Global Passenger Car Sensors Market

Market Size in USD Billion

CAGR :

%

USD

154.21 Billion

USD

307.27 Billion

2024

2032

USD

154.21 Billion

USD

307.27 Billion

2024

2032

| 2025 –2032 | |

| USD 154.21 Billion | |

| USD 307.27 Billion | |

|

|

|

|

Passenger Car Sensors Market Size

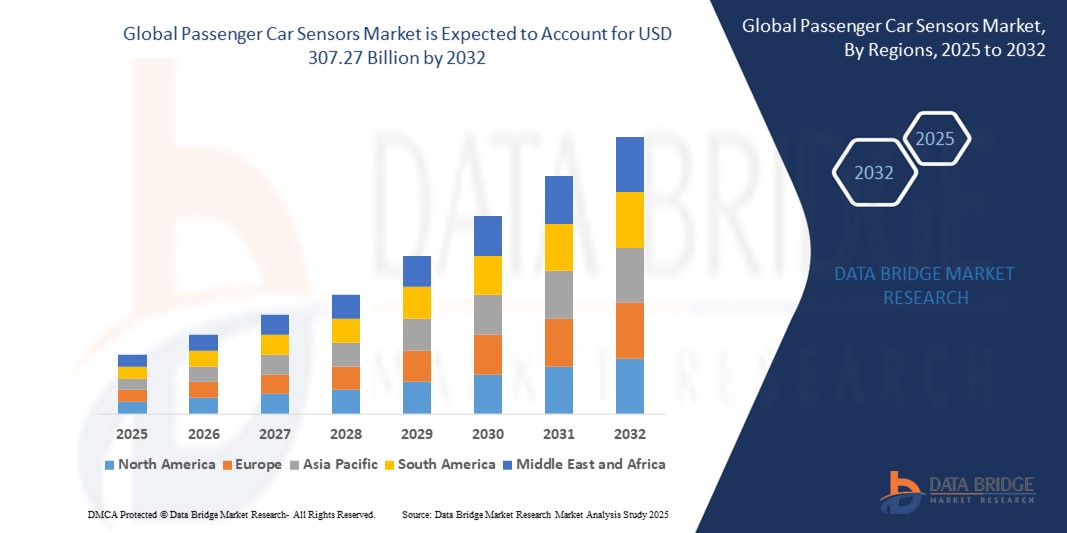

- The global passenger car sensors market size was valued at USD 154.21 billion in 2024 and is expected to reach USD 307.27 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market's growth is primarily fueled by the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on sensor integration for safety, efficiency, and performance

- In addition, the push for stricter emission regulations and fuel efficiency standards has driven automakers to implement sensors for real-time engine monitoring and emissions control

Passenger Car Sensors Market Analysis

- Passenger car sensors play a vital role in enhancing vehicle performance, safety, and fuel efficiency by collecting real-time data on parameters such as speed, temperature, pressure, and proximity

- The market is driven by increasing integration of Advanced Driver Assistance Systems (ADAS), emission control systems, and autonomous vehicle technologies, which rely extensively on sensor networks

- North America dominates the passenger car sensors market with a 38.2% revenue share in 2025, supported by high adoption of advanced automotive technologies, stringent safety regulations, and strong presence of leading automotive OEMs and sensor manufacturers

- Asia-Pacific is the fastest-growing region, driven by rising vehicle production, increasing demand for electric and hybrid cars, and growing investments in smart mobility solutions across emerging economies such as china and India

- The pressure sensors segment leads with a 28.4% market share in 2025, as these are widely used in engine management, tire pressure monitoring systems (TPMS), and braking systems, playing a key role in fuel efficiency and safety enhancement

Report Scope and Passenger Car Sensors Market Segmentation

|

Attributes |

Passenger Car Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Passenger Car Sensors Market Trends

“Integration of AI, IoT, and ADAS in Sensor Systems”

- A prominent trend in the global passenger car sensors market is the rising integration of Artificial Intelligence (AI), Internet of Things (IoT), and Advanced Driver Assistance Systems (ADAS) to enhance vehicle automation, safety, and diagnostics

- For instance, Bosch and Continental have developed AI-enabled sensor platforms that enable real-time analysis of data from cameras, radar, and lidar, helping power adaptive cruise control, emergency braking, and lane-keeping systems

- AI integration in sensors supports predictive maintenance, where embedded analytics forecast component failures using real-time sensor data—improving vehicle uptime and reducing maintenance costs for both consumers and fleet operators

