Global Space Sensors And Actuators Market

Market Size in USD Billion

CAGR :

%

USD

5.03 Billion

USD

19.33 Billion

2024

2032

USD

5.03 Billion

USD

19.33 Billion

2024

2032

| 2025 –2032 | |

| USD 5.03 Billion | |

| USD 19.33 Billion | |

|

|

|

|

Space Sensors and Actuators Market Size

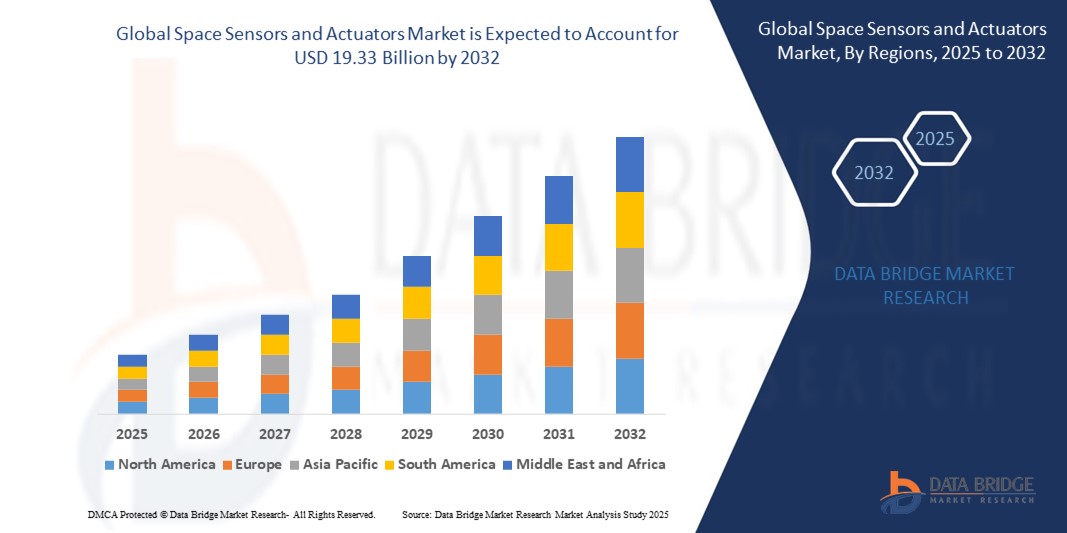

- The global space sensors and actuators market size was valued at USD 5.03 billion in 2024 and is expected to reach USD 19.33 billion by 2032, at a CAGR of 18.3% during the forecast period

- The market growth is largely fueled by increasing global investments in space exploration, satellite deployment, and defense space programs, driving demand for high-precision sensors and actuators that support spacecraft navigation, thermal regulation, propulsion, and communication systems

- Furthermore, the rising integration of miniaturized, energy-efficient, and AI-enabled sensor-actuator systems into satellites, launch vehicles, and planetary rovers is enhancing mission reliability and autonomy. These converging factors are accelerating adoption across commercial and government space sectors, thereby significantly boosting the industry's growth

Space Sensors and Actuators Market Analysis

- Space sensors and actuators are critical components used to monitor and control spacecraft subsystems such as attitude, propulsion, power management, and thermal systems. These devices enable autonomous operation, accurate data collection, and precision control in orbital and deep-space missions

- The growing demand for compact, lightweight, and radiation-hardened components, along with technological advances in MEMS, AI integration, and intelligent processing, is propelling market expansion across both established and emerging spacefaring nations

- North America dominated the space sensors and actuators market with a share of 50.36% in 2024, due to strong government investments in space programs and the presence of major aerospace and defense contractors

- Europe is expected to be the fastest growing region in the space sensors and actuators market during the forecast period due to expanding investments in space missions, rising demand for Earth observation, and the growing influence of the European Space Agency (ESA)

- Sensors segment dominated the market with a market share of 64% in 2024, due to their essential role in ensuring mission safety and functionality through accurate data collection. Sensors are critical for monitoring parameters such as temperature, pressure, radiation, and structural integrity, supporting real-time system diagnostics and facilitating decision-making for spacecraft navigation and operations. Their deployment across all spacecraft subsystems—from propulsion to thermal control—drives consistent demand across both government and commercial missions

Report Scope and Space Sensors and Actuators Market Segmentation

|

Attributes |

Space Sensors and Actuators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Space Sensors and Actuators Market Trends

