Global Bot Service Market

Market Size in USD Billion

CAGR :

%

USD

2.60 Billion

USD

5.60 Billion

2024

2032

USD

2.60 Billion

USD

5.60 Billion

2024

2032

| 2025 –2032 | |

| USD 2.60 Billion | |

| USD 5.60 Billion | |

|

|

|

|

BOT Services Market Size

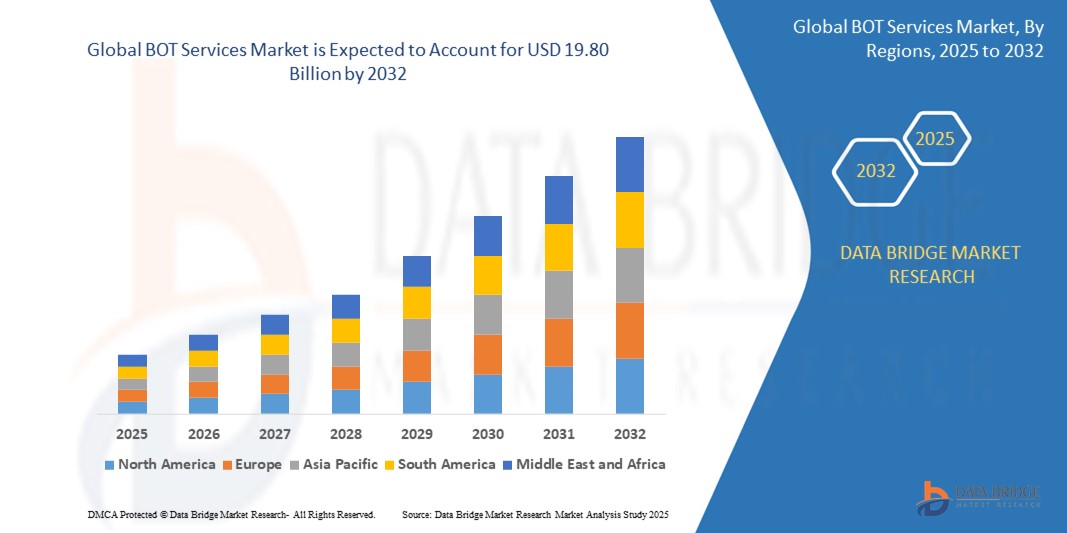

- The global BOT Services market size was valued at USD 2.60 billion in 2024 and is expected to reach USD 19.80 billion by 2032, at a CAGR of 28.8% during the forecast period

- This growth is driven by factors such as the increasing adoption of AI and NLP technologies, the rising demand for automation in customer service, and the proliferation of internet-based and online services across industries

BOT Services Market Analysis

- BOT Services, encompassing chatbots and virtual assistants, are AI-powered software programs that simulate human conversations using natural language processing (NLP) and machine learning (ML) to automate tasks, enhance customer engagement, and streamline operations.

- The demand for BOT services is significantly driven by the global surge in digital transformation, with 70% of businesses adopting AI-driven solutions by 2025, and the growing number of social media users, projected to reach 5.85 billion by 2027.

- North America is expected to dominate the BOT Services market due to its advanced technological infrastructure and the presence of key players like Microsoft and Amazon Web Services.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid digitalization and increasing investments in AI in countries like China and India.

- The Customer Service segment is expected to dominate the market with a market share of 34.7% in 2025 due to its widespread use in automating support operations and improving customer satisfaction.

Report Scope and BOT Services Market Segmentation

|

Attributes |

BOT Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

BOT Services Market Trends

“Advancements in AI and NLP for Enhanced BOT Interactions”

- One prominent trend in the BOT Services market is the increasing integration of advanced AI and NLP technologies, enabling bots to handle complex queries and deliver personalized interactions with up to 40% improved accuracy.

- These advancements allow businesses to automate customer service and marketing tasks, reducing response times by 30% and enhancing user satisfaction.

- For instance, in January 2025, LG Electronics and Microsoft partnered to develop AI-driven bots for smart ecosystems, improving interactivity in homes and vehicles.

- These innovations are transforming BOT services, driving demand for scalable and intelligent platforms across industries

BOT Services Market Dynamics

Driver

“Increasing Demand for Automation and Cost Efficiency”

- The rising need for automation in customer service, sales, and operational processes, coupled with the potential to reduce support costs by up to 30%, is significantly contributing to the demand for BOT services.

- Businesses across sectors like retail and BFSI are adopting bots to handle high volumes of inquiries, with 80% of routine questions answered automatically.

- For instance, in 2024, HDFC Bank in India deployed AI-based bots to enhance customer experience, handling banking inquiries efficiently.

- As automation becomes critical for operational efficiency, the demand for BOT services rises, ensuring cost-effective and scalable solutions

Opportunity

“Growing Adoption of Cloud-Based BOT Platforms”

- Cloud-based BOT platforms offer scalability, ease of deployment, and cost efficiency, enabling businesses to integrate bots rapidly and support digital transformation.

- These platforms can reduce implementation costs by 25% compared to on-premise solutions, appealing to SMEs and large enterprises alike.

- For instance, in 2023, Amazon Web Services expanded its bot service offerings, enabling seamless integration with cloud-based applications.

