Global Rechargeable Spinal Cord Stimulator Scs Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

1.82 Billion

2024

2032

USD

1.19 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Size

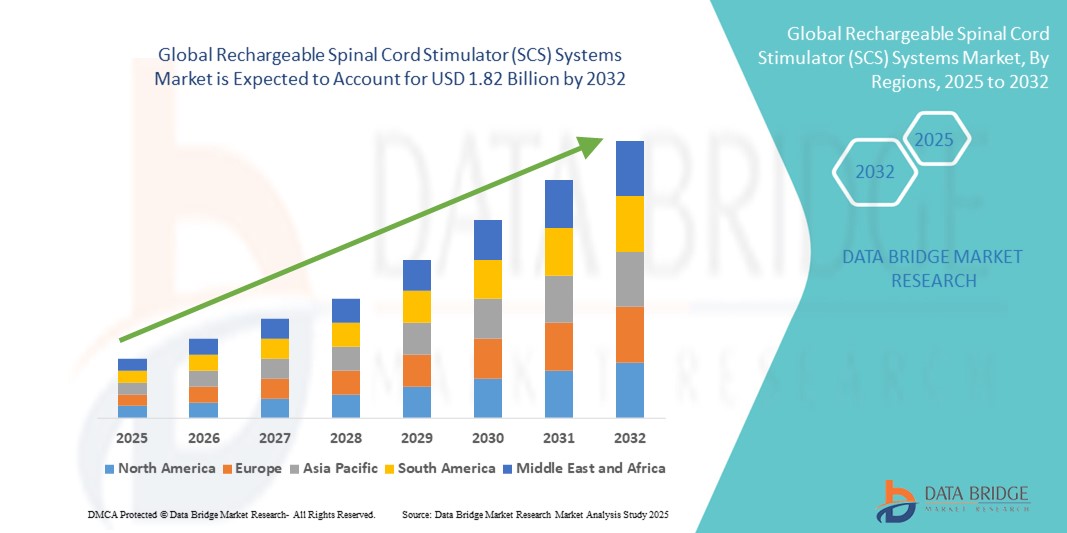

- The global rechargeable spinal cord stimulator (SCS) systems market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within neuromodulation therapies and advanced pain management systems, leading to increased digitization of healthcare practices in both hospital and outpatient settings

- Furthermore, rising patient demand for minimally invasive, long-lasting, and rechargeable solutions for chronic pain is establishing Rechargeable Spinal Cord Stimulator (SCS) Systems as the preferred standard in neuromodulation. These converging factors are accelerating the uptake of Rechargeable SCS Systems solutions, thereby significantly boosting the industry's growth

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Analysis

- Rechargeable spinal cord stimulator (SCS) Systems are implantable neuromodulation devices used for chronic pain management, offering extended battery life, fewer revision surgeries, and greater control for users

- The demand is driven by the growing prevalence of chronic pain conditions (such as failed back surgery syndrome and neuropathic pain), rising awareness of opioid alternatives, and advancements in miniaturized, MRI-compatible, rechargeable SCS devices

- North America dominated the global rechargeable spinal cord stimulator (SCS) systems market with the largest revenue share of 30.30% in 2024, supported by high healthcare spending, established reimbursement coverage, and early adopter behavior in the U.S. and Canada

- Asia-Pacific is projected to be the fastest-growing region in the rechargeable spinal cord stimulator (SCS) systems market, with a forecasted CAGR of around 10.05% from 2025 to 2032, due to expanding healthcare infrastructure, rising chronic pain incidence, and increasing availability of neurostimulation therapies

- The failed back surgery syndrome segment dominated the rechargeable spinal cord stimulator (SCS) systems market with a revenue share of 41.6% in 2024, owing to the high prevalence of chronic pain following spinal surgeries and the effectiveness of SCS therapy in managing intractable postoperative pain. Patients who experience limited relief from surgery often turn to SCS as a minimally invasive, long-term pain management option

Report Scope and Rechargeable Spinal Cord Stimulator (SCS) Systems Market Segmentation

|

Attributes |

Rechargeable Spinal Cord Stimulator (SCS) Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Trends

Improved Device Intelligence and Patient-Centric Pain Management

- A significant and accelerating trend in the global rechargeable spinal cord stimulator (SCS) Systems market is the growing adoption of personalized, patient-centric technologies supported by artificial intelligence (AI), smart sensing capabilities, and remote programming features. These innovations are transforming chronic pain management by offering enhanced control, customization, and comfort to patients

- For instance, Boston Scientific’s WaveWriter Alpha system leverages multiple therapy waveforms and AI-powered stimulation mapping to deliver customized relief. Patients can use remote control tools and Bluetooth-enabled tablets to adjust pain settings in real-time without requiring frequent clinical visits

