Global Sustainable Finance Market

Market Size in USD Billion

CAGR :

%

USD

5.49 Billion

USD

24.17 Billion

2024

2032

USD

5.49 Billion

USD

24.17 Billion

2024

2032

| 2025 –2032 | |

| USD 5.49 Billion | |

| USD 24.17 Billion | |

|

|

|

|

Sustainable Finance Market Size

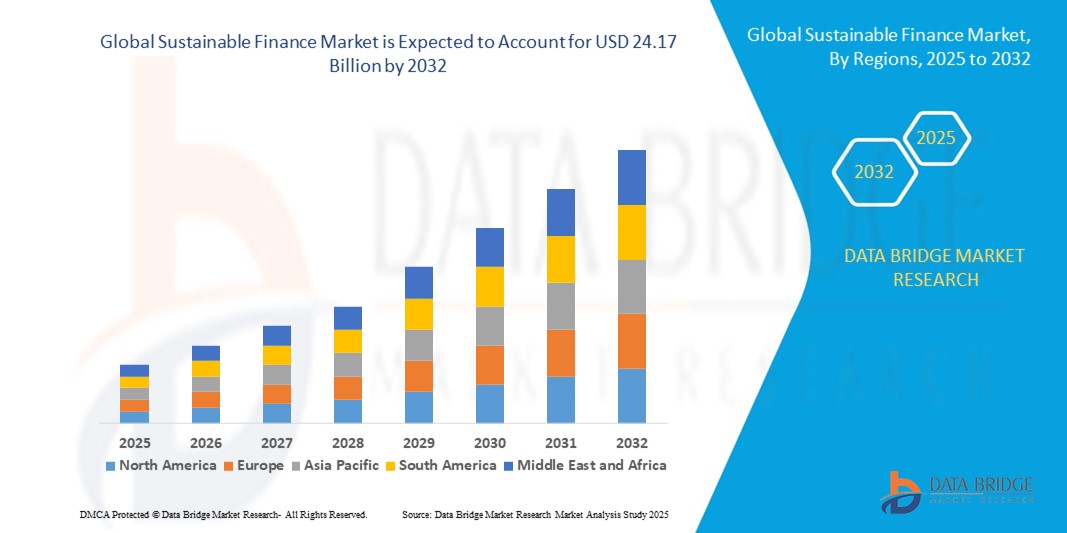

- The global sustainable finance market size was valued at USD 5.49 billion in 2024 and is expected to reach USD 24.17 billion by 2032, at a CAGR of 20.36% during the forecast period

- The market growth is primarily driven by increasing demand for environmentally and socially responsible investments, heightened awareness of climate change, and supportive government policies promoting sustainable development

- Rising investor interest in ESG (Environmental, Social, and Governance) criteria and the growing adoption of sustainable finance solutions by corporations are further propelling market expansion across both institutional and retail investment channels

Sustainable Finance Market Analysis

- The sustainable finance market is experiencing robust growth as investors and corporations prioritize sustainability, driven by regulatory pressures and consumer demand for ethical investment options

- Growing interest from both institutional and retail investors is encouraging financial institutions to innovate with sustainable investment products, such as green bonds and ESG-focused equity funds

- North America dominated the sustainable finance market with the largest revenue share of 36.4% in 2024, driven by a well-established financial ecosystem, stringent ESG regulations, and high investor awareness of sustainable investment opportunities

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid economic growth, increasing adoption of sustainable practices in emerging markets such as China and India, and supportive government initiatives for green financing

- The fixed income segment accounted for the largest market revenue share of 58.2% in 2024, driven by the increasing issuance of green and social bonds, which offer stable returns and align with environmental and social goals. Fixed income instruments are favored by institutional investors for their lower risk profile and ability to fund large-scale sustainable projects, such as renewable energy and infrastructure development

Report Scope and Sustainable Finance Market Segmentation

|

Attributes |

Sustainable Finance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Sustainable Finance Market Trends

Increasing Integration of AI and Big Data Analytics

- The global sustainable finance market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into investment performance, environmental impact, and social governance metrics

- AI-powered sustainable finance platforms allow for proactive decision-making, identifying high-impact investment opportunities and potential risks before they affect portfolio performance

- For instance, several financial institutions are developing AI-driven tools that analyze ESG (Environmental, Social, and Governance) data to tailor investment strategies or optimize green bond allocations based on real-time market and sustainability trends

- This trend enhances the value proposition of sustainable finance instruments, making them more attractive to institutional investors, asset managers, and individual stakeholders

- AI algorithms can evaluate a wide range of ESG factors, including carbon footprints, labor practices, and governance structures, to ensure alignment with sustainability goals

Sustainable Finance Market Dynamics

Driver

Rising Demand for Sustainable Investments and Regulatory Support

- Increasing investor demand for sustainable financial products, such as green bonds and social bonds, is a major driver for the global sustainable finance market

- Sustainable finance enhances portfolio resilience by integrating ESG factors, offering long-term value through investments in renewable energy, sustainable transport, and ethical governance

- Government regulations and international frameworks, particularly in North America, which is the dominating region, are accelerating the adoption of sustainable finance practices

