Global Thermal System for Automotive Market, By Propulsion (Internal Combustion Engine (ICE) vehicles, Electric and hybrid vehicle), Technology (Active Transmission Warm Up, Exhaust Gas Recirculation (EGR), Engine Thermal Mass Reduction, Reduced HVAC System Loading, Others), Component (Air Filter, Condenser, Compressor, Water Pump, Motor, Heat Exchanger, Heater Control Unit, Thermoelectric Generator, Electric Compressor, Electric Water Pump, Electric Motor), Application (Cabin Thermal management, Battery Thermal Management, Transmission System, Engine Cooling, Front Air Conditioning, Motor Thermal Management, Power Electronics, Rear Air Conditioning, Heated/Ventilated Seats, Heated Steering, Waste Heat Recovery, Heating, Ventilation and Air Conditioning (HVAV), Powertrain Cooling, Fluid Transport, Others) – Industry Trends and Forecast to 2030.

Thermal System for Automotive Market Analysis and Size

The automotive industry emphasizes the growing need for better ride quality and heat insulation for cabin comfort, which has increased demand for thermal management systems. Through heat dissipation, the growing number of electrical and electronic components inside cars also increases the need for better thermal management systems. The automotive thermal management system keeps an eye on and maintains the temperature of critical car components. It regulates the temperature of several car parts, including the motor, battery, and cabin, to deliver better performance, expand fuel efficiency, and superior comfort. Effective thermal management improves interior comfort while allowing car components to operate in the ideal temperature range through seat heating, front air conditioning, and rear air conditioning.

