Global Sustainable Finance Market, By Investment Type (Equity, Fixed Income, Mixed Allocation), Transaction Type (Green Bond, Social Bond, Mixed-sustainability Bond), Industry Verticals (Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government) - Industry Trends and Forecast to 2031.

Sustainable Finance Market Analysis and Size

Sustainable finance refers to the integration of environmental, social, and governance (ESG) considerations into financial decision-making processes, investments, and activities. It encompasses a range of financial products and services aimed at supporting environmentally and socially responsible practices. Sustainable finance seeks to align financial goals with broader sustainability objectives, fostering investments that contribute to positive social and environmental impacts while promoting long-term economic stability. This approach considers the interconnectedness of financial, social, and environmental systems to address global challenges and create a more sustainable and resilient financial landscape.

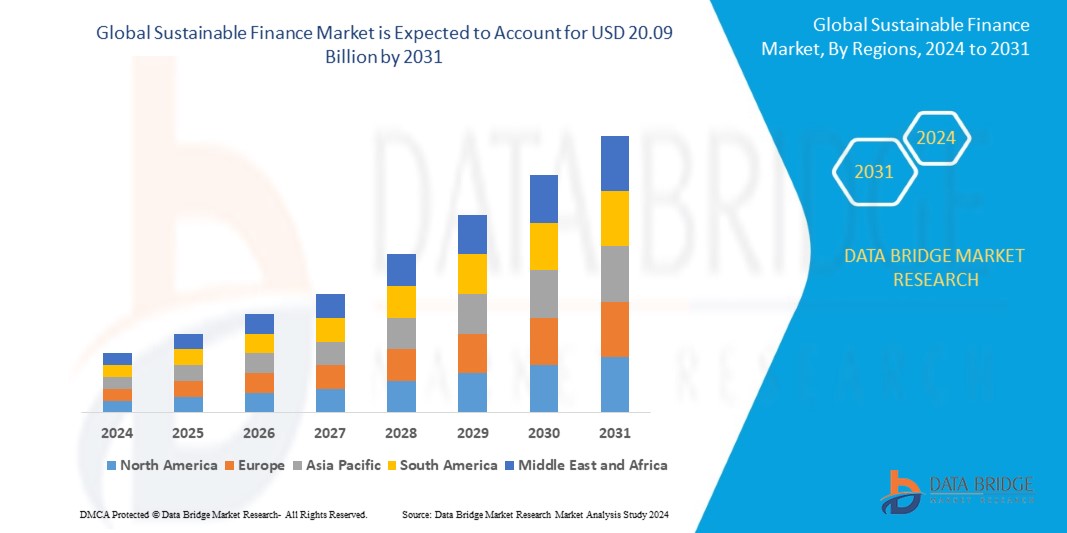

Data Bridge Market Research analyses that the global sustainable finance market which was USD 4.56 billion in 2023, would rocket up to USD 20.09 billion by 2031, and is expected to undergo a CAGR of 20.36% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customized 2016 to 2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Investment Type (Equity, Fixed Income, Mixed Allocation), Transaction Type (Green Bond, Social Bond, Mixed-sustainability Bond), Industry Verticals (Utilities, Transport and Logistics, Chemicals, Food and Beverage, Government)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

|

|

Market Players Covered

|

BlackRock, Inc. (U.S.), Refinitiv (U.S.), Acuity Knowledge Partners (U.S.), NOMURA HOLDINGS, INC (Japan), Aspiration Partners, Inc. (U.S.), Bank of America (U.S.), BNP Paribas (France), Goldman Sachs (U.S.), HSBC Group (U.K.), KPMG International (Netherlands), South Pole (Switzerland), Deutsche Bank AG (Germany), Stripe, Inc. (U.S.), Tred Earth Limited (U.K.), Triodos Bank UK Ltd. (U.K.), UBS (Switzerland), Starling Bank (U.K.), Clarity AI (U.S.)