“Increasing Space Exploration Activities”

- The space sensors and actuators market is rapidly growing driven by the rising frequency of space exploration missions, satellite launches, and advancements in space technologies that require highly precise and reliable sensor and actuator components to ensure mission success

- For instance, NASA’s Artemis program uses advanced sensors and actuators for critical functions including lunar landings and Mars mission preparations, highlighting the demand for innovative, durable components that can withstand extreme space environments

- Miniaturization of sensors and actuators is a notable trend enabling their integration into small satellite platforms, allowing for reduced launch costs and expanded deployment of satellite constellations for Earth observation and communication

- Increased integration of AI and autonomous systems within space missions is pushing the development of intelligent sensors and actuators capable of real-time data processing, fault detection, and autonomous decision-making without needing ground control

- There is growing adoption of IoT-enabled space sensors that promote connectivity and health monitoring of spacecraft, facilitating remote management and enhanced mission safety

- Commercialization of space activities, including satellite internet services and space tourism by companies such as SpaceX and Blue Origin, is creating heightened demand for sophisticated and cost-effective space sensors and actuators

Space Sensors and Actuators Market Dynamics

Driver

“Advancements in Satellite Technology”

- Improvements in satellite technology, including the development of high-precision imaging, communication, and navigation satellites, are driving demand for more sophisticated sensors and actuators that can operate reliably in harsh space conditions

- For instance, SpaceX’s Starlink satellite constellation relies on advanced sensors and actuators to maintain precise orbital control and inter-satellite communication, ensuring network performance and coverage

- The shift toward small satellite constellations requires compact, energy-efficient sensors and actuators that do not compromise on accuracy or durability, fostering innovation in component design and materials

- Technological advancements in autonomous spacecraft and robotic exploration vehicles increase the necessity for reliable and efficient sensors and actuators to support real-time decision-making capabilities without human intervention

- The growing use of space-based renewable energy systems, such as solar power satellites, demands advanced actuator systems to precisely position solar arrays and optimize power generation and transmission

Restraint/Challenge

“High Costs of Advanced Space Sensors and Actuators”

- The development and manufacturing of highly reliable and resilient space sensors and actuators involve substantial costs due to the need for precision engineering, specialized materials, and stringent testing to ensure performance in extreme conditions

- For instance, the development cost of sensors used in ESA’s (European Space Agency) Mars rover missions contributes significantly to the overall expensive mission budgets, limiting the frequency and scale of such missions

- The limited availability of supply chains and specialized manufacturing facilities for space-grade components can increase lead times and costs, restricting market accessibility for emerging space programs and startups

- High costs can act as a barrier for smaller commercial entities and developing countries seeking to enter the space market, slowing down the democratization of space technologies and services

- Pressure to reduce mission costs while maintaining safety and reliability drives the need for innovation in affordable sensor technologies and more cost-effective production methods, requiring ongoing research and collaboration between industry and government

Space Sensors and Actuators Market Scope

The market is segmented on the basis of product type, platform, application, and end user.

• By Product Type

On the basis of product type, the space sensors and actuators market is segmented into sensors and actuators. The sensors segment accounted for the largest market revenue share of 64% in 2024, primarily due to their essential role in ensuring mission safety and functionality through accurate data collection. Sensors are critical for monitoring parameters such as temperature, pressure, radiation, and structural integrity, supporting real-time system diagnostics and facilitating decision-making for spacecraft navigation and operations. Their deployment across all spacecraft subsystems—from propulsion to thermal control—drives consistent demand across both government and commercial missions.

The actuators segment is expected to exhibit the fastest CAGR from 2025 to 2032, driven by rising demand for precise motion control and automation within spacecraft systems. Actuators play a pivotal role in functions such as solar panel deployment, antenna positioning, and robotic arm articulation. As deep space and long-duration missions grow, the need for reliable and high-performance actuators is increasing, particularly those compatible with extreme space environments and capable of operating autonomously with minimal human intervention.

• By Platform

On the basis of platform, the market is segmented into satellites, capsules/cargos, interplanetary spacecraft & probes, rovers/spacecraft landers, and launch vehicles. The satellites segment captured the largest revenue share in 2024, fueled by the surge in Earth observation, telecommunications, and navigation programs globally. Sensors and actuators form the backbone of satellite subsystems including attitude control, power regulation, and communication relay, making them indispensable for maintaining functionality throughout a satellite's orbital lifecycle.

