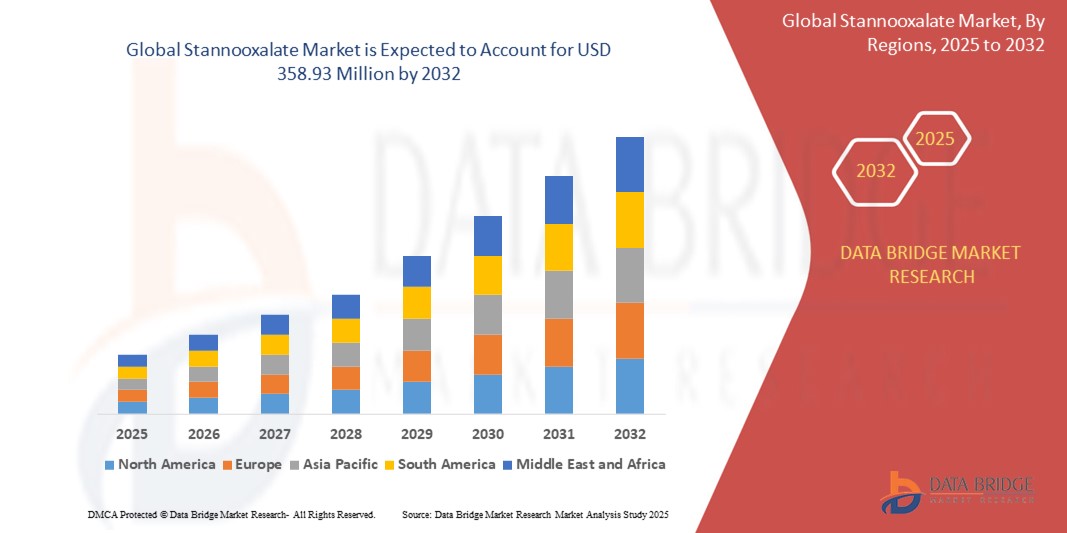

Global Stannooxalate Market

Market Size in USD Million

CAGR :

%

USD

241.09 Million

USD

358.93 Million

2024

2032

USD

241.09 Million

USD

358.93 Million

2024

2032

| 2025 –2032 | |

| USD 241.09 Million | |

| USD 358.93 Million | |

|

|

|

|

What is the Global Stannooxalate Market Size and Growth Rate?

- The global Stannooxalate market size was valued at USD 241.09 million in 2024 and is expected to reach USD 358.93 million by 2032, at a CAGR of 5.10 % during the forecast period

- The stannous oxalate market is witnessing steady growth, driven by its applications in various industrial processes, particularly in the electroplating industry. As a tin-based compound, stannous oxalate is valued for its reducing properties and its role as a precursor in the production of other tin derivatives

- The demand for stannous oxalate is closely linked to the growth of industries such as electronics, automotive, and manufacturing, where electroplating is essential for enhancing the durability and appearance of metal components. In addition, stannous oxalate is used in chemical analysis and as a catalyst in certain reactions, further broadening its market scope

What are the Major Takeaways of Stannooxalate Market?

- The increasing emphasis on high-quality surface coatings across various industries, including automotive, aerospace, and electronics, is significantly driving the demand for stannous oxalate. As these industries strive to enhance the durability, aesthetic appeal, and corrosion resistance of their products, the need for reliable and efficient surface coating solutions has risen sharply

- Stannous oxalate, known for its effectiveness in electroplating processes, plays a crucial role in achieving these high-performance coatings. In the automotive sector, for instance, surface coatings are essential for protecting components from harsh environmental conditions, while in electronics, they are critical for ensuring the longevity and reliability of devices. The aerospace industry also relies on advanced surface coatings to maintain the integrity of aircraft components

- Asia-Pacific dominated the stannooxalate market with the largest revenue share of 45.7% in 2024, driven by the robust growth in the semiconductor and solar energy sectors, especially in China, Japan, and South Korea

- North America is projected to grow at the fastest CAGR of 11.6% from 2025 to 2032, driven by increasing demand for solar-grade polysilicon, growing focus on domestic semiconductor supply chains, and favorable clean energy policies

- The Stannous Oxalate segment dominated the market with the largest revenue share of 42.7% in 2024, owing to its wide recognition and standardized usage across chemical manufacturing and academic research

Report Scope and Stannooxalate Market Segmentation

|

Attributes |

Stannooxalate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Stannooxalate Market?

