Global Spinal Implants And Spinal Devices Market

Market Size in USD Billion

CAGR :

%

USD

10.60 Billion

USD

17.87 Billion

2023

2031

USD

10.60 Billion

USD

17.87 Billion

2023

2031

| 2024 –2031 | |

| USD 10.60 Billion | |

| USD 17.87 Billion | |

|

|

|

|

Spinal Implants Market Size

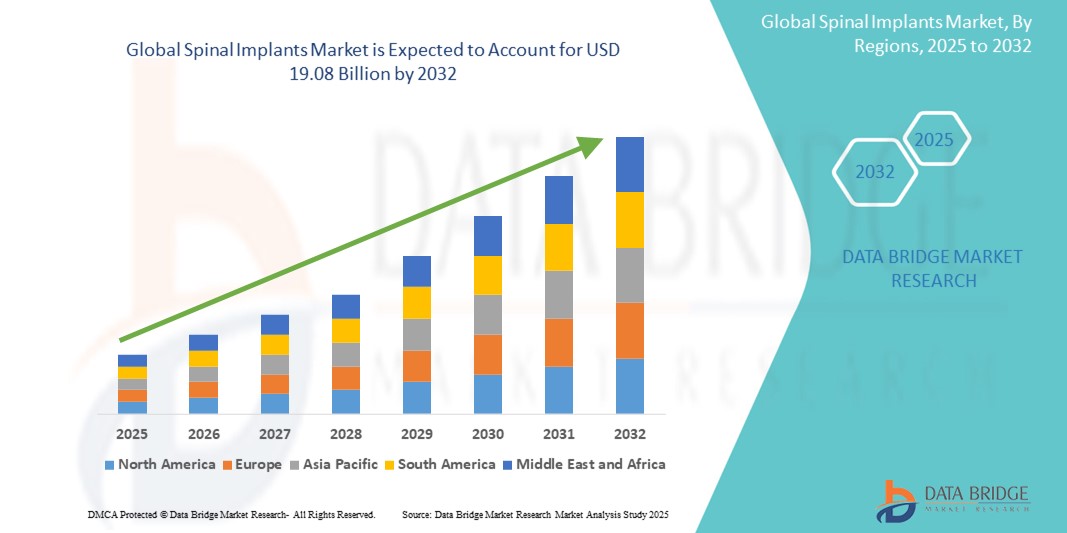

- The global Spinal Implants market was valued at USD 11.31 billion in 2024 and is expected to reach USD 19.08 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.75%, primarily driven by the rising incidence of spinal disorders

- This growth is driven by factors such as the aging population, and advancement in surgical technologies

Spinal Implants Market Analysis

- Spinal implants are critical medical devices used in various spinal surgeries to provide stability, correct deformities, and facilitate fusion between vertebrae. These implants are essential in treating conditions such as degenerative disc disease, spinal stenosis, scoliosis, fractures, and other spinal deformities. Common types include rods, screws, plates, cages, and artificial discs, tailored to suit specific procedures such as spinal fusion, vertebral compression fracture repair, or disc replacement

- The demand for spinal implants is significantly driven by the growing incidence of spinal disorders, especially among aging populations, coupled with technological advancements in surgical techniques. With increasing cases of lower back pain, traumatic spinal injuries, and age-related degenerative conditions, there is a consistent rise in surgical interventions globally. Notably, minimally invasive surgeries (MIS) are contributing to higher adoption of newer, more advanced implant systems

- North America stands out as one of the dominant markets for spinal implants, driven by its robust healthcare infrastructure, high rate of spinal surgeries, and strong presence of key medical device manufacturers. U.S., in particular, has seen steady growth in spinal fusion and artificial disc replacement procedures. The region’s emphasis on adopting innovative technologies, such as 3D-printed implants, robotics, and spinal navigation systems, has further cemented its leadership in the global market

- For instance, the number of spinal surgeries in the U.S. continues to rise, supported by increasing insurance coverage and the widespread availability of specialized spine care centers. From academic hospitals to private spine institutes, North America plays a significant role not only in the utilization but also in the development and global distribution of cutting-edge spinal implant technologies

- Globally, spinal implants are among the most critical components in orthopedic and neurosurgical procedures, following closely behind hip and knee implants in surgical volume. Their role in ensuring spinal alignment, stability, and long-term patient outcomes makes them indispensable in the treatment landscape of spine-related disorders. As innovation continues to advance material science and implant design, the market is expected to witness steady growth in both developed and emerging healthcare economies

Report Scope and Spinal Implants Market Segmentation

|

Attributes |

Spinal Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spinal Implants Market Trends