Rovers/spacecraft landers are projected to witness the highest growth rate during the forecast period, owing to increased planetary exploration programs led by agencies such as NASA, ESA, and ISRO. These platforms demand robust and miniaturized sensors and actuators capable of withstanding harsh planetary environments while enabling autonomous navigation, sampling, and mechanical operations, thereby driving innovation and rapid adoption in this segment.

• By Application

Based on application, the market includes Attitude & Orbital Control System, Command & Data Handling System, Telemetry, Tracking and Command, Thermal System, Propellant Feed System, Rocket Motors, Surface Mobility and Navigation System, Berthing and Docking System, Robotic Arm/Manipulator System, Thrust Vector Control System, Engine Valve Control System, Solar Array Drive Mechanism, and Others. The Attitude & Orbital Control System segment led the market in 2024, driven by its critical role in maintaining spacecraft orientation and trajectory using real-time data from gyroscopes, magnetometers, and actuators. Precise attitude control ensures the correct positioning of antennas and instruments, especially for communication and scientific missions.

The Surface Mobility and Navigation System segment is expected to grow at the fastest pace, particularly due to its significance in robotic missions on lunar and Martian terrains. This includes high-precision actuators and terrain-adaptive sensors enabling autonomous movement and hazard avoidance, which are pivotal for exploratory missions and scientific payload operations on alien surfaces.

• By End User

On the basis of end user, the market is bifurcated into commercial and government & defense. The government and defense segment accounted for the highest revenue share in 2024, as national space agencies continue to invest in high-budget exploration, military satellite systems, and space surveillance missions. These programs require advanced sensors and actuators for mission-critical subsystems, benefiting from high reliability and radiation-hardened components.

The commercial segment is anticipated to grow at the highest CAGR from 2025 to 2032, fueled by the privatization of space missions, increasing small satellite launches, and the emergence of private players in launch and exploration services. Demand from companies involved in satellite constellations, space tourism, and commercial cargo transport is creating a need for cost-effective, compact, and high-performance space-grade sensors and actuators.

Space Sensors and Actuators Market Regional Analysis

- North America dominated the space sensors and actuators market with the largest revenue share of 50.36% in 2024, driven by strong government investments in space programs and the presence of major aerospace and defense contractors

- The region benefits from a mature ecosystem of space research organizations, private sector innovation, and continued demand for satellites and space exploration systems

- Robust funding from agencies such as NASA and the U.S. Department of Defense, along with technological leadership in space robotics and instrumentation, reinforces North America’s market dominance

U.S. Space Sensors and Actuators Market Insight

The U.S. captured the largest share within North America in 2024, bolstered by the increasing number of space missions, rapid adoption of advanced aerospace technologies, and public-private collaborations. Companies such as SpaceX, Blue Origin, and Lockheed Martin are at the forefront of incorporating next-generation sensors and actuators into launch vehicles, rovers, and interplanetary probes. The U.S. government's commitment to deep space exploration, satellite modernization, and national security is further fueling the demand for precise and reliable space-grade components, enhancing the country’s dominance in the sector.

Europe Space Sensors and Actuators Market Insight

Europe is projected to experience the fastest CAGR during the forecast period, driven by expanding investments in space missions, rising demand for Earth observation, and the growing influence of the European Space Agency (ESA). The region’s focus on space sustainability, satellite autonomy, and climate monitoring is creating significant demand for sensors and actuators capable of high performance in challenging space conditions. Collaborative programs among EU nations and the rise of private aerospace startups are further accelerating technological advancements. European manufacturers are also prioritizing compliance with strict reliability and environmental standards, which enhances product adoption across a range of space platforms.

U.K. Space Sensors and Actuators Market Insight

The U.K. is emerging as a key contributor to Europe’s growth, supported by government-backed R&D, growing private investments, and increasing participation in ESA missions. The country is focusing on strengthening its satellite infrastructure and space innovation capabilities. High demand for compact and high-precision components in scientific, commercial, and defense payloads is driving the use of sensors and actuators across orbital and planetary applications.

Germany Space Sensors and Actuators Market Insight

Germany's market is expanding at a considerable rate, underpinned by its strong engineering expertise and focus on automation and sustainability. The country is heavily involved in collaborative European space missions and is home to several leading aerospace companies and research institutes. Demand for advanced sensor-actuator integration is increasing in spacecraft subsystems such as propulsion, docking, and navigation, especially in modular and autonomous vehicle designs.

