Global Upstream Petrotechnical Training Services Market

Market Size in USD Million

CAGR :

%

USD

855.11 Million

USD

1,390.00 Million

2024

2032

USD

855.11 Million

USD

1,390.00 Million

2024

2032

| 2025 –2032 | |

| USD 855.11 Million | |

| USD 1,390.00 Million | |

|

|

|

|

Upstream Petrotechnical Training Services Market Size

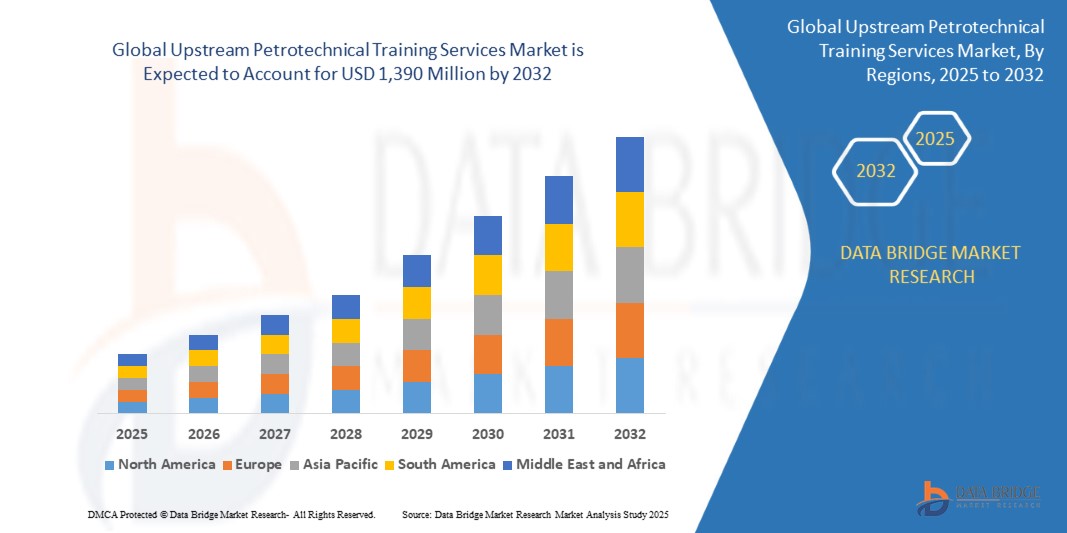

- The Global Upstream Petrotechnical Training Services Market was valued at USD 855.11 million in 2024 and is projected to reach USD 1,390 Million by 2032, growing at a CAGR of 7.18% during the forecast period.

- This growth is driven by the increasing demand for highly skilled technical personnel across upstream oil and gas operations, combined with the rapid digitization of E&P activities and the integration of advanced simulation-based learning tools.

Upstream Petrotechnical Training Services Market Analysis

- The upstream sector of the oil and gas industry relies heavily on technical expertise in domains such as geology, drilling, reservoir management, and production operations. Petrotechnical training services are crucial in bridging the knowledge gap, especially as the industry transitions toward digital oilfields and data-driven reservoir optimization.

- With the adoption of technologies like AI/ML in reservoir modeling, digital twins for field simulation, and automated drilling systems, there is growing need for engineers and technicians to upgrade their competencies. This is fueling the demand for hybrid and immersive training platforms that blend theory with real-time field simulations.

- The shift in industry demographics—due to retiring workforces in mature markets—is also creating a talent vacuum. Companies are addressing this through succession planning, competency-based development programs, and certification-oriented upskilling pathways facilitated by specialized training providers.

- Moreover, upstream operators are expanding operations in deepwater, shale, and unconventional reserves, which require highly specialized training. As a result, tailored petrotechnical programs are being adopted for complex reservoir environments, including high-pressure, high-temperature (HPHT) and offshore assets.

Report Scope and Upstream Petrotechnical Training Services Market Segmentation

|

Attributes |

Upstream Petrotechnical Training Services Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Upstream Petrotechnical Training Services Market Trends

“Digital Platforms, Remote Learning, and Competency-Based Training Models Redefine Oilfield Learning”

- A key trend reshaping the petrotechnical training landscape is the rapid adoption of digital learning platforms. Major oilfield training providers are transitioning from traditional classroom methods to interactive, simulation-rich, and cloud-based training environments. This shift enables learners to engage in realistic drilling or reservoir management scenarios while minimizing field downtime and travel expenses.

