Global Process Analytics Market

Market Size in USD Billion

CAGR :

%

USD

23.61 Billion

USD

44.13 Billion

2024

2032

USD

23.61 Billion

USD

44.13 Billion

2024

2032

| 2025 –2032 | |

| USD 23.61 Billion | |

| USD 44.13 Billion | |

|

|

|

|

Process Analytics Market Size

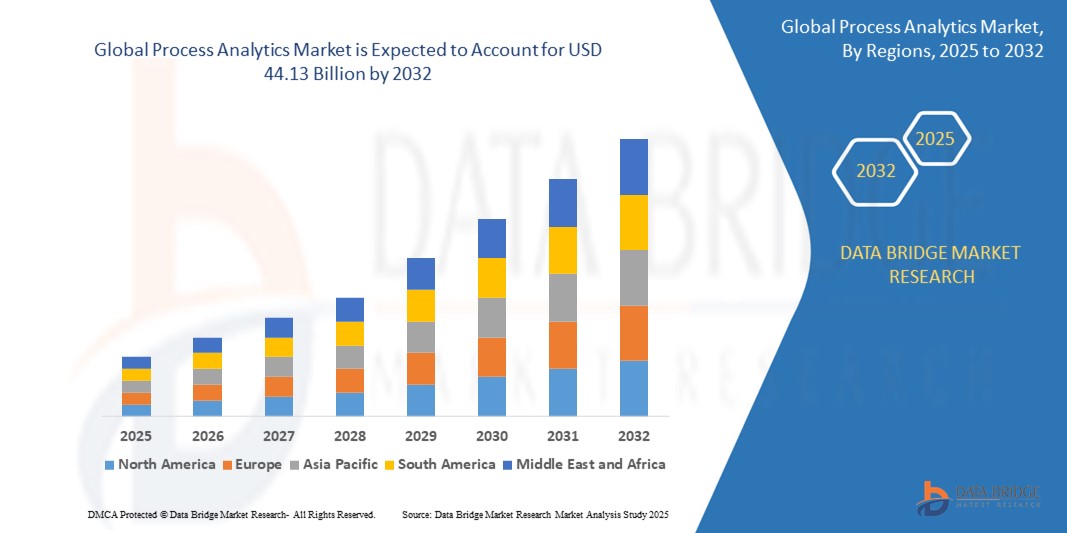

- The Global Process Analytics Market was valued at USD 23.61 billion in 2025 and is projected to reach USD 44.13 billion by 2032, growing at a CAGR of 9.34% during the forecast period.

- Market growth is being fueled by the increasing demand for process transparency, the widespread adoption of digital transformation initiatives, and the need for compliance management and operational efficiency across industries.

Process Analytics Market Analysis

- Process analytics involves extracting insights from business processes by analyzing event logs and system data from enterprise applications such as ERP, CRM, and BPM tools. It allows organizations to visualize workflows, detect inefficiencies, and implement data-driven process improvements.

- The growing complexity of digital ecosystems and the shift toward hyperautomation are driving demand for analytics tools that can monitor, optimize, and predict process behavior in real time.

- Companies across verticals are increasingly integrating process analytics with AI, RPA (robotic process automation), and machine learning to enhance performance monitoring, reduce bottlenecks, and streamline compliance reporting.

- Regulatory pressures in BFSI, healthcare, and government sectors are prompting the use of process conformance tools to ensure that internal workflows align with predefined business rules and regulatory frameworks such as SOX, GDPR, and HIPAA

Report Scope and Process Analytics Market Segmentation

|

Attributes |

Process Analytics Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Process Analytics Market Trends

“Process Intelligence Becomes Core to Enterprise Digital Transformation”

- A major trend is the emergence of process intelligence as a strategic pillar in digital transformation. Enterprises are using process analytics to continuously monitor, measure, and optimize core business functions in real-time.

- Vendors are expanding capabilities with AI and natural language processing (NLP) to automate root cause analysis and create self-improving workflows. Process analytics is increasingly integrated into ERP, CRM, BPM, and HR systems to enable enterprise-wide process visibility.

- Another significant trend is the rise of no-code and low-code platforms that allow business users to build custom process dashboards, driving democratization of data analytics.

- Process analytics is also supporting the hyperautomation movement by working alongside RPA, digital twins, and intelligent document processing, enhancing enterprise agility.

Process Analytics Market Dynamics

Driver

“Growing Enterprise Need for Workflow Transparency, Compliance, and Data-Driven Optimization”

- Increasing business complexity and the shift to distributed digital operations are prompting organizations to seek 360-degree visibility into their workflows.

- Enterprises are under pressure to reduce process latency, eliminate bottlenecks, and comply with evolving regulations, especially in finance, healthcare, and manufacturing.

- Real-time process analytics is helping organizations to move from periodic auditing to continuous monitoring, improving operational agility and reducing risk exposure.

- Integration with ERP systems (like SAP, Oracle) and cloud platforms (like AWS, Azure) is enabling scalable deployment of analytics tools across departments and geographies.

Restraint/Challenge

“Data Integration Complexities and Skills Gap in Process Interpretation”

- A significant challenge lies in integrating disparate data sources such as logs from ERP, CRM, legacy systems, and cloud apps. Incomplete or fragmented data can impact the accuracy of process analytics.

