Global Sports Energy Drinks Market

Market Size in USD Billion

CAGR :

%

USD

74.71 Billion

USD

134.75 Billion

2025

2033

USD

74.71 Billion

USD

134.75 Billion

2025

2033

| 2026 –2033 | |

| USD 74.71 Billion | |

| USD 134.75 Billion | |

|

|

|

|

What is the Global Sports and Energy Drinks Market Size and Growth Rate?

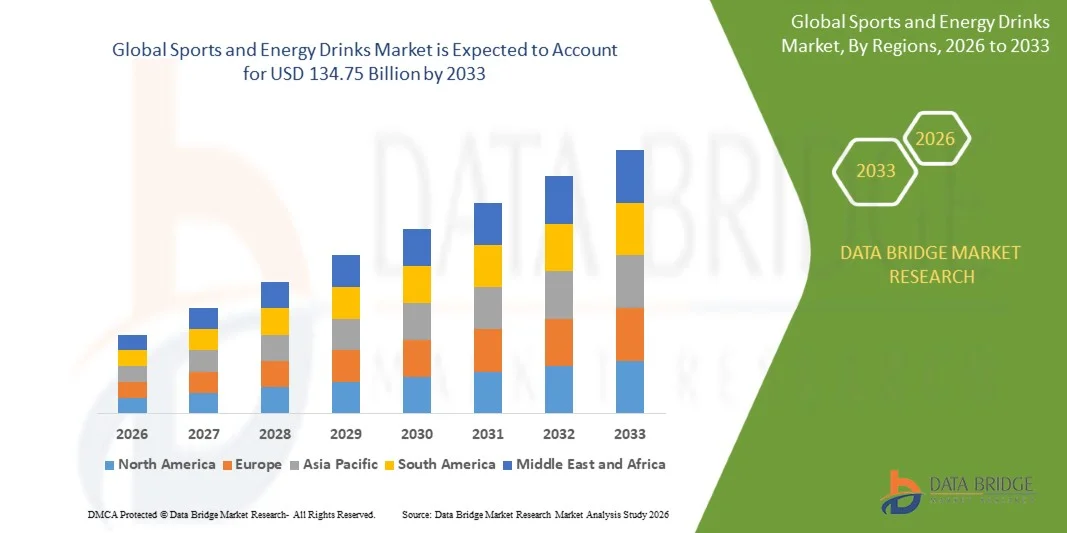

- The global Sports and Energy Drinks market size was valued at USD 74.71 billion in 2025 and is expected to reach USD 134.75 billion by 2033, at a CAGR of7.65% during the forecast period

- This growth is driven by factors such as the increasing health and fitness awareness among consumers, rising participation in sports and fitness activities, and the introduction of innovative formulas with natural ingredients and functional enhancements

What are the Major Takeaways of Sports and Energy Drinks Market?

- Sports drinks are beverages designed to replenish fluids, electrolytes, and energy lost during physical activity, typically containing water, carbohydrates, electrolytes, and sometimes vitamins

- They aim to enhance hydration and improve performance during exercise. Energy drinks, on the other hand, contain stimulants such as caffeine, taurine, and B-vitamins, aiming to provide a temporary boost in energy and alertness

- North America dominated the sports and energy drinks market with a 41.2% revenue share in 2025, driven by strong consumer demand for energy-boosting and functional beverages across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.1% from 2026 to 2033, driven by growing sports participation, health consciousness, and urbanization in China, Japan, India, and South Korea

- The Energy Drinks segment dominated the market with a revenue share of 58.3% in 2025, driven by rising consumer demand for functional beverages that provide instant energy, enhanced endurance, and improved mental focus

Report Scope and Sports and Energy Drinks Market Segmentation

|

Attributes |

Sports and Energy Drinks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Sports and Energy Drinks Market?

“Shift Towards More Functional Beverages”

- There's a growing preference for drinks made with natural ingredients, such as plant-based components, organic sweeteners, and natural flavors. This shift is in response to consumer demand for clean-label products free from artificial additives

- Beyond basic hydration, consumers are seeking drinks that offer additional health benefits, such as enhanced energy, improved focus, and recovery support. This has led to the development of products enriched with vitamins, minerals, and adaptogens

- With rising health concerns related to sugar consumption, brands are introducing low-sugar and sugar-free variants of their products to cater to health-conscious consumers

- Environmental consciousness is influencing purchasing decisions, prompting companies to adopt sustainable practices. This includes using eco-friendly packaging materials and reducing carbon footprints in production processes

- Brands are tailoring their marketing strategies to appeal to specific demographics, such as women and Gen Z consumers, by emphasizing inclusivity and promoting products as part of a healthy lifestyle

What are the Key Drivers of Sports and Energy Drinks Market?

