Global System In Package Sip Technology Market

Market Size in USD Billion

CAGR :

%

USD

16.20 Billion

USD

34.50 Billion

2024

2032

USD

16.20 Billion

USD

34.50 Billion

2024

2032

| 2025 –2032 | |

| USD 16.20 Billion | |

| USD 34.50 Billion | |

|

|

|

|

System in Package (SiP) Technology Market Size

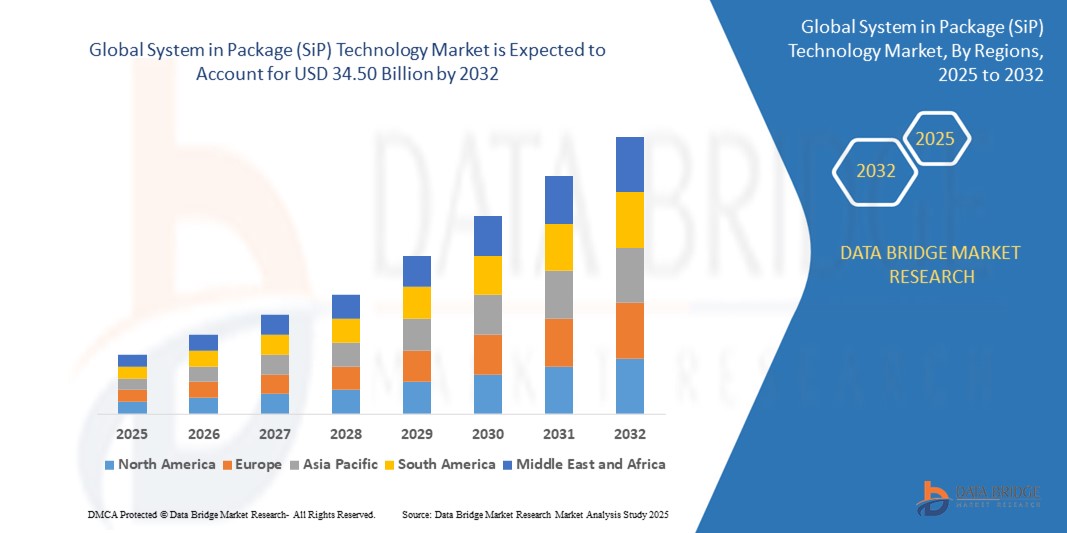

- The Global System in Package (SiP) Technology Market size was valued at USD 16.20 Billion in 2024 and is expected to reach USD 34.50 Billion by 2032, at a CAGR of 11.40% during the forecast period

- The push for smaller, lighter, and more compact electronic devices is a primary driver for SiP technology. As consumers and industries seek miniaturized gadgets without sacrificing performance, SiP solutions enable the integration of multiple components into a single, space-saving package.

- The rapid expansion of the consumer electronics sector—including smartphones, tablets, and wearable devices—fuels the adoption of SiP technology. These products require high performance in compact form factors, which SiP effectively delivers.

System in Package (SiP) Technology Market Analysis

- SiP technology enables the integration of multiple components into a single package, facilitating the development of smaller, more efficient devices. This is particularly beneficial for consumer electronics like smartphones, wearables, and IoT devices, where space and power efficiency are critical.

- Innovations such as 3D stacking, through-silicon vias (TSVs), and wafer-level packaging (WLP) have enhanced the performance and reliability of SiP solutions. These advancements support higher-density interconnections and better thermal management, expanding SiP applications across various industries.

- The consumer electronics sector remains the largest market for SiP technology, driven by the proliferation of smartphones, tablets, and wearable devices. SiP's ability to deliver high performance in compact form factors makes it ideal for these applications.

- Asia-Pacific dominates the System in Package (SiP) Technology Market with the largest revenue share of 42.01% in 2024, due the surge in Internet of Things (IoT) applications demands highly integrated, low-power, and compact solutions. SiP technology is well-suited for smart sensors, actuators, and connected devices, supporting the IoT ecosystem's growth.

- Asia-Pacific is expected to be the fastest growing region in the System in Package (SiP) Technology Market due to Continuous innovations such as 2.5D/3D IC packaging, flip chip, and wafer-level packaging enhance SiP performance and integration capabilities, making them more attractive for a range of applications.

- 2D IC Packaging Technology segment dominates the System in Package (SiP) Technology Market with a market share of 41.2% in 2024, driven by automotive industry is increasingly adopting SiP for advanced driver-assistance systems (ADAS), infotainment, and electric vehicles. SiP’s ability to integrate multiple functionalities in a robust, compact package addresses the space and reliability needs of modern vehicles.

Report Scope and System in Package (SiP) Technology Market Segmentation

|

Attributes |

System in Package (SiP) Technology Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

System in Package (SiP) Technology Market Trends

“Miniaturization and Integration for Compact Devices”

- A major trend in the SiP technology market is the drive toward miniaturization, with manufacturers integrating multiple components into a single compact module. This enables the creation of smaller, lighter, and more efficient electronic devices, meeting the growing demand for advanced consumer electronics, wearables, and IoT applications.