- The use of IoT-connected sensors allows continuous monitoring of tire pressure, engine performance, and environmental conditions. Companies like DENSO and NXP are advancing V2X communications using smart sensors to enable connected car ecosystems

- With growing EV adoption, thermal sensors and battery management sensors are in high demand. Infineon and STMicroelectronics have introduced specialized sensors for efficient thermal regulation and energy optimization in electric vehicles

- This trend toward smart, connected, and autonomous sensor solutions is transforming the passenger car landscape, enabling higher levels of automation, driver safety, and system intelligence, which directly aligns with evolving mobility demands

Passenger Car Sensors Market Dynamics

Driver

“Rising Demand from Road Safety Awareness and Connected Vehicle Growth”

- Growing concerns about road safety, rising global accident rates, and the need for enhanced driving assistance systems are major drivers accelerating demand for passenger car sensors worldwide

- For instance, in February 2025, Bosch announced advancements in radar and ultrasonic sensor technologies to support next-generation ADAS features, enhancing accident prevention capabilities and boosting global sensor adoption in passenger vehicles

- As automakers integrate more connected and autonomous functionalities, sensors are essential for real-time data collection related to braking, steering, obstacle detection, and lane monitoring—improving vehicle control and occupant safety

- Furthermore, safety regulations and mandates by governments, such as the European Union's General Safety Regulation (GSR), which requires ADAS features in new vehicles starting 2024, are increasing the demand for sensors

- The rapid proliferation of electric and hybrid vehicles, which require temperature, voltage, and current monitoring systems, also contributes significantly to sensor demand, especially in emerging markets with growing EV adoption

- Automaker partnerships with sensor technology firms—like those between DENSO and NXP Semiconductors—are fostering sensor integration across mainstream car models, making smart safety systems more accessible and standard across vehicle classes

Restraint/Challenge

“Regulatory Compliance Complexity and High Manufacturing Costs”

- Compliance with varying international safety and emissions regulations poses a major challenge for passenger car sensor manufacturers, as sensor systems must meet stringent and diverse standards across regions such as North America, Europe, and Asia-Pacific

- For instance, the European Union’s regulations on automotive safety and environmental impact require sensors to adhere to rigorous testing and certification processes, which can delay product launches and increase compliance costs

- Automotive manufacturers must invest heavily in research and development to ensure sensors comply with evolving standards such as Euro NCAP and China’s New Car Assessment Program (C-NCAP), which raises the overall cost structure

- In addition, the high precision and advanced technology involved in sensor production—such as lidar, radar, and image recognition sensors—result in significant manufacturing and integration expenses, restricting adoption among budget vehicle segments and emerging economies

- While some entry-level sensor technologies provide cost-effective alternatives, they often lack the advanced features needed for modern safety and autonomous driving systems, limiting their market appeal

- Addressing these challenges through harmonization of global regulations, cost-efficient manufacturing innovations, and scalable sensor solutions will be vital for widespread adoption and market growth

Passenger Car Sensors Market Scope

The market is segmented on the basis of vehicle type, sensor type, application, vehicle type, and connectivity.

By Car Type

On the basis of car type, the passenger car sensors market is segmented into compact, midsize, luxury, and SUVs. The compact segment dominates the largest market revenue share of 38.7% in 2025, driven by the increasing demand for fuel-efficient vehicles equipped with advanced sensors to enhance engine performance and emissions control. Compact cars are widely favored in emerging markets due to their affordability and compliance with strict environmental regulations.

The SUVs segment is anticipated to witness the fastest growth rate of 22.4% from 2025 to 2032, fueled by the rising popularity of SUVs globally. The segment’s growth is supported by the increasing integration of sophisticated sensor systems for off-road capabilities, safety features, and advanced driver assistance systems (ADAS), which are in high demand among SUV buyers.

• By Sensor Type

On the basis of sensor type, the passenger car sensors market is segmented into pressure sensors, position sensors, speed sensors, temperature sensors, O2 and NOx sensors, safety and comfort sensors, and others. The pressure sensors segment held the largest market revenue share in 2025, owing to their critical application in tire pressure monitoring systems (TPMS), fuel injection, and engine management, which are essential for vehicle safety and efficiency.

The safety and comfort sensors segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing consumer demand for enhanced vehicle safety features such as airbags, occupant detection, and cabin environment monitoring, alongside comfort systems like climate control.

