Global Stealth Warfare Market

Market Size in USD Billion

CAGR :

%

USD

13.83 Billion

USD

27.02 Billion

2024

2032

USD

13.83 Billion

USD

27.02 Billion

2024

2032

| 2025 –2032 | |

| USD 13.83 Billion | |

| USD 27.02 Billion | |

|

|

|

|

Stealth Warfare Market Size

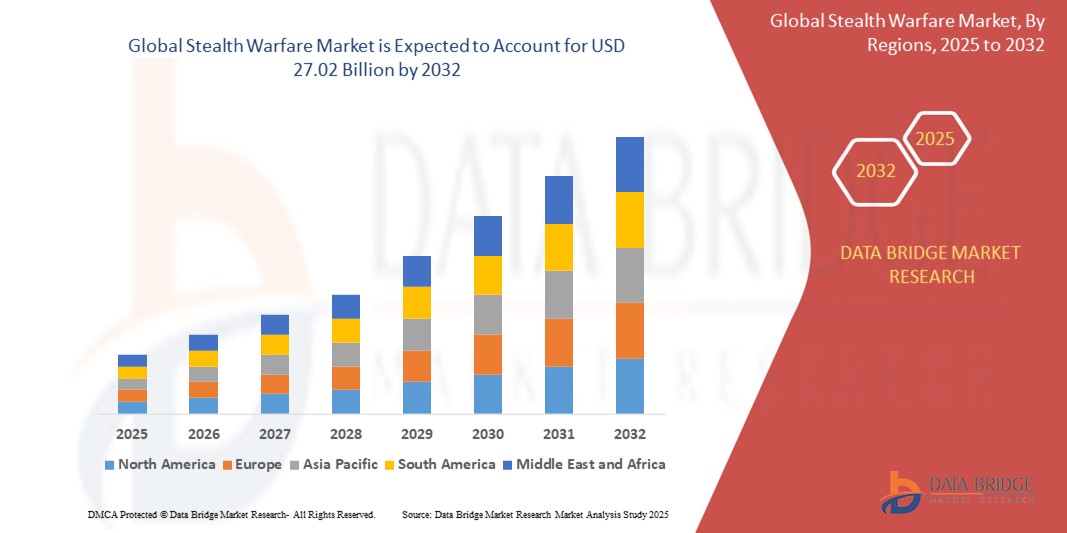

- The global stealth warfare market size was valued at USD 13.83 billion in 2024 and is expected to reach USD 27.02 billion by 2032, at a CAGR of 8.73% during the forecast period

- The market growth is driven by increasing defense budgets, advancements in stealth technology, and rising geopolitical tensions necessitating advanced military capabilities

- The demand for stealth solutions is fueled by the need for enhanced survivability in contested environments, integration of cutting-edge materials, and the development of next-generation platforms for air and naval applications

Stealth Warfare Market Analysis

- Stealth warfare technologies, designed to reduce detection by radar, infrared, and acoustic systems, are critical for modern military operations, offering strategic advantages in air, naval, and ground applications

- The growing adoption of stealth technologies is driven by increasing defense modernization programs, the need for low-observable platforms, and advancements in radar-absorbing materials and sensor systems

- North America dominated the stealth warfare market with the largest revenue share of 42.5% in 2024, attributed to significant investments in defense R&D, a strong presence of key industry players, and early adoption of advanced stealth technologies, particularly in the U.S. for next-generation fighter jets and naval vessels

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by rapid military modernization, increasing defense expenditures, and growing regional security concerns

- The airborne segment dominated the largest market revenue share of 57.8% in 2024, driven by the critical role of stealth aircraft in reconnaissance, tactical engagements, and air superiority missions

Report Scope and Stealth Warfare Market Segmentation

|

Attributes |

Stealth Warfare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stealth Warfare Market Trends

“Increasing Integration of AI and Autonomous Systems”

- The global stealth warfare market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and autonomous systems

- These technologies enhance data processing and analysis, providing deeper insights into platform performance, threat detection, and mission planning

- AI-powered stealth systems enable proactive threat identification, allowing for real-time countermeasures and enhanced survivability in contested environments

- For instance, companies are developing AI-driven platforms that analyze radar, infrared, and acoustic signatures to optimize stealth operations and adapt to advanced enemy detection systems

