Global Smart Home Market

Market Size in USD Billion

CAGR :

%

USD

183.69 Billion

USD

949.92 Billion

2024

2032

USD

183.69 Billion

USD

949.92 Billion

2024

2032

| 2025 –2032 | |

| USD 183.69 Billion | |

| USD 949.92 Billion | |

|

|

|

|

Smart Home Market Size

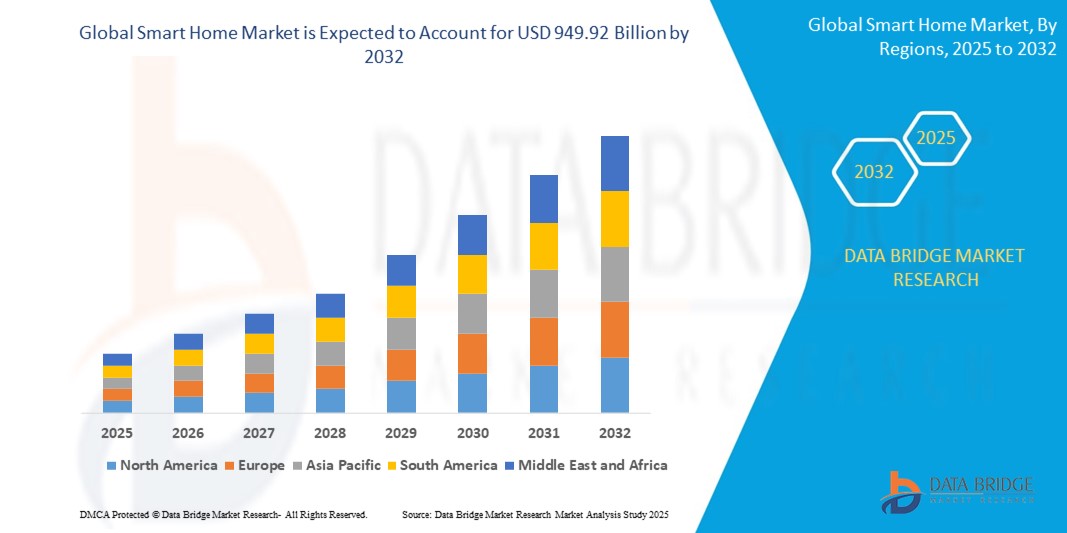

- The global smart home market size was valued at USD 183.69 billion in 2024 and is expected to reach USD 949.92 billion by 2032, at a CAGR of 22.80% during the forecast period

- This growth is driven by factors such as the aging population, increasing adoption of Internet of Things (IoT) devices, advancements in AI-powered home automation, and rising awareness of energy efficiency

Smart Home Market Analysis

- Smart home devices, including technologies like voice assistants, smart thermostats, lighting controls, home automation systems, and smart appliances, are revolutionizing residential living by enhancing convenience, security, energy efficiency, and overall comfort. These devices use artificial intelligence (AI), the Internet of Things (IoT), and automation to create intelligent home environments

- The demand for smart home solutions is being significantly driven by technological advancements, increasing consumer awareness, a growing focus on energy-saving solutions, and the desire for enhanced convenience and lifestyle improvements. Additionally, the integration of smart appliances like refrigerators, ovens, and coffee makers is contributing to market growth

- North America is expected to dominate the global smart home market, holding the largest regional share of 36.15% in 2025. This is driven by high adoption rates, well-established infrastructure, and strong consumer purchasing power

- Asia-Pacific is projected to account for 29.48% of the global smart home market in 2025, making it the second-largest region after North America. Rapid urbanization, increasing disposable incomes, and growing awareness of smart home solutions in countries like China, Japan, South Korea, and India are the key drivers of growth

- The smart kitchen segment is expected to dominate the market with a market share of 38.15% in 2025. The increasing consumer demand for connected kitchen appliances such as smart refrigerators, ovens, dishwashers, and coffee makers, combined with innovations in energy efficiency and cooking convenience, is propelling growth in this segment

Report Scope and Smart Home Market Segmentation

|

Attributes |

Smart Home Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Home Market Trends

“Integration of Artificial Intelligence (AI) and IoT in Smart Home Devices”

- One prominent trend in the global smart home market is the increasing integration of Artificial Intelligence (AI) and the Internet of Things (IoT) in smart home devices

- These innovations enhance home automation by enabling devices to learn from user behaviors, preferences, and routines, creating a more intuitive and personalized user experience

- For instance, smart thermostats such as the Nest Learning Thermostat use AI to adjust the home’s temperature based on occupancy patterns, reducing energy consumption while ensuring optimal comfort. Similarly, smart speakers with AI assistants (like Amazon Alexa and Google Assistant) are improving home control by offering voice-command capabilities, automating tasks, and providing real-time updates

