Global Smart Farming Market

Market Size in USD Billion

CAGR :

%

USD

18.39 Billion

USD

48.42 Billion

2024

2032

USD

18.39 Billion

USD

48.42 Billion

2024

2032

| 2025 –2032 | |

| USD 18.39 Billion | |

| USD 48.42 Billion | |

|

|

|

|

Smart Farming Market Size

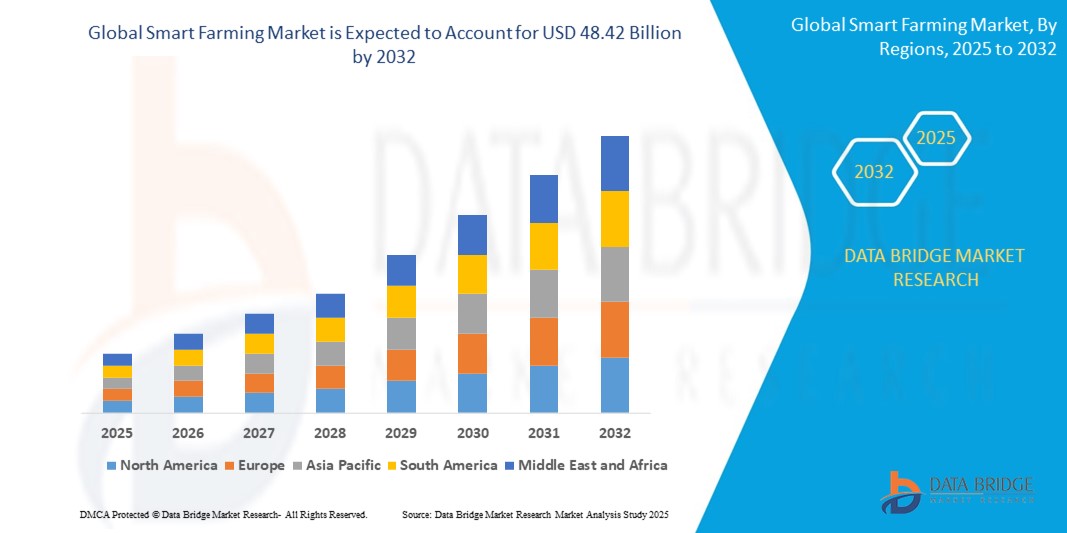

- The global smart farming market size was valued at USD 18.39 billion in 2024 and is expected to reach USD 48.42 billion by 2032, at a CAGR of 12.86% during the forecast period

- The market growth is largely fueled by the increasing adoption of IoT, AI, and robotics in agriculture, with farmers leveraging precision farming tools, automated irrigation systems, and drone-based crop monitoring to enhance productivity and reduce resource wastage

- Furthermore, rising investments and initiatives—such as John Deere’s AI-powered See & Spray technology launched in June 2023 and CNH Industrial’s acquisition of Augmenta in March 2023—are accelerating the deployment of smart farming solutions globally, thereby significantly boosting the industry's growth

Smart Farming Market Analysis

- Smart farming, integrating digital technologies such as IoT, AI, drones, and data analytics, is revolutionizing modern agriculture by enabling real-time monitoring, precision crop management, and resource optimization, thus enhancing yield and operational efficiency

- The rising demand for smart farming solutions is primarily driven by global food security concerns, climate change challenges, and the need for sustainable agricultural practices, alongside growing government support and subsidies for agritech adoption

- North America dominates the smart farming market with the largest revenue share of 39.7% in 2025, driven by early technological adoption, the presence of major agritech firms, and supportive regulatory frameworks, particularly in the United States, where precision farming and autonomous equipment usage are growing rapidly

- Asia-Pacific is expected to be the fastest growing region in the smart farming market during the forecast period due to rising population, increasing food demand, government initiatives promoting smart agriculture (India’s Digital Agriculture Mission), and expanding agritech startups in China, India, and Southeast Asia

- The precision farming segment is expected to dominate the smart farming market with a market share of 45.8% in 2025, attributed to its data-driven approach to optimize crop yields and input use, supported by the growing availability of affordable sensors, GPS tools, and software solutions

Report Scope and Smart Farming Market Segmentation

|

Attributes |

Smart Farming Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Smart Farming Market Trends

“Automation and AI-Powered Decision Making Transforming Agriculture”