- This trend is increasing the strategic value of stealth platforms, making them more effective for air forces, navies, and armies

- AI algorithms can process vast datasets from sensors, such as radar and Infrared Search and Track (IRST) systems, to improve decision-making and maintain stealth capabilities under dynamic battlefield conditions

Stealth Warfare Market Dynamics

Driver

“Rising Demand for Advanced Stealth Platforms and Counter-Detection Capabilities”

- Increasing geopolitical tensions and the need for strategic superiority are driving demand for advanced stealth platforms across airborne, naval, and army applications

- Stealth systems enhance operational effectiveness by reducing detectability through technologies such as radar-absorbing materials, non-metallic airframes, and acoustic signature reduction

- Government initiatives, particularly in North America, which dominates the market due to robust investments in defense infrastructure, are promoting the adoption of stealth technologies

- The proliferation of advanced anti-access/area denial (A2/AD) systems and the development of 5G technology enable faster data transmission and lower latency, supporting more sophisticated stealth applications

- Defense contractors, such as Lockheed Martin and Northrop Grumman, are increasingly integrating stealth features as standard or optional components in aircraft, naval vessels, and ground vehicles to meet evolving military requirements

Restraint/Challenge

“High Development Costs and Counter-Stealth Technology Advancements”

- The substantial investment required for research, development, and integration of stealth technologies, such as radar-absorbing materials and non-metallic airframes, poses a significant barrier, particularly for emerging markets

- Integrating stealth systems into existing platforms, such as aircraft or naval vessels, can be complex and costly, requiring specialized engineering and materials

- In addition, advancements in counter-stealth technologies, such as improved radar and infrared detection systems, present a major challenge by reducing the effectiveness of stealth platforms

- The fragmented global regulatory landscape regarding military technology exports and intellectual property protection complicates operations for international manufacturers and service providers

- These factors can deter adoption in cost-sensitive regions and limit market expansion, particularly in areas with rapidly evolving detection technologies or limited defense budgets

Stealth Warfare market Scope

The market is segmented on the basis of platform, equipment, material, and application.

- By Platform

On the basis of platform, the global stealth warfare market is segmented into airborne and naval. The airborne segment dominated the largest market revenue share of 57.8% in 2024, driven by the critical role of stealth aircraft in reconnaissance, tactical engagements, and air superiority missions. Advancements in aerodynamics and radar-absorbing materials further enhance the adoption of airborne stealth platforms.

The naval segment is expected to witness the fastest growth rate of 10.2% from 2025 to 2032, fueled by increasing investments in stealth-enabled naval vessels, such as submarines and stealth ships, to ensure maritime security and counter evolving threats in contested waters.

- By Equipment

On the basis of equipment, the global stealth warfare market is segmented into radar, infrared search and track (IRST) system, and acoustic signature. The radar segment dominated the market with a revenue share of 45.3% in 2024, owing to its critical role in detecting and countering stealth platforms through advanced radar systems, including ground-based, airborne, naval, and synthetic aperture radar (SAR).

The infrared search and track (IRST) system segment is anticipated to experience the fastest growth rate of 11.5% from 2025 to 2032, driven by its ability to detect stealth platforms through thermal signatures, particularly in environments where radar performance is limited by weather or countermeasures.

- By Material

On the basis of material, the global stealth warfare market is segmented into non-metallic airframe and radar-absorbing material (RAM). The radar-absorbing material segment accounted for the largest market revenue share of 62.7% in 2024, driven by its widespread use in reducing the radar cross-section (RCS) of aircraft, ships, and ground vehicles, enhancing their stealth capabilities.

The non-metallic airframe segment is expected to witness significant growth from 2025 to 2032, propelled by advancements in composite materials and metallurgy, which enable lightweight, durable, and low-observable structures for stealth platforms.

- By Application

On the basis of application, the global stealth warfare market is segmented into air force, navy, and army. The air force segment dominated the market with a revenue share of 50.4% in 2024, driven by the extensive use of stealth aircraft, such as the F-35 and B-21 Raider, for covert operations and precision strikes in contested environments.

