Global Transportation Analytics Market Segmentation, By Type (Descriptive Analytics, Predictive Analytics, and Prescriptive Analytics), Mode (Roadways, Railways, Airways, Waterways, and Others), Deployment (On-Premise, Cloud, and Hybrid), Solution (Analytics Solutions, Advanced Transportation Control Systems, Management Solutions, and Services), Application (Remote Sensing, Transit Management, Traffic Management, Incident Management, Logistics Management, and Others) – Industry Trends and Forecast to 2032

Transportation Analytics Market Analysis

The transportation analytics market is experiencing rapid growth, driven by the increasing demand for efficient transportation systems and the need to optimize operations across various modes, including roadways, railways, airways, and waterways. Transportation analytics uses advanced data analytics, artificial intelligence, and real-time monitoring to improve traffic management, reduce congestion, enhance safety, and optimize logistics. The integration of big data and IoT technologies is helping to streamline operations and improve decision-making for both public and private sector stakeholders. Recent developments include the use of predictive analytics for route optimization, advanced fleet management, and the integration of smart traffic management systems. Additionally, the rise of electric vehicles and autonomous transportation systems is further propelling the demand for transportation analytics solutions. As urbanization and logistics demand continue to grow globally, the transportation analytics market is expected to expand, offering solutions to improve sustainability, efficiency, and safety in transportation systems.

Transportation Analytics Market Size

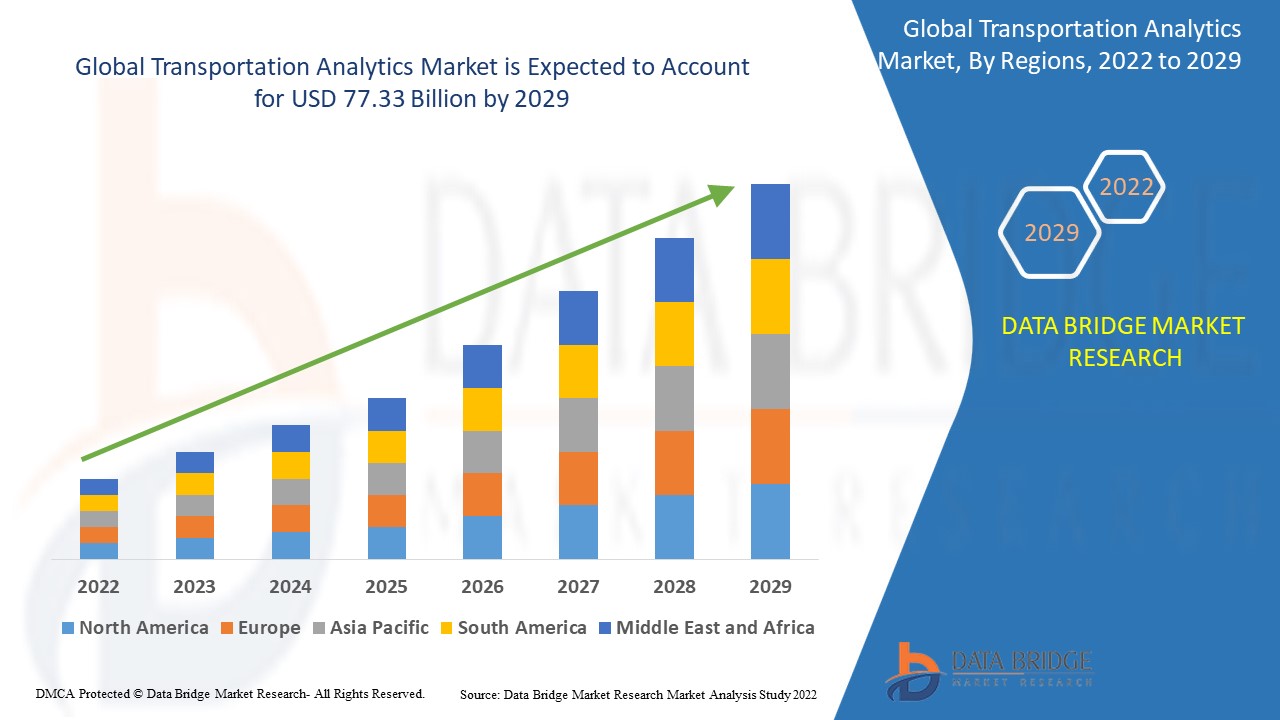

The global transportation analytics market size was valued at USD 28.48 billion in 2024 and is projected to reach USD 140.73 billion by 2032, with a CAGR of 22.10% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Transportation Analytics Market Trends

“Innovations in Data Analytics”

The transportation analytics market is witnessing significant growth due to innovations in data analytics, AI, and IoT technologies, which are transforming how transportation systems are managed. These advancements enable real-time traffic monitoring, predictive analytics for route optimization, and improved fleet management. One key trend is the increasing use of predictive analytics to anticipate traffic patterns and optimize logistics, reducing delays and operational costs. Innovations such as autonomous vehicles and smart traffic systems are further driving the demand for transportation analytics. As urbanization increases and transportation networks become more complex, the market is expanding, offering solutions to improve efficiency, reduce congestion, and enhance safety across all modes of transportation.