- The rapid proliferation of 5G networks and the Internet of Things (IoT) is significantly boosting SiP demand. SiP modules are critical for enabling high-performance, low-latency connectivity in smartphones, smart wearables, and connected devices, as they offer enhanced integration and efficiency in limited space.

- Innovations in packaging, such as Fan-Out Wafer Level Packaging, are gaining traction. These technologies improve thermal management and optimize space, addressing some of the challenges associated with high-density integration in SiP modules.

- Asia-Pacific currently leads the market, the need for greater processing power and real-time data handling in edge devices.

- SiP technology is being adopted across a diverse range of industries—including automotive, telecommunications, healthcare, and consumer electronics—due to its flexibility, scalability, and ability to deliver tailored solutions for specific application requirements.

System in Package (SiP) Technology Market Dynamics

Driver

“Rising Demand for Miniaturization and High-Performance Electronics”

- The increasing proliferation of smartphones, wearable devices, IoT sensors, and automotive electronics is fueling demand for compact, high-performance, and energy-efficient semiconductor solutions.

- For instance, in early 2025, Apple introduced its latest smartwatch series featuring a SiP module that integrates multiple functionalities—such as wireless connectivity, sensor fusion, and power management—within a single compact package, enabling thinner designs and longer battery life.

- SiP technology allows for heterogeneous integration of different chips (logic, memory, RF, sensors) into a single package, reducing space and improving system performance.

- This trend is accelerating adoption in consumer electronics and automotive sectors, where space constraints and the need for advanced features are critical.

Restraint/Challenge

“Complex Manufacturing Processes and High Initial Investment”

- SiP assembly requires advanced packaging techniques, precise placement, and sophisticated testing, which increase manufacturing complexity and costs.

- For instance, in 2025, TSMC reported delays in ramping up its new SiP production lines due to yield challenges and the need for specialized equipment, impacting delivery schedules for major smartphone OEMs.

- The high initial capital expenditure for setting up SiP manufacturing facilities can be a barrier for new entrants and smaller players.

- Additionally, SiP modules can face reliability issues such as thermal management and signal interference, especially as more components are densely packed, limiting their adoption in certain high-reliability applications like aerospace and mission-critical industrial systems.

System in Package (SiP) Technology Market Scope

The market is segmented on the basis of Packaging Technology, Package Type, Packaging Method, Device, Application

- By Packaging Technology

On the basis of Packaging Technology, the System in Package (SiP) Technology Market is segmented into 2D IC Packaging Technology, 2.5D IC Packaging Technology, 3D IC Packaging Technology. The 2D IC Packaging Technology segment dominates the largest market revenue share of 42.2% in 2024, driven by medical devices are becoming more sophisticated and portable, requiring miniaturized, reliable, and high-performance electronics. SiP enables the integration of complex functionalities for diagnostics, monitoring, and implantable devices.

The 2.5D IC Packaging Technology segment is anticipated to witness the fastest growth rate of 11.7% from 2025 to 2032, fueled by Advent of 5G and High-Speed Connectivity.

- By Package Type

On the basis of Package Type, the System in Package (SiP) Technology Market is segmented into Ball Grid Array (BGA), Surface Mount Package, Pin Grid Array (PGA), Flat Package (FP), Small Outline Package. The Ball Grid Array (BGA) segment held the largest market revenue share in 2024 driven by Rising Adoption in Healthcare Devices.

The Surface Mount Package segment is expected to witness the fastest CAGR from 2025 to 2032, driven by Artificial Intelligence and High-Performance Applications.

- By Packaging Method

On the basis of Packaging Method, the System in Package (SiP) Technology Market is segmented into Wire Bond and Die Attach, Flip Chip, Fan-Out Wafer Level Packaging (FOWLP). The Wire Bond and Die Attach segment held the largest market revenue share in 2024, driven by medical devices are becoming more sophisticated and portable, requiring miniaturized, reliable, and high-performance electronics.

The Flip Chip, Fan-Out Wafer Level Packaging (FOWLP) is expected to witness the fastest CAGR from 2025 to 2032, driven by Automotive Electronics and ADAS.

- By Device

On the basis of Device, the System in Package (SiP) Technology Market is segmented into Power Management Integrated Circuit (PMIC), Microelectromechanical Systems (MEMS), RF Front-End, RF Power Amplifier, Baseband Processor, Application Processor, Others. The Power Management Integrated Circuit (PMIC) segment held the largest market revenue share in 2024, driven by Rising Adoption in Healthcare Devices.

The Microelectromechanical Systems (MEMS) is expected to witness the fastest CAGR from 2025 to 2032, driven by Advent of 5G and High-Speed Connectivity.

