Global Rugged Servers Market

Market Size in USD Million

CAGR :

%

USD

601.94 Million

USD

966.66 Million

2024

2032

USD

601.94 Million

USD

966.66 Million

2024

2032

| 2025 –2032 | |

| USD 601.94 Million | |

| USD 966.66 Million | |

|

|

|

|

Rugged Servers Market Analysis

The rugged servers market is experiencing significant growth, driven by increasing demand from military, aerospace, industrial, energy, and telecommunication sectors that require high-performance, durable computing solutions for harsh environments. Rugged servers are designed to withstand extreme temperatures, vibrations, humidity, and electromagnetic interference, making them essential for mission-critical applications. The rise of industrial IoT (IIoT), edge computing, and AI-driven analytics has further accelerated adoption, as businesses seek reliable and secure data processing at the edge. Advancements in hardware and software technologies, such as next-generation Intel and AMD processors, improved thermal management, advanced cooling systems, and enhanced cybersecurity features, have enhanced the efficiency and reliability of rugged servers. Companies such as Advantech, Crystal Group, and General Micro Systems are continuously innovating with compact, high-speed, and AI-powered solutions to meet evolving market demands. In addition, the growth of 5G networks and cloud integration is expanding deployment opportunities, particularly in defense and industrial automation. With increasing RandD investments and government contracts, the rugged servers market is set for continuous expansion, catering to industries that require uncompromised performance in extreme conditions.

Rugged Servers Market Size

The global rugged servers market size was valued at USD 601.94 million in 2024 and is projected to reach USD 966.66 million by 2032, with a CAGR of 6.10% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Rugged Servers Market Trends

“Increasing Integration of AI-Driven Edge Computing”

The rugged servers market is witnessing rapid growth, with one key trend being the integration of AI-driven edge computing to enhance real-time data processing in harsh environments. As industries such as defense, aerospace, and industrial automation demand low-latency computing for mission-critical applications, rugged servers are evolving to incorporate AI and machine learning capabilities for autonomous decision-making and predictive analytics. For instance, General Micro Systems has developed AI-powered rugged servers that support real-time battlefield intelligence for the U.S. Army, improving situational awareness and operational efficiency. In addition, edge AI integration in rugged servers is optimizing industrial IoT (IIoT) applications, enabling automated diagnostics and remote monitoring in sectors such as oil and gas and manufacturing. As 5G networks and cloud computing expand, AI-enhanced rugged servers will play a crucial role in enabling high-speed data processing and secure communication, further driving market adoption and innovation across multiple industries.

Report Scope and Rugged Servers Market Segmentation

|

Attributes |

Rugged Servers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Dell Inc. (U.S.), Mercury Systems, Inc. (U.S.), Siemens (Germany), SAP (Germany), Crystal International Group Limited (Hong Kong), CpTechnology Srl (Italy), Symmatrix Pte Ltd (Singapore), Systel (U.S.), Trenton Systems, Inc. (U.S.), Acme Portable Machines, Inc. (U.S.), Amity Technologies (India), beltronic IPC AG (Switzerland), Elma Electronic (Switzerland), General Micro Systems, Inc. (U.S.), GETAC (Taiwan), Kontron (Germany), MPL AG Elektronikunternehmen (Switzerland), ZMicro (U.S.), SuperLogics, Inc. (U.S.), and TP Group (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Rugged Servers Market Definition

Rugged servers are high-performance computing systems designed to operate reliably in harsh and extreme environments where standard servers would fail. These servers are built to withstand extreme temperatures, shock, vibration, humidity, dust, and electromagnetic interference, making them ideal for mission-critical applications in industries such as military, aerospace, industrial automation, energy, telecommunications, and marine.

Rugged Servers Market Dynamics

Drivers

- Growing Demand in Defense and Aerospace

The increasing reliance on mission-critical computing solutions in military operations, battlefield intelligence, and aerospace applications is a key driver of the rugged servers market. Defense forces worldwide require high-performance, durable computing systems that can withstand extreme temperatures, shock, vibration, and electromagnetic interference while ensuring real-time data processing in the field. Rugged servers are extensively used in command-and-control systems, unmanned aerial vehicles (UAVs), and advanced radar systems to enhance decision-making and operational efficiency. For instance, Crystal Group Inc. secured a multimillion-dollar contract in May 2024 to supply cybersecurity-enabled rugged servers for U.S. Army radar systems, ensuring secure and efficient battlefield communication. The continuous development of AI-driven analytics, real-time situational awareness, and autonomous defense systems is further fueling market growth, making rugged servers an indispensable component in modern military and aerospace operations.

- Rising Cybersecurity Concerns

As cyber threats targeting critical infrastructure, defense networks, and industrial systems become more sophisticated, the demand for rugged servers with advanced security features is rising. These servers are designed with secure boot mechanisms, intrusion detection systems, hardware encryption, and AI-driven threat mitigation to ensure data integrity and operational security in high-risk environments. For instance, General Micro Systems (GMS) has integrated next-generation cybersecurity features into its rugged small form factor (SFF) servers, providing real-time protection for U.S. Army communication networks. In addition, industries such as telecommunications, energy, and aerospace are adopting rugged servers to safeguard mission-critical data from cyber espionage and hacking attempts. With governments and defense agencies prioritizing cyber resilience, investments in secure, military-grade rugged servers are expected to drive sustained market expansion in the coming years.