Report Scope and Transportation Analytics Market Segmentation

|

Attributes

|

Transportation Analytics Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Cellint (Israel), Cubic Corporation (U.S.), Iteris Inc. (U.S.), Hitachi Ltd. (Japan), Garmin, Ltd. (U.S.), IBM (U.S.), INRIX (U.S.), TomTom International B.V. (Netherlands), Oracle (U.S.), Ryder Systems, Inc. (U.S.), enVista, LLC. (U.S.), Syntelic Solutions Corporation (U.S.), Trimble Inc. (U.S.), SmartDrive Systems Inc. (U.S.), Qualcomm Technologies Inc. (U.S.), TheTrafficmaster (U.K.), Thales (France), Kapsch TrafficCom AG (Austria), Qorvo, Inc (Ireland)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Transportation Analytics Market Definition

Transportation analytics refers to the use of data analysis tools, techniques, and technologies to optimize transportation systems and operations. It involves collecting, processing, and analyzing large volumes of data from various sources such as traffic sensors, GPS devices, and transportation networks. The goal is to enhance decision-making, improve efficiency, reduce costs, and ensure safety across different transportation modes, including roadways, railways, airways, and waterways. By leveraging technologies such as artificial intelligence, machine learning, and predictive analytics, transportation analytics helps in traffic management, route optimization, fleet management, and logistics, as well as forecasting future trends and improving overall transportation infrastructure.

Transportation Analytics Market Dynamics

Drivers

- Increasing Demand for Efficient Transportation Systems

As urbanization continues to accelerate globally, cities are facing increased congestion, longer travel times, and greater strain on transportation networks. This creates a pressing need for smarter, more efficient transportation solutions that can address these challenges. Transportation analytics plays a crucial role by utilizing real-time data to optimize traffic flow, reduce delays, and enhance logistics operations. With the growth of metropolitan areas and an expanding urban population, there is a rising demand for data-driven solutions to improve the efficiency of both public and private transportation systems. This trend is a key driver of the transportation analytics market, enabling smarter urban mobility and better management of transportation resources.

- Growth of E-Commerce and Logistics

The rapid growth of e-commerce has led to an increased demand for fast, reliable, and efficient delivery services. Consumers now expect quicker delivery times, often with same-day or next-day options, putting pressure on logistics and supply chain operations. To meet these demands, businesses are turning to advanced transportation analytics to optimize delivery routes, reduce delays, and enhance inventory management. By utilizing real-time data, predictive analytics, and route optimization tools, transportation analytics helps streamline logistics operations, reduce operational costs, and ensure on-time deliveries. This growing need for optimized supply chains and fast deliveries is a key driver fueling the expansion of the transportation analytics market.

Opportunities

- Expansion of Smart Cities

The development of smart cities is rapidly transforming urban landscapes, with a strong emphasis on interconnected transportation infrastructure. As cities aim to improve mobility, reduce traffic congestion, and enhance public transportation services, the demand for data-driven solutions has never been higher. Transportation analytics plays a vital role in these smart city initiatives by providing real-time data, predictive insights, and optimization tools to improve the flow of traffic, reduce delays, and ensure efficient public transit systems. This ongoing trend presents a significant market opportunity for transportation analytics solutions, as cities strive for more sustainable and efficient urban mobility solutions.

- Rise of Autonomous Vehicles

The rise of autonomous vehicles is creating significant opportunities for transportation analytics to enhance vehicle coordination, traffic management, and fleet optimization. These vehicles generate vast amounts of real-time data, which can be leveraged to improve transportation systems by enabling more efficient route planning, reducing traffic congestion, and optimizing fleet operations. With autonomous vehicles capable of communicating with one another and traffic infrastructure, transportation analytics can provide more accurate predictions and real-time adjustments to traffic flow. As the adoption of autonomous vehicles continues to grow, the demand for advanced analytics solutions will expand, further driving the growth of the transportation analytics market.

Restraints/Challenges

- Resistance to Change

Traditional transportation companies and municipalities often face resistance to adopting new technologies, primarily due to a lack of understanding, familiarity, or trust in data-driven systems. This reluctance can delay the transition to more advanced transportation analytics solutions, as stakeholders may be hesitant to invest in unfamiliar technologies or may have concerns about system reliability and performance. Additionally, the potential disruption to existing workflows and operations can further contribute to resistance. Overcoming this challenge requires effective education, clear communication of the benefits, and evidence of the system’s ability to improve efficiency and reduce costs, helping to build confidence and accelerate adoption.