- AI and machine learning are also being used to predict therapy outcomes and automatically adapt stimulation levels based on patient behavior, activity levels, and feedback. Some new-generation devices incorporate motion sensors that adjust stimulation during sleep, walking, or sitting to maintain comfort and optimize results

- Rechargeable SCS devices are also being designed with longer battery life—typically lasting over 10 years—thereby reducing the need for surgical replacements. These devices also support wireless charging and user-friendly interfaces, empowering patients to take control of their therapy independently

- The remote programming capability, which gained momentum during the COVID-19 pandemic, continues to be in demand, particularly among elderly patients and those living in remote areas. Physicians can now fine-tune stimulation parameters remotely, ensuring uninterrupted care and better clinical outcomes

- This trend toward smarter, longer-lasting, and more adaptive SCS technologies is significantly reshaping how chronic pain is managed. Leading companies such as Medtronic, Nevro Corp, and Abbott are investing in R&D to enhance neurostimulator precision, reduce side effects, and expand indications for use in conditions like diabetic neuropathy and fibromyalgia

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Dynamics

Driver

Growing Need Due to Rising Chronic Pain Prevalence and Demand for Alternative Therapies

- The increasing prevalence of chronic pain conditions such as failed back surgery syndrome, complex regional pain syndrome, and diabetic neuropathy, coupled with a growing demand for non-opioid alternatives, is a significant driver for the heightened demand for Rechargeable Spinal Cord Stimulator (SCS) Systems

- For instance, in April 2024, Nevro Corp. expanded the clinical application of its HFX™ SCS platform, launching new studies to support therapy for chronic post-surgical pain, beyond standard indications. Such strategies by key companies are expected to drive the Rechargeable SCS Systems industry growth in the forecast period

- As patients and healthcare providers seek more effective and long-lasting pain management options with fewer side effects than pharmacological interventions, SCS systems offer targeted neuromodulation that blocks pain signals at the spinal cord level

- Furthermore, growing awareness of SCS therapy’s clinical efficacy, especially for treatment-resistant neuropathic pain, is boosting adoption rates across pain management clinics and specialty hospitals

- The convenience of rechargeable implants—with battery lives exceeding 10 years, reduced surgical revisions, and improved patient comfort—are key factors propelling the adoption of rechargeable SCS devices over non-rechargeable systems. Technological advancements like Bluetooth-enabled programming, MRI compatibility, and smaller implantable pulse generators further contribute to market growth

Restraint/Challenge

Concerns Regarding High Initial Costs and Limited Access in Emerging Markets

- Despite clinical advantages, the high initial cost of SCS devices and implantation procedures poses a significant barrier to adoption, especially in low- and middle-income countries where reimbursement policies are limited or non-existent

- For instance, while major markets like the U.S. and parts of Europe have robust reimbursement frameworks for SCS therapy, many emerging regions lack standardized insurance coverage, making the therapy unaffordable for many patients

- Moreover, the surgical nature of the implantation procedure can deter patients who are averse to invasive treatments or do not have access to specialized pain care centers

- Addressing these cost and access challenges through health policy reforms, local manufacturing partnerships, and increased training of physicians in emerging markets will be essential to expand therapy availability

- Although the long-term cost-effectiveness of rechargeable SCS systems (due to reduced need for replacement surgeries) is gaining recognition, up-front device and surgical costs continue to restrict broader market penetration. Public-private collaborations and increased investment in outpatient neuromodulation infrastructure may help mitigate these limitations over time

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Scope

The market is segmented on the basis of application and end use.

- By Application

On the basis of application, the rechargeable spinal cord stimulator (SCS) systems market is segmented into failed back surgery syndrome, complex regional pain syndrome, ischemic limb pain, and others. The failed back surgery syndrome segment accounted for the largest revenue share of 41.6% in 2024, owing to the high prevalence of chronic pain following spinal surgeries and the effectiveness of SCS therapy in managing intractable postoperative pain. Patients who experience limited relief from surgery often turn to SCS as a minimally invasive, long-term pain management option.

The complex regional pain syndrome segment is projected to witness the fastest CAGR of 17.9% from 2025 to 2032, driven by growing awareness of neuromodulation therapies, the debilitating nature of CRPS, and increasing clinical adoption of SCS to reduce pain intensity and improve quality of life in affected patients. Advancements in SCS programming are further boosting demand in this segment.

- By End Use

On the basis of end use, the rechargeable spinal cord stimulator (SCS) systems market is segmented into hospitals & clinics and ambulatory facilities. The hospitals & clinics segment dominated the market with a revenue share of 68.4% in 2024, supported by the availability of trained specialists, advanced surgical infrastructure, and comprehensive pain management programs. These facilities often serve as primary treatment centers for chronic pain patients requiring SCS implantation and follow-up care.