- There's a growing preference for drinks made with natural ingredients, such as plant-based components, organic sweeteners, and natural flavors. This shift is in response to consumer demand for clean-label products free from artificial additives

- Beyond basic hydration, consumers are seeking drinks that offer additional health benefits, such as enhanced energy, improved focus, and recovery support. This has led to the development of products enriched with vitamins, minerals, and adaptogens

- With rising health concerns related to sugar consumption, brands are introducing low-sugar and sugar-free variants of their products to cater to health-conscious consumers

- Environmental consciousness is influencing purchasing decisions, prompting companies to adopt sustainable practices. This includes using eco-friendly packaging materials and reducing carbon footprints in production processes

- Brands are tailoring their marketing strategies to appeal to specific demographics, such as women and Gen Z consumers, by emphasizing inclusivity and promoting products as part of a healthy lifestyle

Which Factor is Challenging the Growth of the Sports and Energy Drinks Market?

- Several global health organizations including WHO and the American Heart Association have warned against regular consumption of sugary beverages linking it to obesity, diabetes, and heart disease

- Brands such as Monster and Rockstar have faced backlash over marketing their products to young audiences leading to public scrutiny and tighter labeling laws in markets such as the EU and Canada

- Health-conscious consumers are actively reading labels and opting for sugar-free or low-calorie versions, pushing brands to innovate quickly or risk losing market share

- In response, PepsiCo introduced “Mountain Dew Rise,” a lower-calorie energy drink targeted at morning consumers, and Coca-Cola’s “Powerade Ultra” now includes zero-sugar options

- This restraint creates a dual challenge for manufacturers — they must balance taste and energy efficacy while meeting regulatory and consumer expectations for health and transparency

How is the Sports and Energy Drinks Market Segmented?

The market is segmented on the basis of product type, type, packaging type, and distribution channel.

• By Product Type

On the basis of product type, the market is segmented into Sports Drinks and Energy Drinks. The Energy Drinks segment dominated the market with a revenue share of 58.3% in 2025, driven by rising consumer demand for functional beverages that provide instant energy, enhanced endurance, and improved mental focus. Energy drinks are widely consumed among athletes, fitness enthusiasts, and working professionals, fueling consistent demand across retail, online, and convenience channels. Manufacturers are introducing fortified blends with caffeine, electrolytes, vitamins, and natural stimulants to cater to evolving consumer needs.

The Sports Drinks segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing awareness of hydration, post-workout recovery, and electrolyte replenishment among active consumers. Innovations in sugar-free, low-calorie, and plant-based formulations further accelerate adoption globally.

• By Type

On the basis of type, the market is segmented into Organic and Non-Organic. The Non-Organic segment dominated the market with a revenue share of 65.1% in 2025, owing to widespread availability, cost-effective production, and strong demand from mainstream consumers. Non-organic beverages are preferred in mass-market retail, gyms, and convenience stores due to lower price points and consistent supply chains.

The Organic segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising health consciousness, preference for clean-label ingredients, and increasing demand for chemical-free, sustainable beverages. Consumers are increasingly seeking organic energy and sports drinks enriched with natural flavors, plant extracts, and functional ingredients, supporting rapid market growth, especially in North America and Europe.

• By Packaging Type

On the basis of packaging type, the market is segmented into Bottles, Cans, and Others. The Bottles segment dominated the market with a revenue share of 52.7% in 2025, driven by convenience, portability, and reusability. Bottled beverages are widely used for pre-workout, post-workout, and on-the-go consumption.

The Cans segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by innovative, single-serve, and eco-friendly packaging formats. Attractive labeling, portion control, and easy recycling encourage consumer adoption, especially in urban regions with high retail penetration.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Hypermarkets and Supermarkets, On-trade, Convenience Stores, Independent Retailers, and Others. The Hypermarkets and Supermarkets segment dominated the market with a revenue share of 46.9% in 2025, owing to wide product assortment, high brand visibility, and strong consumer trust in organized retail.

The On-trade segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumption in gyms, fitness centers, cafes, and restaurants. Increased awareness of functional beverages and experiential marketing campaigns further accelerate adoption in these channels.

Which Region Holds the Largest Share of the Sports and Energy Drinks Market?

- North America dominated the sports and energy drinks market with a 41.2% revenue share in 2025, driven by strong consumer demand for energy-boosting and functional beverages across the U.S. and Canada. Rising interest in pre-workout hydration, endurance supplements, and ready-to-drink functional drinks supports widespread adoption among athletes, fitness enthusiasts, and working professionals

- Leading players are expanding product portfolios through innovations in natural ingredients, electrolyte formulations, sugar reduction, and caffeine blends to enhance energy and hydration. Regulatory support for ingredient safety, clean-label claims, and functional beverage certifications further reinforces market leadership

- High disposable incomes, urbanization, and a growing preference for convenient, performance-enhancing drinks over traditional soft drinks contribute to strong regional growth

U.S. Sports and Energy Drinks Market Insight

The U.S. is the largest contributor in North America, fueled by high demand for functional energy and sports beverages. Manufacturers are investing in R&D for advanced formulations with caffeine, electrolytes, vitamins, and natural extracts to enhance performance and taste. Strong retail and online penetration, combined with growing fitness culture, continues to support market expansion.