- A significant and accelerating trend in the global smart farming market is the integration of artificial intelligence (AI), machine learning (ML), and automation to support data-driven decision-making, optimize inputs, and increase yield efficiency while minimizing environmental impact

- For instance, in March 2023, John Deere launched its fully autonomous tractor equipped with AI and GPS technologies that allow remote monitoring and control via a smartphone app, enabling farmers to manage operations with minimal manual intervention

- AI integration in smart farming solutions enables real-time analysis of data from soil sensors, drones, and weather stations to generate actionable insights, such as optimized irrigation schedules or early pest/disease detection. Corteva Agriscience, in May 2024, enhanced its Granular platform to use AI models for predictive analytics in crop management

- The adoption of autonomous drones and robotic harvesters is growing rapidly, allowing for precision pesticide application, automated weeding, and crop monitoring, reducing labor costs and increasing productivity—e.g., XAG introduced its upgraded agricultural drones with AI-powered object recognition in July 2023

- Seamless integration of AI with cloud-based platforms facilitates centralized control of diverse farm operations, enabling farmers to remotely monitor field conditions, machinery status, and resource usage from a single interface

- This trend toward intelligent, interconnected, and automated farming systems is reshaping modern agriculture. Consequently, companies such as Trimble Inc. and Climate LLC are heavily investing in AI-driven agri-platforms that provide end-to-end farm management solutions

- The demand for AI-enhanced smart farming technologies is surging across both developed and developing markets as stakeholders prioritize sustainability, efficiency, and climate resilience in agricultural production

Smart Farming Market Dynamics

Driver

“Growing Need for Sustainable Agriculture and Food Security”

- The escalating global demand for food due to population growth, coupled with increasing concerns over climate change and resource depletion, is a key driver propelling the adoption of smart farming technologies worldwide

- For instance, in February 2024, Bayer Crop Science announced the expansion of its digital farming platform, Climate FieldView, incorporating new predictive analytics to support sustainable crop management and reduce input wastage, highlighting industry commitment to driving smart farming adoption

- As farmers face pressures to enhance yield while reducing environmental impact, smart farming solutions such as precision irrigation, soil monitoring, and automated machinery provide critical tools to optimize resource use and increase productivity

- Furthermore, supportive government policies and subsidies promoting digital agriculture—such as the European Union’s Digital Farming Strategy launched in late 2023—are accelerating smart technology uptake, especially in regions striving to improve agricultural efficiency and sustainability

- The increasing availability of affordable, user-friendly smart farming equipment and software, combined with rising awareness about the benefits of data-driven farming, is encouraging widespread adoption across small, medium, and large-scale agricultural operations globally

Restraint/Challenge

“Concerns Regarding Data Security and High Initial Investment Costs”

- Concerns about cybersecurity vulnerabilities in connected farming equipment and digital platforms pose a significant challenge to the broader adoption of smart farming technologies. As these solutions depend heavily on IoT connectivity and cloud computing, risks such as data breaches, hacking of autonomous machinery, and unauthorized access to sensitive farm data create hesitation among users

- For instance, reports of cyberattacks targeting agricultural infrastructure, such as ransomware attacks on food supply chain systems in 2023, have increased awareness of potential risks and the need for stronger cybersecurity protocols in smart farming solutions

- Addressing these cybersecurity challenges requires companies to implement robust encryption, secure authentication, and regular software updates, with industry leaders like Trimble and John Deere emphasizing security features in their smart farming platforms to build user confidence

- In addition, the relatively high initial investment cost of advanced smart farming equipment—such as drones, autonomous tractors, and sensor networks—can deter small and medium-scale farmers, especially in developing economies, from adopting these technologies

- While prices for some components are gradually decreasing and financing options are emerging, the upfront capital requirement remains a barrier, particularly where farmers lack access to credit or government subsidies

- Overcoming these restraints through enhanced cybersecurity measures, increased farmer education, cost-effective technology solutions, and supportive financing programs will be essential to sustain the growth and adoption of smart farming worldwide

Smart Farming Market Scope

The market is segmented on the basis agriculture type, software, service, solution, and application.

By Agriculture Type

On the basis of agriculture type, the smart farming market is segmented into precision farming, livestock monitoring, fish farming, smart greenhouse, and others. The precision farming segment dominates the largest market revenue share in 2025, driven by its data-driven approach to optimize crop yields, resource utilization, and cost efficiency.