- The proliferation of digital platforms and blockchain technology is further enabling transparent and efficient transaction processes, supporting the growth of green and mixed-sustainability bonds

- Financial institutions are increasingly embedding sustainable finance options into their offerings to meet investor expectations and align with global sustainability goals

Restraint/Challenge

High Implementation Costs and Data Transparency Concerns

- The substantial initial investment required for developing sustainable finance frameworks, including ESG data integration and compliance systems, can be a significant barrier, particularly in emerging markets

- Integrating sustainable finance principles into existing investment portfolios can be complex and resource-intensive

- Data transparency and reliability concerns pose a major challenge. Sustainable finance relies on accurate ESG data, raising issues about potential greenwashing, data inconsistencies, and compliance with varying global standards

- The fragmented regulatory landscape across different regions, particularly in the fast-growing Asia-Pacific market, complicates operations for international investors and financial institutions

- These factors can deter potential investors and limit market expansion, especially in regions with limited awareness of sustainable finance or where cost sensitivity is a significant concern

Sustainable Finance market Scope

The market is segmented on the basis of investment type, transaction type, and industry verticals.

- By Investment Type

On the basis of investment type, the global sustainable finance market is segmented into equity, fixed income, and mixed allocation. The fixed income segment accounted for the largest market revenue share of 58.2% in 2024, driven by the increasing issuance of green and social bonds, which offer stable returns and align with environmental and social goals. Fixed income instruments are favored by institutional investors for their lower risk profile and ability to fund large-scale sustainable projects, such as renewable energy and infrastructure development. Their standardized structures and transparency further enhance their appeal to risk-averse investors.

The equity segment is expected to register the fastest growth rate from 2025 to 2032, fueled by rising investor interest in companies with strong environmental, social, and governance (ESG) performance. Equity investments allow for direct participation in sustainable businesses, offering higher potential returns and supporting innovation in clean technologies and sustainable practices. Growing awareness of climate risks and the shift toward ESG-focused portfolios are driving demand for equity-based sustainable finance solutions.

- By Transaction Type

On the basis of transaction type, the global sustainable finance market is segmented into green bonds, social bonds, and mixed-sustainability bonds. Green bonds dominated with the highest revenue share in 2024, attributed to their widespread adoption for financing environmentally friendly projects such as renewable energy, energy efficiency, and sustainable infrastructure. Green bonds benefit from strong regulatory support, clear frameworks such as the Green Bond Principles, and increasing demand from institutional investors seeking measurable environmental impact.

The mixed-sustainability bond segment is projected to grow at the fastest CAGR from 2025 to 2032, as issuers increasingly combine environmental and social objectives in a single instrument. These bonds appeal to a broader investor base by addressing multiple sustainability challenges, such as climate change and social inclusion, while offering flexibility in fund allocation. The rise of blended finance models and growing investor appetite for diversified ESG outcomes are key drivers of this segment’s rapid growth.

- By Industry Verticals

On the basis of industry verticals, the global sustainable finance market is segmented into utilities, transport and logistics, chemicals, food and beverage, and government. The utilities sector held the largest revenue share in 2024, driven by significant investments in renewable energy projects, such as solar, wind, and hydroelectric power. The sector’s critical role in achieving net-zero goals, coupled with supportive government policies and incentives, has positioned it as a cornerstone of sustainable finance.

The transport and logistics segment is anticipated to grow at the fastest rate from 2025 to 2032, propelled by the global push for decarbonization and the adoption of sustainable transport solutions, such as electric vehicles and green shipping. Investments in low-carbon infrastructure, sustainable supply chains, and innovative logistics technologies are accelerating this segment’s growth. Rising consumer demand for eco-friendly products and stringent emissions regulations further bolster the need for sustainable finance in this sector.

Sustainable Finance Market Regional Analysis

- North America dominated the sustainable finance market with the largest revenue share of 36.4% in 2024, driven by a well-established financial ecosystem, stringent ESG regulations, and high investor awareness of sustainable investment opportunities

- The trend towards sustainable investing and increasing regulations promoting transparency in ESG reporting further boost market expansion. Financial institutions’ growing issuance of green and social bonds complements retail investment growth, creating a diverse ecosystem of sustainable finance products

U.S. Sustainable Finance Market Insight

The U.S. sustainable finance market captured the largest revenue share of 83.5% in 2024 within North America, fueled by robust demand for green bonds and equity investments in sustainable industries. The trend towards ESG-focused portfolios and increasing regulatory support for sustainable finance standards further accelerate market growth. The integration of sustainable finance in corporate and government funding strategies supports a thriving market ecosystem.

Europe Sustainable Finance Market Insight

The Europe sustainable finance market is expected to witness significant growth, supported by regulatory emphasis on ESG compliance and sustainable development. Investors seek financial instruments that align with climate goals while offering stable returns. The growth is prominent in both new issuances of green and social bonds and sustainable equity investments, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban infrastructure needs.