“Increasing Adoption of 3D Imaging and Digital Integration”

- One prominent trend in the global spinal implants market is the growing adoption of 3D imaging and digital integration. These advanced technologies are enhancing the precision, accuracy, and overall outcomes of spinal surgeries by providing surgeons with high-definition, three-dimensional views of the spine's complex anatomy

- For instance, 3D imaging technology allows surgeons to visualize detailed, patient-specific spinal structures, including vertebrae, discs, and neural pathways. This enhanced visualization is crucial for planning and performing complex procedures such as spinal fusion, deformity correction, and disc replacement, where precision in alignment and placement of implants is vital

- Digital integration also enables real-time data sharing, patient-specific modeling, and improved surgical planning. Surgeons can now plan and simulate surgeries using 3D models before performing them, significantly improving procedural accuracy. In addition, this technology allows for real-time navigation during surgeries, offering continuous feedback on implant positioning, which reduces the likelihood of complications and improves patient outcomes

- This trend is revolutionizing the way spinal surgeries are performed, leading to better precision, shorter recovery times, and fewer complications. As a result, the demand for 3D imaging and digitally integrated spinal implant systems is increasing, making them an essential part of modern spinal surgery practices and driving further innovation in the market

Spinal Implants Market Dynamics

Driver

“Growing Need Due to Prevalence of Spinal Disorders”

- The rising prevalence of spinal disorders such as degenerative disc disease, spinal stenosis, scoliosis, and vertebral fractures is significantly driving the demand for spinal implants

- As the global population ages, the incidence of these conditions continues to grow, with older adults being more prone to spinal degenerative conditions that often require surgical intervention

- Degenerative disc disease, in particular, is one of the leading causes of lower back pain, necessitating surgical procedures that demand precise spinal implant placements

- The ongoing advancements in spinal surgery, such as minimally invasive spinal procedures and robotic-assisted surgery, further highlight the need for advanced spinal implants that offer greater precision, durability, and patient-specific solutions

- As more individuals seek treatment for these conditions, the demand for spinal implants rises, ensuring improved surgical outcomes and reduced risk of complications

For instance:

- In June 2023, according to a report published by the National Institutes of Health (NIH), degenerative spinal conditions account for over 80% of chronic back pain cases in adults aged 50 and older, highlighting the increasing demand for spinal surgeries and implant solutions

- In December 2022, a study published by the World Health Organization (WHO) highlighted that the global aging population is rapidly increasing, with those aged 60 years and above projected to make up 25% of the population by 2050. As a result, the demand for spinal implants is expected to grow due to the higher occurrence of spinal degenerative diseases in older individuals

- The growing prevalence of spinal disorders, particularly among aging populations, is driving the increasing demand for advanced spinal implants, with conditions such as degenerative disc disease fueling the need for precise surgical interventions and patient-specific solutions

Opportunity

“Advancing Spinal Surgery with Robotic and AI Integration”

- Robotic-assisted spinal surgery and AI-powered surgical planning tools are revolutionizing spinal procedures by enhancing precision, reducing human error, and improving patient outcomes

- Robotic systems can assist surgeons in the accurate placement of spinal implants, ensuring better alignment and reducing complications in complex surgeries such as spinal fusion and scoliosis correction

- In addition, AI algorithms are being integrated into spinal implant systems to analyze patient data, recommend the most effective surgical approach, and even guide the surgery in real time

For instance:

- In March 2024, a study published in The Journal of Spinal Disorders showed that AI-driven surgical planning tools reduced the incidence of implant misplacement in spinal fusion surgeries by 15%, leading to better long-term patient outcomes

- In January 2025, the use of robotic-assisted spinal surgery was reported to increase by 30% across North American hospitals, with systems such as the Mazor Robotics platform gaining widespread adoption for their ability to guide implant placement with greater accuracy and precision

- Robotic-assisted spinal surgery and AI-powered planning tools are enhancing precision, reducing complications, and improving patient outcomes by optimizing spinal implant placement and surgical decision-making

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of spinal implants and associated surgical equipment poses a significant challenge, particularly in developing regions with limited healthcare budgets

- Spinal implants, such as rods, screws, cages, and artificial discs, often cost tens of thousands of dollars, which can make them prohibitively expensive for smaller hospitals, clinics, and healthcare systems in emerging markets

- This substantial financial barrier can hinder the adoption of advanced spinal implant systems and delay the upgrading of outdated equipment, potentially limiting access to cutting-edge treatments for patients in need

For instance:

- In November 2023, a report published by the Global Spine Outreach Organization highlighted that the high cost of spinal implants remains a primary concern in low- and middle-income countries, where healthcare providers often struggle to afford the latest implant technologies

- According to a study by the World Spine Care Foundation in February 2024, hospitals in regions such as Sub-Saharan Africa and Southeast Asia face significant difficulties in providing affordable spinal surgeries due to the high cost of implants and surgical equipment, affecting the overall quality of care and limiting access to life-saving treatments

- The high cost of spinal implants and surgical equipment is a major barrier to access, particularly in developing regions, limiting the adoption of advanced treatments and impacting healthcare quality

Spinal Implants Market Scope

The market is segmented on the basis of procedure, product type, application, material, indication and configuration.

|

Segmentation |

Sub-Segmentation |

|

By Procedure |

|

|

By Product Type |

|

|

By Application |

|

|

By Material |

|

|

By Indication |

|

|

By Configuration |

|

Spinal Implants Market Regional Analysis

“North America is the Dominant Region in the Spinal Implants Market”

- North America leads the spinal implants market, driven by its advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the presence of major market players

- U.S. holds a significant share due to the increasing demand for spinal surgeries, the rising prevalence of spinal disorders such as degenerative disc disease and scoliosis, and ongoing advancements in surgical techniques

- Well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthen the market

- In addition, the increasing number of spinal surgeries, including spinal fusion and artificial disc replacement, along with a high rate of adoption of minimally invasive techniques, is contributing to market growth across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to experience the highest growth rate in the Spinal Implants market, fuelled by rapid improvements in healthcare infrastructure, growing awareness of spinal health, and rising surgical volumes

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more prone to spinal conditions such as degenerative disc disease, spinal fractures, and scoliosis

- Japan, with its advanced medical technology and a high number of trained spinal surgeons, remains a crucial market for spinal implants, with increasing adoption of premium surgical equipment for higher precision and efficiency

- In China and India, the rising population and increasing cases of spinal disorders are driving higher demand for spinal surgeries, with expanding investments from both the government and private sectors in modern spinal implant technologies and surgical setups

Spinal Implants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Zimmer Biomet (U.S.)

- ATEC Spine, Inc (U.S.)

- RTI Surgical (U.S.)

- Stryker (U.S.)

- Orthofix Medical Inc. (U.S.)

- NuVasive, Inc. (U.S.)

- Globus Medical (U.S.)

- Aesculap, Inc. (U.S.)

- Apollo Hospitals (India)

- Centinel Spine, LLC (U.S.)

- Premia Spine USA (U.S.)

- Lumitex, LLC. (U.S.)

- Life Spine, Inc. (U.S.)

- Spineart (Switzerland)

- ulrich GmbH & Co. KG (Germany)

- Spinal Elements, Inc. (U.S.)

- Xtant Medical (U.S.)

- Integra LifeSciences Corporation (U.S.)

Latest Developments in Global Spinal Implants Market

- In January 2025, Medtronic announced the launch of its Mazor X Stealth Edition robotic-assisted spinal surgery system in the European Union, following regulatory approval. This advanced system integrates with the StealthStation navigation system, offering enhanced precision and improved surgical planning for spinal procedures. The system is designed to optimize the placement of spinal implants, including screws, rods, and cages, making complex spinal surgeries such as spinal fusion and scoliosis correction more efficient and minimally invasive

- In October 2024, DePuy Synthes, a subsidiary of Johnson & Johnson, presented its latest innovations at the North American Spine Society (NASS) annual meeting, including the EXPEDIUM Spine System, a next-generation platform designed to offer greater flexibility and stability during spinal surgeries. The system’s modular design allows for personalized solutions tailored to patient-specific spinal anatomy, with new enhancements aimed at improving intraoperative efficiency and reducing recovery times

- In September 2024, Stryker unveiled its new T5 Spinal System at the 43rd annual meeting of the Spine Summit in Chicago. The system incorporates advanced materials and technology for spinal fusion procedures, offering improved biomechanical support for patients with degenerative spinal diseases and traumatic spinal injuries. The T5 Spinal System includes titanium rods and screws that optimize the fusion process and reduce the risk of complications in complex spinal deformities

- In September 2024, Zimmer Biomet announced the launch of the Persona® Spine Total Disc Replacement (TDR) System, offering a state-of-the-art solution for patients with degenerative disc disease. This innovative system utilizes a flexible design to replicate the natural motion of the spine, providing better clinical outcomes and enhanced patient satisfaction compared to traditional fusion techniques. The Persona® TDR system is expected to revolutionize the approach to spinal disc replacement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.