The livestock monitoring segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for animal health tracking, welfare management, and productivity enhancement through wearable sensors and automated feeding systems.

• By Software

On the basis of software, the smart farming market is segmented into web-based and cloud-based solutions. Cloud-based software held the largest market revenue share in 2025, driven by its scalability, real-time data accessibility, and remote management capabilities.

Web-based solutions offer user-friendly interfaces and are widely adopted by small to medium-sized farms due to ease of deployment and lower upfront costs.

• By Service

On the basis of service, the smart farming market is segmented into system integration and consulting, support and maintenance, connectivity services, managed services, and professional services. System integration and consulting dominate the market share in 2025, as farmers increasingly require expert guidance to implement complex smart farming technologies.

Support and maintenance services are growing steadily, reflecting the importance of uptime and reliability in precision agriculture operations.

• By Solution

On the basis of solution, the smart farming market is segmented into network management, agriculture asset management, supervisory control and data acquisition (SCADA), logistics and supply chain management, smart water management, and others. Smart water management holds the largest market share in 2025, owing to the critical need for efficient irrigation and water conservation.

Agriculture asset management solutions help farmers track equipment usage, maintenance schedules, and optimize machinery deployment.

• By Application

On the basis of application, the smart farming market is segmented into yield monitoring, field mapping, crop scouting, weather tracking and forecasting, irrigation management, farm labour management, financial management, feeding management, milk harvesting, breeding management, fish tracking and fleet navigation, water quality management, HVAC management, and others. Yield monitoring commands the largest market revenue share in 2025, supported by technologies such as remote sensing and data analytics.

Irrigation management is expected to experience the fastest growth, driven by the adoption of automated irrigation systems and IoT-based soil moisture monitoring for efficient water use.

Smart Farming Market Regional Analysis

- North America dominates the smart farming market with the largest revenue share of 39.7% in 2024, driven by rapid adoption of advanced agricultural technologies, extensive government support, and a strong presence of leading smart farming solution providers.

- Farmers and agribusinesses in the region increasingly leverage precision farming, IoT sensors, and data analytics to improve crop yields, reduce costs, and enhance sustainability, supported by high investments in agritech innovations

- The region’s robust infrastructure, favorable regulatory environment, and rising focus on sustainable agriculture further strengthen North America’s leadership in the smart farming market

U.S. Smart Farming Market Insight

The U.S. smart farming market holds a dominant position in North America, capturing the largest revenue share of 42% in 2025, driven by early adoption of precision agriculture technologies and extensive government initiatives promoting sustainable farming. The increasing use of IoT sensors, drones, and AI-powered analytics to optimize crop yields and resource management is fueling market growth. Additionally, strong investments by agritech startups and established companies are accelerating technology integration across farms of all sizes.

Europe Smart Farming Market Insight

The European smart farming market is expected to grow steadily, propelled by stringent regulations on environmental sustainability and food safety. Countries like France, Germany, and the Netherlands are at the forefront of adopting smart greenhouses, automated irrigation, and livestock monitoring technologies. Growing awareness of climate change impacts and government subsidies for digital agriculture solutions are encouraging farmers to implement smart farming systems, particularly in precision farming and water management.

U.K. Smart Farming Market Insight

The U.K. smart farming market is projected to witness robust growth, driven by increased investment in agricultural research and development, along with rising adoption of AI and robotics. The emphasis on reducing carbon footprint and enhancing food production efficiency is motivating farmers to adopt smart farming technologies such as crop scouting and yield monitoring. Furthermore, the U.K.’s government initiatives to promote digital agriculture and smart farm labor management support the market expansion.

Germany Smart Farming Market Insight

Germany leads smart farming adoption in continental Europe, supported by its advanced infrastructure and strong focus on agricultural innovation. The country’s smart farming market growth is driven by increasing deployment of Supervisory Control and Data Acquisition (SCADA) systems, smart water management, and agricultural asset management solutions. German farmers increasingly adopt technology to meet sustainability goals, reduce operational costs, and optimize resource use, particularly in crop and livestock sectors.

Asia-Pacific Smart Farming Market Insight

The Asia-Pacific smart farming market is set to grow at the fastest CAGR of over 18% through 2032, led by rapid urbanization, rising farmer incomes, and strong government support in countries like China, India, Japan, and Australia. The region’s expanding smart greenhouse initiatives, fish farming technologies, and connected livestock monitoring systems are driving adoption. Moreover, the availability of affordable cloud-based and web-based smart farming software solutions is enabling widespread digital agriculture transformation.