|

|

Market Opportunities

|

|

Market Definition

The global sustainable finance market refers to the financial services and investment activities that prioritize environmental, social, and governance (ESG) considerations. This market encompasses a wide range of financial products, including loans, bonds, and investment funds, that support sustainable and socially responsible initiatives. Sustainable finance aims to allocate capital to projects and businesses that contribute to positive environmental and social outcomes while delivering financial returns. It involves integrating ESG criteria into decision-making processes, encouraging responsible investment practices, and fostering transparency. The market plays a crucial role in promoting sustainability, addressing climate change, and achieving long-term economic and societal well-being.

Global Sustainable Finance Market Dynamics

Drivers

- Rising Focus on Environmental and Social Issues

The rising focus on environmental and social issues serves as a significant driver for the global sustainable finance market. As global awareness of climate change, social inequality, and environmental degradation increases, there is a growing demand for financial instruments and services that align with sustainable and responsible practices. Investors and financial institutions are increasingly incorporating environmental, social, and governance (ESG) criteria into their decision-making processes. This shift is driven by the recognition that sustainable finance not only addresses pressing global challenges but also contributes to long-term financial stability and resilience. The commitment to promoting positive environmental and social outcomes has become a key factor influencing investment decisions and shaping the trajectory of the global sustainable finance market.

- Growing Awareness of Climate Change Risks

The growing awareness of climate change risks is a significant driver for the global sustainable finance market. As the world becomes more cognizant of the environmental impact of economic activities, there is an increasing demand for financial products and services that prioritize sustainability and address climate-related risks. Investors, businesses, and financial institutions are recognizing the importance of integrating climate considerations into their decision-making processes. Sustainable finance provides a framework for channeling capital toward environmentally friendly and climate-resilient projects, fostering a transition to a low-carbon economy. This driver reflects a broader global commitment to combating climate change and promoting financial practices that align with long-term environmental sustainability goals.

- Collaboration Between Governments, Businesses, and Investors

Collaboration between governments, businesses, and investors is a significant driver for the global sustainable finance market. The increasing recognition of the urgent need to address environmental and social challenges has led to collaborative efforts among various stakeholders. Governments are implementing policies and regulations that promote sustainable finance practices, creating a supportive regulatory environment. Businesses are incorporating sustainability into their strategies, and investors are seeking opportunities that align with environmental, social, and governance (ESG) criteria. This collaborative approach enhances the credibility and impact of sustainable finance initiatives, fostering a more holistic and systemic transformation toward a sustainable global economy. The alignment of goals and concerted efforts among these entities is crucial for driving the growth of sustainable finance and achieving broader environmental and social objectives.

Opportunity

- Growing Demand for Sustainable Investments

The growing demand for sustainable investments presents a significant opportunity for the global sustainable finance market. As awareness of environmental and social issues rises, there is an increasing desire among investors to align their portfolios with sustainable and responsible practices. This demand is driving financial institutions and asset managers to offer a diverse range of sustainable investment products, including green bonds, impact funds, and ESG-focused financial instruments. The opportunity lies in meeting this escalating demand by developing innovative and robust sustainable financial products that cater to investors seeking both financial returns and positive societal and environmental impact.

Restraint

- Higher Upfront Costs

One of the significant restraints for the global sustainable finance market is the higher upfront costs associated with implementing sustainable financial practices. While there is a growing demand for sustainable investments, the initial costs involved in transitioning traditional financial operations to more sustainable and responsible models can be substantial. Financial institutions may need to invest in new technologies, conduct extensive training programs, and implement rigorous reporting and compliance measures to adhere to sustainability standards. These upfront costs, coupled with potential uncertainties about immediate returns, may act as a deterrent for some market participants. Overcoming this restraint requires a strategic approach that considers long-term benefits and emphasizes the positive impact on both the environment and society, encouraging more institutions to embrace sustainable finance practices despite the initial financial commitments.

