Global Retail Edge Computing Market

Market Size in USD Billion

CAGR :

%

USD

2.15 Billion

USD

4.16 Billion

2024

2032

USD

2.15 Billion

USD

4.16 Billion

2024

2032

| 2025 –2032 | |

| USD 2.15 Billion | |

| USD 4.16 Billion | |

|

|

|

|

Retail Edge Computing Market Size

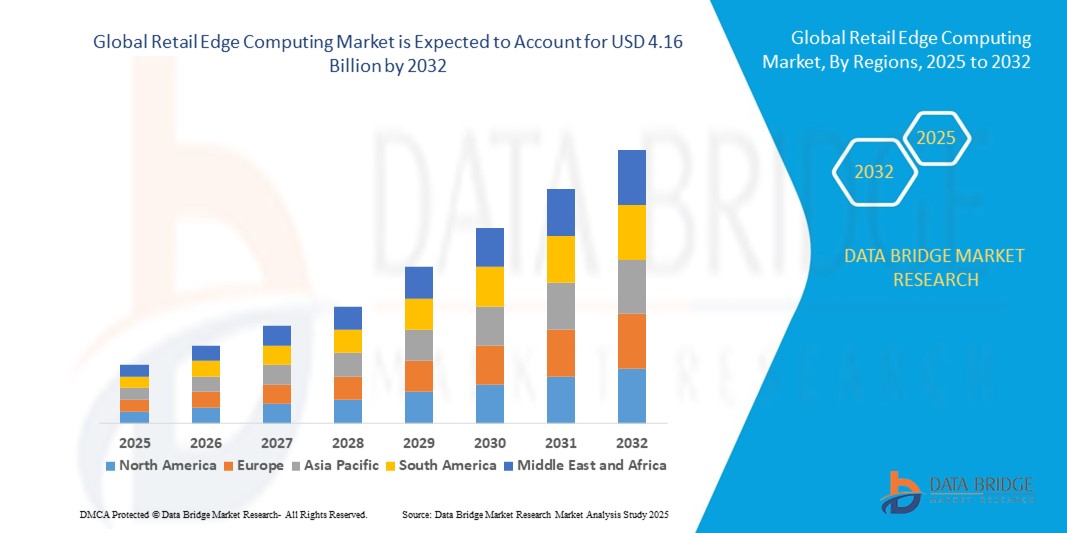

- The global retail edge computing market size was valued at USD 2.15 billion in 2024 and is expected to reach USD 4.16 billion by 2032, at a CAGR of 8.60% during the forecast period

- The market growth is largely driven by the increasing demand for real-time data processing across retail environments, enabling faster decision-making, reduced latency, and improved operational efficiency

- In addition, the rapid deployment of IoT devices, AI-powered analytics, and connected infrastructure within physical retail spaces is accelerating the adoption of edge computing. These advancements are empowering retailers to deliver personalized customer experiences, optimize inventory, and support automation, thereby significantly propelling market growth

Retail Edge Computing Market Analysis

- Retail edge computing refers to the deployment of computing resources closer to end-user locations, such as retail stores, warehouses, and distribution centers, to enable localized processing of data generated by POS systems, cameras, sensors, and connected devices

- The rising adoption of edge computing in retail is fueled by the need for low-latency insights, seamless omnichannel integration, and enhanced data security. By processing data at the edge rather than in a centralized cloud, retailers can improve responsiveness, reduce bandwidth costs, and deliver more efficient and tailored services across their operations

- North America dominated the retail edge computing market with a share of 46.30% in 2024, due to the rising need for real-time data processing and robust infrastructure to support digital transformation in the retail sector

- Asia-Pacific is expected to be the fastest growing region in the retail edge computing market during the forecast period due to increasing urbanization, rising disposable incomes, and rapid technological advancement across major economies

- Hardware segment dominated the market with a market share of 52% in 2024, due to increasing adoption of sensors, routers, and edge servers in physical retail spaces to support real-time data processing. Retailers are deploying advanced hardware to power surveillance, inventory tracking, smart shelves, and customer analytics without relying heavily on cloud infrastructure. This shift ensures reduced latency, higher operational speed, and localized decision-making, especially in large-format stores. The scalability and reliability of edge hardware have made it indispensable for digital-first retail strategies. Retailers are also leveraging edge devices to integrate contactless checkout and in-store navigation features

