Global Professional Printer Market

Market Size in USD Billion

CAGR :

%

USD

15.10 Billion

USD

30.32 Billion

2024

2032

USD

15.10 Billion

USD

30.32 Billion

2024

2032

| 2025 –2032 | |

| USD 15.10 Billion | |

| USD 30.32 Billion | |

|

|

|

|

Professional Printer Market Analysis

The professional printer market is experiencing significant growth, driven by technological advancements, increasing demand for high-quality printing, and the evolving needs of businesses across various industries. The market encompasses a wide range of printers, including inkjet, laser, and multifunctional devices, catering to sectors such as commercial printing, packaging, textiles, and industrial applications. The rise of digital transformation, coupled with automation and AI integration, has enhanced printing efficiency, speed, and customization, enabling businesses to meet evolving customer demands. Innovations such as high-speed inkjet printing, cloud-based print management, and eco-friendly printing solutions are revolutionizing the industry, making professional printers more versatile and sustainable. The shift toward hybrid work environments has further increased the demand for compact, high-performance printers that offer seamless connectivity and remote access. In addition, the adoption of 3D printing technology is opening new opportunities for specialized applications in healthcare, manufacturing, and design. With strong investments in research and development, leading companies are continuously innovating to enhance print quality, reduce operational costs, and expand their product portfolios, ensuring a competitive edge in the growing professional printer market.

Professional Printer Market Size

The global professional printer market size was valued at USD 15.10 billion in 2024 and is projected to reach USD 30.32 billion by 2032, with a CAGR of 9.10% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Professional Printer Market Trends

“Increasing Integration of Sustainable Printing Solutions”

The professional printer market is witnessing a major trend toward sustainable printing solutions, driven by growing environmental concerns and regulatory mandates. Companies are increasingly adopting eco-friendly printers, which use water-based inks, energy-efficient technologies, and recyclable materials to reduce their carbon footprint. One notable instance is HP’s PageWide technology, which enhances energy efficiency while delivering high-speed, high-quality printing for commercial applications. In addition, Canon’s PRISMA workflow software optimizes print production, minimizing waste and improving overall efficiency. Businesses are also integrating cloud-based print management systems to reduce paper usage and enhance remote accessibility, aligning with sustainability goals. The rising demand for carbon-neutral printing solutions in industries such as packaging, publishing, and textiles is further fueling innovation in eco-conscious ink formulations and biodegradable substrates. As organizations prioritize green initiatives, the professional printer market is expected to see continued advancements in sustainable printing technologies, ensuring both cost-effectiveness and environmental responsibility.

Report Scope and Professional Printer Market Segmentation

|

Attributes |

Professional Printer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Videojet Technologies, Inc. (U.S.), Pannier Corporation (U.S.), Canon Singapore Pte. Ltd. (Singapore), HP Development Company, L.P. (U.S.), Xerox Corporation (U.S.), Brother Industries, Ltd. (Japan), KEYENCE CORPORATION (Japan), Konica Minolta Business Solutions India Private Limited (India), Seiko Epson Corporation (Japan), Lexmark International, Inc. (U.S.), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Hewlett Packard Enterprise Development LP (U.S.), Domino Printing Sciences plc (U.K.), Eastman Kodak Company (U.S.), and Dell Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Professional Printer Market Definition

A professional printer is a high-performance printing device designed for businesses and industries that require high-quality, high-speed, and large-volume printing. These printers are equipped with advanced technologies, such as inkjet, laser, and digital printing, to deliver precise, durable, and efficient print outputs for various applications, including commercial printing, packaging, textiles, and industrial labeling.