Asia-Pacific Space Sensors and Actuators Market Insight

The Asia-Pacific market is undergoing rapid development due to increasing space activities in countries such as China, India, and Japan. The region is witnessing a surge in satellite launches, lunar and Mars missions, and defense surveillance systems. Government space agencies are investing heavily in indigenous capabilities and launching space missions that demand robust, miniaturized, and reliable sensors and actuators. Furthermore, the region's growing focus on space commercialization and its role as a manufacturing hub are improving the affordability and availability of advanced components for space applications.

China Space Sensors and Actuators Market Insight

China accounted for the largest market share in Asia-Pacific in 2024, driven by its aggressive space ambitions, such as the Tiangong space station, lunar exploration, and Mars missions. The country’s focus on self-reliance in space technology, combined with its strong domestic manufacturing base, is fueling the rapid adoption of sensors and actuators in launch vehicles, satellites, and planetary systems.

Japan Space Sensors and Actuators Market Insight

Japan’s market is gaining traction due to its expertise in robotics, automation, and deep-space exploration. The Japan Aerospace Exploration Agency (JAXA) continues to develop missions involving autonomous rovers and robotic arms, which heavily rely on high-performance sensors and actuators. The aging population in Japan is also influencing design preferences towards low-maintenance, self-operating systems that are vital in long-duration missions.

Space Sensors and Actuators Market Share

The space sensors and actuators industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Innovative Sensor Technology IST AG (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman (U.S.)

- Moog Inc. (U.S.)

- TE Connectivity (Switzerland)

- Renesas Electronics Corporation (Japan)

- Teledyne Technologies Incorporated (U.S.)

- Analog Devices, Inc (U.S.)

- MinebeaMitsumi Inc. (Japan)

- Siemens (Germany)

Latest Developments in Global Space Sensors and Actuators Market

- In May 2022, Raytheon Technologies received a strategic contract from the U.S. Space Force to develop digital models of sensor technology for future missile warning satellite constellations. This development reinforces Raytheon’s leadership in advanced aerospace defense systems and also signals a growing reliance on sophisticated sensor modeling for next-generation space-based threat detection. The contract supports the broader market trend toward integrating high-fidelity simulation and digital twin technologies to enhance satellite performance, reliability, and rapid deployment capabilities

- In March 2022, Honeywell introduced the MV60 micro-electro-mechanical system (MEMS) accelerometer, offering a combination of high performance, compact size, and rugged reliability. Designed specifically for aerospace and defense applications, the accelerometer also presents strong potential in industrial and marine domains. Its ability to deliver navigation-grade precision in a lightweight and low-power format makes it highly suitable for satellite systems, launch vehicles, and planetary rovers. This innovation aligns with increasing market demand for miniaturized, durable sensors that can perform in extreme conditions without sacrificing accuracy or efficiency

- In February 2022, STMicroelectronics launched its Intelligent Sensor Processing Unit (ISPU), a breakthrough that merges MEMS sensors with a Digital Signal Processor (DSP) on a single chip. Capable of running AI algorithms at the edge, the ISPU reduces component size and system power consumption by up to 80%, which is critical for space missions where power and weight are at a premium. This advancement directly impacts the space sensors market by enabling smarter, faster, and more autonomous decision-making on spacecraft and satellites, thereby reducing reliance on ground control and enhancing operational efficiency

- In October 2021, Curtiss-Wright introduced its latest line of electro-mechanical actuators, the Exlar SA-R080 rotary and SA-L080 linear models, as part of the SA-080 series. These actuators are engineered with integral controls and designed to withstand harsh operational environments, making them highly suitable for aerospace, defense, and space missions. Their robust construction, precision, and compact frame size contribute to improved motion control in applications such as satellite antenna positioning, robotic systems, and launch vehicle mechanisms, further expanding the market for high-reliability actuation solutions

- In October 2021, Ewellix launched the CAHB-2xS, a smart electro-mechanical actuator featuring integrated diagnostics, advanced control functionality, and enhanced communication capabilities. Although originally designed for demanding industries such as construction and agriculture, its intelligent design and rugged performance make it a strong candidate for adaptation in space systems requiring autonomous control and remote monitoring. The actuator’s smart sensing and feedback capabilities reflect a broader market shift toward intelligent actuation, where real-time performance data and predictive maintenance are essential for mission-critical systems in space environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.