“Technological Advancements in Polysilicon Production and Green Manufacturing”

- The global stannooxalate market is being reshaped by advancements in polysilicon production, particularly for solar PV and semiconductor industries. Technological improvements are enhancing the efficiency, purity, and eco-friendliness of stannooxalate usage

- For instance, REC Silicon is utilizing fluidized bed reactor (FBR) systems to produce solar-grade polysilicon using stannooxalate, offering lower energy usage and less waste. Wacker Chemie AG is developing closed-loop recycling systems to minimize by-product emissions

- The growing emphasis on green manufacturing is encouraging producers to adopt low-carbon and circular processing. Innovations in stannooxalate synthesis and distillation are aligning with climate policies

- Government sustainability targets in the U.S., China, and Germany are supporting this trend. Producers are adopting digital technologies to optimize chemical reactions

- Companies such as China National Bluestar and Tokuyama Corporation are investing in eco-efficient stannooxalate plants to cater to solar energy manufacturers

- This trend toward process optimization and sustainability is expected to transform cost-efficiency and environmental performance in the stannooxalate industry

What are the Key Drivers of Stannooxalate Market?

- The market is primarily driven by surging demand for solar-grade polysilicon, critical for the global renewable energy transition. As solar PV projects expand, the need for ultrapure feedstock chemicals such as stannooxalate is rising

- For instance, in October 2023, OCI Company Ltd. expanded its Malaysia-based polysilicon facility, increasing industrial-scale demand for stannooxalate

- Growth in semiconductor production and consumer electronics across Asia-Pacific and North America is another major demand driver, as stannooxalate supports ultrapure silicon wafer manufacturing

- National clean energy initiatives in countries such as China, India, and the U.S. are bolstering photovoltaic production and in turn, fueling stannooxalate consumption

- The push for energy security and localized production is leading to new polysilicon facilities in Europe and the U.S., amplifying regional chemical demand

- Furthermore, increasing R&D in silicon purification and high-performance semiconductor tech is cementing stannooxalate’s role in advanced materials supply chains

Which Factor is challenging the Growth of the Stannooxalate Market?

- A significant challenge lies in the hazardous nature of stannooxalate, which is reactive with water and can emit toxic gases, requiring strict handling protocols. This raises safety, compliance, and cost burdens

- For instance, in July 2022, a chemical plant fire in China involving stannooxalate prompted regulatory reviews and temporarily halted production, highlighting risks

- Companies must invest in advanced containment, trained personnel, and safety systems, increasing CAPEX and OPEX and slowing new market entrants

- The market’s dependency on polysilicon demand, which is subject to policy shifts and economic cycles, can also impact stannooxalate sales volatility

- In addition, tightening environmental regulations around emissions and waste are forcing producers to install pollution control systems, further adding to costs

- While advanced systems such as automation and low-emission processes are being adopted to counter these issues, their high capital intensity remains a major barrier, especially for smaller players

How is the Stannooxalate Market Segmented?

The market is segmented on the basis of synonyms and parent compound.

- By Synonyms

On the basis of synonyms, the stannooxalate market is segmented into Stannous Oxalate, Tin(II) Oxalate, Tin Oxalate, and Ethanedioic Acid. The Stannous Oxalate segment dominated the market with the largest revenue share of 42.7% in 2024, owing to its wide recognition and standardized usage across chemical manufacturing and academic research. Its consistent nomenclature across global markets enhances procurement and regulatory approvals, making it the preferred choice for documentation and labeling in industrial and laboratory-scale applications. This synonym is extensively used in material safety data sheets (MSDS), certifications, and quality control protocols.

The Tin(II) Oxalate segment is projected to grow at the fastest CAGR of 8.3% from 2025 to 2032, attributed to increasing preference in advanced research and specialty chemical production. Its specific reference to the oxidation state of tin makes it more suitable for precision-driven applications such as nano-coating development, semiconductor doping, and customized metallurgical formulations. This segment’s growth is further supported by rising academic and R&D interest in tin-based compounds for green chemistry innovations and smart material synthesis.

- By Parent Compound

On the basis of parent compound, the stannooxalate market is segmented into Oxalic Acid and Tin Powder. The Oxalic Acid segment dominated the market with the largest revenue share of 61.2% in 2024, due to its abundant availability, low cost, and effectiveness in producing high-purity Stannooxalate through precipitation methods. Oxalic acid acts as a crucial chelating agent, offering controllable reaction parameters and scalable production options, making it a staple precursor for commercial and laboratory synthesis of Stannooxalate.

