Global Technical Textile Market

Market Size in USD Billion

CAGR :

%

USD

205.70 Billion

USD

325.50 Billion

2024

2032

USD

205.70 Billion

USD

325.50 Billion

2024

2032

| 2025 –2032 | |

| USD 205.70 Billion | |

| USD 325.50 Billion | |

|

|

|

|

Global Technical Textile Market Size

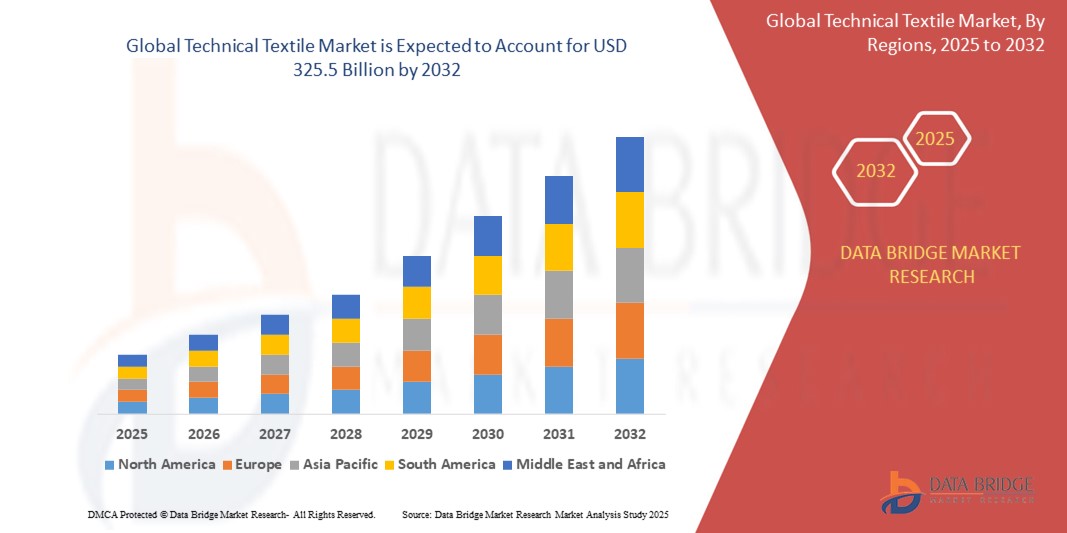

- The global technical textile market size was valued at USD 205.7 billion in 2024 and is expected to reach USD 325.5 billion by 2032, growing at a CAGR of 5.90% during the forecast period

- Market expansion is primarily driven by the increasing demand across various end-use industries such as automotive, healthcare, construction, agriculture, and defense, which are leveraging the performance, durability, and functional superiority of technical textiles over traditional materials

- Additionally, technological advancements in fiber engineering, polymer science, and textile manufacturing are facilitating the development of more specialized and application-specific textiles. This, coupled with rising awareness of sustainable and high-performance materials, is accelerating the integration of technical textiles globally, thereby contributing significantly to market growth

Global Technical Textile Market Analysis

- Smart locks, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for smart locks is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominates the Global Technical Textile Market with the largest revenue share of 40.01% in 2024, characterized by early smart home adoption, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in smart lock installations, particularly in new smart homes and multi-dwelling units, driven by innovations from both established tech companies and startups focusing on AI and voice-activated features.

- Asia-Pacific is expected to be the fastest growing region in the Global Technical Textile Market during the forecast period due to increasing urbanization and rising disposable incomes

- Deadbolt segment dominates the Global Technical Textile Market with a market share of 43.2% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and Global Technical Textile Market Segmentation

|

Attributes |

Global Technical Textile Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Technical Textile Market Trends

“Innovation-Driven Functionalization and Sustainability in Technical Textiles”

- A key and rapidly evolving trend in the global technical textile market is the convergence of material innovation, sustainability, and functional performance, enabling textiles to address specialized needs across a wide array of industries—from healthcare and agriculture to construction and defense.

- For example, smart textiles embedded with sensors and conductive fibers are gaining traction in medical and sports applications, where fabrics can monitor vitals, detect pressure points, or even deliver therapeutic benefits. Companies like DuPont and Toyobo are developing advanced textile solutions with integrated electronics, antimicrobial coatings, and moisture management features, aligning with the demand for wearable technology and functional fabrics.

- At the same time, there is a strong industry push toward sustainable and eco-conscious technical textiles, including the use of biodegradable polymers, recycled fibers, and waterless dyeing technologies. Firms such as Freudenberg SE and Lenzing Plastics are investing in closed-loop manufacturing systems and plant-based raw materials to reduce environmental impact without compromising performance.