- This opportunity drives market growth by addressing the need for flexible and accessible BOT solutions in a digital-first world.

Restraint/Challenge

“Data Privacy and Security Concerns”

- Data privacy and security concerns, with 60% of consumers expressing worries about bot-handled data in 2024, pose a significant challenge to the BOT Services market.

- Strict regulatory compliance requirements, such as GDPR in Europe and CCPA in the U.S., along with the persistent risk of data breaches, limit bot service adoption, particularly in sensitive sectors like BFSI (Banking, Financial Services, and Insurance), healthcare, and government.

- For instance, in 2024, 45% of enterprises reported facing significant challenges in ensuring their BOT services complied fully with updated data protection regulations, impacting bot deployment strategies.

- These challenges can hinder the market's growth trajectory, requiring service providers to invest heavily in advanced security frameworks, encryption, ethical AI practices, and transparent data handling policies to build user trust and ensure regulatory compliance

BOT Services Market Scope

The market is segmented on the basis technology, deployment channel, mode type, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Technology |

|

|

By Deployment Channel |

|

|

By Mode |

|

|

By End User

|

|

In 2025, the Framework is projected to dominate the market with the largest share in Technology segment

The Framework segment is expected to dominate the BOT Services market with the largest share of 56.22% in 2025 due to its widespread adoption in streamlining development processes and enabling scalable solutions. Frameworks offer a structured and reusable code base, accelerating time-to-market and ensuring consistency across BOT projects. As companies increasingly prioritize automation and integration, the demand for robust development frameworks continues to drive growth and solidify this segment’s market leadership.

The Website is expected to account for the largest share during the forecast period in Deployment Mode market

In 2025, the Website segment is expected to dominate the BOT Services market with the largest market share of 51.31% due to its ease of access, lower operational costs, and growing preference for web-based interfaces. As businesses seek to deliver seamless user experiences and maintain centralized control over services, websites emerge as the preferred deployment channel. The proliferation of cloud computing and cross-platform accessibility further amplifies this segment’s dominance during the forecast period.

BOT Services Market Regional Analysis

“North America Holds the Largest Share in the BOT Services Market”[AN2]

- North America dominates the BOT Services market, driven by advanced technological infrastructure, high AI adoption, and the presence of key players like Microsoft and Google.

- The U.S. holds a significant share, capturing 33.46% of the global market in 2023, due to early adoption of bots in retail, BFSI, and healthcare sectors.

- The availability of robust cloud infrastructure and growing investments in AI research further strengthen the market.

- In addition, the high penetration of social media and e-commerce platforms fuels market expansion across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the BOT Services Market[AN3] ”

- The Asia-Pacific region is expected to witness the highest growth rate, driven by rapid digitalization, increasing social media users, and government-led AI initiatives.

- Countries such as China and India are emerging as key markets, with India projected to grow at a CAGR of 35.2% due to its expanding IT sector and automation demand.

- China, with a projected market value of USD 1.3 billion by 2032, remains a crucial market for BOT services due to its e-commerce growth.

- The expanding presence of global BOT vendors and improving technological infrastructure further contribute to market growth.

BOT Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Microsoft Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Nuance Communications, Inc. (U.S.)

- Meta Platforms, Inc. (U.S.)

- [24]7.ai, Inc. (U.S.)

- Inbenta Holdings Inc. (U.S.)

- Creative Virtual Ltd. (U.K.)

- Kore.ai, Inc. (U.S.)

Latest Developments in Global BOT Services Market

- January 2025: UiPath, a global leader in robotic process automation (RPA), launched its AI-powered automation platform in the European Union to further enhance its capabilities in automating complex business workflows. The platform integrates advanced machine learning and natural language processing to allow businesses to automate tasks that require higher cognitive abilities, such as customer service and document processing. This move aims to expand the use of BOTs beyond simple tasks, positioning UiPath at the forefront of automation in industries like finance and healthcare.

- October 2024: Automation Anywhere unveiled its new Bot Insight 4.0 at the Automation Anywhere World 2024 conference, which includes powerful AI and machine learning capabilities for advanced analytics and decision-making in RPA processes. Bot Insight 4.0 allows organizations to track the real-time performance of BOTs and optimize workflows through in-depth analytics, providing greater transparency and control over automation deployments. The platform is expected to enhance BOT adoption, particularly in industries such as banking, insurance, and telecommunications, where data analysis is crucial.

- September 2024: At the Digital Transformation Expo 2024, Blue Prism announced the launch of Intelligent Automation Hub, a platform designed to help enterprises accelerate their digital transformation initiatives. This platform offers an integrated suite of tools for automating business processes, enabling companies to deploy and manage intelligent BOTs with greater ease. The new system also incorporates enhanced AI capabilities to provide real-time insights into operational performance, making it particularly useful for industries such as retail, healthcare, and logistics.

- September 2024: AutomationEdge, a leading provider of IT process automation, introduced EdgeBot, an advanced BOT service aimed at automating IT operations and support. EdgeBot uses a combination of RPA and artificial intelligence to handle incident management, problem resolution, and system monitoring, helping businesses reduce the workload on IT teams and improve operational efficiency. With the launch of EdgeBot, AutomationEdge continues to strengthen its position in the market by expanding its BOT offerings into the IT management space.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.