Global Rigid Plastic Packaging Market

Market Size in USD Million

CAGR :

%

USD

229.10 Million

USD

338.48 Million

2024

2032

USD

229.10 Million

USD

338.48 Million

2024

2032

| 2025 –2032 | |

| USD 229.10 Million | |

| USD 338.48 Million | |

|

|

|

|

Rigid Plastic Packaging Market Analysis

The rigid plastic packaging market is experiencing significant growth, driven by increasing demand across industries such as food and beverages, pharmaceuticals, and personal care. Rigid plastics offer durability, lightweight properties, and cost-effectiveness, making them a preferred choice over traditional materials such as glass and metal. The market is witnessing a shift toward sustainable packaging solutions, with manufacturers investing in recyclable and biodegradable plastics to meet environmental regulations. Key players are focusing on innovation, such as advanced barrier technologies and lightweight designs, to enhance product performance. Recent developments include mergers, acquisitions, and expansion strategies to strengthen market presence. For instance, major companies are adopting eco-friendly production techniques to reduce carbon footprints. The growing e-commerce sector is also fueling demand for impact-resistant and tamper-proof packaging solutions. With technological advancements and sustainability initiatives shaping the industry, the rigid plastic packaging market is expected to expand steadily in the coming years.

Rigid Plastic Packaging Market Size

The rigid plastic packaging market size was valued at USD 229.10 Million in 2024 and is projected to reach USD 338.48 Million by 2032, with a CAGR of 5.00% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Rigid Plastic Packaging Market Trends

“Shift Toward Sustainable Packaging”

Increasing environmental concerns and stringent government regulations are pushing the rigid plastic packaging industry toward sustainable alternatives. Manufacturers are actively investing in the development of recyclable, biodegradable, and compostable plastics to minimize environmental impact. Regulatory bodies worldwide are implementing strict policies to reduce plastic waste, leading companies to explore innovative materials such as bio-based plastics and post-consumer recycled (PCR) content. In addition, consumer awareness regarding eco-friendly packaging is rising, influencing brands to adopt greener packaging solutions to enhance their sustainability credentials. Companies are also focusing on lightweight packaging designs to reduce material usage and carbon emissions. This shift toward sustainable packaging is becoming a key trend, reshaping the rigid plastic packaging market and driving long-term growth.

Report Scope and Rigid Plastic Packaging Market Segmentation

|

Attributes |

Rigid Plastic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Amcor plc (Australia), Anchor Packaging LLC (U.S.), Berry Global Inc. (U.S.), Blisterpak, Inc. (U.S.), Plastipak Holdings, Inc. (U.S.), Silgan Holdings Inc. (U.S.), Altium Packaging (U.S.), D&W Fine Pack (U.S.), Coveris (Austria), Sonoco Products Company (U.S.), Sabert Corporation (U.S.), UFP Technologies, Inc. (U.S.), Universal Plastics Group, Inc. (U.S.), DS Smith (U.K.), Placon (U.S.), Genpak (U.S.), ALPLA (Austria), Huhtamaki Flexible Packaging (Finland), EasyPak (U.S.), Sealed Air (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rigid Plastic Packaging Market Definition

Rigid plastic packaging refers to durable, non-flexible packaging solutions made from plastic materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and polystyrene (PS). It is widely used to protect and preserve products across various industries, including food and beverages, pharmaceuticals, cosmetics, and industrial goods. Unlike flexible packaging, rigid plastic packaging retains its shape and structure, offering enhanced durability, impact resistance, and tamper protection. Common instances include bottles, containers, jars, trays, and tubs. With advancements in sustainable materials, recyclable and biodegradable rigid plastic packaging options are gaining traction to meet environmental regulations and consumer preferences for eco-friendly solutions.

Rigid Plastic Packaging Market Dynamics

Drivers

- Increasing Demand in Food and Beverage Industry

The increasing consumption of packaged and ready-to-eat foods is a significant driver of the rigid plastic packaging market. Busy lifestyles, urbanization, and changing consumer preferences have fueled the demand for convenient food options, necessitating durable, tamper-proof, and lightweight packaging solutions. Rigid plastic packaging provides excellent protection against contamination, extends shelf life, and enhances product appeal, making it an ideal choice for food manufacturers. In addition, advancements in food-grade plastics and sustainable materials are further supporting market growth. As the food industry continues to expand, the need for high-quality, reliable packaging solutions will drive the adoption of rigid plastic packaging globally.

- Rising E-commerce and Online Retail

The rapid growth of e-commerce and online retail is significantly driving the demand for impact-resistant and protective rigid plastic packaging. As consumers increasingly rely on online shopping for groceries, electronics, and personal care products, the need for secure and durable packaging has risen. Rigid plastic packaging offers superior strength, tamper resistance, and protection against damage during transit, ensuring product integrity. In addition, the rise of subscription-based services and doorstep delivery models is further accelerating market growth. With e-commerce continuing to expand globally, the demand for high-performance, protective packaging solutions is expected to drive the rigid plastic packaging market forward.