- Advancements in nano-coatings and fiber modification technologies are enabling textiles to become flame-retardant, UV-resistant, antimicrobial, and self-cleaning, extending their application in sectors like construction (Buildtech), automotive (Mobiltech), and protective clothing (Protech). For example, Asahi Kasei and Stahl Holdings B.V. are exploring novel coating solutions to meet increasingly stringent performance and regulatory requirements.

- The integration of technical textiles into composite materials and infrastructure systems is also gaining momentum. In geotextiles, for instance, synthetic fibers are being used in soil stabilization and drainage systems, particularly in regions investing heavily in transportation and civil infrastructure.

- This evolving demand for high-performance, multifunctional, and sustainable textile solutions is reshaping the global technical textile market. Leading companies are scaling up R&D investments to innovate across fiber chemistry, textile engineering, and end-user customization. As a result, the market is seeing growing adoption in high-growth areas like medical implants, personal protective equipment (PPE), vertical farming covers, and automotive interiors.

- Overall, these innovation-led trends are not only expanding the application base of technical textiles but are also establishing functionality, sustainability, and integration with advanced systems as core value drivers for future market growth.

Global Technical Textile Market Dynamics

Driver

“Expanding Industrial Applications and Government Support for Innovation”

- The global demand for technical textiles is being significantly driven by their expanding role across diverse industrial applications—including automotive, construction, agriculture, healthcare, and defense—where performance, durability, and functionality are critical.

- For instance, in early 2024, India’s Ministry of Textiles announced new financial incentives under the National Technical Textiles Mission, aimed at boosting domestic innovation, R&D, and manufacturing capacity in high-value segments such as Meditech and Agrotech. Similar support programs are also active in the EU and the US, encouraging private investment in sustainable and functional textile development.

- As industries seek materials that offer thermal resistance, flame retardance, antimicrobial properties, and structural reinforcement, technical textiles provide customized solutions that outperform traditional fabrics. This performance edge is especially valued in applications like geotextiles for infrastructure, PPE for health and safety, and composites for automotive lightweighting.

- Additionally, the push for eco-friendly and recyclable materials is accelerating R&D into bio-based technical textiles, with companies like Freudenberg, Berry Global, and Lenzing Plastics developing greener alternatives aligned with circular economy principles.

- The rising adoption of smart textiles integrated with sensors or conductive fibers in sportswear, medical diagnostics, and defense wearables is also unlocking new revenue streams. These innovations are positioning technical textiles as essential components in the transition toward advanced manufacturing and digital industries.

Restraint/Challenge

“High Production Costs and Fragmented Regulatory Landscape”

- A key challenge facing the technical textile industry is the relatively high production cost associated with advanced manufacturing processes, specialty raw materials, and continuous R&D investments. Many technical textiles require complex fiber blends, precision coating techniques, and proprietary finishing treatments, all of which raise costs compared to conventional fabrics.

- This cost barrier can limit adoption in price-sensitive markets or sectors with tight margins, such as agriculture or low-end automotive. For example, small-scale manufacturers in developing regions often face difficulties accessing high-performance fibers or scaling up production economically.

- Moreover, the lack of harmonized global standards and regulations adds complexity, especially for companies operating across multiple jurisdictions. While the EU may impose stringent environmental and performance standards, other regions may lag in enforcement or apply inconsistent testing protocols. This creates challenges in product certification, market entry, and compliance, particularly for newer firms or exporters targeting multiple regions.

- Additionally, limited awareness about technical textiles’ capabilities in certain regions or sectors continues to restrain demand growth. For example, rural infrastructure planners may not fully understand the cost-saving benefits of geotextiles in road construction, or traditional farmers may resist switching to advanced agrofabrics without direct incentives.

- Overcoming these challenges will require a mix of policy support, supply chain optimization, knowledge dissemination, and investment in cost-efficient, scalable manufacturing technologies, as well as stronger global collaboration on regulatory alignment and sustainability benchmarks.

Global Technical Textile Market Scope

- By Process

The technical textile market is segmented into Knitted, Non-Woven, Woven, and Others.

- The non-woven segment held the largest market revenue share in 2024, driven by its broad application in medical textiles (Meditech), filtration (Indutech), and hygiene products, due to its cost-effectiveness, high absorbency, and ease of customization. Non-wovens are widely used in disposable masks, surgical gowns, geotextiles, and automotive insulation, making them essential in fast-growing industries.

- The knitted segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand in sportswear (Sportech), protective clothing (Protech), and smart wearables. Knitted fabrics offer flexibility, breathability, and integration potential with smart textile technologies, making them ideal for comfort-driven and tech-integrated applications.