- These advancements are transforming the way consumers interact with their homes, making them more energy-efficient, secure, and user-friendly, driving the growing demand for AI-powered smart home devices

Smart Home Market Dynamics

Driver

“Rising Demand Due to Growing Consumer Interest in Home Automation”

- The increasing consumer demand for convenience, security, and energy efficiency is significantly contributing to the growth of the global smart home market

- As more individuals embrace the idea of home automation, there is a notable rise in the adoption of smart home devices like smart thermostats, lighting systems, security cameras, and voice assistants. These solutions not only improve the quality of life but also optimize home energy usage and offer greater security features

- With the continuous development of AI and IoT technologies, these devices are becoming more integrated, creating a seamless home experience. The demand for smart home solutions is particularly high among millennials and tech-savvy consumers who prioritize ease of use, energy savings, and personalized automation

For instance,

- In March 2024, a report from the Consumer Technology Association (CTA) highlighted that 59% of U.S. households have adopted at least one smart home device, with a steady increase in the purchase of smart thermostats, security systems, and connected appliances. This is driven by a growing interest in making homes more efficient and secure

- As a result of the increasing consumer interest in home automation, there is a marked rise in the demand for connected devices, further propelling the growth of the global smart home market

Opportunity

“Growth in Energy Efficiency and Sustainability through Smart Home Devices”

- The increasing focus on energy efficiency and sustainability is creating significant opportunities for the smart home market. Smart home technologies that monitor and optimize energy usage are in high demand, particularly as consumers and governments push for more sustainable living practices

- Smart thermostats, lighting systems, and energy monitoring tools allow homeowners to reduce their carbon footprint, lower energy costs, and contribute to environmental sustainability. These devices can automatically adjust home systems based on occupancy, weather patterns, and energy usage patterns, helping to conserve energy when not needed

- In addition, smart appliances like refrigerators, washing machines, and dishwashers are becoming more energy-efficient by optimizing their operation times and using less power, further contributing to eco-friendly practices

For instance,

- In March 2024, according to a report by the Environmental Protection Agency (EPA), smart thermostats were found to reduce energy consumption by an average of 10-12% annually. This is due to their ability to learn user preferences and adjust the temperature accordingly, ensuring that energy is used only when necessary, ultimately helping homeowners lower their energy bills and reduce their environmental impact

- The growing awareness of climate change and the need for sustainability is expected to drive the demand for energy-efficient smart home solutions, opening new avenues for product development and innovation in the sector

Restraint/Challenge

“High Initial Costs Hindering Market Penetration”

- The high initial cost of smart home devices and systems presents a significant challenge to market growth, especially for price-sensitive consumers, particularly in developing regions

- Smart home technologies, including advanced security systems, AI-powered thermostats, and connected appliances, often come with a hefty price tag, which can discourage potential buyers from making the investment

- These financial barriers can prevent widespread adoption, particularly among middle-income households or individuals who are hesitant to spend on high-tech devices, even if they offer long-term savings and convenience

For instance,

- In January 2024, according to a report from Statista, the average cost of installing a full smart home system with AI features in the U.S. can range from USD2,000 to USD10,000, depending on the number of devices and the complexity of the system. This significant cost can deter some consumers from embracing smart home technologies, especially in regions where household budgets are more constrained

- Consequently, the high cost of smart home devices can result in slower adoption rates, particularly in emerging economies, and limit the market potential, as a large portion of the population may not be able to afford these technologies

Smart Home Market Scope

The market is segmented on the basis product type, technology, software and service, sales channel application and offering.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By Software and Service |

|

|

By Sales Channel |

|

|

By Application |

|

|

By Offering |

|

In 2025, the smart kitchen is projected to dominate the market with a largest share in product type segment

In 2025, the smart kitchen segment is projected to dominate the global smart home market with the largest share of 38.15%, driven by growing consumer demand for convenience, energy efficiency, and connected living. The increasing adoption of smart appliances such as refrigerators, ovens, dishwashers, and coffee makers—often integrated with voice assistants and mobile apps—is transforming modern kitchens into technology-enabled hubs. Rising disposable incomes, rapid urbanization, and lifestyle shifts toward automation are further accelerating this trend.

The hybrid microscopes is expected to account for the largest share during the forecast period in technology segments

In 2025, the smart furniture segment is expected to dominate the global smart home market with the largest market share of 51.31%, driven by the rising demand for multifunctional, space-saving, and tech-integrated home solutions. Smart furniture—such as beds with sleep monitoring, desks with wireless charging, and sofas with embedded speakers—is gaining popularity for enhancing comfort, convenience, and connectivity in modern living spaces. The trend toward urbanization, smaller living areas, and increased adoption of IoT-enabled devices is fueling the integration of technology into everyday furniture.