Canada Sports and Energy Drinks Market Insight

Canada contributes significantly to regional growth, supported by rising demand for natural, low-sugar, and fortified beverages. Sports nutrition brands and beverage companies are expanding product offerings in hypermarkets, convenience stores, and e-commerce platforms. Increased awareness of health, wellness, and active lifestyles drives adoption across retail and specialty channels.

Asia-Pacific Sports and Energy Drinks Market Insight

Asia-Pacific is projected to register the fastest CAGR of 9.1% from 2026 to 2033, driven by growing sports participation, health consciousness, and urbanization in China, Japan, India, and South Korea. Rising disposable incomes, digital retail penetration, and subscription-based fitness products enhance accessibility and adoption.

China Sports and Energy Drinks Market Insight

China is the largest contributor to Asia-Pacific, supported by strong manufacturing infrastructure and increasing sports and fitness trends. Demand is rising for functional beverages enriched with electrolytes, vitamins, and natural stimulants. Investments in R&D, localized flavors, and premium packaging strengthen market expansion.

Japan Sports and Energy Drinks Market Insight

Japan shows steady growth, driven by consumer preference for low-sugar, functional, and energy-enhancing beverages. Innovation in flavor profiles, micro-dosed caffeine products, and health-focused formulations continues to attract health-conscious consumers. Established retail and e-commerce networks ensure nationwide accessibility.

India Sports and Energy Drinks Market Insight

India is an emerging growth market, fueled by rising awareness of sports nutrition, energy supplementation, and fitness trends. Demand for ready-to-drink energy and protein beverages is increasing, supported by e-commerce penetration and growing health-conscious urban populations.

South Korea Sports and Energy Drinks Market Insight

South Korea contributes significantly, driven by fitness and wellness trends, functional beverage innovation, and social media influence. Consumers increasingly prefer low-calorie, plant-based, and performance-enhancing drinks. Product innovation and premium packaging accelerate market adoption.

Which are the Top Companies in Sports and Energy Drinks Market?

The sports and energy drinks industry is primarily led by well-established companies, including:

- Glanbia plc. (Ireland)

- NOW Foods (U.S.)

- Nutiva Inc (U.S.)

- The Simply Good Foods Company (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm (U.S.)

- Kerry Group plc (Ireland)

- Nature's Bounty (U.S.)

- Reliance Private Label Supplements (U.S.)

- Herbalife International of America, Inc. (U.S.)

- Danone S.A. (France)

- GNC Holdings, LLC(U.S.)

- Orgain Inc. (U.S.)

- True Citrus (U.S.)

What are the Recent Developments in Global Sports and Energy Drinks Market?

- In April 2024, GURU Organic Energy Corp., Canada's organic energy drink brand, launched Peach Mango Punch in Canada, supported by a national marketing campaign. This new drink, low in calories and rich in natural ingredients, aims to enhance focus and brain performance. It contains caffeine and plant-based ingredients and is certified organic without sucralose or aspartame. Key ingredients include L-theanine, monk fruit, and stevia, contributing to its health benefits and sweetness

- In February 2024, Red Bull GmbH launched its Summer Edition Curuba Elderflower drink in a 250ml can. This flavor, featuring a mix of curuba and elderflower, was made in multiple formats, including sugar-free options. The brand expanded its customer base by 50% with its 'Editions' range and introduced an 8x250ml mixed sugar-free multipack to meet growing demand

- In January 2024, Celsius Holdings, Inc. expanded its products into Canada, the UK, and Ireland through PepsiCo, Inc. and Suntory Beverage & Food Great Britain and Ireland. PepsiCo is the exclusive distributor in Canada, extending an agreement from the U.S. in 2022. Suntory Beverage & Food Limited was selected for exclusive sales and distribution in the UK, the Isle of Man, the Channel Islands, and the Republic of Ireland

- In 2024 Pepsi Gatorade collaborates with Saudi Arabian soccer's top tier, becoming its official sports drink sponsor. The collaboration aims to enhance the matchday experience for fans through various activations and events, discovering the growing interest in sports and hydration

- In 2023 Spar collaborates with US distributor Congo Brands to introduce Prime drinks to its stores, making Spar the first symbol group in the convenience channel to stock Prime. This move strengthens Spar's offerings and highlights its commitment to providing diverse beverage options to its customer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sports Energy Drinks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sports Energy Drinks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sports Energy Drinks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.