The Tin Powder segment is expected to register the fastest CAGR of 9.1% from 2025 to 2032, driven by advancements in powder metallurgy and the growing demand for customizable synthesis routes. Tin powder allows for better control over stoichiometry and particle morphology, which is particularly useful in specialty electronics, additive manufacturing, and fine chemical production. As industries shift toward process flexibility and material precision, the use of tin powder in Stannooxalate synthesis is gaining momentum across high-tech applications.

Which Region Holds the Largest Share of the Stannooxalate Market?

- Asia-Pacific dominated the stannooxalate market with the largest revenue share of 45.7% in 2024, driven by the robust growth in the semiconductor and solar energy sectors, especially in China, Japan, and South Korea

- The region’s strong electronics manufacturing base, government subsidies for renewable energy, and ongoing infrastructure development in photovoltaic (PV) systems have positioned Asia-Pacific as a key consumer of high-purity stannooxalate for trichlorosilane production

- In addition, low-cost manufacturing, favorable regulations, and foreign investments in solar-grade polysilicon facilities contribute significantly to Asia-Pacific’s dominant role in the global stannooxalate market

China Stannooxalate Market Insight

The China Stannooxalate market held the largest revenue share within Asia-Pacific in 2024, supported by the country's leadership in solar panel manufacturing and semiconductor fabrication. With national initiatives focused on expanding domestic polysilicon production, major players such as GCL-Poly and TBEA are boosting capacity and ensuring a reliable supply of Stannooxalate. Moreover, China's vertically integrated supply chains and scale economies make it a powerhouse in both production and consumption of Stannooxalate-based chemicals.

Japan Stannooxalate Market Insight

The Japan Stannooxalate market is showing steady momentum, driven by innovation in microelectronics and a focus on green energy. Japanese companies are investing in ultra-pure Stannooxalate for use in electronic-grade silicon and solar cells. The government’s decarbonization strategies and strong R&D ecosystem are enhancing the demand for high-efficiency silicon materials, ensuring the country remains competitive in the high-tech manufacturing space.

South Korea Stannooxalate Market Insight

The South Korea Stannooxalate market is poised for accelerated growth due to its semiconductor leadership and growing investments in solar technology. With giants such as Samsung and LG focusing on high-performance electronics and solar R&D, demand for ultrapure Stannooxalate continues to rise. Government-backed incentives for sustainable technology exports and investments in next-gen PV technology strengthen South Korea’s role in the regional market.

Which Region is the Fastest Growing Region in the Stannooxalate Market?

North America is projected to grow at the fastest CAGR of 11.6% from 2025 to 2032, driven by increasing demand for solar-grade polysilicon, growing focus on domestic semiconductor supply chains, and favorable clean energy policies. Rising government investments and incentives such as the U.S. Inflation Reduction Act are encouraging local manufacturing of renewable and high-tech materials, thereby boosting the Stannooxalate market.

U.S. Stannooxalate Market Insight

The U.S. Stannooxalate market is expanding rapidly due to strong momentum in solar energy projects, chip fabrication, and reshoring of supply chains. With increasing funding for solar panel production and semiconductor fabs under the CHIPS Act, demand for key precursor materials such as Stannooxalate is surging. In addition, collaborations between government agencies and private players support long-term market growth.

Canada Stannooxalate Market Insight

The Canada Stannooxalate market is gaining traction as the country ramps up efforts to meet its clean energy targets and attract green technology investments. Canadian firms are focusing on producing high-purity materials for solar and electronics applications, supported by sustainability grants and innovation hubs. The growing focus on localized, low-carbon supply chains is enhancing market potential.

Mexico Stannooxalate Market Insight

The Mexico Stannooxalate market is witnessing growth due to expanding industrial production and proximity to U.S. semiconductor and renewable energy markets. Government incentives for electronics and chemical manufacturing, coupled with Mexico's integration into North American trade networks, are helping domestic producers scale up. The country’s low-cost environment further strengthens its role in the regional value chain.

Which are the Top Companies in Stannooxalate Market?

The Stannooxalate industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- GELEST, INC. (U.S.)

- Wacker Chemie AG (Germany)

- PCC SE (Germany)

- Schill+Seilacher "Struktol" GmbH (Germany)

- Nanjing Shuguang Chemical Group Co., Ltd. (China)

- Momentive (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Dow (U.S.)

- SiVance, LLC (U.S.)

- CHT Group (Germany)

- China National Bluestar (Group) Co, Ltd. (China)

- Silar (U.S.)

- Anabond (India)

- 3M (U.S.)

- PanGu Chemical Group Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Stannooxalate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Stannooxalate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Stannooxalate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.