- By Application

On the basis of Application, the System in Package (SiP) Technology Market is segmented into Consumer Electronics, Industrial, Automotive and Transportation, Aerospace and Defence, Healthcare, Emerging, Others. The Consumer Electronics segment held the largest market revenue share in 2024, driven by Rising Growth in Wearable Technology.

The Consumer Electronics is expected to witness the fastest CAGR from 2025 to 2032, driven by Heterogeneous Integration.

System in Package (SiP) Technology Market Regional Analysis

- Asia-Pacific dominates the System in Package (SiP) Technology Market with the largest revenue share of 42.01% in 2024, driven by the rollout of 5G networks and the need for high-frequency RF components drive SiP adoption, as these packages can efficiently integrate RF, analog, and digital components for high-speed communication devices.

- Medical devices are becoming more sophisticated and portable, requiring miniaturized, reliable, and high-performance electronics. SiP enables the integration of complex functionalities for diagnostics, monitoring, and implantable devices.

- The increasing popularity of smartwatches, fitness trackers, and other wearables relies on SiP to deliver high functionality in extremely small packages, supporting the trend toward ubiquitous, always-connected devices.

China System in Package (SiP) Technology Market Insight

The China System in Package (SiP) Technology Market captured the largest revenue share of 59% in 2024 within North America, fueled by the surge in Internet of Things (IoT) applications demands highly integrated, low-power, and compact solutions. SiP technology is well-suited for smart sensors, actuators, and connected devices, supporting the IoT ecosystem's growth.

Europe System in Package (SiP) Technology Market Insight

Continuous innovations such as 2.5D/3D IC packaging, flip chip, and wafer-level packaging enhance SiP performance and integration capabilities, making them more attractive for a range of applications.

U.K. System in Package (SiP) Technology Market Insight

The U.K. System in Package (SiP) Technology Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by presence of major semiconductor manufacturers and high consumer demand. Strategic collaborations, R&D investments, and expanding applications in emerging markets further accelerate SiP adoption.

Germany System in Package (SiP) Technology Market Insight

The Germany System in Package (SiP) Technology Market is expected to expand at a considerable CAGR during the forecast period, fueled by Widespread adoption of server virtualization has increased the need for automation to efficiently provision, monitor, and manage virtual resources at scale.

Asia-Pacific System in Package (SiP) Technology Market Insight

The Asia-Pacific System in Package (SiP) Technology Market is poised to grow at the fastest CAGR of 17% during the forecast period of 2025 to 2032, driven SiP reduces the need for complex PCB designs and assembly, lowering overall system costs and shortening development cycles, which is attractive for manufacturers aiming for rapid product launches.

Japan System in Package (SiP) Technology Market Insight

The Japan System in Package (SiP) Technology Market is gaining momentum The rise of Industry 4.0 and smart factories increases demand for compact, reliable, and integrated control systems, where SiP plays a crucial role in enabling automation and connectivity.

U.S. System in Package (SiP) Technology Market Insight

The U.S. System in Package (SiP) Technology Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by SiP technology enables heterogeneous integration, combining processors, memory, sensors, and RF components into a single package. This versatility meets the complex demands of modern electronic systems.

System in Package (SiP) Technology Market Share

The System in Package (SiP) Technology Market is primarily led by well-established companies, including:

SAMSUNG (South Korea)

Amkor Technology (U.S.)

ASE Group (Taiwan)

ChipMOS TECHNOLOGIES INC. (Taiwan)

JCET Group Co., Ltd. (China)

Texas Instruments Incorporated. (U.S.)

Unisem (Malaysia)

UTAC (Singapore)

Renesas Electronics Corporation (Japan)

Intel Corporation (U.S.)

FUJITSU (Japan)

TOSHIBA ELECTRONICS EUROPE GMBH (Germany)

Amkor Technology (U.S.)

SPIL (Taiwan)

Powertech Technology (Taiwan)

Latest Developments in Global System in Package (SiP) Technology Market

- In July 2024, Amkor expanded its SiP assembly and testing capabilities by inaugurating a new facility in Bac Ninh, Vietnam. This move aims to cater to the growing demand for innovative SiP solutions in the electronics and semiconductor sectors.

- In August 2022 Amkor expanded its SiP assembly and testing capabilities by inaugurating a new facility in Bac Ninh, Vietnam. This move aims to cater to the growing demand for innovative SiP solutions in the electronics and semiconductor sectors.

- In April 2024, Toshiba launched 80V N-channel power MOSFETs utilizing advanced manufacturing techniques. These components, housed in surface-mount packages, are designed for industrial equipment in data centers and telecom base stations.

- In February 2025, Qualcomm's Snapdragon SiP was featured in ASUS's ZenFone Max Shot and Max Plus (M2) smartphones in Brazil. This integration marked a significant step in delivering compact and efficient mobile solutions.

- In January 2025, JCET ramped up production at its Incheon, South Korea facility by introducing a new 12-inch wafer bumping line. This enhancement aimed to bolster their SiP manufacturing capabilities.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.