Global Smoke, Gas and Alcohol Sensor Market, By Power Source (Battery Powered, Hardwired With Battery Backup, Hardwired Without Battery Backup), Product Type (Photoelectric Smoke Detector, Ionization Smoke Detector, Dual Sensor Smoke Detector, Others), Service (Engineering Services, Installation & Design Services, Maintenance Services, Managed Services, Other Services), Type (Oxygen, Carbon Monoxide (C.O.), Carbon Dioxide (CO2), Nitrogen Oxide, Hydrocarbon, Other Types), Technology (Electrochemical, Photoionization Detectors (PID), Solid State/Metal Oxide Semiconductor, Catalytic, Infrared, Semiconductor, Fuel Cell Technology, Others), End User (Commercial, Residential, Oil & Gas and Mining, Transportation & Logistics, Telecommunication, Manufacturing, Food & Beverages, Others) – Industry Trends and Forecast to 2029.

Smoke, Gas and Alcohol Sensor Market Analysis and Size

The global development and implementation of various health and safety regulations, increased adoption of gas sensors in HVAC systems and air quality monitors, increased demand for gas sensors in critical industries, increased air pollution levels, and the need to monitor air quality in smart cities are the factors driving the growth of the gas, smoke and alcohol sensor market. Alcohol consumption impairs a person's judgement. An individual loses the ability to think clearly, leading to various issues such as drinking and driving, which increases the risk of accidents and harmful activities that escalate into ferocity.

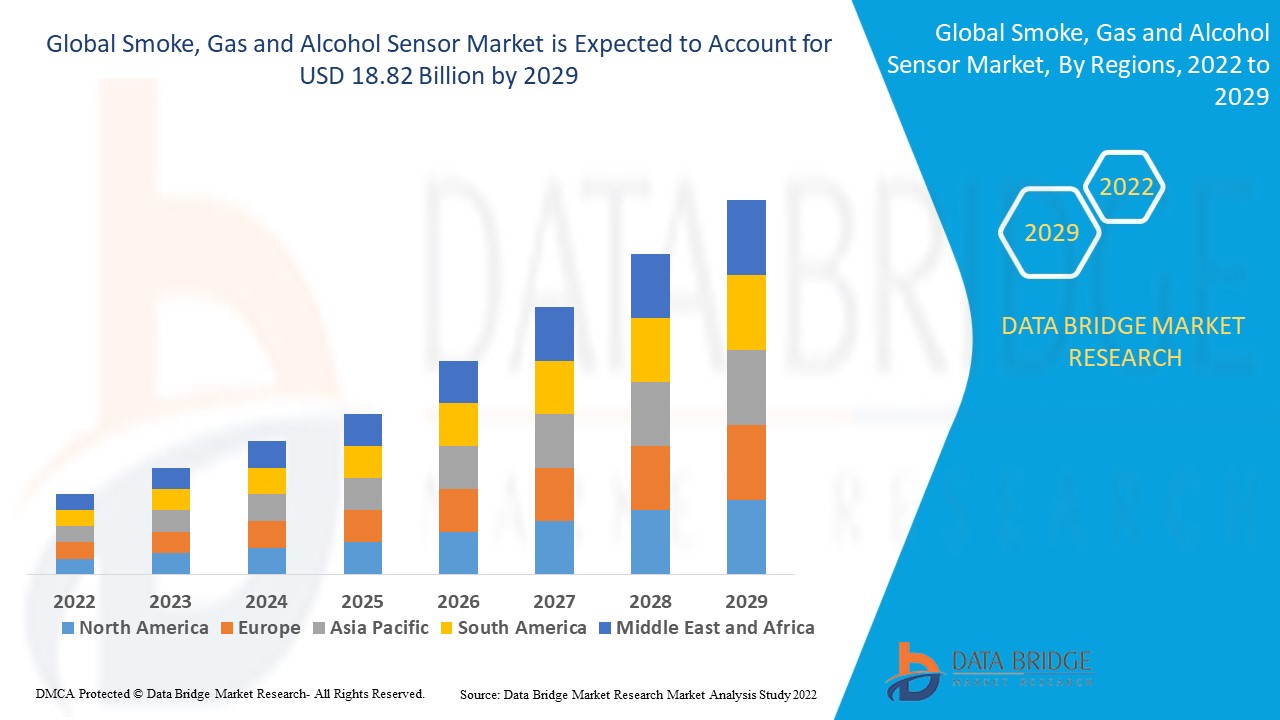

Data Bridge Market Research analyses that the smoke, gas and alcohol sensor market which was growing at a value of 3.64 billion in 2021 and is expected to reach the value of USD 18.82 billion by 2029, at a CAGR of 22.80% during the forecast period of 2022-2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Smoke, Gas and Alcohol Sensor Market Scope and Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014 - 2019)