The navy segment is anticipated to grow at the fastest rate of 10.8% from 2025 to 2032, fueled by the increasing adoption of stealth technology in naval vessels, including submarines and frigates, to enhance survivability and operational effectiveness in maritime warfare.

Stealth Warfare Market Regional Analysis

- North America dominated the stealth warfare market with the largest revenue share of 42.5% in 2024, attributed to significant investments in defense R&D, a strong presence of key industry players, and early adoption of advanced stealth technologies, particularly in the U.S. for next-generation fighter jets and naval vessels

- Demand is fueled by the need for enhanced survivability, tactical surprise, and penetration capabilities in contested environments, particularly for air, naval, and ground operations

- Growth is supported by innovations in stealth technologies, such as radar-absorbing materials, infrared signature reduction, and acoustic suppression, alongside increasing adoption in both military modernization programs and new platform deployments

U.S. Stealth Warfare Market Insight

The U.S. stealth warfare market captured the largest revenue share of 78.6% in 2024 within North America, fueled by robust defense spending and a strong focus on maintaining strategic superiority. The development of next-generation stealth platforms, such as the B-21 Raider, and advancements in radar-absorbing materials drive market growth. Increasing integration of stealth technologies in unmanned systems and stringent regulations for countering advanced detection systems further boost demand.

Europe Stealth Warfare Market Insight

The European stealth warfare market is expected to witness significant growth, supported by regional emphasis on modernizing defense capabilities and countering evolving threats. Countries such as the U.K. and France are investing in stealth technologies for air and naval platforms to enhance operational effectiveness. The focus on multi-domain operations and integration of AI-driven stealth systems contributes to market expansion, particularly in retrofit and new platform applications.

U.K. Stealth Warfare Market Insight

The U.K. market for stealth warfare is expected to experience rapid growth, driven by investments in advanced radar systems and stealth coatings for air and naval platforms. The demand for enhanced situational awareness and survivability in complex battlefields encourages adoption. Regulatory frameworks promoting interoperability and network-centric warfare, combined with collaborations such as the Eurofighter Typhoon upgrades, support sustained market growth.

Germany Stealth Warfare Market Insight

Germany is expected to witness significant growth in the stealth warfare market, attributed to its advanced defense manufacturing sector and focus on technological innovation. German military programs prioritize stealth technologies for aircraft and naval vessels to reduce detectability and enhance mission success. The integration of advanced materials, such as non-metallic airframes, and partnerships with companies such as Hensoldt drive market growth.

Asia-Pacific Stealth Warfare Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the global stealth warfare market, driven by rising defense budgets and geopolitical tensions in countries such as China, India, and Japan. Increasing awareness of stealth technology’s role in air superiority, maritime security, and ground operations boosts demand. Government initiatives for indigenous defense production and modernization programs further accelerate market growth.

Japan Stealth Warfare Market Insight

Japan’s stealth warfare market is expected to grow rapidly due to strong demand for advanced stealth technologies in airborne and naval platforms. The presence of major defense contractors and integration of stealth features in OEM platforms, such as fighter jets, enhance market penetration. Rising interest in countering regional threats and adopting AI-driven stealth systems contributes to significant market expansion.

China Stealth Warfare Market Insight

China holds the largest share of the Asia-Pacific stealth warfare market, fueled by rapid military modernization, increasing defense budgets, and a focus on indigenous stealth platform development. The demand for radar-absorbing materials and acoustic signature reduction for naval and air forces drives growth. Competitive domestic manufacturing and investments in unmanned systems with stealth capabilities enhance market accessibility and expansion.

Stealth Warfare Market Share

The stealth warfare industry is primarily led by well-established companies, including:

- BAE Systems Plc. (U.K.)

- Northrop Grumman Corporation (U.S.)

- Raytheon Technologies Corporation (U.S.)

- Lockheed Martin Corporation (U.S.)

- Thales Group (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- Israel Aerospace IndU.S..tries (Israel)

- SAAB AB (Sweden) Zoho Corporation (India)

- WebHR (U.S.)

- Infor (U.S.)

- Kronos Incorporated (U.S.)

- The Sage Group plc. (U.S.)

- Mitsubishi Heavy Industries (Japan)

- Dassault Aviation (France)

- Sukhoi (Russia)

What are the Recent Developments in Global Stealth Warfare Market?

