Global Smart Elevator Market

Market Size in USD Billion

CAGR :

%

USD

12.29 Billion

USD

34.57 Billion

2024

2032

USD

12.29 Billion

USD

34.57 Billion

2024

2032

| 2025 –2032 | |

| USD 12.29 Billion | |

| USD 34.57 Billion | |

|

|

|

|

Smart Elevator Market Analysis

The smart elevator market is experiencing significant growth driven by technological advancements and innovations aimed at enhancing user experience, efficiency, and sustainability. One of the latest methods is the integration of IoT (Internet of Things) technology into elevators, allowing for real-time monitoring, predictive maintenance, and energy optimization. This connectivity helps reduce downtime, lowers maintenance costs, and improves service reliability. In addition, AI-driven systems are being utilized to optimize elevator dispatch and reduce wait times by learning user patterns and traffic flow.

Green technologies are also becoming crucial, with the adoption of energy-efficient motors and regenerative drives that recycle energy during descent, contributing to reduced power consumption. Touchless and voice-activated controls are gaining popularity, particularly due to heightened hygiene concerns post-pandemic, providing a safer and more convenient experience.

As urbanization increases, there is a growing demand for smarter, more efficient buildings, pushing the adoption of smart elevators. These elevators also offer enhanced security features such as biometric system and facial recognition, further driving their growth in high-rise buildings, commercial spaces, and residential complexes. As a result, the market is projected to expand significantly in the coming years.

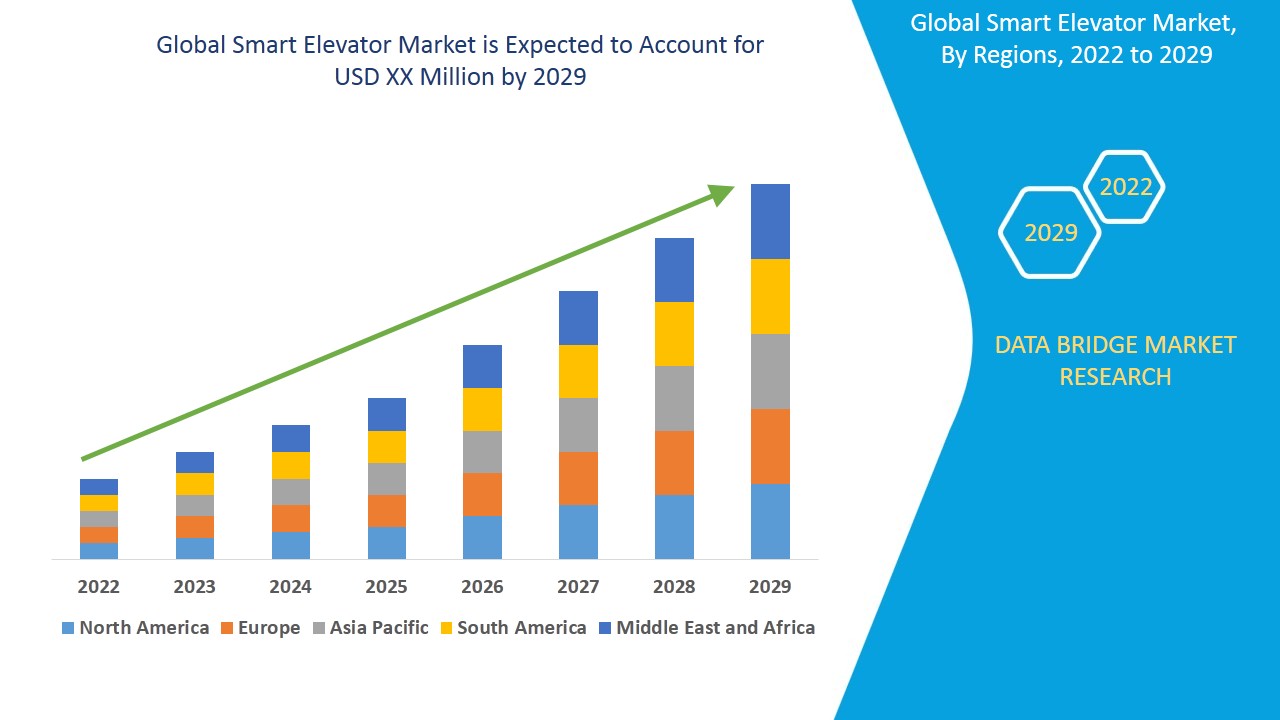

Smart Elevator Market Size

The global smart elevator market size was valued at USD 12.29 billion in 2024 and is projected to reach USD 34.57 billion by 2032, with a CAGR of 13.8% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Smart Elevator Market Trends

“Integration of IoT and Smart Technology in Smart Elevators”

A key trend in the smart elevator market is the integration of the Internet of Things (IoT) and advanced smart technologies. IoT-enabled smart elevators offer enhanced connectivity and real-time monitoring, allowing for predictive maintenance, energy efficiency, and smoother operation. For instance, Otis' "eCall" system uses IoT to allow passengers to summon elevators via mobile apps, reducing wait times. Similarly, Schindler's "Port Technology" uses smart algorithms to optimize elevator traffic flow, improving the efficiency of the building's vertical transportation system. This trend is expected to continue driving market growth by offering better user experiences and cost-effective, sustainable solutions.