• By Application

On the basis of application, the market is segmented into powertrain/drivetrain system sensors, exhaust system sensors, interior and comfort system sensors, body control system sensors, and safety/DAS sensors. The powertrain/drivetrain system sensors segment accounted for the largest market revenue share in 2025, as these sensors are vital for optimizing engine performance, fuel efficiency, and emission control compliance.

The safety/DAS sensors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of advanced driver assistance systems and autonomous driving technologies that heavily rely on sensor inputs for real-time decision-making and enhanced vehicle safety.

• By Vehicle Type

On the basis of vehicle type, the passenger car sensors market is segmented into sedan, SUV, hatchback, coupe, and convertible. The sedan segment held the largest market revenue share in 2025, supported by strong demand in urban areas and the integration of diverse sensor technologies for performance optimization and safety.

The SUV segment is anticipated to register the fastest CAGR from 2025 to 2032, due to rising consumer preference for SUVs and the requirement for advanced sensor systems to support safety, infotainment, and off-road capabilities in this vehicle category.

• By Connectivity

On the basis of connectivity, the market is segmented into wired, wireless, bluetooth, CAN bus, and ethernet. The wired segment dominated the market revenue share in 2025, attributed to its reliability and high-speed data transmission for critical sensor systems in vehicles.

The wireless segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by advancements in vehicle connectivity technologies, including vehicle-to-everything (V2X) communications and the demand for reduced wiring complexity, enabling more flexible sensor deployments and weight reduction in vehicles.

Passenger Car Sensors Market Regional Analysis

- North America accounts for approximately 28.5% of the global Passenger Car Sensors market revenue in 2025, driven by rapid adoption of advanced vehicle safety systems and connected car technologies

- The U.S. and Canada lead the market, fueled by stringent government safety regulations, growing electric vehicle penetration, and strong investments in automotive sensor R&D

- Increasing regulatory pressure on emission control and safety standards, combined with consumer demand for smart and autonomous vehicle features, is accelerating sensor integration in passenger cars across the region

U.S. Passenger Car Sensors Market Insight

The U.S. holds a dominant share of the North America passenger car sensors market in 2025, driven by its advanced automotive industry and high adoption of connected vehicle technologies. The country’s strong emphasis on vehicle safety and emission regulations supports growing demand for sophisticated sensor systems. Major automakers such as ford, generalmotors, and tesla are integrating advanced sensors to enhance autonomous driving and driver assistance features. In addition government initiatives promoting electric vehicles and smart mobility are accelerating sensor adoption across urban and suburban areas.

Europe Passenger Car Sensors Market Insight

Germany and France lead Europe’s passenger car sensors market, driven by stringent safety and emission regulations and advanced automotive manufacturing. rapid adoption of connected car technologies and increasing electric vehicle sales are key growth factors. European governments strongly support smart mobility and sensor innovation through policies and incentives. Major automakers like Volkswagen, BMW, and Renault collaborate with sensor suppliers to integrate cutting-edge sensor systems in new vehicles. Rising consumer demand for enhanced safety and environmental compliance is accelerating market expansion across Europe.

U.K. Passenger Car Sensors Market Insight

The U.K. passenger car sensors market is witnessing steady growth, supported by stringent vehicle safety regulations and increasing integration of advanced sensor technologies. Adoption is driven by rising demand for connected and autonomous vehicle features in both private and fleet cars. Leading automakers such as jaguar land rover and Bentley are partnering with sensor manufacturers to enhance safety, comfort, and emission monitoring. In addition, government initiatives promoting smart mobility and environmental sustainability are accelerating sensor deployment across the U.K.

Germany Passenger Car Sensors Market Insight

Germany is a major player in Europe’s passenger car sensors market, propelled by strict automotive safety standards and environmental regulations. German automakers like Volkswagen, BMW, and Mercedes-Benzes lead sensor integration in advanced driver assistance and emission control systems. strong government support for Industry 4.0 and smart mobility fosters innovation and widespread sensor adoption. Rising consumer demand for safer, more efficient vehicles across urban and rural regions is further driving market expansion.

Asia-Pacific Passenger Car Sensors Market Insight

Asia-Pacific is the fastest-growing Passenger car sensors market, driven by rapid vehicle production, urbanization, and rising safety regulations. Countries like China, Japan, and South Korea lead adoption, supported by major automakers such as Toyota, Hyundai, and Nissan integrating advanced sensors. Government initiatives promoting electric vehicles and smart mobility solutions accelerate sensor deployment. Increasing consumer demand for safer, connected vehicles is fueling widespread adoption across both developed and emerging markets in the region.