- The lack of skilled professionals who can translate analytics into actionable process improvements hampers adoption in some organizations. Business users often require training in data literacy and process modeling to derive full value.

- Concerns over data security, compliance, and governance, especially in cloud environments, may limit adoption in highly regulated sectors without robust privacy controls.

- Small enterprises may struggle with the cost of deployment, especially for platforms requiring customization and third-party integration support.

Process Analytics Market Scope

The market is segmented by type, deployment model, application, and end user, each addressing a specific demand pattern across industries.

• By Type

Includes Process Discovery, Process Conformance, and Process Enhancement. Process discovery dominated in 2025, as organizations seek visibility into undocumented workflows and identify operational inefficiencies. Process enhancement is expected to grow fastest as companies move from diagnostics to active process transformation using analytics-led insights.

• By Deployment

Divided into on-premise and cloud-based. Cloud-based deployments are leading the market due to ease of integration with SaaS platforms, cost-efficiency, and scalability. On-premise solutions remain relevant in regulated industries that require tight data control and internal hosting.

• By Application

Covers Business Process Optimization, Transaction Monitoring, Compliance & Risk Management, and Auditing. Business process optimization holds the largest share in 2025, as enterprises seek to improve operational KPIs. Compliance & risk management is seeing increased traction, especially in industries that require transparency, traceability, and audit readiness.

• By End User

Includes BFSI, IT & Telecom, Healthcare, Retail, Manufacturing, Government, and Others. BFSI dominates due to its need for fraud detection, transaction accuracy, and regulatory compliance. Healthcare is emerging as a fast-growing segment as providers use process analytics for patient care optimization, resource allocation, and policy compliance.

Process Analytics Market Regional Analysis

- North America leads the global market, driven by strong digital transformation initiatives across BFSI, healthcare, and IT sectors. The U.S. is home to leading analytics and cloud providers, fostering rapid adoption of AI-enhanced process discovery and compliance tools.

- Europe is a key region for process analytics adoption due to its strict regulatory environment, particularly in data governance and financial services. Countries like Germany, the Netherlands, and the U.K. are investing in conformance and enhancement solutions across banking, manufacturing, and healthcare.

- Asia-Pacific is expected to register the fastest growth through 2032, supported by large-scale enterprise digitization, increasing RPA usage, and growing analytics demand in India, China, Japan, and South Korea. SMEs and government programs are boosting the use of cloud-based tools for business performance monitoring.

- Middle East and Africa (MEA) is experiencing steady growth, particularly in UAE and Saudi Arabia, as part of national digital transformation agendas. Government and energy sectors are deploying process analytics for resource planning and compliance tracking.

- South America, led by Brazil and Chile, is seeing growing adoption of process analytics in telecom, finance, and e-commerce, supported by cloud migration and the expansion of BPM tools.

United States

The U.S. is the largest market, driven by widespread enterprise use of ERP and CRM platforms. Companies across finance, telecom, and logistics are leveraging process analytics to improve SLA compliance, identify automation targets, and monitor risk.

Germany

Germany is a leading European market due to its advanced manufacturing sector and the presence of major vendors like Celonis, SAP, and Software AG. Process analytics is central to Industry 4.0 strategies, audit readiness, and ISO-compliant operations.

India

India is emerging as a high-growth market fueled by outsourcing, BFSI, and digital government initiatives. Enterprises are adopting cloud-based and open-source process mining tools for improving workflow visibility and RPA deployment planning.

United Kingdom

U.K. enterprises are embracing process analytics for compliance and digital operations monitoring, especially in insurance, e-commerce, and public administration. Post-Brexit regulatory updates have increased demand for transparent process mapping tools.

Brazil

Brazil’s expanding fintech, telecom, and e-retail sectors are investing in process analytics to manage operational risk, streamline onboarding processes, and improve customer journey mapping. Local demand is growing for low-code analytics dashboards and multi-language platform support.

Process Analytics Market Share

The Process Analytics industry is primarily led by well-established companies, including:

- Celonis GmbH (Germany)

- Software AG (Germany)

- SAP SE (Germany)

- ABBYY Solutions Ltd. (U.K.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- QPR Software Plc (Finland)

- Kofax Inc. (U.S.)

- UiPath Inc. (U.S.)

- Nintex Global Ltd. (U.S.)

- Signavio (an SAP company) (Germany)

- Infosys Limited (India)

Latest Developments in Global Process Analytics Market

- In April 2025, Celonis launched its next-gen Execution Management System (EMS) 3.0, integrating AI-driven simulation and prescriptive insights to automate process enhancement across finance and supply chain operations.

- In March 2025, SAP Signavio introduced Live Insights Dashboard, allowing real-time conformance monitoring by integrating ERP activity logs with user-defined KPIs, helping enterprises track deviations and process delays.

- In February 2025, IBM partnered with UiPath to create an end-to-end hyperautomation suite, combining process analytics, RPA, and AI-led orchestration to improve enterprise workflows in banking and telecom sectors.

- In January 2025, Microsoft added Power Automate Process Mining tools to its ecosystem, enabling business users to extract, visualize, and optimize workflows directly from Microsoft Dynamics and third-party systems.

- In December 2024, Software AG enhanced its ARIS Process Mining platform with predictive modeling capabilities, enabling early detection of SLA breaches and optimization recommendations for shared service centers..

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.