Opportunities

- Expansion of Industrial IoT (IIoT) and Edge Computing

The rapid adoption of Industrial IoT (IIoT), smart factories, and automation is creating a significant market opportunity for rugged servers, as industries increasingly require real-time data processing at the edge. In sectors such as oil and gas, manufacturing, and energy, operations often take place in remote and extreme environments, where traditional computing systems fail due to temperature fluctuations, dust, vibrations, and moisture. Rugged servers are built to endure these conditions while providing low-latency computing, predictive maintenance, and enhanced operational efficiency. For instance, GETAC’s X600 Server, launched in February 2023, is designed for harsh industrial environments, offering high-performance computing for remote monitoring and industrial automation. As IIoT adoption continues to grow, companies are investing in rugged edge servers to process large volumes of sensor-generated data securely, minimizing downtime and improving decision-making in mission-critical operations. This trend presents a major growth avenue for the rugged servers market, particularly as industries move toward smart, data-driven operations.

- Increasing Advancements in AI and 5G Integration

The convergence of AI-powered analytics and 5G connectivity is revolutionizing the rugged servers market, offering faster data transmission, real-time monitoring, and advanced machine learning applications. With AI-driven edge computing, rugged servers can process and analyze vast amounts of data on-site, reducing latency and reliance on cloud infrastructure, which is crucial for military, industrial, and autonomous systems. The integration of 5G networks further enhances remote access, autonomous decision-making, and communication in high-risk environments. For instance, General Micro Systems (GMS) has introduced AI-powered rugged servers for defense applications, enabling real-time battlefield intelligence and secure, high-speed data exchange. In industrial sectors, 5G-enabled rugged servers are improving predictive maintenance, robotic automation, and real-time process control, particularly in manufacturing and critical infrastructure. As AI and 5G adoption accelerate, rugged servers will become essential for organizations looking to enhance operational efficiency, security, and automation, making this a key market expansion opportunity.

Restraints/Challenges

- High Production and Maintenance Costs

Rugged servers are designed to operate in extreme conditions, requiring specialized materials and components that significantly increase production costs. Unlike commercial servers, which use standard parts, rugged servers must incorporate reinforced enclosures, shock-resistant drives, and thermal management systems to endure harsh environments such as military battlefields or industrial sites. In addition, customization needs for industries such as defense and aerospace add to the overall cost, as each sector demands specific durability and security features. Maintenance is another financial burden, as repairing or replacing rugged server components requires skilled technicians and specialized parts that are often expensive and difficult to source. These high costs make it challenging for small and mid-sized enterprises (SMEs) to adopt rugged servers, limiting market expansion.

- Regulatory and Certification Challenges

The rugged server market is heavily regulated, particularly in industries such as defense, aerospace, and critical infrastructure, where compliance with strict standards is mandatory. For instance, military-grade rugged servers must meet MIL-STD-810 (a U.S. military standard for environmental durability) and DO-160 (aerospace compliance for airborne equipment). Obtaining these certifications is a lengthy and costly process, delaying product launches and limiting the number of manufacturers capable of entering the market. Furthermore, environmental regulations such as RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment Directive) in Europe impose additional compliance requirements on rugged server manufacturers, increasing production complexity. These regulatory hurdles make it difficult for new players to compete, restricting market growth and innovation.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Rugged Servers Market Scope

The market is segmented on the basis of offering, type, memory size, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Hardware