The ambulatory facilities segment is expected to grow at the fastest CAGR of 18.5% from 2025 to 2032, fueled by the increasing preference for outpatient procedures, lower costs, and the rising number of minimally invasive spinal procedures being conducted in ambulatory surgery centers. These centers offer convenience and shorter recovery times, which are increasingly valued by both patients and providers.

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Regional Analysis

- North America dominated the rechargeable spinal cord stimulator (SCS) Systems market with the largest revenue share of 39.30% in 2024, driven by increasing incidences of chronic pain disorders, a strong reimbursement framework, and rapid adoption of neuromodulation therapies

- The region benefits from advanced healthcare infrastructure and early access to innovative medical technologies

- In addition, favorable clinical outcomes, supportive regulatory policies, and a growing geriatric population suffering from back pain and neuropathic conditions are propelling demand for long-lasting, implantable SCS solutions. Manufacturers in the region are also focused on developing smaller, MRI-compatible, and wireless charging-enabled systems

U.S. Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The U.S. rechargeable spinal cord stimulator (SCS) systems market accounted for 81.7% of the North American SCS revenue in 2024. Growth is driven by high procedural volumes of spine surgeries, greater awareness of neurostimulation devices among physicians, and the robust presence of key market players such as Medtronic, Abbott, and Boston Scientific. The shift toward rechargeable and MRI-safe devices and the increasing number of FDA-approved indications are significantly boosting adoption.

Europe Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The Europe rechargeable spinal cord stimulator (SCS) systems market held the second-largest market share of 30.6% in 2024, fueled by growing demand for drug-free pain management alternatives, aging populations, and national healthcare systems increasingly reimbursing neurostimulation procedures. Countries like Germany, France, and the U.K. are at the forefront of adopting minimally invasive spinal implants, supported by dedicated pain clinics and neurology centers.

U.K. Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The U.K. rechargeable spinal cord stimulator (SCS) systems market is projected to grow at a CAGR of 14.3% from 2025 to 2032. Government support for outpatient spinal therapies, increased NHS funding for pain management programs, and a rise in chronic conditions such as failed back surgery syndrome are encouraging broader usage of rechargeable SCS systems.

Germany Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The Germany rechargeable spinal cord stimulator (SCS) systems market is expected to grow at a CAGR of 13.8%, backed by strong hospital infrastructure and high adoption of neuromodulation therapies by pain specialists. German consumers also prefer rechargeable, long-duration systems that reduce replacement surgery needs, particularly in elderly populations.

Asia-Pacific Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The Asia-Pacific rechargeable spinal cord stimulator (SCS) systems market region is poised to grow at the fastest CAGR of 10.05% between 2025 and 2032, attributed to rising awareness of spinal disorders, increasing healthcare expenditures, and expanding access to neurostimulation devices in emerging economies like China, India, and South Korea. Strategic investments from global players and the rise of local manufacturing hubs are improving affordability and accessibility in the region.

Japan Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The Japan rechargeable spinal cord stimulator (SCS) systems market known for its technologically advanced healthcare sector, is witnessing rapid growth in demand for implantable neurostimulation systems. The market is driven by the country’s aging population and high prevalence of conditions such as diabetic neuropathy and spinal stenosis. The integration of telemedicine and wireless recharging capabilities into SCS systems is also gaining traction.

China Rechargeable Spinal Cord Stimulator (SCS) Systems Market Insight

The China rechargeable spinal cord stimulator (SCS) systems market captured the largest market share within Asia-Pacific at 39.1% in 2024, due to the country’s increasing burden of chronic pain, rapid urbanization, and government-led initiatives to expand access to advanced medical devices. Domestic companies are also entering the SCS landscape, offering cost-effective and technologically competitive products, further intensifying the market.

Rechargeable Spinal Cord Stimulator (SCS) Systems Market Share

The Rechargeable Spinal Cord Stimulator (SCS) Systems industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Boston Scientific Corporation (U.S.)

- Nevro Corp (U.S.)

- Nuvectra Corporation (U.S.)

- Stimwave LLC (U.S.)

- Saluda Medical (Australia)

- Axonics Modulation Technologies (U.S.)

- Integer Holdings Corporation (U.S.)

- Synapse Biomedical Inc. (U.S.)

Latest Developments in Global Rechargeable Spinal Cord Stimulator (SCS) Systems Market

- In April 2024, Medtronic received U.S. FDA approval for its Inceptiv closed-loop rechargeable SCS system. This innovative device automatically adjusts stimulation by sensing spinal cord signals (ECAPs), improving patient comfort during everyday activities and offering compatibility with full‑body 1.5T and 3T MRI scans

- In September 2024, Nevro Corp. launched HFX AdaptivAI an AI‑driven platform for the HFX iQ SCS system. This is the only FDA‑approved AI‑enabled SCS system and delivers personalized stimulation using real-time quality-of-life and device data for optimized chronic pain management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.