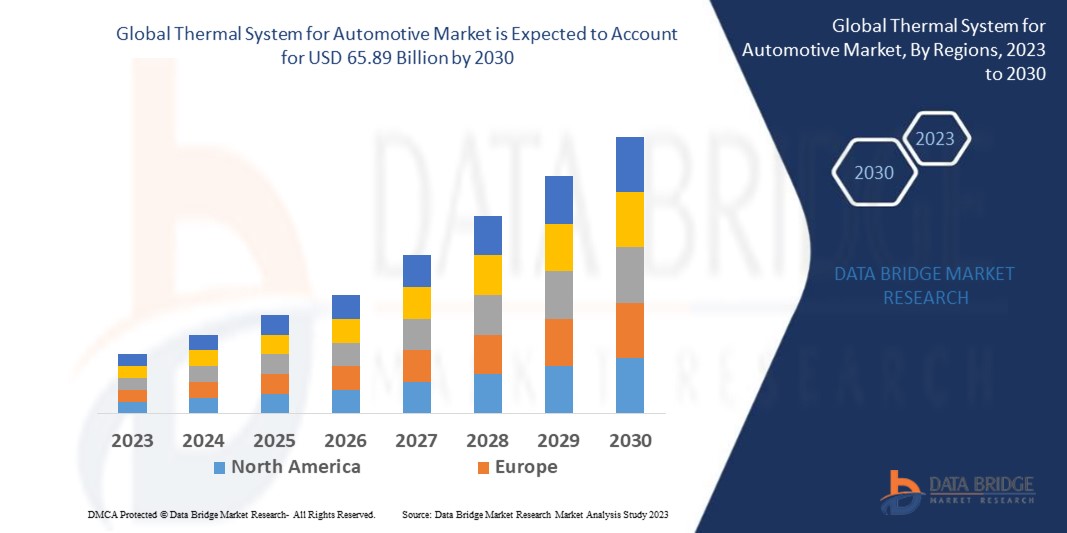

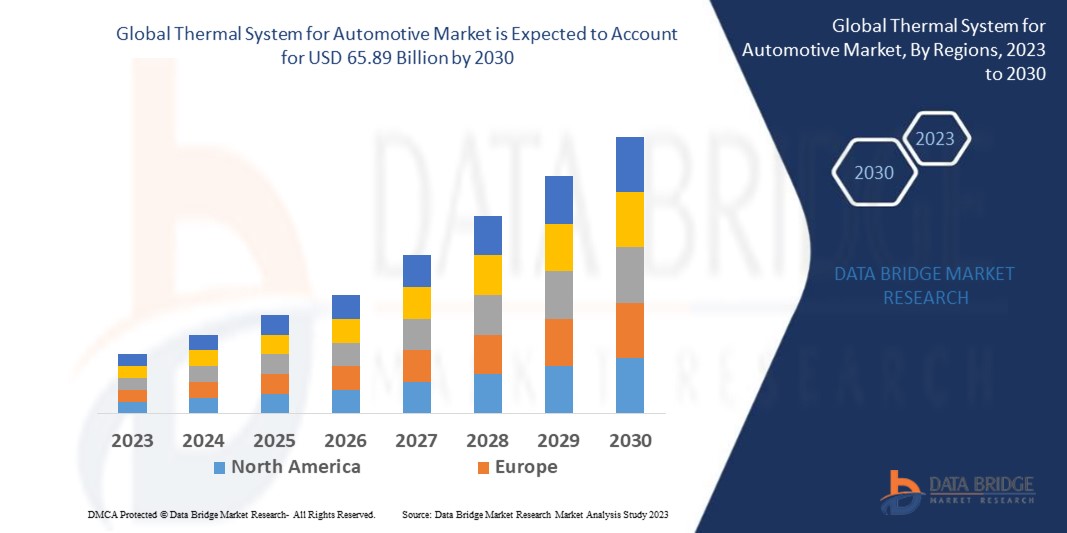

Data Bridge Market Research analyses that the thermal system for automotive market, valued at USD 46.65 billion in 2022, will reach USD 65.89 billion by 2030, growing at a CAGR of 4.41% during the forecast period of 2023 to 2030. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Thermal System for Automotive Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Propulsion (Internal Combustion Engine (ICE) vehicles, Electric and hybrid vehicle), Technology (Active Transmission Warm Up, Exhaust Gas Recirculation (EGR), Engine Thermal Mass Reduction, Reduced HVAC System Loading, Others), Component (Air Filter, Condenser, Compressor, Water Pump, Motor, Heat Exchanger, Heater Control Unit, Thermoelectric Generator, Electric Compressor, Electric Water Pump, Electric Motor), Application (Cabin Thermal management, Battery Thermal Management, Transmission System, Engine Cooling, Front Air Conditioning, Motor Thermal Management, Power Electronics, Rear Air Conditioning, Heated/Ventilated Seats, Heated Steering, Waste Heat Recovery, Heating, Ventilation and Air Conditioning (HVAV), Powertrain Cooling, Fluid Transport, Others

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

DENSO CORPORATION (Japan), MAHLE GmbH (Germany), VALEO (France), Hanon Systems (South Korea), GENTHERM (U.S.), Schaeffler AG (Germany), Johnson Electric Holdings Limited. (China), Robert Bosch GmbH (Germany), VOSS Automotive GmbH (Germany), Grayson (U.S.), MODINE MANUFACTURING COMPANY (U.S.), Boyd. (U.S.), SANDEN CORPORATION (Japan), BorgWarner Inc.(Japan), Dana Limited (U.S.), MODINE MANUFACTURING COMPANY (U.S.), Lennox International Inc.(U.S.), Diabatix nv (Belgium), Harper International (U.S.)

|

|

Market Opportunities

|

|

Market Definition

The automotive thermal system monitors and controls the battery, motor, cabinet, and other car parts' operating temperatures, which also increases efficiency and prevents breakdowns. In addition to maintaining the desired temperature inside the car, the automotive thermal system promotes comfort. The automotive thermal system monitors and maintains the temperature of critical auto components. It regulates the temperature of several parts, including the motor, battery, and vehicle cabin, to provide better performance, superior comfort and increased fuel efficiency,. Effective thermal management enables automotive components to operate in the ideal temperature range while enhancing interior comfort through seat heating, front air conditioning, and rear air conditioning.

Thermal System for Automotive Market Dynamics

Drivers

- Demands are increased by the implementation of strict emission regulations

Automobile manufacturers have already begun to invest in electric vehicles to comply with the strict emission standards set by numerous governments worldwide. Automobile manufacturers must address safety concerns regarding the batteries used in electric engines as they release new electric vehicles onto the market. To increase engine efficiency and battery life, thermal management systems in electric vehicles help maintain battery packs within a desired temperature range. As a result, one of the important factors that is anticipated to contribute to the growth of the automotive thermal system industry is enforcing strict emission regulations.

- The application of sophisticated thermal management technologies in automobiles

Thermal management systems maintain key components' operating temperatures to lower the possibility of component damage in vehicles. New energy vehicles are being built with smart thermal solutions. Additionally, several manufacturers provide intelligent thermal solutions for automobiles. Johnson Electric, for instance, offers thermal management options for batteries, cabin heating, and power electronics. Demand for automotive thermal systems is anticipated to increase due to integrating thermal management solutions into vehicles.

Opportunities

- A growing market for luxury vehicles with cutting-edge features and comfort exists

High safety standards and cutting-edge features are standard in luxury vehicles. They are built to provide comfort features such as airbags, heated steering, and comfortable heated and cooled seats. The demand for luxury cars has increased as disposable income and living standards have improved. The demand for automotive thermal systems is anticipated to rise due to manufacturers integrating advanced thermal systems into high-end vehicles to increase performance and fuel economy. The automotive industry emphasizes the growing need for better ride quality and heat insulation for cabin comfort, increasing the demand for thermal management systems.

- E-mobility shift spurs market expansion

Through heat dissipation, the growing number of electrical and electronic components inside cars also increases the need for better thermal management systems. Thermal management systems for IC engines are anticipated to become completely obsolete in the long run as the automotive industry transitions to electric mobility. However, the high demand in these areas is expected to persist due to the growing number of heavy-duty electrical components, such as heavy-duty batteries and high-current motors. The demand for electrical and electronic components in passenger cars and commercial vehicles in the automotive industry increased exponentially with increasing automation and powertrain electrification.

