Global Treasury Software Market, By Operating System (Windows, Linux, IOS, Android, MAC), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, Others), Deployment Mode (On Premise, Cloud), Organization Size (Large Enterprises And Small And Medium Sized Enterprises), Vertical (Banking, Financial Services And Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others) - Industry Trends and Forecast to 2030.

Treasury Software Market Analysis and Size

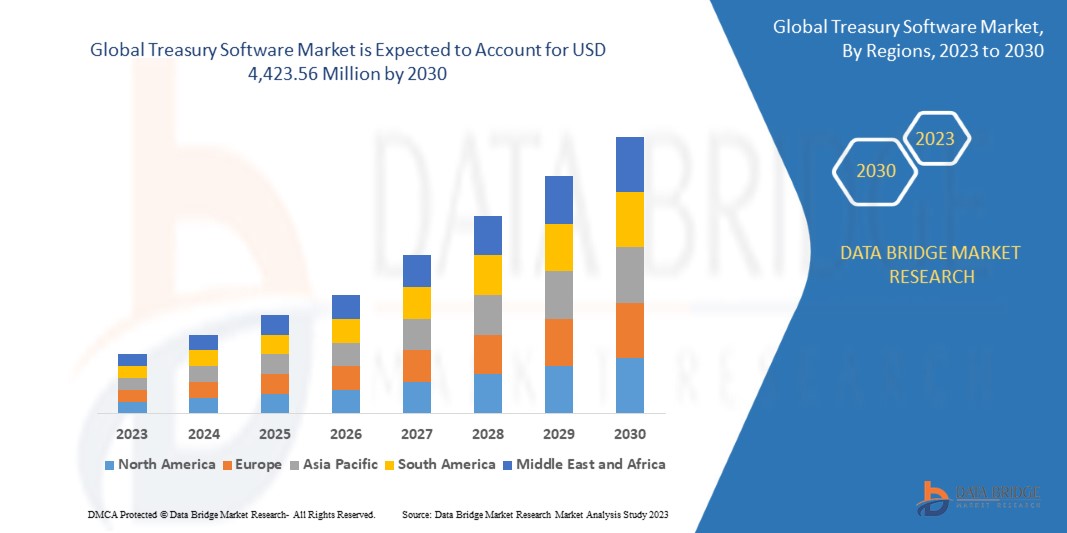

The global treasury software market is expected to gain market growth in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% from 2023 to 2030 and is expected to reach USD 4,423.56 million by 2030. An increase in the requirement for quick-decision-making processes in biotechnology is e expected to drive the growth of the market significantly.

The global treasury software market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the global treasury software market scenario contact Data Bridge Market Research for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable to 2020-2016)

|

|

Quantitative Units

|

Revenue in USD Thousand, Pricing in USD

|

|

Segments Covered

|

Operating System (Windows, Linux, IOS, Android, MAC), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning, Others), Deployment Mode (On Premise, Cloud), Organization Size (Large Enterprises And Small And Medium Sized Enterprises), Vertical (Banking, Financial Services And Insurance, Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others)

|

|

Countries Covered

|

U.S., Canada, and Mexico, Germany, France, U.K., Italy, Spain, Netherlands, Belgium, Russia, Switzerland, Turkey, and the rest of Europe, China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and the rest of Asia-Pacific, Saudi Arabia, South Africa, UAE, Egypt, Israel, and the rest of the Middle East and Africa

|

|

Market Players Covered

|

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys) , Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others

|

Market Definition

Treasury software is an application that automates a company's financial activities like cash flow, assets, and investments. It provides a treasury management system that tracks the ability of a business to convert assets into cash to meet a financial obligation. Financial managers and accounts use Treasury management software to monitor liquidity and the ability to convert assets into cash to meet financial obligations. The software automates and streamlines treasury management functions, reducing financial and reputational risks, saving costs, and improving operational efficiency and effectiveness. The greater visibility, analytics, and forecasting that the treasury management system provides improves decision-making and helps to create organizational financial strategies.