• By Material

The market is segmented into Regenerated Fiber, Mineral, Synthetic Polymer, Natural Fiber, Metal, High Performance Fiber, and Others.

- Synthetic polymers dominated the market share in 2024, with widespread usage in applications such as Packtech, Buildtech, and Indutech, driven by their versatility, strength, and resistance to chemicals and moisture. Materials like polyester, polypropylene, and polyamide continue to lead due to cost efficiency and compatibility with industrial-scale production.

- High-performance fibers (e.g., aramid, carbon, and UHMWPE) are projected to record the fastest growth rate, owing to rising demand in aerospace, defense (Protech), automotive, and medical applications, where enhanced mechanical properties, flame resistance, and durability are required.

• By Manufacturing

The manufacturing segment includes Thermo-forming, 3D Weaving, 3D Knitting, Finishing Treatments, and Hand-made Elements.

- Finishing treatments accounted for the largest revenue share in 2024, as industries increasingly require fabrics with antimicrobial, flame-retardant, water-resistant, and anti-static properties. The importance of surface modification and functionality enhancement makes finishing a critical step in value-added textile production.

- 3D weaving and 3D knitting are anticipated to witness the fastest CAGR, driven by innovations in composite reinforcement, orthopedic textiles, and structural fabrics. These techniques allow complex, multi-layered structures with superior mechanical performance and are gaining ground in Buildtech, Meditech, and Mobiltech applications.

• By Application

The market is segmented into Geotech, Oekotech, Mobiltech, Indutech, Packtech, Sportech, Protech, Buildtech, Agrotech, Hometech, Clothtech, and Meditech.

- Indutech (industrial textiles) held the largest market share in 2024, owing to high demand for technical fabrics in filtration, insulation, conveyor belts, and machinery components. Its utility in a wide range of industrial environments makes it a cornerstone segment of the market.

- Meditech and Protech are expected to witness the fastest CAGR, driven by surging demand for PPE kits, surgical textiles, antimicrobial hospital curtains, and flame-retardant protective gear across global healthcare and defense sectors, especially post-COVID-19 and amid rising workplace safety norms.

• By Technology

The technology segment is categorized into Spinning, Weaving, Knitting, Finishing, Nanotechnology, and Others.

- Weaving dominated in 2024, given its dominance in producing durable and tightly packed textiles for Buildtech, Geotech, and Mobiltech. Woven technical fabrics offer superior tensile strength, structural stability, and durability, critical for demanding industrial use.

- Nanotechnology is projected to experience the fastest CAGR from 2025 to 2032, as the demand grows for smart, high-performance, and sustainable textiles. Nanotech-enhanced fabrics can offer self-cleaning, moisture-wicking, UV-protection, and antimicrobial properties, making them highly attractive for medical, sports, and military applications.

Global Technical Textile Market Regional Analysis

- North America dominates the technical textile market with the largest revenue share of 38.4% in 2024, driven by strong demand across key application sectors such as Mobiltech, Protech, and Meditech, alongside well-established industrial and R&D infrastructure.

- The region is a front-runner in the adoption of advanced processes such as 3D weaving, finishing treatments, and nanotechnology, and has a robust focus on sustainability and performance optimization.

- Rising usage in protective clothing, filtration systems, and automotive insulation—combined with strict workplace safety regulations—is propelling market expansion across industrial and defense sectors.

U.S. Technical Textile Market Insight

The U.S. technical textile market captured the largest revenue share of 83% in 2024 within North America, led by massive demand from aerospace, defense, infrastructure, and healthcare. Innovation in high-performance fibers, flame-retardant materials, and non-woven composites has supported the growth of technical textiles in applications such as Protech, Geotech, and Meditech.The country is witnessing high integration of thermo-forming, 3D knitting, and smart textile technologies in advanced use-cases, supporting scalability and automation in both civilian and defense textile consumption

Europe Technical Textile Market Insight

The Europe technical textile market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent quality and safety regulations, growing sustainability mandates, and strong demand in construction, medical, and industrial filtration. Applications such as Oekotech, Buildtech, and Indutech are experiencing robust adoption, supported by growing consumer awareness of eco-friendly and performance-driven materials. The region benefits from the presence of leading manufacturers, academic R&D institutions, and a proactive approach to circular economy practices

U.K. Technical Textile Market Insight

The U.K. technical textile market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by high-value adoption in defense, healthcare, and wearable technology sectors. The U.K. is investing in smart textiles, antimicrobial materials, and biodegradable fibers to meet rising demand in Clothtech, Protech, and Meditech. Growing concerns around worker protection and the integration of sensor-based fabrics in health monitoring systems are accelerating innovation and uptake.