- In March 2025, the 2025 Tech Trends Report by the Future Today Strategy Group (FTSG) spotlighted the rise of “Living Intelligence Systems”—a convergence of AI, advanced sensors, and bioengineering that enables systems to sense, learn, adapt, and evolve in real time. This technological shift, combined with the global rollout of 5G infrastructure by companies such as Ericsson, signals a new era in advanced communication systems. These developments are poised to significantly impact stealth capabilities, enhancing data processing, signal intelligence, and real-time adaptability for military and defense applications, including low-detectability operations

- In June 2024, SatixFy Communications Ltd., a leader in next-generation satellite communication systems, secured a landmark order exceeding $20 million for its Prime2 Space-Grade digital beamformer chips and software from an undisclosed customer. The Prime2 chip, a cutting-edge Application-Specific Integrated Circuit (ASIC), is designed for massive MIMO antennas in Low Earth Orbit (LEO) and Geostationary Earth Orbit (GEO) satellite systems. This technology enables multi-beam, electronically steered antennas, offering enhanced scalability, flexibility, and performance

- In May 2024, the U.S. House of Representatives Committee on Armed Services released its report on the "Servicemember Quality of Life Improvement and National Defense Authorization Act for Fiscal Year 2025." While specific stealth warfare initiatives are not detailed in the brief snippet, such legislative acts often include funding and strategic directives for the development and acquisition of advanced defense technologies, including those related to stealth.

- In February 2024, Ericsson achieved a major milestone by deploying 100,000 Massive MIMO 5G radios for Bharti Airtel across 12 telecom circles in India, completing the rollout in just over 500 days. This large-scale deployment enhances Airtel’s 5G network capacity and energy efficiency, serving over 65 million users. While primarily aimed at advancing commercial 5G infrastructure, Massive MIMO technology—with its ability to dynamically steer beams and reduce interference—also holds significant potential for advanced communication systems used in stealth operations, particularly in signal intelligence and low-detectability communications

- In July 2023, it remains evident that due to the inherent secrecy of stealth warfare, comprehensive public disclosures on specific product launches, mergers, acquisitions, partnerships, or recalls in this domain are extremely limited. Instead, developments are typically reported under the broader umbrella of defense technology advancements, classified R&D programs, or through national defense budgets and strategic modernization initiatives. For instances, the U.S. FY2025 defense budget allocates emphasizing next-generation air superiority, hypersonic strike capabilities, and multi-domain deterrence—all of which have direct implications for stealth technologies. Similarly, India’s 2025–26 defense budget allocates with a strong focus on AI-driven systems, cyber warfare, and domestic procurement, further underscoring the shift toward advanced, often stealth-related, capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL STEALTH WARFARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL STEALTH WARFARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL STEALTH WARFARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