Global Treasury Software Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Growing demand for advanced treasury management systems for enhancing customer experience

Treasury management systems (TMS) are software that helps to automate manual treasury processes. Offering greater visibility into cash and liquidity while gaining control over bank accounts, maintaining compliance, and managing financial transactions has enhanced customer satisfaction. The treasury management system basically offers seven core benefits in the organization that can enhance the capabilities, including,

- Boost productivity

- Real-time and precise data availability

- Reduction in manual entry and calculation errors

- Limit redundant banking and FX costs

- Detailed activity monitoring

- Bank and connectivity flexibility

- Regulatory compliance and risk mitigation

According to Coupa Software Inc., adopting TMS solutions can get affected by various factors such as FX volatility by 52%, cash flow & financial risk exposure by 43%, cash repatriation by 40%, inadequate treasury infrastructure by 30%, global tax reform impacts by 24%, operational and fraud risk due to traditional methods by 20%, treasury operational cost 12% and other factors 12%.

- Heaving adoption of artificial intelligence in treasury management

Artificial intelligence in recent times has played a vital role in strengthening and transforming industries around the globe. From governmental bodies, and large organizations to small online businesses, artificial intelligence (AI) is being used by multiple entities over multiple platforms across the globe.

In 2020, according to the survey conducted by NewVantage, 91.5% of top businesses were investing heavily in AI. Although companies with investments in AI are using AI technologies at a modest rate, just 14.6 % of them use AI technology extensively within their organization. Out of which, more than half of that, which is 51.2%, have AI deployed to limited production, and 26.8 % is piloting it. This signifies the growing cardinal of AI technologies and surges amongst businesses for adopting them.

Artificial intelligence (AI) has already shown its incredible potential for cash management and forecasting in treasury management. AI attempts to solve problems that were previously believed to be only solved by human intervention.

Opportunities

- Penetration of advanced analytics solutions in the banking sector

Nowadays, banks are increasingly using analytics to gain a competitive advantage and to form conclusions and insights based on the information and data collection. Advanced analytics can be used to predict customer behavior and preferences and to improve risk assessment. Sometimes data generated by banking and finance industries are of large scale, and these are not possible for the bank to handle with their traditional database. Therefore, analytics have paved a path for financial industries to handle a large amount of data at a time.

Furthermore, the digital world has made a revolution in the banking industry. Most of the advanced analytics solutions for banking are comprised of four different components: reporting, descriptive analytics, predictive analytics, and prescriptive analytics. Financial institutions can now target and engage customers on a continuous basis, and not just when they go into a branch. Their reach now includes customers who use mobile apps, ATMs, and online banking apps. Banks also can use analytics to offer customized products, services, and deals to customers based on their profiles and histories. Moreover, analytics in the banking world also helps to identify and prevent fraud. Banks use advanced analytics to compare customer usage patterns against their own fraud indicators and can immediately take action when potentially fraudulent activity is detected. The overall penetration of analytics in banking is still relatively low compared to its usage in other industries. However, the penetration of analytics in the banking sector is creating a lot of opportunities for the treasury software market to grow.

Restraints/Challenges

- Increasing cyber threats and data breaches

Due to the COVID-19, cybercrime and cybersecurity issues increased by 600% in 2020. Flaws in network security are exploited by hackers to perform unauthorized actions within a system.

According to Purple Sec LLC, in 2018, mobile malware variants for mobile increased by 54%, out of which 98% of mobile malware target various smart android devices. 25% of businesses are estimated to have been victims of crypto-jacking. The businesses include banking, financial management team of various businesses/industries.

In recent times businesses/industries are adopting digitization heavily. Banking, shopping, travel, and others, are moving towards digital models to enhance consumer experiences. Digitization generates a huge amount of customer data and information. This raises security concerns, and this data has always been at a higher risk of cyber-attacks and data breaches. Through this information and data, it becomes easy for fraudsters and cyber attackers to mimic or steal the identity of an individual, which can be used for various crimes.

According to an S&P Global study on the share of global cyber-attacks incidents across the industries in the past five years from 2016 to 2021, financial institutions have topped the list with 26% cybersecurity incidents followed by healthcare 11%, software and technology services at 7% and retail at 6%.