- Remote learning and hybrid delivery formats are becoming the new standard. With increased reliance on VR/AR simulation, AI-driven performance feedback, and gamified learning tools, upstream companies are equipping engineers and operators to gain technical skills in virtual settings that mirror live wellsite operations.

- Another trend is the rise of competency-based training frameworks. E&P firms and training providers are developing structured learning paths that align with role-specific capabilities, certification requirements, and international safety standards (like IWCF and IADC). These programs improve talent readiness while ensuring compliance and operational excellence.

- Additionally, there is growing focus on environmental and HSE modules within upstream curricula. As the industry aligns with low-carbon strategies and ESG reporting, training programs are being expanded to include sustainable field development, emissions reduction best practices, and zero-harm safety cultures.

Upstream Petrotechnical Training Services Market Dynamics

Driver

“Growing Complexity of Oilfield Operations and Need for Digitally-Skilled Workforce”

- As oilfields become more complex—with deepwater wells, enhanced oil recovery (EOR), and intelligent completions—the need for specialized training in disciplines like petrophysics, well control, and reservoir simulation has increased significantly.

- The industry’s push toward automation, digital twins, and AI-driven geoscience interpretation is creating demand for professionals skilled in both domain knowledge and digital technologies. Training programs are being restructured to include hands-on instruction in proprietary software, cloud modeling platforms, and real-time well monitoring tools.

- Globalization of E&P operations means that companies must upskill diverse teams across geographies. Centralized learning platforms and standardized training frameworks help unify operational procedures and safety protocols across international assets.

- Governments and regulatory bodies are mandating certification and HSE compliance, especially for offshore and HPHT environments, further boosting the need for accredited petrotechnical training services.

Restraint/Challenge

“Budget Limitations, Regional Skill Gaps, and Resistance to Digital Learning Models”

- Training budgets in the upstream sector are often the first to be cut during oil price volatility or cost-reduction cycles. Smaller operators and independent E&P firms may delay investment in structured technical training, slowing overall market penetration.

- Skill shortages and education gaps, particularly in Africa, Southeast Asia, and parts of South America, present barriers to scaling complex petrotechnical training programs. Language limitations and lack of technical infrastructure also hinder uniform adoption.

- Despite the benefits, resistance to digital learning models persists in traditional oilfield environments. Some professionals prefer hands-on learning or instructor-led courses, challenging providers to build trust and demonstrate the effectiveness of virtual alternatives.

- Interoperability issues between different training platforms, lack of universal standards in simulator technologies, and inconsistent certification recognition across regions further restrict seamless workforce development.

Automotive Battery Market Scope

The market is segmented on the battery type, vehicle type, engine type, functions and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Training Mode |

|

|

By Training Type |

|

|

By Service Provider |

|

|

By End User |

|

Upstream Petrotechnical Training Services Market Scope

The market is segmented by training mode, training type, service provider, and end user, reflecting the evolving landscape of oil & gas workforce development strategies.

- By Training Mode

Includes classroom-based, online, simulator-based, and blended learning formats.

Blended learning models are gaining popularity due to their flexibility, allowing field personnel to balance operational responsibilities while undergoing technical training. is experiencing strong growth as E&P firms adopt immersive technologies to reduce training time and improve retention in complex drilling and reservoir scenarios.

- By Training Type

Segmented into geology & geophysics, reservoir engineering, drilling engineering, production technology, petrophysics, and health & safety.

Reservoir engineering and drilling engineering training programs lead in demand due to their critical role in upstream project planning, optimization, and execution. Health & safety training remains an essential compliance focus across all operational sites, especially for offshore assets.

- By Service Provider

Divided into OEM training providers, independent training institutes, and university partnerships.

Independent training providers dominate in 2025 due to their tailored course offerings, global availability, and technical collaborations with oilfield service companies. OEMs are also increasingly offering training tied to proprietary software and equipment to ensure workforce readiness.

- By End User

Includes National Oil Companies (NOCs), International Oil Companies (IOCs), and Independent E&P firms. NOCs lead in training investment due to national capacity-building programs and upstream expansion projects. IOCs are focusing on continuous professional development and reskilling as part of digital transformation initiatives, while independent E&P companies are adopting cost-effective online training solutions to upskill field engineers.

Upstream Petrotechnical Training Services Market Regional Analysis

- North America leads the Global Upstream Petrotechnical Training Services Market in 2025, owing to a mature oil & gas sector, widespread adoption of digital oilfield technologies, and strong presence of service companies like Schlumberger, Halliburton, and IHRDC.

U.S.-based operators prioritize simulator-based learning and digital well control solutions to enhance safety, productivity, and efficiency across complex assets including shale basins and deepwater platforms.