Professional Printer Market Dynamics

Drivers

- Growing Demand for Digital Printing

The increasing need for customization, variable data printing (VDP), and on-demand printing is significantly driving the professional printer market. Businesses today require personalized and short-run printing solutions, which traditional offset printing cannot efficiently provide. Digital printing offers cost-effective, high-quality, and quick turnaround times, making it ideal for industries such as packaging, textiles, and publishing. For instance, in the packaging industry, brands use custom-printed labels and flexible packaging to enhance customer engagement and meet diverse market demands. Similarly, in publishing, print-on-demand services allow publishers to print books in smaller batches, reducing inventory costs and waste. Textile printing is also witnessing a surge in demand for digital fabric printing, where brands leverage direct-to-garment (DTG) and dye-sublimation technologies to produce customized designs. This growing shift toward flexibility, efficiency, and sustainability in printing continues to accelerate the demand for digital printing technologies, making it a key market driver.

- Increasing Expansion of Commercial and Industrial Sectors

The rapid growth of advertising, retail, healthcare, education, and manufacturing industries is further fueling the demand for high-performance professional printers. Businesses across these sectors require high-quality, large-format, and high-speed printing solutions to support their operational needs. For instance, in the advertising and retail sector, companies rely on wide-format printers for printing banners, posters, and signage, ensuring strong brand visibility. In healthcare, hospitals and pharmaceutical companies need precise and durable label printing for medical devices, prescriptions, and patient records. In addition, the education sector depends on multifunction printers (MFPs) to handle bulk printing for learning materials, examination papers, and administrative documentation. The manufacturing industry also benefits from industrial printers for barcode labeling, product packaging, and inventory management. As these industries continue to expand, the need for efficient, high-quality, and scalable professional printing solutions grows, establishing this trend as a significant market driver.

Opportunities

- Increasing Technological Advancements

Innovations in AI, automation, high-speed inkjet, and laser printing are revolutionizing the professional printer market, creating significant opportunities for businesses. AI-driven predictive maintenance and workflow automation are improving printer efficiency by reducing downtime and enhancing output quality. In addition, high-speed inkjet technology is replacing traditional offset printing in commercial applications due to its faster production speeds, lower costs, and superior color accuracy. For instance, HP’s Indigo 120K Digital Press leverages liquid electrophotography (LEP) technology to deliver high-resolution, high-volume printing, meeting the growing demand for short-run and personalized printing. Similarly, Canon’s varioPRINT iX series uses advanced inkjet technology to provide cost-effective, high-speed production printing for industries such as publishing and packaging. As businesses increasingly adopt automated and AI-integrated printing solutions, the professional printer market presents lucrative opportunities for manufacturers to develop smarter, more efficient, and high-performance printing systems.

- Increasing Demand for Sustainability and Eco-Friendly Solutions

With a rising global emphasis on sustainability and eco-friendly solutions, the professional printer market is witnessing a shift toward green printing technologies. Companies are focusing on reducing carbon footprints, minimizing waste, and adopting energy-efficient devices to align with environmental regulations and corporate sustainability goals. Water-based inks, bio-based toners, and recyclable printing materials are becoming key trends in the market. For instance, Epson’s PrecisionCore technology ensures lower energy consumption and reduced ink wastage, making it an eco-friendly alternative to traditional printers. In addition, Xerox’s Adaptive CMYK+ Kit introduces fluorescent and metallic inks, allowing commercial printers to expand their capabilities while using environmentally friendly formulations. The adoption of cloud-based print management systems is also reducing paper waste and energy consumption in corporate offices. As businesses prioritize sustainable printing practices, manufacturers have an opportunity to innovate and offer green printing solutions that meet both efficiency and environmental standards.

Restraints/Challenges

- Declining Print Volume in Key Sectors

One of the biggest challenges in the professional printer market is the decline in print volume across key industries. Sectors such as banking, education, healthcare, and retail are increasingly shifting to digital alternatives, reducing their reliance on printed materials. For instance, banks are promoting e-statements and mobile banking apps over printed account statements and checkbooks. Educational institutions are adopting digital classrooms, replacing printed textbooks with e-books and learning management systems. Similarly, the healthcare sector is digitizing patient records and prescriptions to improve efficiency and reduce paperwork. This shift directly impacts the demand for office and production printers, forcing manufacturers to adapt their business models by offering value-added services such as managed print solutions (MPS) or transitioning into digital workflow solutions.