Post-COVID-19 Impact on Global Treasury Software Market

The COVID-19 pandemic has had a significant impact on the global Treasury Software market. The pandemic has caused major disruptions to global supply chains, financial markets, and economic activities, leading to a shift in the priorities and strategies of treasury departments worldwide.

One of the most significant impacts of the pandemic on the treasury software market has been the increased demand for cloud-based solutions. The pandemic forced many organizations to quickly transition to remote work, which highlighted the importance of having secure, accessible, and scalable cloud-based treasury solutions. As a result, there has been a significant increase in demand for cloud-based treasury software solutions.

Another impact of the pandemic on the treasury software market is the increased focus on cash forecasting and liquidity management. The pandemic has created significant uncertainties and risks for businesses, making accurate cash forecasting and liquidity management critical for survival. Treasury software solutions that can provide accurate and real-time cash forecasting, liquidity management, and risk assessment have become increasingly essential.

Overall, the COVID-19 pandemic has accelerated the adoption of digital treasury solutions, leading to significant growth in the global treasury software market. The demand for cloud-based solutions, cash forecasting and liquidity management, and advanced automation and integration capabilities is expected to continue in the post-pandemic world as organizations seek to improve their agility, resilience, and efficiency.

Recent Developments

- In March 2022, Lease Accounting Software for IFRS-16 was provided to Redington Gulf by ZenTreasury and their local partner MCA. Now Customers are not required to import data from many sources and store it on various platforms. Everything is completed with one software

- In September 2022, TIS and Delega collaborated to provide customers with next-generation automated multi-bank signatory rights management. Customers of TIS and Delega can take advantage of NextGen electronic bank account management thanks to the agreement (eBAM)

Global Treasury Software Market Scope

The global treasury software market is segmented on the basis of operating system, application, deployment model, organization size, and vertical. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

GLOBAL TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

- MAC

- WINDOWS

- IOS

- ANDROID

- LINUX

On the basis of operating system, the global treasury software market is segmented into windows, linux, MAC, android, and iOS.

GLOBAL TREASURY SOFTWARE MARKET, BY APPLICATION

- LIQUIDITY AND CASH MANAGEMENT

- FINANCIAL RISK MANAGEMENT

- DEBT MANAGEMENT

- INVESTMENT MANAGEMENT

- TAX PLANNING

- COMPLIANCE MANAGEMENT

- OTHERS

On the basis of application, the global treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning, and others

GLOBAL TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

- ON PREMISES

- CLOUD

On the basis of deployment mode, the global treasury software market is segmented into cloud and on premises.

GLOBAL TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

- SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

- LARGE ENTERPRISES

On the basis of organization size, the global treasury software market is segmented into large enterprises and small and medium enterprises.

GLOBAL TREASURY SOFTWARE MARKET, BY VERTICAL

- BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

- WEALTH MANAGEMENT

- GOVERNMENT

- MANUFACTURING

- HEALTHCARE

- CONSUMER GOODS

- CHEMICALS

- ENERGY

- OTHERS

On the basis of vertical, the global treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others.

Global Treasury Software Market Regional Analysis/Insights

The global treasury software market is analysed and market size insights and trends are provided by country, operating system, application, deployment model, organization size, and vertical as referenced above.

Some countries covered in the global treasury software market report are the U.S., Canada, and Mexico, Germany, France, U.K., Italy, Spain, Netherlands, Belgium, Russia, Switzerland, Turkey, and the rest of Europe, China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and the rest of Asia-Pacific, Saudi Arabia, South Africa, UAE, Egypt, Israel, and the rest of the Middle East and Africa.

The U.S. in the North America is expected to dominate the global treasury software market due to the high adoption of advanced technology and the presence of major players in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Treasury Software Market Share Analysis

The global treasury software market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global treasury software market.

Some of the major players operating in the global treasury software market are Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX S.A.S, EdgeVerve Systems Limited (A wholly owned subsidiary of Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD and among others.

SKU-