Report Scope and Smart Elevator Market Segmentation

|

Attributes |

Smart Elevator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Thyssenkrupp AG (Germany), Otis (U.S.), KONE Elevator India Private Limited (India), Schindler (Switzerland), Hitachi Ltd. (Japan), Hyundai Elevator Co., Ltd. (South Korea), Toshiba India Pvt. Ltd. (India), Mitsubishi Electric Corporation (Japan), Fujitec Co., Ltd. (Japan), Motion Control Engineering Inc. (U.S.), Thames Valley Controls (U.K.), EITO & GLOBAL INC. (Japan), EITA Elevator (M) Sdn. Bhd. (Malaysia), Express Lifts Ltd. (U.K.), and Electra Elevators (Israel) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Smart Elevator Market Definition

A smart elevator is an advanced, technology-driven elevator system designed to improve efficiency, user experience, and energy consumption. These elevators are equipped with sensors, touchless interfaces, and artificial intelligence to adapt to passenger needs in real-time. They can optimize travel routes, detect maintenance issues, and enhance security by offering features such as facial recognition or mobile app control. Smart elevators also integrate with building management systems for better monitoring and energy efficiency, reducing wait times and improving building accessibility. This innovation is particularly beneficial in high-rise buildings, offering a smoother and more personalized transportation experience.

Smart Elevator Market Dynamics

Drivers

- Aging Infrastructure and Modernization Projects

The need to modernize aging infrastructure is a significant driver for the smart elevator market. Many buildings, especially older high-rises, are equipped with outdated elevator systems that lack advanced features, efficiency, and safety standards. Retrofitting these systems with modern technologies such as IoT connectivity, AI-based predictive maintenance, and energy-efficient solutions enhances overall building performance. For instance, in March 2021, Kone Elevator India introduced its digitally connected elevators, positioning itself as a leader in the smart elevator market. These elevators, equipped with advanced connectivity features, allow for better management of passenger flow, making them ideal for high-demand environments. As the second-largest elevator market globally, India presents a significant opportunity for Kone to expand its market presence with this innovative, smart solution.

- Integration with Building Management Systems

Integration with Building Management Systems (BMS) is a significant driver for the smart elevator market. By connecting elevators to BMS, these systems can coordinate seamlessly with other building functions such as lighting, HVAC, and security. This integration enables real-time monitoring and optimization, improving operational efficiency. For instance, in April 2021, Hyundai Elevators collaborated with Woowa Brothers to integrate elevator and delivery robot technologies. This partnership aims to develop elevators synchronized with delivery robots, enhancing service efficiency in commercial facilities, hotels, and residential buildings. The collaboration focuses on creating seamless operations in various sectors by improving logistics and reducing human intervention, ultimately driving growth in the smart technology space within the elevator industry.

Opportunities

- Demand for Enhanced User Experience

The growing demand for enhanced user experiences in smart elevators presents a significant market opportunity. Features such as facial recognition, voice commands, and personalized settings are revolutionizing how passengers interact with elevators. For instance, in June 2021, Otis launched the Smart Gen3 elevator, enhancing its smart elevator product portfolio. The elevator integrates cloud-based IoT technology, offering a streamlined, energy-efficient solution for smart buildings. Otis targets the growing construction market in China, driven by the nation’s focus on green development. The Smart Gen3 is designed to provide convenience and operational ease for elevator occupants, making it ideal for new infrastructure projects.

- Growing Commercial Infrastructure

The rapid expansion of commercial infrastructure, including office buildings, shopping malls, and mixed-use complexes in regions such as Asia-Pacific and the Middle East, creates significant opportunities for the smart elevator market. These regions are experiencing a construction boom, with cities such as Dubai, Singapore, and Mumbai investing in high-rise developments and smart buildings. For instance, the Burj Khalifa in Dubai features advanced elevator systems that enhance building management and traffic flow. As these commercial spaces grow, the demand for smart elevators—capable of managing high volumes of traffic, optimizing energy usage, and ensuring enhanced user experience—continues to rise, further driving market growth.

Restraints/Challenges

- High Initial Investment

The high initial investment required for smart elevators is a significant restraint in the market. Integrating advanced technologies such as IoT sensors, machine learning, and AI raises the upfront costs of these systems. This price increase can be a barrier, especially for building owners and developers in developing markets with limited budgets. The high cost makes it difficult for many potential customers to justify the expense, even though these systems offer long-term benefits. The financial strain associated with adopting smart elevators often leads to delays or avoidance in implementation, hindering market growth. As a result, the market faces slow penetration in price-sensitive regions, limiting its overall expansion potential.