Restraints/Challenges

- High price limits market expansion

Implementing strict emission and fuel economy targets has encouraged the adoption of new technologies by OEMs. Due to increased demand for improved engine performance and features, manufacturers have been forced to concentrate on the powertrain, drivetrain, and in-vehicle cabin comfort thermal system. A thermal system's efficiency can be determined by comparing the cost to the overall CO2 reduction achieved. OEMS have already accepted and incorporated CO2 REDUCTION technologies into their premium models. Leading automakers such as BMW, Fiat Chrysler, Ford, GM, Honda, Hyundai, and HLR have created technology such as polymer material heat exchangers, active grille shutters, predictive power stain control, variable engine oil pumps, and multizone climate control systems. Due to the high cost of advanced thermal systems, their installation will primarily be restricted to luxury cars.

- Lack of uniformity limits the development

Local or regional manufacturers adhere to emission standards set by regulatory bodies. However, since regional emission limits differ, a lack of standardization may make exporting different thermally related systems, such as catalytic converters, challenging. For instance, strict CO2 regulations in Europe necessitate reduction, whereas no such mandates are necessary for developing nations like South Africa. As a result, lack of standardization makes it difficult for manufacturers to obtain raw materials or inventory, which hurts the export industry.

This thermal system for automotive market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the thermal system for automotive market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2022, At the Bus and Coach Expo in Sydney, Australia, Denso Corp. unveiled the new LD9 electric zero emissions thermal management unit for buses and coaches.

- In 2022, To produce heating, ventilation, and air conditioning (HVAC) modules for electrified vehicles, Hanon Systems opened a new facility in Huchai, China.

- In 2022, Borgwarner Inc. obtained a contract to provide High-Voltage Coolant Heaters (HVCH) for use in the fully electric iX and i4 architectures from BMW Group. The solution regulates the thermal management system of the battery as well as cabin heating, greatly extending the battery's range of operation and reliability.

- In 2021, Volvo tested its brand-new thermal management system, which uses electrical and electronic control systems to warm up a truck's batteries. Their demand has significantly increased due to the thermal system's ability to maintain temperature under adverse weather conditions.

Global Thermal System for Automotive Market Scope

The thermal system for automotive market is segmented on the basis of propulsion, technology, type, component, application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Propulsion

- Internal Combustion Engine (ICE) vehicles

- Passenger Car

- Hatchback

- Sedan

- Utility Vehicles

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicles

- Off road Vehicles

- Agricultural tractor and equipment

- Construction and mining equipmnet

- Industrial Vehicles

- Forklift

- Truck

- Bus

- Electric and hybrid vehicle

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

- 48v Mild Hybrid Vehicle

Technology

- Active Transmission Warm Up

- Exhaust Gas Recirculation (EGR)

- Engine Thermal Mass Reduction

- Reduced HVAC System Loading

- Others

Component

- Air Filter

- Condenser

- Compressor

- Water Pump

- Motor

- Heat Exchanger

- Heater Control Unit

- Thermoelectric Generator

- Electric Compressor

- Electric Water Pump

- Electric Motor

Application

- Cabin Thermal management

- Battery Thermal Management

- Transmission System

- Engine Cooling

- Front Air Conditioning

- Motor Thermal Management

- Power Electronics

- Rear Air Conditioning

- Heated/Ventilated Seats

- Heated Steering

- Waste Heat Recovery

- Heating, Ventilation and Air Conditioning (HVAV)

- Powertrain Cooling

- Fluid Transport

- Others

- Seat

- Battery

- Motor

Thermal System for Automotive Market Regional Analysis/Insights

The thermal system for automotive market is analysed and market size insights and trends are provided by country, propulsion, ice vehicle type, technology, electric vehicle type, component, application as referenced above.

The countries covered in the thermal system for automotive market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America dominates the market and will continue to flourish its trend of dominance during the forecast period. The major factors attributable to the region’s dominance are the adoption of cutting-edge technology along with an increase in Research and Development activities.

Asia-Pacific will undergo the highest growth rate during the forecast period due to the increasing preferences towards electric vehicles and the region's introduction of BS VI norms. Additionally, a positive outlook for market growth is anticipated during the forecast period due to the expanding government regulations promoting the adoption of electric vehicles and the aggressive expansion strategies adopted by OEMs and suppliers in the region to meet the rising demand from China's automotive industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Thermal System for Automotive Market Share Analysis

The Thermal System for Automotive Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Thermal System for Automotive Market.

Some of the major players operating in the thermal system for automotive market are:

- DENSO CORPORATION (Japan)

- MAHLE GmbH (Germany)

- VALEO (France)

- Hanon Systems (South Korea)

- GENTHERM (U.S.)

- Schaeffler AG (Germany)

- Johnson Electric Holdings Limited. (China)

- Robert Bosch GmbH (Germany)

- VOSS Automotive GmbH (Germany)

- Grayson (U.S.)

- MODINE MANUFACTURING COMPANY (U.S.)

- Boyd. (U.S.)

- SANDEN CORPORATION (Japan)

- BorgWarner Inc. (Japan)

- Continental AG (Germany)

- Dana Limited (U.S.)

- MODINE MANUFACTURING COMPANY (U.S.)

- Lennox International Inc.(U.S.)

- Diabatix nv (Belgium)

- Harper International (U.S.)

SKU-