Smart Home Market Regional Analysis

“North America Holds the Largest Share in the Smart Home Market”

- North America dominates the global smart home market with a market share of 36.15%, driven by widespread adoption of smart technologies, robust internet infrastructure, and strong consumer purchasing power. The region leads in integrating AI, IoT, and cloud-based solutions into residential environments

- The U.S. holds a significant portion of the regional market due to the high penetration of voice-controlled assistants, home automation systems, and advanced security solutions. Growing consumer preference for convenience, energy efficiency, and enhanced home safety continues to fuel demand

- The region benefits from heavy investments in smart home innovation by major tech companies, such as Amazon, Google, and Apple, along with strong ecosystem development and compatibility across devices and platforms

- In addition, rising concerns over home security, energy consumption, and the need for remote monitoring are contributing to the growing adoption of smart thermostats, surveillance systems, smart lighting, and kitchen appliances, further solidifying North America's leading position in the global smart home market

“Asia-Pacific is Projected to Register the Highest CAGR in the Smart Home Market”

- Asia-Pacific is projected to hold a market share of 29.48% in the global smart home market in 2025, making it the second-largest region after North America. This growth is fueled by rapid urbanization, increasing disposable incomes, expanding middle-class populations, and rising awareness of energy efficiency and home automation across countries such as China, Japan, South Korea, and India

- Countries such as China, India, and Japan are emerging as key markets due to their large populations, government initiatives supporting smart infrastructure, and growing consumer interest in connected devices for improved home management and security

- China is expected to hold the largest market share in Asia-Pacific, estimated at 42.6% in 2025, driven by strong government support for smart cities, growing internet penetration, and rising demand for AI- and IoT-enabled home appliances

- India follows with a market share of 26.5% in 2025, where increased smartphone usage, a young tech-savvy population, and a surge in residential construction are accelerating smart home adoption

- Japan, with its advanced technological ecosystem and consumer emphasis on convenience and energy conservation, is projected to contribute 18.2% to the region’s market share in 2025

Smart Home Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Honeywell International Inc. (U.S.)

- Siemens (Germany)

- Johnson Controls (Ireland)

- Axis Communications AB (Sweden)

- Schneider Electric (France)

- ASSA ABLOY (Sweden)

- Amazon (U.S.)

- Apple Inc., (U.S.)

- ADT (US)

- ABB (Switzerland)

- Robert Bosch GmbH (Germany)

- Sony Corporation (Japan)

- Samsung (South Korea)

- Ooma Inc., (U.S.)

- Delta Controls (Canada)

- Comcast (U.S.)

- Crestron Electronics Inc., (U.S.)

Latest Developments in Global Smart Home Market

- In February 2025, Amazon introduced Alexa+, an upgraded AI-powered virtual assistant designed to enhance user interactions. Powered by Amazon Bedrock models like Nova and Anthropic’s Claude AI, Alexa+ enables more natural conversations, improved contextual understanding, and multi-command handling

- In September 2024, Schneider Electric SE introduced an AI-powered energy management feature on its Wiser Home app, revolutionizing home energy optimization. This innovative tool intelligently manages water heaters and EV chargers, leveraging AI to analyze user habits, weather forecasts, and tariff data for automated load balancing

- In August 2024, LG Electronics introduced the ThinQ ON AI Home Hub at IFA 2024, revolutionizing connected home living. This hub serves as a central control point for managing and monitoring smart appliances, ensuring seamless connectivity and convenience. Powered by Affectionate Intelligence, it continuously learns user preferences to deliver personalized services and automate daily routines. The Matter-certified hub supports various network connectivity options, making it compatible with a wide range of IoT devices

- In April 2024, Apple advanced its HomeKit platform by introducing new smart home devices and improving interoperability, reinforcing its commitment to seamless ecosystem integration. This expansion incorporates Matter support, enabling broader compatibility with third-party smart home products and enhancing automation features. Apple’s latest updates focus on privacy, security, and ease of use, ensuring a more connected and intuitive smart home experience

- In March 2024, Google introduced a new smart home security system aimed at improving surveillance and integrating seamlessly with its Nest products. This system enhances home security by offering advanced monitoring features, better connectivity, and improved automation. Designed to meet the increasing demand for reliable home security solutions, Google's latest innovation ensures a more secure and responsive environment for users

- In January 2024, Amazon unveiled its newest smart home devices, featuring enhanced AI capabilities designed to elevate home automation and security. These innovations aim to create a more intuitive and responsive environment, allowing users to control various aspects of their homes seamlessly. With advanced AI integration, Amazon's smart home ecosystem enhances convenience, efficiency, and safety, making everyday tasks simpler

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Home Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Home Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Home Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.