- Software

- Services

Type

- Dedicated

- Standard

Memory Size

- 512 GB – 1 TB

- 1 TB

Application

- Military and Aerospace

- Telecommunication

- Industrial

- Energy and Power

- Marine

- Others

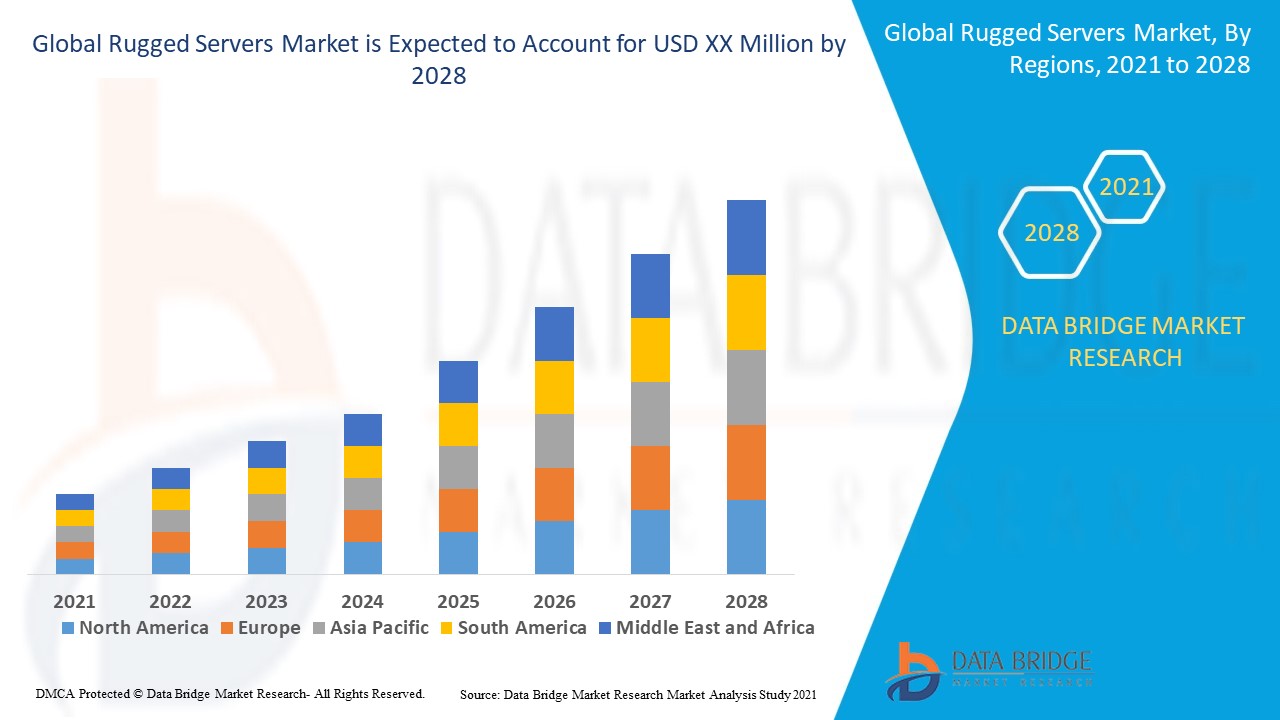

Rugged Servers Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, offering, type, memory size, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the rugged servers market, driven by their extensive use in mission-critical applications, particularly in the military, aerospace, and industrial sectors. In addition, ongoing technological advancements, research and development activities, and the increasing demand for enhanced process flexibility and operational efficiency are expected to further accelerate market growth in the region during the forecast period.

Asia-Pacific is expected to experience fastest growth in the rugged servers market, driven by the increasing demand for smart energy solutions. In addition, the rapid adoption of industrial IoT is anticipated to further accelerate market expansion in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rugged Servers Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rugged Servers Market Leaders Operating in the Market Are:

- Dell Inc. (U.S.)

- Mercury Systems, Inc. (U.S.)

- Siemens (Germany)

- SAP (Germany)

- Crystal International Group Limited (Hong Kong)

- CpTechnology Srl (Italy)

- Symmatrix Pte Ltd (Singapore)

- Systel (U.S.)

- Trenton Systems, Inc. (U.S.)

- Acme Portable Machines, Inc. (U.S.)

- Amity Technologies (India)

- beltronic IPC AG (Switzerland)

- Elma Electronic (Switzerland)

- General Micro Systems, Inc. (U.S.)

- GETAC (Taiwan)

- Kontron (Germany)

- MPL AG Elektronikunternehmen (Switzerland)

- ZMicro (U.S.)

- SuperLogics, Inc. (U.S.)

- TP Group (U.K.)

Latest Developments in Rugged Servers Market

- In May 2024, Crystal Group Inc., a leading provider of rugged high-performance edge computing solutions, secured a multimillion-dollar contract with a major defense contractor to supply cybersecurity-enabled rugged servers for advanced radar systems used by the U.S. Army

- In April 2024, Advantech Co., Ltd., a pioneer in industrial computing, introduced a new range of industrial solutions and servers powered by 14th Generation Intel Core processors. This lineup includes the ASMB-610V3, ASMB-788, ASMB-588, and the Edge Accelerator Server HPC-6120 + ASMB-610V3, designed to significantly enhance industrial and edge computing applications

- In February 2023, GETAC expanded its X600 mobile workstation series by launching the X600 Pro-PCI and X600 Server, specifically engineered to meet the demands of professionals working in harsh environments, including oil and gas, manufacturing, and defense

- In January 2023, General Micro Systems announced the expansion of its rugged small form factor (SFF), OpenVPX, and rackmount equipment portfolio, offering next-generation processing and enhanced bandwidth for the U.S. Army. Partnering with Dell Technologies OEM, this expanded portfolio enables the integration of commercial-off-the-shelf (COTS) technologies with GMS’s rugged server solutions

- In July 2021, Trenton Systems unveiled the Tactical Advanced Computer (TAC) family, a series of fanless, sealed, small-form-factor embedded mission computers. These systems are specifically designed for mission-critical deployments, prioritizing SWaP-C optimization and advanced data-at-rest security for edge computing applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rugged Servers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rugged Servers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rugged Servers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.