- High R&D Costs for Innovation

Another significant market challenge is the rising cost of research and development (R&D) in advancing printing technologies. Companies need to invest heavily in innovations such as high-speed inkjet, precision laser printing, and 3D printing to remain competitive. For instance, in the 3D printing segment, firms are exploring advanced materials such as metal and biocompatible resins, which require extensive testing and regulatory approvals. Similarly, inkjet technology advancements focus on high-resolution color printing for commercial applications, demanding sophisticated printhead designs and ink formulations. These R&D investments increase operational costs, and companies often struggle to balance innovation with profitability. If a company fails to recoup these costs through product sales, it may lead to financial strain and limit future technological progress.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Professional Printer Market Scope

The market is segmented on the basis of product type, technology, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Professional Desktop Printer

- Professional Commercial Printers

Technology

- Professional Inkjet Printers

- Professional Laser Printers

Sales Channel

- E-Commerce/Online

- Organized Retail Stores

- Unorganized Retail Stores

Professional Printer Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, technology, and sales channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

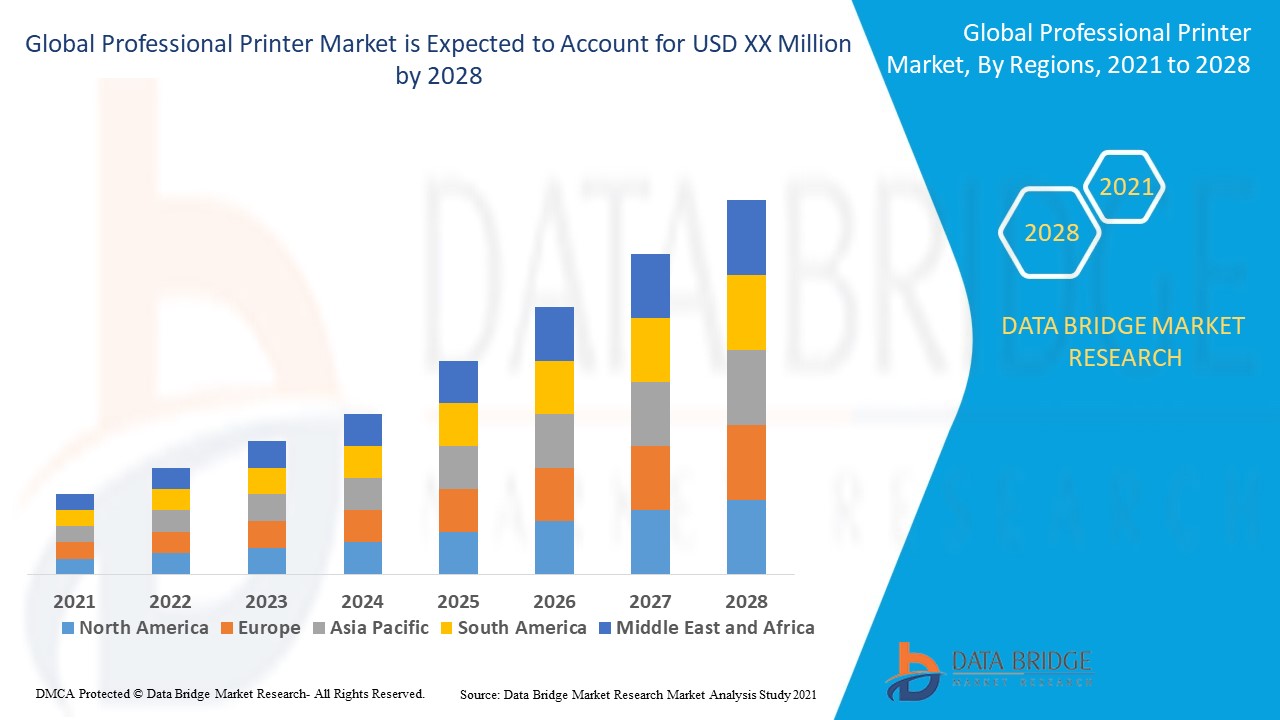

North America dominates the professional printer market, driven by the strong presence of leading industry players in the region. The availability of advanced printing technologies, along with continuous innovation by key manufacturers, further strengthens its market leadership. In addition, the high demand for professional printing solutions across various industries, including commercial and industrial sectors, contributes to its growth. Favorable economic conditions and a well-established distribution network also support the expansion of the professional printer market in North America.

Asia-Pacific is projected to experience fastest growth in the professional printer market from 2025 to 2032, driven by its large population of young consumers and the rapid expansion of emerging economies. The increasing adoption of digital technologies and rising entrepreneurial activities contribute to the growing demand for professional printing solutions. In addition, government initiatives supporting industrialization and business development further fuel market expansion. The region’s evolving economic landscape, coupled with advancements in printing technology, is expected to create significant growth opportunities.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Professional Printer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Professional Printer Market Leaders Operating in the Market Are:

- Videojet Technologies, Inc. (U.S.)

- Pannier Corporation (U.S.)

- Canon Singapore Pte. Ltd. (Singapore)

- HP Development Company, L.P. (U.S.)

- Xerox Corporation (U.S.)

- Brother Industries, Ltd. (Japan)

- KEYENCE CORPORATION (Japan)

- Konica Minolta Business Solutions India Private Limited (India)

- Seiko Epson Corporation (Japan)

- Lexmark International, Inc. (U.S.)

- Hitachi Industrial Equipment Systems Co., Ltd. (Japan)

- Hewlett Packard Enterprise Development LP (U.S.)

- Domino Printing Sciences plc (U.K.)

- Eastman Kodak Company (U.S.)

- Dell Inc. (U.S.)

Latest Developments in Professional Printer Market

- In June 2024, CMYKhub, Australia's leading wholesale printer, expanded its service capabilities by investing in two Canon varioPRINT iX3200 cut-sheet presses at Drupa. This family-owned business serves a diverse clientele, including independent printers, advertising agencies, and graphic designers, offering a wide range of printed products such as business cards, brochures, stationery, calendars, banners, signage, labels, and packaging

- In May 2024, Canon, Inc. established a global sales and service partnership with Heidelberg Druckmaschinen AG to advance inkjet printing. This collaboration aims to assist commercial print businesses in transitioning to hybrid offset/digital production by integrating Canon's B2 and B3 sheet-fed inkjet presses into Heidelberg's Prinect workflow, enhancing flexibility and productivity

- In April 2024, Xerox Holdings Corporation expanded access for its channel partners to its portfolio of printers and multifunction printers through Distribution Management Inc. This initiative is part of the company’s strategy to simplify partner collaboration, support hybrid workplaces, and address production printing needs with a partner-enabled go-to-market approach

- In March 2024, HP Development Company, L.P. introduced a new lineup of HP digital printing presses and intelligent solutions, including the HP Indigo 120k Digital Press. Designed for high-demand commercial printing, this advanced digital press can print up to 4,600 B2 sheets per hour and features liquid electrophotography extended (LEPx) technology, setting a new benchmark for high-volume production, automation, and ease of use

- In January 2023, Xerox Holdings Corporation acquired Advanced U.K., a leading hardware and managed print services provider based in Uxbridge, U.K. This acquisition was aimed at strengthening Xerox’s vertical integration strategy, expanding its presence in the U.K. market, and enhancing service offerings for Advanced U.K.'s customer base

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Professional Printer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Professional Printer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Professional Printer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.