Report Scope and Retail Edge Computing Market Segmentation

|

Attributes |

Retail Edge Computing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Retail Edge Computing Market Trends

Rising Technological Advancements and Innovation

- Retail edge computing is increasingly leveraged to process data at the source, enabling real-time analytics, improved customer experiences, and rapid decision-making by reducing latency in retail environments

- For instance, Amazon Web Services (AWS) offers edge computing solutions integrated with their retail platforms to facilitate immediate data processing for inventory management, personalized promotions, and smart checkout systems

- Advances in IoT devices, AI-powered analytics, and 5G connectivity are driving innovative use cases such as cashier-less stores, smart shelves, and demand forecasting based on real-time customer behavior data

- The integration of edge computing with cloud AI platforms allows retailers to balance data privacy and speed, processing sensitive data locally while syncing aggregate insights to centralized cloud systems for broader strategic planning

- Retailers are adopting modular and scalable edge architectures to support omnichannel strategies, enabling seamless interaction across physical stores, e-commerce, and mobile platforms

- Growing emphasis on sustainability and energy efficiency is encouraging development of edge devices with low power consumption and adaptive performance to optimize operational costs in retail establishments

Retail Edge Computing Market Dynamics

Driver

Increasing Demand for Low-Latency Data Processing and Real-Time Analytics

- The surge in customer expectations for instant service and personalized shopping experiences is driving demand for edge computing solutions that reduce data transmission delays and enable real-time insights at retail locations

- For instance, Microsoft’s Azure IoT Edge is utilized by retailers globally to power applications such as real-time inventory updates and personalized in-store promotions that enhance customer engagement and operational efficiency

- Expansion of IoT ecosystems within retail outlets, including smart cameras, sensors, and connected POS systems, creates vast amounts of data needing immediate processing, fueling edge adoption

- Increasing investments in 5G networks further empower retailers to deploy edge computing solutions that require high bandwidth and low latency connectivity for augmented reality experiences and automated checkout systems

- Competitive pressure to differentiate in a crowded retail market is motivating enterprises to adopt innovative edge-driven technologies to optimize supply chains, reduce shrinkage, and improve customer loyalty

Restraint/Challenge

High Cost and Initial Investment

- The substantial upfront cost of implementing edge computing infrastructure, including hardware acquisition, system integration, and workforce training, poses a barrier, particularly for small and medium-sized retailers

- For instance, deployment delays have been reported by regional retail chains when integrating sophisticated edge gateways and AI modules due to budget constraints and complex legacy system compatibility issues

- Maintenance and operational expenses, including software updates and cybersecurity measures, add to the total cost of ownership over time, making ROI justification challenging for some retailers

- Integration complexity with existing IT and cloud systems requires specialized technical expertise and can disrupt ongoing operations during deployment phases

- Variable regulatory environments around data security and consumer privacy compel retailers to invest heavily in compliance solutions, raising the initial expenditure and ongoing operational burdens

Retail Edge Computing Market Scope

The market is segmented on the basis of component, technology, application, organization size, and vertical.

- By Component

On the basis of component, the retail edge computing market is segmented into hardware, gateways, micro data center, platform, and solution and services. The hardware segment held the largest revenue share of 52% in 2024, driven by increasing adoption of sensors, routers, and edge servers in physical retail spaces to support real-time data processing. Retailers are deploying advanced hardware to power surveillance, inventory tracking, smart shelves, and customer analytics without relying heavily on cloud infrastructure. This shift ensures reduced latency, higher operational speed, and localized decision-making, especially in large-format stores. The scalability and reliability of edge hardware have made it indispensable for digital-first retail strategies. Retailers are also leveraging edge devices to integrate contactless checkout and in-store navigation features.

The micro data center segment is projected to witness the fastest growth rate from 2025 to 2032 due to its compact and modular design that supports edge deployments in space-constrained retail environments. These centers offer pre-configured and containerized infrastructure that simplifies deployment and maintenance across multiple outlets. Their ability to deliver enterprise-grade compute and storage locally enables efficient data processing at the store level. Micro data centers minimize the need for full-scale IT rooms, reducing cost and physical footprint while maintaining high performance. As demand grows for decentralized computing, micro data centers are becoming a critical solution for retail digitalization.