- Complex Installation and Maintenance

The smart elevator market faces a significant challenge due to the complex installation and maintenance requirements. These systems involve advanced technologies such as IoT sensors, AI, and machine learning, which necessitate specialized skills for both installation and ongoing servicing. This complexity leads to increased installation costs and extended timelines, which can deter building owners from adopting these solutions. In addition, the need for expert technicians to handle repairs and upgrades further escalates operational costs. As a result, the adoption of smart elevators is slowed, especially in regions with a limited pool of trained professionals, ultimately hindering market growth and reducing the overall appeal of smart elevator technologies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Smart Elevator Market Scope

The market is segmented on the basis of component, installation, application, carrier and service. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Control Systems

- Elevator Control System

- Security Control Systems

- Surveillance Cameras

- Intruder Alarm Systems

- Fire Alarm Systems

- Visitor Management Systems

- Access Control Systems

- Biometric Access Control Solutions

- Card-Based Access Control Systems and Touch Screen

- Keypad-Based Access Control Systems

- Sensors

- Maintenance Systems

- Communication Systems

Installation

- Low and Mid-rise

- High Rise

Application

- Residential

- Commercial

- Institutional

- Automated Vehicle Storage

- Retrieval System

Carrier

- Passenger

- Freight

Service

- New Installation Services

- Modernization Services

- Maintenance Services

Smart Elevator Market Regional Analysis

The market is analyzed and market size insights and trends are provided by component, installation, application, carrier and service as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is expected to dominate the smart elevator market during the forecast period due to the prevalence of advanced infrastructure in the region. The growing demand for energy-efficient, automated, and modernized elevator solutions across commercial, residential, and industrial sectors is driving market growth. In addition, the presence of major players, technological advancements, and increased focus on enhancing building safety and accessibility are further fueling the market's expansion. Moreover, smart cities and eco-friendly initiatives contribute to the rising adoption of smart elevator systems, positioning North America as a key market leader in this segment.

Asia-Pacific is expected to witness significant growth in the smart elevator market during the forecast period. The region's rapid urbanization, coupled with an increasing population, is fueling demand for advanced infrastructure solutions. Countries such as China, Japan, and India are leading the charge with the development of smart elevators, which offer enhanced energy efficiency, improved safety features, and better user experience. In addition, the rise in construction activities and the growing trend of smart cities are further driving the adoption of smart elevators, making Asia-Pacific a key growth driver for the global market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Smart Elevator Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Smart Elevator Market Leaders Operating in the Market Are:

- Thyssenkrupp AG (Germany)

- Otis (U.S.)

- KONE Elevator India Private Limited (India)

- Schindler (Switzerland)

- Hitachi Ltd. (Japan)

- Hyundai Elevator Co., Ltd. (South Korea)

- Toshiba India Pvt. Ltd. (India)

- Mitsubishi Electric Corporation (Japan)

- Fujitec Co., Ltd. (Japan)

- Motion Control Engineering Inc. (U.S.)

- Thames Valley Controls (U.K.)

- EITO & GLOBAL INC. (Japan)

- EITA Elevator (M) Sdn. Bhd. (Malaysia)

- Express Lifts Ltd. (U.K.)

- Electra Elevators (Israel)

Latest Developments in Smart Elevator Market

- In July 2024, FUJITEC CO., LTD. expanded its operations in India by opening a new sales office in Ahmedabad. This strategic move aims to increase the company’s regional market share and enhance its multi-brand strategy. By establishing a local presence, FUJITEC intends to strengthen relationships with Indian customers and boost sales growth in the highly competitive elevator and escalator industry

- In July 2024, Hitachi Elevator Asia Pte. Ltd. secured the largest-ever contract in Singapore from the Housing & Development Board (HDB) to supply and install 450 lifts for high-rise residential buildings. This landmark deal surpasses all previous contracts in size, positioning Hitachi as a leading player in the local elevator market, and further solidifying its reputation for high-quality, reliable lift solutions

- In April 2024, Bosch showcased its cutting-edge visual and audio intelligence solutions at ISC West 2024. The company demonstrated its edge-based analytics, video cameras, and Intelligent Video Analytics Pro (IVA Pro) technologies aimed at enhancing security, safety, and operational efficiency. Bosch’s offerings focus on perimeter security, building safety, and data-driven decision-making, contributing to safer and more efficient industries across the globe

- In June 2021, Otis launched the Smart Gen3 elevator, enhancing its smart elevator product portfolio. The elevator integrates cloud-based IoT technology, offering a streamlined, energy-efficient solution for smart buildings. Otis targets the growing construction market in China, driven by the nation’s focus on green development. The Smart Gen3 is designed to provide convenience and operational ease for elevator occupants, making it ideal for new infrastructure projects

- In June 2021, Hyundai Elevators and KT signed a memorandum of understanding (MoU) to expedite the development of AI-integrated elevators. This collaboration will incorporate automatic driving robots and voice recognition technologies into Hyundai’s elevator portfolio. By focusing on digital transformation (DX), the companies aim to drive growth in the smart elevator market, enhancing the functionality and convenience of elevators for various industries, including commercial spaces and residential buildings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smart Elevator Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smart Elevator Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smart Elevator Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.