Opportunities

- Advancements in Packaging Technologies

Technological advancements in rigid plastic packaging, such as high-barrier coatings, lightweight materials, and digital printing, are opening new growth opportunities in the market. High-barrier coatings enhance product protection by preventing moisture, oxygen, and contaminants from affecting packaged goods, extending shelf life. The development of lightweight yet durable plastics reduces material usage and transportation costs, making packaging more sustainable and cost-effective. In addition, digital printing allows for enhanced customization, branding, and improved visual appeal, helping companies differentiate their products. As businesses seek innovative packaging solutions to improve performance and aesthetics, these advancements are expected to drive market expansion.

- Growth in Pharmaceutical and Healthcare Sectors

The increasing need for secure, contamination-free packaging in the pharmaceutical, medical, and personal care industries is creating significant growth opportunities for the rigid plastic packaging market. With stringent regulations governing the packaging of medicines and medical devices, manufacturers are focusing on high-quality, tamper-resistant, and sterile packaging solutions to ensure product safety and integrity. Rigid plastic packaging offers excellent durability, moisture resistance, and extended shelf life, making it an ideal choice for healthcare applications. In addition, the growing demand for hygienic and protective packaging in the personal care sector further fuels market expansion, driving innovation in material design and functionality.

Restraints/Challenges

- Recycling and Waste Management Issues

One of the major challenges in the rigid plastic packaging market is the limited recycling infrastructure and the complexity of processing multi-layered plastics. Many rigid plastic packaging materials, especially those with multiple layers or mixed compositions, are difficult to separate and recycle efficiently. The lack of advanced recycling technologies and inadequate waste management systems further restrict the circular economy for plastics. As governments and environmental agencies impose stricter regulations on plastic waste, manufacturers face increasing pressure to develop sustainable alternatives. However, the high costs and technical challenges associated with recycling rigid plastics continue to hinder large-scale adoption and market growth.

- High Raw Material Costs

Fluctuations in the prices of key raw materials, such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), pose a significant restraint on the rigid plastic packaging market. The prices of these materials are highly influenced by global oil and gas market trends, supply chain disruptions, and geopolitical factors. Sudden price hikes increase production costs, reducing profit margins for manufacturers and limiting affordability for end users. In addition, the instability in raw material availability forces companies to seek alternative materials, which may not always meet the required performance standards. This ongoing cost volatility creates challenges in long-term production planning and market expansion.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Global Rigid Plastic Packaging Market Scope

The market is segmented on the basis of type, raw material, production process, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Bottles and Jars

- Rigid Bulk Products

- Trays

- Tubs, Cups, and Pots

- Others

Raw Material

- Bioplastics

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Expanded Polystyrene (EPS)