- Europe is a key region, driven by high demand for offshore safety certification, decommissioning knowledge transfer, and advanced reservoir training for North Sea operations.

Countries such as the United Kingdom, Norway, and Netherlands are expanding partnerships between oil companies and academic institutions to deliver ESG-compliant and energy transition-aligned training programs.

- Asia-Pacific is expected to register the fastest CAGR from 2025 to 2032, supported by increasing upstream investments in India, China, Australia, and Southeast Asia.

The region is focused on upskilling local talent for unconventional and offshore reserves, with digital learning platforms, multilingual content, and government-led oil & gas skilling missions gaining momentum.

- Middle East and Africa (MEA) is experiencing steady growth driven by national energy strategies in Saudi Arabia, UAE, Nigeria, and Ghana that emphasize local talent development through public-private training centers.

Programs supporting HSE certification, well intervention, and smart field training are being rolled out to meet the technical needs of expanding hydrocarbon projects.

- South America, especially Brazil, is expanding offshore-focused training services with emphasis on pre-salt basin operations, FPSO platforms, and subsea technologies.

Partnerships between Petrobras, academic institutions, and independent training firms are central to upskilling workers for high-complexity deepwater fields.

United States Upstream Petrotechnical Training Services Market Insights

The U.S. remains a key market for upstream training services, led by a mature E&P sector, high well complexity, and demand for digital and AI-integrated learning platforms. Major oilfield service companies based in Houston and Midland offer cutting-edge simulation and compliance programs aligned with industry standards. The U.S. also leads in offshore HSE and well control training.

United Kingdom Upstream Petrotechnical Training Services Market Insights

The U.K., with its North Sea operations, has a strong focus on offshore safety certification, deepwater reservoir training, and decommissioning knowledge transfer. Partnerships between industry and universities like Aberdeen are shaping advanced curricula in energy transition and subsea engineering.

India Upstream Petrotechnical Training Services Market Insights

India is an emerging training hub, with state-run oil companies investing in capacity-building for deepwater and unconventional fields. The country is scaling up training for young professionals through digital platforms and university alliances under the government’s Skilling India initiative.

Saudi Arabia Upstream Petrotechnical Training Services Market Insights

Saudi Arabia is rapidly expanding upstream training under Vision 2030, focusing on developing local talent through national oil companies and global partnerships. Aramco and TVTC have launched large-scale petrotechnical training centers to prepare engineers for complex field operations.

Nigeria Upstream Petrotechnical Training Services Market Insights

Nigeria’s upstream training market is evolving, supported by local content laws and capacity-building mandates. Training centers focus on rig operations, HSE, and well intervention, helping bridge the skill gap in the Gulf of Guinea region.

Brazil Upstream Petrotechnical Training Services Market Insights

Brazil is investing in offshore-focused petrotechnical education, with training programs centered on pre-salt reservoir development, FPSO operations, and subsea technology. Petrobras and regional institutions are key players driving localized training content.

Upstream Petrotechnical Training Services Market Share

The Upstream Petrotechnical Training Services industry is primarily led by well-established companies, including:

- Schlumberger Limited

- Halliburton Company

- PetroSkills

- International Human Resources Development Corporation (IHRDC)

- PetroEdge

- The Nautical Institute

- Oilennium Ltd. (Petrofac Group)

- NExT (A Schlumberger Company)

- Rigworld Training Centre

- Falcon Global Solutions

- Aucerna (Quorum Software)

- International Well Control Forum (IWCF)

Latest Developments in Global Upstream Petrotechnical Training Services Market

- In April 2025, PetroSkills launched an AI-driven virtual training platform that delivers adaptive learning modules for reservoir engineering, drilling, and production workflows. The system personalizes content based on learner progress and real-time assessments.

- In March 2025, Schlumberger’s NExT division partnered with a leading Middle Eastern university to offer simulator-based training for unconventional plays, integrating digital twin technology for field replication.

- In February 2025, IHRDC introduced a cloud-based Learning Management System (LMS) designed for national oil companies to track workforce competency, align training with job roles, and streamline certification workflows across multiple geographies.

- In January 2025, PetroEdge expanded its deepwater training curriculum with immersive VR content for offshore platform operations and HPHT (High-Pressure, High-Temperature) drilling conditions, targeting the Asia-Pacific and African markets.

- In December 2024, Halliburton launched its Upstream Technical Academy, offering blended training in drilling automation, well integrity, and ESG-aligned exploration practices, aimed at accelerating digital competency across its client base.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.