Japan Passenger Car Sensors Market Insight

Japan is a key market in the Asia-Pacific passenger car sensors segment, driven by its advanced automotive industry and high safety standards. Major manufacturers like Toyota, Honda, and Nissan extensively use sensors for vehicle safety, emission control, and autonomous driving technologies. Strong government support for smart mobility and environmental policies accelerates sensor adoption. In addition, tech-savvy consumers in urban areas increasingly demand connected and efficient vehicles, boosting market growth.

China Passenger Car Sensors Market Insight

China is the largest contributor to the Asia-Pacific passenger car sensors market in 2025, driven by rapid automotive production and growing adoption of advanced sensor technologies. Leading automakers like BYD, Geely, and NIO are integrating sensors for safety, emissions, and autonomous features. Government initiatives supporting electric vehicles and smart transportation accelerate sensor deployment. Rising consumer awareness and demand for connected vehicles further propel market growth across urban and emerging areas.

Passenger Car Sensors Market Share

The passenger car sensors industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Robert Bosch GmbH (Germany)

- DENSO Corporation (Japan)

- TE Connectivity (Switzerland)

- BorgWarner Inc. (U.K.)

- Allegro MicroSystems (U.S.)

- Analog Devices, Inc, (U.S.)

- Infineon Technologies AG (Germany)

- NXP Semiconductor (Netherlands)

- ZF Friedrichshafen AG (Germany)

- Hitachi, Ltd (Japan)

- STMicroelectronics (Switzerland)

- VALEO (France)

- Semiconductor Components Industries, LLC (U.S.)

- CTS Corporation (U.S.)

- Elmos Semiconductor SE (Germany)

- Sensirion AG (Switzerland)

- Thor Industries (U.S.)

- Autoliv (Sweden)

Latest Developments in Global Passenger Car Sensors Market

- In May 2024, Samsung Electronics Co. and KEPCO signed a memorandum of understanding (MOU) to collaborate on power facility technology exchange. Under this agreement, both companies will share AI-based technologies for evaluating and diagnosing power facilities, including transformers and circuit breakers. The partnership also involves case studies on fault prevention and the application of new preventive diagnostic technologies to ensure stable power infrastructure operation. To implement the MOU, Samsung and KEPCO will form a dedicated task force for ongoing cooperation

- In April 2024, POWERGRID Corporation won three interstate transmission projects through tariff-based competitive bidding (TBCB), enhancing renewable energy integration and power evacuation infrastructure. The first project includes a 765/400/220 kV pooling substation at Mandsaur and a 765 kV D/C transmission line in Madhya Pradesh to facilitate power evacuation from Rajasthan’s Jaisalmer/Barmer complex. The second focuses on augmentation works at an existing substation for power transmission from Gujarat’s Khavda Renewable Energy Zone. The third establishes a new 765 kV substation at Rishabhdeo and 765 kV D/C transmission lines in Rajasthan and Madhya Pradesh, strengthening India’s transmission network

- In May 2023, ON Semiconductor introduced the Hyperlux automotive image sensor family, designed to enhance Advanced Driver Assistance Systems (ADAS) and autonomous driving. Featuring industry-leading 150dB ultra-high dynamic range (HDR) and LED flicker mitigation (LFM), Hyperlux ensures high-quality imaging under extreme lighting conditions. The sensors offer low power consumption, a compact footprint, and support Level 2+ driving automation, making them ideal for safety-critical applications

- In June 2022, Allegro MicroSystems, Inc. introduced the A33110 and A33115 magnetic position sensors, designed for advanced driver assistance systems (ADAS). These sensors combine vertical Hall technology (VHT) with tunneling magnetoresistance (TMR) to enhance accuracy and redundancy in safety-critical applications. They provide high-resolution magnetic angle sensing, ensuring precise motor control for electric power steering (EPS) and brake-by-wire systems. The sensors are ASIL D-compliant, offering built-in diagnostics for improved reliability in autonomous driving

- In May 2022, Infineon Technologies AG introduced the XENSIV 60 GHz automotive radar sensor, designed for in-cabin monitoring systems (ICMS). This sensor detects micro-movements and vital signs, helping prevent heat-related risks for infants and pets left in vehicles. It also supports gesture sensing, distance measurement, and short-range sensing operations. Featuring 4 GHz ultra-wide bandwidth FMCW operation, the radar ensures high precision and low power consumption. In addition, it enables seat belt reminders and enhances passenger safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.