|

|

Quantitative Units

|

Revenue in USD billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Power Source (Battery Powered, Hardwired With Battery Backup, Hardwired Without Battery Backup), Product Type (Photoelectric Smoke Detector, Ionization Smoke Detector, Dual Sensor Smoke Detector, Others), Service (Engineering Services, Installation & Design Services, Maintenance Services, Managed Services, Other Services), Type (Oxygen, Carbon Monoxide (C.O.), Carbon Dioxide (CO2), Nitrogen Oxide, Hydrocarbon, Other Types), Technology (Electrochemical, Photoionization Detectors (PID), Solid State/Metal Oxide Semiconductor, Catalytic, Infrared, Semiconductor, Fuel Cell Technology, Others), End User (Commercial, Residential, Oil & Gas and Mining, Transportation & Logistics, Telecommunication, Manufacturing, Food & Beverages, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

Texas Instruments Incorporated (U.S.), Panasonic Corporation (Japan), Siemens (Germany), Honeywell International Inc. (U.S.), ABB (Switzerland), Analog Devices, Inc. (U.S.), General Electric (U.S.), Kongsberg (Norway), Emerson Electric Co. (U.S.), STMicroelectronics (Switzerland), Microchip Technology Inc. (U.S.), NXP Semiconductors (Netherland), Maxim Integrated (U.S.) and Mouser Electronics, Inc. (U.S.), Robert Bosch GmbH (Germany), T.E. Connectivity (Switzerland), OMEGA Engineering Inc. (U.S.), Semiconductor Components Industries, LLC (U.S.), Endress+Hauser Hauser Group Services AG (Switzerland), Amphenol Corporation (U.S.), among others

|

|

Opportunities

|

|

Market Definition

A smoke sensor is a device that is installed in smoke alarms. A smoke alarm detects the presence of smoke in a home and alerts the occupants that a fire has started. Gas sensors are electronic devices that detect and identify various types of gases. They are commonly used to detect toxic or explosive gases and to measure gas concentration. The alcohol sensor, which detects ethanol in the air, is technically known as a MQ3 sensor. When a drunk person breathes near an alcohol sensor, the sensor detects the ethanol in his breath and provides an output based on the concentration of alcohol.

Global Smoke, Gas and Alcohol Sensor Market Dynamics

Drivers

- Rising pollution levels and growing emphasis on HVAC systems

The growing use of HVAC systems and rising levels of air pollution have accelerated global demand for gas sensors from critical industries to monitor air quality. The government's emphasis on industrial hygiene and safety is expected to open up new opportunities for gas sensor manufacturers. Aside from that, the global development of smart cities provides a boost to market growth. Global demand for gas sensors is being fuelled by a rapidly expanding semiconductor industry, the development of high-end features in sensor devices, and technological advancements. Regulations imposed by the government on industries and mining, as well as other activities to reduce emissions, are expected to accelerate market growth.

- Strict regulations on drunk driving

Currently, one of the key drivers increasing the adoption of alcohol sensor is drunk driving regulation. The police use a two-step procedure to enforce drunk driving laws. In the first step, potential offenders are screened at sobriety checkpoints. Previously, they used handheld Alco metres to identify individuals who may be driving while under the influence of alcohol. Blood sampling or more advanced breath analysing instruments are used in the second step to deliver judicial evidence. The first sorting phase is typically inefficient because checkpoints must be strategically placed to avoid impeding traffic, which encourages the use of alcohol sensors.

Opportunity

Smart phone-based sensors integrated with mobile applications and rising demand for accurate alcohol and narcotics detection systems will create enormous opportunities for the growth of the smoke, gas, and alcohol sensor market during the forecast period.