- By Technology

On the basis of technology, the market is bifurcated into mobile edge computing and fog computing. The fog computing segment dominated the market in 2024, owing to its layered approach that distributes computing tasks across devices and local networks. This model enables retailers to analyze and act on data closer to the source, improving response times and reducing cloud dependency. Fog computing supports diverse retail functions including dynamic pricing, inventory updates, and security analytics. Its ability to coordinate data flow between store systems and cloud platforms ensures consistent performance across chains. Large retailers prefer fog architecture for scaling their smart retail operations across geographically distributed outlets.

The mobile edge computing segment is anticipated to grow at the fastest rate from 2025 to 2032 due to its high compatibility with mobile-driven retail models and 5G infrastructure. It allows real-time processing of customer interactions through mobile apps, in-store Wi-Fi, and IoT-enabled devices. Mobile edge computing enhances location-based marketing, mobile checkout, and proximity-based alerts by ensuring ultra-low latency and contextual awareness. Retailers use this technology to deliver hyper-personalized content and offers directly to shoppers’ mobile devices. Its role in enabling next-gen experiences such as AR and VR through mobile interfaces further accelerates adoption.

- By Application

On the basis of application, the market is segmented into smart cities, location services, analytics, environmental monitoring, optimized local content, data caching, augmented reality, and others. The analytics segment accounted for the largest market share in 2024, driven by the retail sector’s growing need for actionable, real-time insights. Edge-powered analytics allows retailers to monitor foot traffic, product interaction, dwell time, and sales patterns with minimal latency. This localized processing reduces the time between data collection and decision-making, supporting agile merchandising and workforce management. Retailers are using in-store analytics to drive dynamic pricing, optimize shelf layouts, and enhance customer engagement. As competition intensifies, analytics capabilities at the edge are becoming critical to maintain operational and strategic agility.

The augmented reality segment is expected to register the fastest growth from 2025 to 2032 due to its increasing use in immersive shopping experiences. Edge computing supports AR by enabling real-time image recognition, spatial awareness, and content rendering directly within the store environment. This eliminates latency issues and ensures seamless interactions for virtual try-ons, product visualization, and guided shopping experiences. AR applications powered by edge technology enhance consumer engagement and reduce return rates by improving decision confidence. Retailers are integrating AR mirrors and mobile AR tools to bridge the gap between online and offline shopping, which is fueling segment growth.

- By Organization Size

On the basis of organization size, the market is segmented into small-sized enterprises, medium-sized enterprises, and large enterprises. The large enterprises segment held the largest revenue share in 2024 due to their aggressive investments in digital transformation and scalable edge infrastructure. Big-box retailers and department store chains are leveraging edge computing for supply chain visibility, predictive maintenance, and customer behavior modeling. These enterprises benefit from large-scale data integration across stores, warehouses, and digital platforms through edge deployment. High capital expenditure and strong IT capabilities enable large retailers to implement end-to-end smart solutions that support both operational efficiency and enhanced customer experience.

The small-sized enterprises segment is expected to grow at the fastest pace from 2025 to 2032 as modular edge solutions become more accessible and affordable. Compact micro data centers and plug-and-play edge services allow small retailers to benefit from real-time analytics, inventory optimization, and digital signage without needing extensive IT staff or infrastructure. Edge-as-a-service models further lower entry barriers, enabling even standalone stores to leverage data for personalized customer engagement. As competition with large players intensifies, small retailers are increasingly turning to edge technology to stay relevant and agile.

- By Vertical

On the basis of vertical, the market is segmented into manufacturing, healthcare, transportation, government and public, media and entertainment, energy and utilities, telecom and IT, retail, and others. The retail segment dominated the market in 2024 as brands rapidly implemented edge computing to support omnichannel models, smart checkouts, and in-store automation. Edge infrastructure enables retailers to collect and process data locally, powering applications such as real-time promotions, fraud detection, and robotic store assistants. The ability to instantly adapt to consumer behavior while maintaining data privacy has made edge technology a key driver in retail modernization. With increasing focus on personalization and efficiency, edge computing is foundational to future-ready retail operations.

The healthcare segment is projected to experience the fastest growth from 2025 to 2032 due to the rising need for real-time data processing in patient care, diagnostics, and medical imaging. Edge computing enables decentralized data handling, which is crucial in supporting wearable devices, smart diagnostics, and remote patient monitoring. By reducing latency and processing data near the point of care, edge solutions help healthcare providers deliver faster, more accurate services. The demand for local data handling to ensure compliance with health data regulations is also boosting adoption. Hospitals, clinics, and diagnostic centers are increasingly integrating edge systems for efficient and secure operations.