- High Implementation Costs

Implementing advanced transportation analytics solutions requires substantial upfront investments in hardware, software, sensors, and infrastructure upgrades. For smaller cities or organizations with limited budgets, these high initial costs can be a significant barrier. The expense of acquiring and maintaining advanced technologies, including data storage, processing capabilities, and skilled personnel, may discourage stakeholders from adopting these solutions. Additionally, the long-term return on investment might not be immediately evident, making it harder to justify the expense. This financial challenge can hinder the widespread implementation of transportation analytics, particularly in regions with tight financial constraints.

Transportation Analytics Market Scope

The market is segmented on the basis of type, mode, deployment, solution, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

Mode

- Roadways

- Railways

- Airways

- Waterways

- Others

Deployment

- On-Premise

- Cloud

- Hybrid

Solution

- Analytics Solutions

- Advanced Transportation Control Systems

- Management Solutions

- Services

Application

- Remote Sensing

- Transit Management

- Traffic Management

- Incident Management

- Logistics Management

- Others

Transportation Analytics Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, mode, deployment, solution, and application as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America leads the transportation analytics market, driven by the early adoption of advanced solutions and increased efforts to improve intelligent transportation systems. The region’s focus on optimizing traffic management and mobility services has fueled demand for data-driven insights. Ongoing initiatives to modernize infrastructure and transportation networks further contribute to its dominance in the market.

Asia-Pacific (APAC) is projected to experience substantial growth from 2025 to 2032, driven by the growing adoption of smart city and smart transportation initiatives. The region's focus on modernizing infrastructure and improving urban mobility systems is accelerating demand for transportation analytics. These initiatives are expected to boost the need for data-driven solutions to optimize traffic flow and enhance overall transportation efficiency.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Transportation Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Transportation Analytics Market Leaders Operating in the Market Are:

- Cellint (Israel)

- Cubic Corporation (U.S.)

- Iteris Inc. (U.S.)

- Hitachi Ltd. (Japan)

- Garmin, Ltd. (U.S.)

- IBM (U.S.)

- INRIX (U.S.)

- TomTom International B.V. (Netherlands)

- Oracle (U.S.)

- Ryder Systems, Inc. (U.S.)

- enVista, LLC. (U.S.)

- Syntelic Solutions Corporation (U.S.)

- Trimble Inc. (U.S.)

- SmartDrive Systems Inc. (U.S.)

- Qualcomm Technologies Inc. (U.S.)

- TheTrafficmaster (U.K.)

- Thales (France)

- Kapsch TrafficCom AG (Austria)

- Qorvo, Inc (Ireland)

Latest Developments in Transportation Analytics Market

- In October 2023, IBM reached a 100% order fulfillment rate and reduced supply chain costs by USD 160 million despite significant disruptions. This was achieved through the implementation of a cognitive supply chain solution. The innovation enhanced operational efficiency and helped IBM navigate challenges effectively

- In September 2023, 3SC Solutions introduced its intelligent transport management solution, iTMS. This integrated system leverages artificial intelligence and data analytics to optimize transportation management. The solution aims to enhance operational efficiency and improve decision-making through advanced technologies

- In June 2023, AFWERX, in collaboration with the Air Force Research Laboratory's Information Directorate, introduced an Uncrewed Aircraft System Traffic Management (UTM) system at Eglin Air Force Base, Florida. The initiative aims to enhance the safety of drones and electric vertical takeoff and landing (eVTOL) aircraft during flights. By creating a robust UTM infrastructure, this project addresses the growing safety concerns surrounding the increased presence of unmanned aerial vehicles and eVTOLs in airspace

- In March 2022, the Airports Authority of India (AAI) partnered with Bharat Electronics Limited (BEL), a Navratna Defence PSU, to advance the "Make in India" initiative. This collaboration focuses on developing indigenous air traffic management and aircraft surface movement systems for airports across the country. Moving away from the reliance on imports, the partnership supports the government’s goal of fostering domestic manufacturing and enhancing self-reliance in critical infrastructure development

- In February 2022, Eve UAM, a subsidiary of Embraer, partnered with Skyports, a leading eVTOL infrastructure provider, to assist the Japan Civil Aviation Bureau (JCAB) in developing a new Concept of Operations (CONOPS) for Advanced Air Mobility (AAM) and Urban Air Mobility (UAM). The collaboration aims to create a unified approach that covers airspace design, operational procedures, infrastructure needs, and other key factors. The goal is to ensure the safe and efficient integration of AAM in Japan’s airspace

SKU-