRALIA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 AUSTRALIA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 AUSTRALIA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 AUSTRALIA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 AUSTRALIA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 190 INDONESIA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 192 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 INDONESIA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 INDONESIA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 195 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 196 INDONESIA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 197 INDONESIA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 INDONESIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 INDONESIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 200 INDONESIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 INDONESIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 202 INDONESIA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 INDONESIA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 INDONESIA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 INDONESIA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 INDONESIA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 THAILAND INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 THAILAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 219 THAILAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 THAILAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 221 THAILAND ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 THAILAND AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 THAILAND FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 THAILAND WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 THAILAND AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 228 SINGAPORE IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 230 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SINGAPORE PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SINGAPORE OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 233 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 234 SINGAPORE INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 SINGAPORE MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SINGAPORE OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 SINGAPORE OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 238 SINGAPORE OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SINGAPORE OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 240 SINGAPORE ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SINGAPORE AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SINGAPORE FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SINGAPORE WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 SINGAPORE AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 247 MALAYSIA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 249 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 MALAYSIA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 MALAYSIA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 252 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 253 MALAYSIA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 254 MALAYSIA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 MALAYSIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 MALAYSIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 257 MALAYSIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 MALAYSIA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 259 MALAYSIA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 MALAYSIA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 MALAYSIA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 MALAYSIA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 MALAYSIA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 VIETNAM OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 276 VIETNAM OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 VIETNAM OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 278 VIETNAM ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 VIETNAM AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 VIETNAM FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 VIETNAM WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 VIETNAM AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 285 PHILIPPINES IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 287 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 PHILIPPINES PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 PHILIPPINES OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 290 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 291 PHILIPPINES INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 292 PHILIPPINES MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 PHILIPPINES OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 PHILIPPINES OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 295 PHILIPPINES OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 PHILIPPINES OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 297 PHILIPPINES ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 PHILIPPINES AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 PHILIPPINES FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 PHILIPPINES WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 PHILIPPINES AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 304 NEW ZEALAND IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 306 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 NEW ZEALAND PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 NEW ZEALAND OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 309 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 310 NEW ZEALAND INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 311 NEW ZEALAND MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 NEW ZEALAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 NEW ZEALAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 314 NEW ZEALAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 NEW ZEALAND OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 316 NEW ZEALAND ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 NEW ZEALAND AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 NEW ZEALAND FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 NEW ZEALAND WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 NEW ZEALAND AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 REST OF ASIA-PACIFIC INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 323 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 325 NORTH AMERICA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 327 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 NORTH AMERICA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 NORTH AMERICA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 330 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 331 NORTH AMERICA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 332 NORTH AMERICA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 NORTH AMERICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 NORTH AMERICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 335 NORTH AMERICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 NORTH AMERICA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 337 NORTH AMERICA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 NORTH AMERICA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 NORTH AMERICA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 NORTH AMERICA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 NORTH AMERICA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 U.S. INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 U.S. INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 344 U.S. IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 U.S. INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 346 U.S. INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 U.S. PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 U.S. OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 349 U.S. INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 350 U.S. INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 351 U.S. MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 U.S. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 353 U.S. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 354 U.S. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 U.S. OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 356 U.S. ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 U.S. AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 U.S. FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 U.S. WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 U.S. AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 CANADA INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 CANADA INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 363 CANADA IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 CANADA INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 365 CANADA INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 CANADA PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 CANADA OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 368 CANADA INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 369 CANADA INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 370 CANADA MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 CANADA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 CANADA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 373 CANADA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 CANADA OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 375 CANADA ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 CANADA AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 CANADA FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 CANADA WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 CANADA AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 MEXICO INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 MEXICO INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 382 MEXICO IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 MEXICO INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 384 MEXICO INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 MEXICO PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 MEXICO OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 387 MEXICO INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)

TABLE 388 MEXICO INDUSTRIAL CONTROLLER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 389 MEXICO MANUFACTURING IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 MEXICO OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 MEXICO OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY END-USER PROCESS, 2018-2032 (USD THOUSAND)

TABLE 392 MEXICO OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY DEPLOYMENT TYPE, 2018-2032 (USD THOUSAND)

TABLE 393 MEXICO OIL AND GAS IN INDUSTRIAL CONTROLLER MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 394 MEXICO ENERGY AND UTILITIES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 MEXICO AUTOMOTIVE IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 MEXICO FOOD PROCESSING AND BEVERAGES IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 MEXICO WATER AND WASTEWATER IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 MEXICO AEROSPACE AND AVIATION IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 EUROPE INDUSTRIAL CONTROLLER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 400 EUROPE INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 EUROPE INDUSTRIAL CONTROLLER MARKET, BY COMPONENTS, 2018-2032 (USD THOUSAND)

TABLE 402 EUROPE IT AND OT IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 EUROPE INDUSTRIAL CONTROLLER MARKET, BY CONTROL, 2018-2032 (USD THOUSAND)

TABLE 404 EUROPE INDUSTRIAL CONTROLLER MARKET, BY NETWORK TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 EUROPE PROCESS FILED BUS (PROFIBUS) IN INDUSTRIAL CONTROLLER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 EUROPE OPEN PLATFORM COMMUNICATION (OPC) IN INDUSTRIAL CONTROLLER MARKET, BY OPERATING SYSTEM, 2018-2032 (USD THOUSAND)

TABLE 407 EUROPE INDUSTRIAL CONTROLLER MARKET, BY ENTERPRISE SIZE, 2018-2032 (USD THOUSAND)