Retail Edge Computing Market Regional Analysis

- North America dominated the retail edge computing market with the largest revenue share of 46.30% in 2024, driven by the rising need for real-time data processing and robust infrastructure to support digital transformation in the retail sector

- Retailers in the region are rapidly deploying edge computing to enhance customer experience through personalized content, efficient inventory management, and faster checkouts

- This widespread adoption is further enabled by the region’s advanced IT ecosystem, strong cloud adoption rates, and increasing reliance on IoT and AI-powered analytics at the edge

U.S. Retail Edge Computing Market Insight

The U.S. retail edge computing market accounted for the largest share within North America in 2024, owing to the country’s dominant retail sector, mature cloud ecosystem, and accelerated shift towards automation and personalized customer experiences. Retailers are actively deploying edge computing to manage localized workloads, optimize pricing strategies, and enable predictive analytics for dynamic customer interactions. Integration of edge solutions with 5G, AI, and IoT devices is becoming common, allowing retailers to run smart checkout systems, automate inventory management, and deliver real-time promotions. The strong presence of tech-driven retail giants and supportive investment climate continues to drive edge deployment across physical and digital retail touchpoints.

Europe Retail Edge Computing Market Insight

The Europe retail edge computing market is expected to witness steady growth over the forecast period, supported by the region’s focus on data protection, efficient operations, and technology modernization in the retail space. Retailers across countries such as Germany, France, and the U.K. are embracing edge computing to comply with GDPR, improve real-time decision-making, and reduce data transfer latency. The technology is enabling personalized marketing, efficient checkout processes, and in-store analytics while ensuring data sovereignty. The shift toward hybrid cloud-edge models, combined with investments in 5G and AI, is transforming Europe’s retail landscape and driving demand for scalable edge infrastructure.

U.K. Retail Edge Computing Market Insight

The U.K. retail edge computing market is poised for notable growth, fueled by the widespread adoption of smart retail systems, evolving consumer expectations, and a growing preference for contactless retail solutions. Retailers are deploying edge computing to support automated checkout systems, smart shelves, and AI-powered customer behavior analysis. The country’s well-established telecom infrastructure and progressive regulatory framework are also contributing to the expansion of edge deployments in retail environments. As consumers increasingly demand seamless, secure, and personalized experiences, retailers in the U.K. are investing in localized edge systems that deliver low-latency performance and real-time insights across both e-commerce and physical stores.

Germany Retail Edge Computing Market Insight

Germany’s retail edge computing market is expanding rapidly due to its strong emphasis on digital innovation, industrial automation, and data privacy. Retailers are leveraging edge computing to enhance supply chain visibility, monitor in-store systems, and support dynamic pricing strategies. The country’s robust logistics networks and smart retail infrastructure are driving adoption of real-time edge analytics for improving customer satisfaction and operational efficiency. As sustainability and energy efficiency become key concerns, edge solutions are also being integrated with environmental monitoring systems to help retailers meet ESG goals. Germany’s commitment to privacy, innovation, and smart technologies positions it as a pivotal market for edge adoption in Europe.

Asia-Pacific Retail Edge Computing Market Insight

The Asia-Pacific retail edge computing market is projected to grow at the fastest CAGR from 2025 to 2032, led by increasing urbanization, rising disposable incomes, and rapid technological advancement across major economies such as China, Japan, and India. Retailers in the region are turning to edge computing to support digital transformation, especially in dense urban areas where latency and bandwidth are critical concerns. With a surge in smart stores, AI-driven analytics, and self-service technologies, edge computing is becoming central to enhancing customer experiences and operational flexibility. Government support for smart infrastructure, coupled with the region’s strong manufacturing capabilities, is driving affordability and accessibility of edge solutions in retail.

Japan Retail Edge Computing Market Insight

Japan’s retail edge computing market is accelerating due to the country’s high level of technological maturity and growing adoption of smart retail solutions. Retailers are implementing edge computing to power automation, predictive analytics, and contactless retail operations in convenience stores and malls. Integration with robotics, AI, and IoT systems is enhancing the efficiency of checkout processes, customer service, and inventory tracking. As Japan faces labor shortages and an aging population, edge computing provides retailers with the ability to streamline operations and offer user-friendly solutions. The demand for secure, localized data processing is also aligned with Japan’s strong emphasis on privacy and innovation in technology.