Japan Smart Farming Market Insight

Japan’s smart farming market is advancing due to its aging farmer population and high-tech culture, which fosters adoption of automated feeding management, crop scouting, and yield monitoring solutions. The integration of IoT and AI in greenhouses and livestock farms supports productivity while addressing labor shortages. Government programs promoting precision farming and the use of robotics in agriculture further boost market expansion.

China Smart Farming Market Insight

China dominates the Asia-Pacific smart farming market with the largest revenue share in 2025, driven by massive investments in smart irrigation, crop mapping, and livestock monitoring technologies. The country’s push for digital agriculture and smart city projects supports adoption across rural and urban farming landscapes. The proliferation of domestic agritech manufacturers and affordable connectivity services accelerates the deployment of scalable smart farming solutions across smallholder and commercial farms alike.

Smart Farming Market Share

The smart farming industry is primarily led by well-established companies, including:

- Grownetics, Inc. (U.S.)

- Auroras s.r.l. (Italy)

- Granular, Inc. (San Francisco)

- TOPCON CORPORATION (Japan)

- Climate LLC. (U.S.)

- Farmers Edge Inc. (Canada)

- DICKEY-john. (U.S.)

- Conservis, a division of Traction Ag Inc. (U.S.)

- Ag Leader Technology. (U.S.)

- Raven Industries, Inc. (U.S.)

- Iteris, Inc. (U.S.)

- Reed Business Information Ltd (U.S.)

- AgJunction (Canada)

- Trimble Inc. (U.S.)

- Deere & Company. (U.S.)

- Mothive (U.S.)

- CropX inc. (U.S.)

- Ceres Imaging, Inc (U.S.)

- GAMAYA (Switzerland)

- AgriData Incorporated (U.S.)

- AgEagle Aerial Systems Inc. (U.S.)

- Aker Solutions (Norway)

Latest Developments in Global Smart Farming Market

- In April 2025, IBM introduced an AI-driven crop management platform aimed at optimizing irrigation, pest control, and yield prediction. Leveraging advanced data analytics and satellite imagery, this innovative solution helps farmers make informed decisions to enhance productivity and sustainability. By integrating real-time weather data and IoT sensors, the platform provides actionable insights for efficient resource management. IBM’s commitment to precision agriculture ensures improved crop health and reduced environmental impact

- In April 2025, Farmers Edge Inc. partnered with Taurus Agricultural Marketing Inc. to enhance access to high-quality soil testing solutions across Canada. As the exclusive sales representative for Farmers Edge Laboratories, Taurus will expand the availability of advanced lab services, ensuring industry-leading turnaround times and tailored insights for growers, agronomists, and agri-businesses. This collaboration aims to streamline soil chemistry testing, tissue analysis, and diagnostics, supporting data-driven agricultural decisions

- In October 2023, Deere & Co. partnered with Sweden-based DeLaval and Norway-based Yara to advance digital precision agriculture tools and launch the Milk Sustainability Center. This collaboration integrates livestock and fertilizer data, enabling farmers to make informed, environmentally conscious decisions. The Milk Sustainability Center provides a unified platform for tracking nutrient use efficiency (NUE) and carbon dioxide equivalent (CO2e) emissions, helping dairy farmers optimize sustainability efforts

- In April 2023, AGCO Corporation partnered with Hexagon to enhance its factory-fit and aftermarket guidance offerings, advancing precision farming technology and agricultural productivity. This collaboration expands AGCO’s distribution of Hexagon’s guidance systems, including the Fuse Guide, which integrates rugged electronic steering and high-accuracy navigation solutions. The initiative aims to improve efficiency and accessibility for farmers, supporting sustainable and data-driven agricultural practices

- In February 2023, Topcon Agriculture introduced Transplanting Control, a cutting-edge guidance solution tailored for specialty farmers. This innovative system enhances efficiency, minimizes labor requirements, and boosts production through GNSS-driven guidance, autosteering, and control. Designed for growers of perennial trees, vegetables, and fruits, it optimizes planting patterns, reduces manual field measurements, and improves resource utilization. By leveraging precision technology, farmers can achieve higher yields and streamlined operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Farming Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Farming Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Farming Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.