U.K. Sustainable Finance Market Insight

The U.K. market for sustainable finance is expected to witness rapid growth, driven by demand for green and social bonds in urban and suburban financial hubs. Increased interest in ESG-compliant investments and rising awareness of climate risk mitigation benefits encourage adoption. Evolving regulations, such as the U.K.’s Sustainable Finance Framework, influence investor choices, balancing returns with compliance.

Germany Sustainable Finance Market Insight

Germany is expected to witness rapid growth in sustainable finance, attributed to its advanced financial sector and high investor focus on ESG integration and energy efficiency. German investors prefer technologically advanced financial instruments, such as green bonds, that support renewable energy and contribute to lower carbon emissions. The integration of sustainable finance in corporate and government funding supports sustained market growth.

Asia-Pacific Sustainable Finance Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding financial markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of ESG principles, climate risk mitigation, and sustainable development is boosting demand. Government initiatives promoting green financing and sustainable infrastructure further encourage the adoption of advanced financial instruments.

Japan Sustainable Finance Market Insight

Japan’s sustainable finance market is expected to witness rapid growth due to strong investor preference for high-quality, ESG-aligned financial instruments that enhance portfolio sustainability and resilience. The presence of major financial institutions and integration of green bonds in government and corporate financing accelerate market penetration. Rising interest in sustainable equity investments also contributes to growth.

China Sustainable Finance Market Insight

China holds the largest share of the Asia-Pacific sustainable finance market, propelled by rapid urbanization, rising investor interest, and increasing demand for green and social bond solutions. The country’s growing middle class and focus on sustainable development support the adoption of advanced financial instruments. Strong domestic financial capabilities and competitive pricing enhance market accessibility.

Sustainable Finance Market Share

The sustainable finance industry is primarily led by well-established companies, including:

- BlackRock, Inc. (U.S.)

- Refinitiv (U.S.)

- Acuity Knowledge Partners (U.S.)

- NOMURA HOLDINGS, INC (Japan)

- Aspiration Partners, Inc. (U.S.)

- Bank of America (U.S.)

- BNP Paribas (France)

- Goldman Sachs (U.S.)

- HSBC Group (U.K.)

- KPMG International (Netherlands)

- South Pole (Switzerland)

- Deutsche Bank AG (Germany)

- Stripe, Inc. (U.S.)

- Tred Earth Limited (U.K.)

- Triodos Bank UK Ltd. (U.K.)

- UBS (Switzerland)

- Starling Bank (U.K.)

- Clarity AI (U.S.)

What are the Recent Developments in Global Sustainable Finance Market?

- In August 2025, ISS Sustainability Solutions, the sustainable investment arm of ISS STOXX, acquired Sust Global, a geospatial AI-powered climate risk data provider. This strategic move underscores the growing importance of advanced data analytics in sustainable finance, as investors increasingly seek precise tools to assess and manage climate-related risks. Sust Global’s proprietary platform integrates satellite data and machine learning to deliver high-resolution insights into physical climate hazards. The acquisition enables ISS to enhance its asset-level risk mapping capabilities and expand its offerings to institutional clients worldwide

- In July 2025, Mizuho Financial Group, a leading Tokyo-based banking and financial services company, announced its acquisition of Augusta & Co, a UK-based investment bank specializing in renewable energy and the energy transition. This strategic move strengthens Mizuho’s M&A advisory platform and deepens its expertise in sustainable finance. Augusta will retain its brand and leadership, operating as Mizuho’s renewables advisory arm in the EMEA region. The acquisition reflects a broader trend of traditional financial institutions acquiring niche firms to expand their capabilities and market share in the fast-growing energy transition sector

- In June 2024, Australia made history by issuing its inaugural sovereign green bond worth USD 7 billion, becoming the first country to do so at that scale. The bond attracted in bids from 105 global investor institutions, underscoring strong international confidence in Australia’s climate strategy. Funds raised will support projects such as green hydrogen hubs, clean transport, community batteries, and biodiversity conservation. This initiative marks a major milestone in sustainable finance, reinforcing Australia’s commitment to achieving net zero emissions by 2050 and aligning with the United Nations Sustainable Development Goals

- In March 2024, the UN-hosted Joint SDG Fund significantly expanded its programming, reaching—a 160% increase from the previous year. This surge in capital reflects a growing commitment among international partners to pool resources for global sustainable development. The Fund’s expanded reach supports transformative initiatives in digital access, food systems, and energy transition, benefiting over 10 million people in 2024 alone. By mobilizing both public and private financing, the Joint SDG Fund continues to play a pivotal role in accelerating progress toward the 2030 Agenda and delivering impact where it matters most

- In February 2024, Japan announced the issuance of its inaugural sovereign climate transition bonds, becoming the first country to launch this innovative debt product. Valued at ¥1.6 trillion (approximately USD 11 billion), the bonds aim to finance Japan’s decarbonization efforts under its Green Transformation (GX) strategy. Proceeds will support projects across sectors such as hydrogen, ammonia, next-generation reactors, and energy-efficient technologies. This initiative reflects Japan’s commitment to a phased, inclusive transition from high-emission practices to sustainable alternatives, and highlights the growing role of sovereign finance in driving climate action

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sustainable Finance Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sustainable Finance Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sustainable Finance Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.