China Retail Edge Computing Market Insight

China captured the largest revenue share in the Asia-Pacific retail edge computing market in 2024, driven by its dominant e-commerce ecosystem, robust 5G rollout, and proactive push toward smart cities. Retailers across China are deploying edge computing to support unmanned stores, real-time promotions, and hyper-personalized shopping experiences. The country’s large pool of tech manufacturers and innovation hubs enables fast deployment of edge infrastructure at competitive costs. Domestic retail giants and startups alike are leveraging AI, video analytics, and IoT integrations through edge networks to boost consumer engagement and operational efficiency. China’s digital-forward approach and scalable ecosystem make it a key growth engine in the global retail edge computing landscape.

Retail Edge Computing Market Share

The retail edge computing industry is primarily led by well-established companies, including:

- Nokia (Finland)

- Huawei Technologies Co., Ltd. (China)

- Juniper Networks, Inc. (U.S.)

- Dell Inc. (U.S.)

- Cisco System, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- SixSq SA (Switzerland)

- FogHorn Systems (U.S.)

- Vasona Networks Inc. (U.S.)

- Machine Shop co. (U.S.)

- Saguna Networks Ltd. (Israel)

- Vapor IO (U.S.)

- Violin Systems (U.S.)

- Aricent (U.S.)

- ADLINK Technology Inc. (U.S.)

- Amazon Web Services Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- IBM Corporation (U.S.)

- Intel Corporation (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

Latest Developments in Global Retail Edge Computing Market

- In February 2025, Microsoft broadened its edge computing initiatives to strengthen support for the utility sector amid growing demands for grid modernization, electrification, and integration of distributed energy sources. This expansion, focused on hybrid edge-cloud architectures, connects critical systems such as SCADA, EMS, and DERMS with Microsoft Cloud. The move positions Microsoft as a key enabler of resilient and secure edge solutions in energy infrastructure, particularly across Europe and North America, while reinforcing the value of edge computing in mission-critical industries requiring high reliability and real-time responsiveness

- In April 2023, Dell Technologies entered a strategic collaboration with Ericsson to develop open cloud networks that deliver telecom-grade performance at the far edge. By incorporating Dell PowerEdge servers—including the XR8000 and XR5610—into Ericsson’s Cloud RAN solution, the partnership offers customers increased flexibility and choice in deploying edge infrastructure. These servers, purpose-built for mobile edge computing and Open RAN workloads, enhance performance, interconnectivity, and operational efficiency. This alliance significantly strengthens Dell’s footprint in the telco edge market, enabling scalable, high-performance edge computing for modern telecom environments

- In April 2023, Nokia introduced four third-party applications for its MX Industrial Edge platform, aimed at helping enterprises connect, collect, and analyze data from diverse operational technology (OT) sources such as video cameras. This launch supports secure, on-premise edge deployments and enhances real-time insights from OT assets. By unlocking previously siloed data, Nokia empowers enterprises to make faster, more informed decisions, reinforcing its position in the industrial edge computing market and expanding the ecosystem of intelligent edge solutions for manufacturing and critical infrastructure sectors

- In February 2023, Cisco launched Cisco Edge Intelligence, a data governance and asset insight solution designed to extract actionable intelligence from connected devices. Built with Cisco’s multi-layered security framework, this tool enhances data control and operational visibility for enterprises adopting IoT and edge architectures. By streamlining edge data management and improving decision-making efficiency, Cisco strengthens its offering in industrial and commercial edge environments, advancing its competitiveness in the edge computing market

- In February 2022, IBM acquired Sentaca to expand its hybrid cloud consulting capabilities and offer advanced support to Communications Service Providers (CSPs). The acquisition was aimed at accelerating the modernization of IBM’s cloud platforms and enhancing its ability to deliver edge-enabled solutions to the telecom sector. This strategic move solidified IBM’s presence in the edge and hybrid cloud ecosystem by providing telecom clients with tailored consulting and integration services to streamline digital transformation at the edge

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Retail Edge Computing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Retail Edge Computing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Retail Edge Computing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.