- Others

Production Process

- Extrusion

- Injection Molding

- Blow Molding

- Thermoforming

- Others

End User

- Food

- Beverages

- Pharmaceuticals

- Cosmetics and Toiletries

- Healthcare

- Industrial

- Others

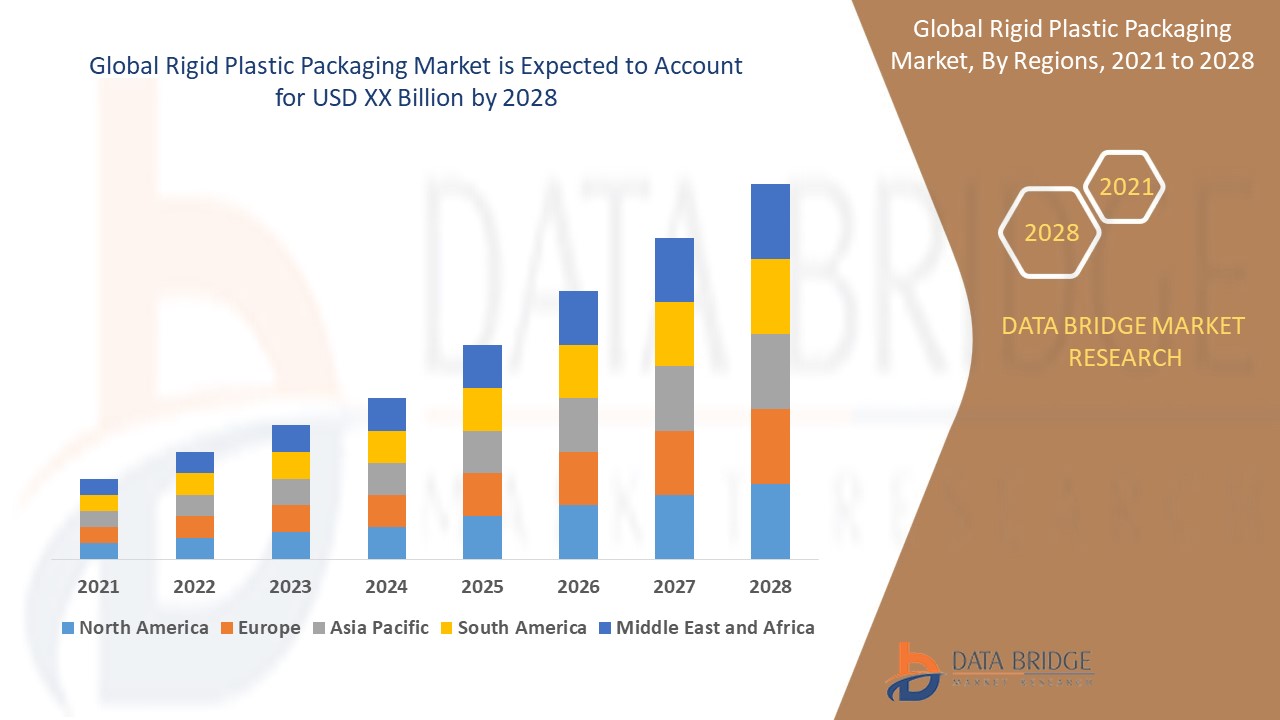

Rigid Plastic Packaging Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, raw material, production process, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

Asia-Pacific dominates the rigid plastic packaging market, driven by rapid industrialization and urbanization in emerging economies such as China and India. The region's expanding manufacturing sector, rising disposable incomes, and growing demand for packaged goods are fueling market growth. In addition, increasing investments in infrastructure and advanced packaging technologies further support the market's expansion.

North America is the fastest-growing region in the rigid plastic packaging market, driven by rising beverage consumption and increasing demand from the manufacturing and e-commerce sectors. The region's strong retail presence, expanding logistics network, and focus on sustainable packaging solutions further accelerate market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Rigid Plastic Packaging Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rigid Plastic Packaging Market Leaders Operating in the Market Are:

- Amcor plc (Australia)

- Anchor Packaging LLC (U.S.)

- Berry Global Inc. (U.S.)

- Blisterpak, Inc. (U.S.)

- Plastipak Holdings, Inc. (U.S.)

- Silgan Holdings Inc (U.S.)

- Altium Packaging (U.S.)

- D&W Fine Pack (U.S.)

- Coveris (Austria)

- Sonoco Products Company (U.S.)

- Sabert Corporation (U.S.)

- UFP Technologies, Inc. (U.S.)

- Universal Plastics Group, Inc (U.S.)

- DS Smith (U.K.)

- Placon (U.S.)

- Genpak (U.S.)

- ALPLA (Austria)

- Huhtamaki Flexible Packaging (Finland)

- EasyPak (U.S.)

- Sealed Air (U.S.)

Latest Developments in Rigid Plastic Packaging Market

- In November 2022, STERIMED, a global leader in sterilization packaging materials, introduced POLYBOND CGP 85, an innovative substrate tailored to meet customer requirements. This new product is designed to enhance the company’s polymer-reinforced cellulose-based portfolio for the healthcare sector. The launch aims to improve performance, durability, and sustainability in medical packaging solutions. With this addition, STERIMED continues to advance its position in the healthcare packaging industry

- In September 2022, Borealis partnered with ITC Packaging, a leading European manufacturer of thin-wall packaging, to develop more sustainable food-contact packaging solutions. The collaboration focuses on designing environmentally friendly packaging formats that reduce plastic consumption and improve recyclability. These new solutions aim to meet the rising demand for sustainable food packaging in the European market. The partnership underscores both companies' commitment to innovation and circular economy principles

- In October 2021, Pactiv Evergreen Inc. announced the successful acquisition of Fabri-Kal through its wholly owned subsidiary, Pactiv Evergreen Group Holdings Inc. Fabri-Kal is a well-known manufacturer of foodservice and consumer brand packaging solutions. This acquisition strengthens Pactiv Evergreen’s product portfolio, particularly in sustainable and compostable packaging. The move aligns with the company’s strategy to expand its presence in the growing eco-friendly packaging market

- In June 2020, Amcor secured a leading position in engineering and design technology with the development of an ultra-lightweight PET bottle. The company successfully designed a 900-ml polyethylene terephthalate (PET) bottle specifically for edible oil applications in Brazil. This innovation significantly reduces material usage while maintaining strength and functionality. The initiative reflects Amcor’s dedication to sustainable packaging and resource efficiency

- In February 2020, Plastipak announced a strategic investment in lightweight finish technology for carbonated beverage bottles. This development enables the commercialization of a new family of preforms in the U.S. and Europe. The innovative preforms utilize the lightest-weight neck finish designed for carbonated drinks, enhancing sustainability and cost efficiency. This investment reinforces Plastipak’s commitment to advancing lightweight packaging solutions in the beverage industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rigid Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rigid Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rigid Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.