Germany Technical Textile Market Insight

The Germany technical textile market is expected to expand at a considerable CAGR during the forecast period, driven by the country's leadership in automotive, construction, and mechanical engineering. High investment in 3D weaving, high-performance fibers, and composite layering technologies is contributing to the rapid evolution of Mobiltech, Indutech, and Buildtech segments. Germany’s commitment to eco-design, recyclability, and functional textile development aligns with European Union goals, enhancing its influence on market direction.

Asia-Pacific Technical Textile Market Insight

The Asia-Pacific technical textile market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and industrial expansion across China, India, Japan, and Southeast Asia. Growth is being supported by government-backed manufacturing programs, R&D investments, and the rising demand for Agrotech, Packtech, and Meditech applications. Additionally, the region's increasing capacity in fiber production, nanotechnology integration, and automation positions APAC as the future hub for both consumption and export of advanced technical textiles.

Japan Technical Textile Market Insight

The Japan technical textile market is gaining momentum due to the country's aging population, high technology adoption, and demand for precision textiles. Applications in wearable health devices, smart clothing, and lightweight composites for infrastructure and transportation are boosting demand across Hometech, Meditech, and Buildtech. Japan’s advanced capabilities in finishing treatments and compact design optimization further reinforce its global competitiveness in technical textile innovation.

China Technical Textile Market Insight

The China technical textile market accounted for the largest market revenue share in Asia Pacific in 2024, driven by its dominance in global textile manufacturing and rapidly expanding domestic consumption. Government policies promoting smart cities, infrastructure modernization, and defense capability are increasing demand in Geotech, Mobiltech, and Protech. China’s integration of automated thermo-forming and sustainable manufacturing practices, along with its cost competitiveness, positions it as both a production powerhouse and a fast-growing end market

Global Technical Textile Market Share

The Technical Textile industry is primarily led by well-established companies, including:

- DuPont – US

- Ahlstrom-Munksjö – Finland

- Otego Textile – France

- Freudenberg SE – Germany

- Koninklijke Ten Cate B.V. – Netherlands

- Lenzing Plastics – Austria

- Low & Bonar – UK

- Mitsui Chemicals, Inc. – Japan

- Alexium International – Australia / US

- Berry Global Inc. – US

- 3M – US

- DeRoyal Industries, Inc. – US

- Swift Textile Metalizing LLC – US

- Toyobo Co., Ltd. – Japan

- Asahi Kasei Corporation – Japan

- Stahl Holdings B.V. – Netherlands

- Bhilwara Technical Textiles Limited – India

- Kama Holdings Limited – India

- ITG Group (International Textile Group) – US

Latest Developments in Global Technical Textile Market

- In April 2024, Freudenberg Performance Materials, a global leader in technical textiles, announced the launch of its new nonwoven filtration solutions designed specifically for industrial air and liquid filtration systems. These high-performance materials are developed to enhance energy efficiency and durability, aligning with global sustainability goals. The move reaffirms Freudenberg’s leadership in delivering technically advanced, environmentally friendly solutions for industrial and environmental applications.

- In March 2024, Toray Industries, Inc., a Japanese pioneer in advanced fibers, unveiled its next-generation ultra-lightweight carbon fiber textiles for use in aerospace and automotive applications. These fabrics are engineered using 3D weaving and thermoplastic processing technologies to deliver high strength-to-weight ratios and enhanced heat resistance. This development highlights Toray's focus on expanding the use of technical textiles in Mobiltech and Protech domains with performance-driven innovation.

- In March 2024, Indorama Ventures, a global leader in synthetic fiber manufacturing, announced the commissioning of a new facility in India focused on producing high-tenacity polyester yarns and nonwoven fabrics for Geotech, Packtech, and Agrotech applications. The expansion aligns with the company’s commitment to regional manufacturing and supply chain optimization, as well as increasing demand for durable technical textile components across infrastructure and agriculture sectors.

- In February 2024, DuPont launched a new range of protective fabrics under its Nomex® and Kevlar portfolios, aimed at the fire safety, military, and oil & gas sectors. These textiles incorporate nanotechnology-based coatings for enhanced flame resistance and moisture management. The development emphasizes DuPont’s ongoing commitment to innovation in Protech and Indutech, where safety, durability, and regulatory compliance are critical.

- In January 2024, Baltex (UK) introduced its eco-smart range of warp-knitted technical fabrics, engineered for use in medical compression garments, performance sportswear, and orthopedic applications. Developed with recycled yarns and advanced 3D knitting methods, this line addresses rising demand for sustainable, high-performance medical and Sportech textiles. Baltex's initiative reflects a broader industry shift toward integrating circularity and comfort in healthcare and athletic applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Technical Textile Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Technical Textile Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Technical Textile Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.