Restraints

Smartphone-based sensors integrated with mobile applications and rising demand for accurate alcohol and narcotics detection systems will create enormous opportunities for the growth of the smoke, gas, and alcohol sensor market during the forecast period.

This smoke, gas and alcohol sensor market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the smoke, gas and alcohol sensor market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Smoke, Gas and Alcohol Sensor Market

During the 2019 coronavirus pandemic, there is an increase in demand for multifunctional medical equipment. Demand is expected to fall in the coming months as hospitals postpone purchases to improve liquidity. However, protection of patients and hospital infrastructure from harmful gas leaks directly related to management, particularly during the COVID-19 crisis, is expected to see a limited market adoption.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In November 2019 Sensirion AG, a sensor manufacturer, released a new mass flow metre for measuring oxygen (O2) and laughing gas (N2O) levels. The product is expected to hit the market by mid-2020.

- In August 2022, Emerson Electric Co. Ltd., an American technology leader, launched two new Rosemount 628 Universal Wireless Gas Sensors to detect three gases carbon monoxide, oxygen, and hydrogen sulfide simultaneously.

- Amphenol, a fibre optic cable manufacturing company based in the United States, launched the Telaire T3022 series of CO2 lasers in March 2019.

- In January 2019, NGK Spark Plug Co., Ltd. acquired Caire Inc., a manufacturer of oxygen sensors, to expand its product portfolio with oxygen sensors.

Global Smoke, Gas and Alcohol Sensor Market Scope

The smoke, gas and alcohol sensor market is segmented on the basis of power source, product type, service, type, technology and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Power source

- Battery Powered

- Hardwired With Battery Backup

- Hardwired Without Battery Backup

Product type

- Photoelectric Smoke Detector

- Ionization Smoke Detector

- Dual Sensor Smoke Detector

- Others

Service

- Engineering Services

- Installation & Design Services

- Maintenance Services

- Managed Services

- Other Services

Type

- Oxygen

- Carbon Monoxide (C.O.)

- Carbon Dioxide (CO2)

- Nitrogen Oxide

- Hydrocarbon

- Other Types

Technology

- Electrochemical

- Photoionization Detectors (PID)

- Solid State/Metal Oxide Semiconductor

- Catalytic

- Infrared

- Semiconductor

- Fuel Cell Technology

- Others

End users

- Commercial

- Residential

- Oil & Gas and Mining

- Transportation & Logistics

- Telecommunication

- Manufacturing

- Food & Beverages

- Others

Smoke, Gas and Alcohol Sensor Market Regional Analysis/Insights

The smoke, gas and alcohol sensor market is analysed and market size insights and trends are provided by country, power source, product type, service, type, technology and end user as referenced above.

The countries covered in the smoke, gas and alcohol sensor market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominated the market, accounting for more than 32.0% of global revenue. The growing awareness of the impact of air pollutants on human health in Asia Pacific countries such as India and China is driving demand for gas sensors for air quality monitoring.

The region's continued urbanisation is also contributing to the rising demand for gas sensors. Furthermore, governments in the Asia Pacific region are heavily investing in smart city projects, creating significant opportunity for smart sensor devices. Such factors bode well for the growth of the regional market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Smoke, Gas and Alcohol Sensor Market Share Analysis

The smoke, gas and alcohol sensor market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to smoke, gas and alcohol sensor market.

Some of the major players operating in the smoke, gas and alcohol sensor market are:

- Texas Instruments Incorporated (U.S.)

- Panasonic Corporation (Japan)

- Siemens (Germany)

- Honeywell International Inc. (U.S.)

- ABB (Switzerland)

- Analog Devices, Inc. (U.S.)

- General Electric (U.S.)

- Kongsberg (Norway)

- Emerson Electric Co. (U.S.)

- STMicroelectronics (Switzerland)

- Microchip Technology Inc. (U.S.)

- NXP Semiconductors (Netherland)

- Maxim Integrated (U.S.)

- Mouser Electronics, Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- T.E. Connectivity (Switzerland)

- OMEGA Engineering Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Endress+Hauser Hauser Group Services AG (Switzerland)

- Amphenol Corporation (U.S.)

SKU-