Challenge

- Data and Technology Costs

A significant challenge faced by the global sustainable finance market is the associated data and technology costs. Implementing sustainable finance practices often requires advanced technologies and robust data analytics capabilities to track, measure, and report on environmental, social, and governance (ESG) metrics. Collecting and managing vast amounts of relevant data for assessing sustainability performance can be resource-intensive, requiring sophisticated technologies and skilled personnel. In addition, integrating these technologies into existing financial systems may incur substantial costs. Addressing these challenges will be pivotal in advancing the adoption of sustainable finance practices across the financial industry.

This global sustainable finance market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the variable frequency drive market contact the Data Bridge Market Research for an analyst brief, our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In January 2024, Deutsche Bank launched the "Sustainable Ocean Bond" in January, financing projects related to ocean conservation and sustainable fisheries management. This innovative bond aims to protect our vital marine ecosystems

- In January 2024, Citigroup announced the "Sustainable Infrastructure Equity Fund" in January, investing in public companies developing and operating sustainable infrastructure globally. This fund supports responsible infrastructure development like clean energy grids and public transport

Global Sustainable Finance Market Scope

The global sustainable finance market is segmented on the basis of investment type, transaction type, and industry vertical. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Investment Type

- Equity

- Fixed Income

- Mixed Allocation

Transaction Type

- Green Bond

- Social Bond

- Mixed- sustainability Bond

Industry Verticals

- Utilities

- Transport and Logistics

- Chemicals

- Food and Beverage

- Government

Global Sustainable Finance Market Region Analysis/Insights

The global sustainable finance market is analyzed and market size insights and trends are provided by region, investment type, transaction type, and industry vertical, as referenced above.

The regions covered in the global sustainable finance market are North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. The countries covered in the global sustainable finance market report are U.S., Canada, Mexico, Brazil, Argentina, the Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa.

North America is the region dominates the global sustainable finance market because the region has witnessed a surge in awareness and commitment to environmental and social causes, driving increased demand for sustainable finance solutions. The presence of a mature financial sector, coupled with strong regulatory frameworks emphasizing ESG considerations, further propels the market's growth. In addition, robust technological infrastructure and a burgeoning number of sustainable finance initiatives by key players contribute to North America's leadership. The region's investor community, with a growing focus on sustainable investments, also plays a pivotal role in steering the market dynamics.

Asia-Pacific region is the fastest growing region due to the escalating awareness of environmental and social issues, prompting governments and businesses across the region to prioritize sustainability. With a rising demand for sustainable investments, Asia-Pacific witnesses significant collaboration between governments, businesses, and investors, fostering a conducive ecosystem for sustainable finance. The region's unique position as a major contributor to global emissions drives a growing recognition of climate change risks, further accelerating the adoption of sustainable finance solutions.. As a result, Asia-Pacific stands out as a dynamic and burgeoning hub for sustainable finance, exhibiting substantial potential for continued expansion.

The region section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, and Porter’s five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Global Sustainable Finance Market Share Analysis

The global sustainable finance market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the global sustainable finance market.

Some of the major players operating in the global sustainable finance market are:

- BlackRock, Inc. (U.S.)

- Refinitiv (U.S.)

- Acuity Knowledge Partners (U.S.)

- NOMURA HOLDINGS, INC (Japan)

- Aspiration Partners, Inc. (U.S.)

- Bank of America (U.S.)

- BNP Paribas (France)

- Goldman Sachs (U.S.)

- HSBC Group (U.K.)

- KPMG International (Netherlands)

- South Pole (Switzerland)

- Deutsche Bank AG (Germany)

- Stripe, Inc. (U.S.)

- Tred Earth Limited (U.K.)

- Triodos Bank UK Ltd. (U.K.)

- UBS (Switzerland)

- Starling Bank (U.K.)

- Clarity AI (U.S.)

SKU-