6 GLOBAL STEALTH WARFARE MARKET, BY TYPE OF PLATFORM

6.1 OVERVIEW

6.2 STEALTH AIRCRAFT

6.3 STEALTH MISSILES

6.4 STEALTH UAVS

6.5 STEALTH NAVAL PLATFORMS

7 GLOBAL STEALTH WARFARE MARKET, BY TECHNOLOGIES

7.1 OVERVIEW

7.2 RADAR CROSS SECTION (RCS)

7.3 RADAR ABSORBENT MATERIALS (RAM)

7.4 NON-METALLIC/METALLIC COATING

7.5 PLASMA CLOUD

7.6 IR SIGNATURE EMISSION

7.7 RADAR EMISSION

7.8 ACOUSTIC EMISSION

7.9 RF EMISSION

8 GLOBAL STEALTH WARFARE MARKET, BY END USER

8.1 OVERVIEW

8.2 MILITARY

8.3 LAW ENFORCEMENT

9 GLOBAL STEALTH WARFARE MARKET, BY GEOGRAPHY

9.1 GLOBAL STEALTH WARFARE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

9.1.1 NORTH AMERICA

9.1.1.1. U.S.

9.1.1.2. CANADA

9.1.1.3. MEXICO

9.1.2 EUROPE

9.1.2.1. GERMANY

9.1.2.2. FRANCE

9.1.2.3. U.K.

9.1.2.4. ITALY

9.1.2.5. SPAIN

9.1.2.6. RUSSIA

9.1.2.7. TURKEY

9.1.2.8. BELGIUM

9.1.2.9. NETHERLANDS

9.1.2.10. NORWAY

9.1.2.11. FINLAND

9.1.2.12. SWITZERLAND

9.1.2.13. DENMARK

9.1.2.14. SWEDEN

9.1.2.15. POLAND

9.1.2.16. REST OF EUROPE

9.1.3 ASIA PACIFIC

9.1.3.1. JAPAN

9.1.3.2. CHINA

9.1.3.3. SOUTH KOREA

9.1.3.4. INDIA

9.1.3.5. AUSTRALIA

9.1.3.6. NEW ZEALAND

9.1.3.7. SINGAPORE

9.1.3.8. THAILAND

9.1.3.9. MALAYSIA

9.1.3.10. INDONESIA

9.1.3.11. PHILIPPINES

9.1.3.12. TAIWAN

9.1.3.13. VIETNAM

9.1.3.14. REST OF ASIA PACIFIC

9.1.4 SOUTH AMERICA

9.1.4.1. BRAZIL

9.1.4.2. ARGENTINA

9.1.4.3. REST OF SOUTH AMERICA

9.1.5 MIDDLE EAST AND AFRICA

9.1.5.1. SOUTH AFRICA

9.1.5.2. EGYPT

9.1.5.3. SAUDI ARABIA

9.1.5.4. U.A.E

9.1.5.5. OMAN

9.1.5.6. BAHRAIN

9.1.5.7. ISRAEL

9.1.5.8. KUWAIT

9.1.5.9. QATAR

9.1.5.10. REST OF MIDDLE EAST AND AFRICA

9.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

10 GLOBAL STEALTH WARFARE MARKET,COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: GLOBAL

10.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.3 COMPANY SHARE ANALYSIS: EUROPE

10.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

10.5 MERGERS & ACQUISITIONS

10.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

10.7 EXPANSIONS

10.8 REGULATORY CHANGES

10.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

11 GLOBAL STEALTH WARFARE MARKET, SWOT & DBMR ANALYSIS

12 GLOBAL STEALTH WARFARE MARKET, COMPANY PROFILE

12.1 NORTHROP GRUMMAN

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 GEOGRAPHIC PRESENCE

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 LOCKHEED MARTIN CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 GEOGRAPHIC PRESENCE

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 RTX

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 GEOGRAPHIC PRESENCE

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENT

12.4 SAAB

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 GEOGRAPHIC PRESENCE

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 BAE SYSTEMS

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 GEOGRAPHIC PRESENCE

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 GENERAL DYNAMICS MISSION SYSTEMS, INC.

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 GEOGRAPHIC PRESENCE

12.6.4 PRODUCT PORTFOLIO

12.6.5 RECENT DEVELOPMENT

12.7 KRATOS DEFENSE & SECURITY SOLUTIONS, INC

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 GEOGRAPHIC PRESENCE

12.7.4 PRODUCT PORTFOLIO

12.7.5 RECENT DEVELOPMENT

12.8 BOEING

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 GEOGRAPHIC PRESENCE

12.8.4 PRODUCT PORTFOLIO

12.8.5 RECENT DEVELOPMENT

12.9 LEONARDO S.P.A.

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 GEOGRAPHIC PRESENCE

12.9.4 PRODUCT PORTFOLIO

12.9.5 RECENT DEVELOPMENT

12.1 BAYRAKTAR K

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 GEOGRAPHIC PRESENCE

12.10.4 PRODUCT PORTFOLIO

12.10.5 RECENT DEVELOPMENT

12.11 SUKHOI

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 GEOGRAPHIC PRESENCE

12.11.4 PRODUCT PORTFOLIO

12.11.5 RECENT DEVELOPMENT

12.12 AVIC

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 GEOGRAPHIC PRESENCE

12.12.4 PRODUCT PORTFOLIO

12.12.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

13 CONCLUSION

14 QUESTIONNAIRE

15 RELATED REPORTS

16 ABOUT DATA BRIDGE MARKET RESEARCH

Global Stealth Warfare Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Stealth Warfare Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Stealth Warfare Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.