Global Digital Payment Processing Market

Market Size in USD Billion

CAGR :

%

USD

110.19 Billion

USD

381.63 Billion

2024

2032

USD

110.19 Billion

USD

381.63 Billion

2024

2032

| 2025 –2032 | |

| USD 110.19 Billion | |

| USD 381.63 Billion | |

|

|

|

|

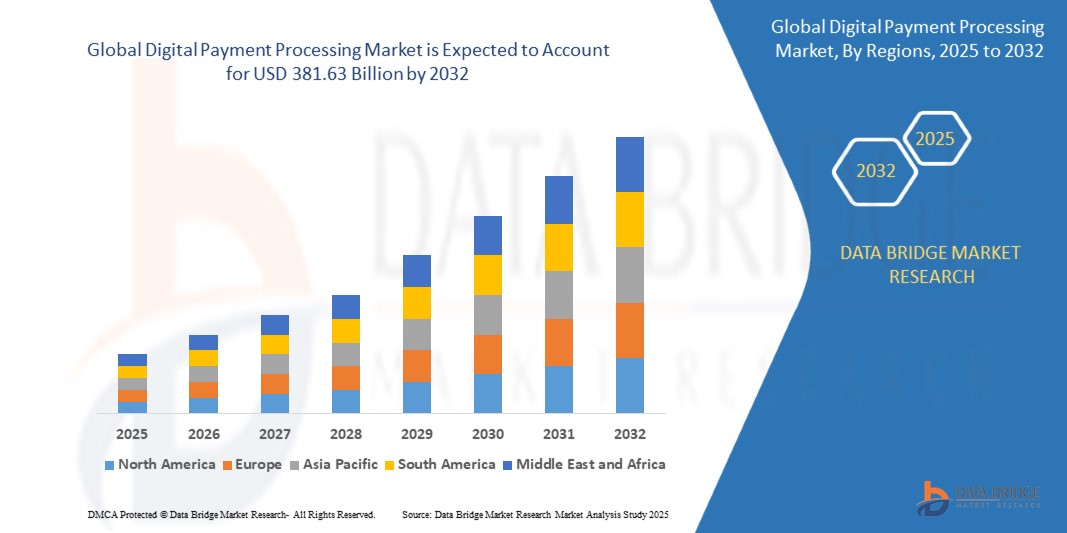

What is the Global Digital Payment Processing Market Size and Growth Rate?

- The global digital payment processing market size was valued at USD 110.19 billion in 2024 and is expected to reach USD 381.63 billion by 2032, at a CAGR of 14.80% during the forecast period

- The proliferation of global digitalization, increasing demand for digital payment services, the high adoption by merchants to provide their services in the digital payment services market space, and the increasing need to provide enhanced customer support at the point of sales (POS) terminal are the major factors driving the digital payment processing market

- The unfavorable return policy as cash purchase tends to be final and irreversible unless the seller agrees upon a return policy; the popularity of digital payment for its user-friendly and digital payment features real-time, agile, and personalized payment services accelerate the digital payment processing market growth

What are the Major Takeaways of Digital Payment Processing Market?

- The proliferation of global digitalization has revolutionized the way financial transactions are conducted, giving rise to a dynamic digital payment processing market. As businesses and consumers increasingly embrace digital channels for financial transactions, the demand for secure, efficient, and convenient payment solutions has surged

- This paradigm shift, fueled by advancements in technology and changing consumer preferences, has led to the widespread adoption of digital payment methods, reshaping the landscape of the financial industry and paving the way for innovative and streamlined payment processing solutions

- North America dominated the digital payment processing market with the largest revenue share of 35.78% in 2024, fueled by the widespread adoption of contactless payments, digital wallets, and e-commerce platforms

- Asia-Pacific is expected to be the fastest growing region in the Digital Payment Processing market during the forecast period due to increasing urbanization and rising disposable incomes

- The Cloud segment dominated the digital payment processing market with the largest revenue share of 68.4% in 2024, owing to its flexibility, scalability, and cost-effectiveness

Report Scope and Digital Payment Processing Market Segmentation

|

Attributes |

Digital Payment Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Payment Processing Market?

“Enhanced Efficiency through AI and Voice Technology Integration”

- A significant and accelerating trend in the global digital payment processing market is the integration of artificial intelligence (AI) and voice-enabled platforms such as Amazon Alexa, Google Assistant, and Apple Siri, which is enhancing both operational efficiency and user convenience. AI is increasingly being used to automate payment routing, detect fraudulent transactions in real time, and personalize user experiences across payment platforms

- For instance, Mastercard’s AI-powered Cyber Secure platform analyzes transaction risks in milliseconds, while Visa’s voice-enabled payments let users authorize transactions via smart speakers. This integration is making payments faster, more secure, and more accessible to users of all ages and tech familiarity

- AI also enables predictive analytics for financial behavior, helping businesses offer personalized payment options, while voice technology allows users to check balances, approve transactions, or initiate peer-to-peer payments hands-free. This is particularly useful for mobile and smart device users on the go

- The fusion of AI, biometrics, and voice assistance provides a more seamless and secure digital payment experience. Payment service providers are integrating these technologies to allow real-time risk scoring, intelligent fraud prevention, and conversational interfaces that elevate the user journey

- This trend is fundamentally reshaping the digital transaction landscape, prompting players such as PayPal, Stripe, and Apple Pay to continually refine their platforms with AI-driven features. The demand for smart, intuitive, and voice-enabled payment solutions is accelerating across both the consumer and enterprise segments

What are the Key Drivers of Digital Payment Processing Market?

- The rise in e-commerce, increased smartphone penetration, and growing preference for contactless transactions are major forces driving the global digital payment processing market. Consumers and businesses asuch as are shifting toward faster, frictionless payment experiences across online and offline channels

- For instance, in March 2024, Stripe expanded its AI fraud detection engine, Radar, to support real-time analysis across global markets, enabling merchants to reduce chargebacks and enhance transaction trust

- The adoption of digital wallets, real-time payment platforms, and Buy Now Pay Later (BNPL) services is also contributing significantly. These tools streamline transactions and enhance customer engagement and retention for merchants

- The growing integration of APIs and open banking frameworks allows third-party developers and fintech startups to innovate, promoting more inclusive financial solutions. Digital payments are no longer limited to retail they now span sectors such as healthcare, education, and government

- Furthermore, government initiatives supporting digital infrastructure, such as India’s UPI or Europe’s PSD2 regulation, are laying the foundation for widespread adoption. Businesses are leveraging these digital platforms for cost reduction, efficiency gains, and broader customer reach, further propelling market growth

Which Factor is challenging the Growth of the Digital Payment Processing Market?

- Cybersecurity risks, including fraud, phishing, and data breaches, remain the primary concern hampering the growth of the digital payment processing market. With sensitive user and transaction data at stake, the potential for loss or misuse is a significant barrier to broader adoption

- For instance, in late 2023, a major phishing scam targeted QR-code payments in Southeast Asia, exploiting users' lack of awareness and weak authentication protocols

- Although industry leaders such as Visa, Adyen, and PayPal continuously upgrade their encryption and authentication frameworks, public skepticism persists—especially in emerging markets with limited digital literacy

- Another barrier is the lack of interoperability across payment systems and regional networks. While global standards are evolving, disparities in regulatory compliance, banking integration, and currency conversion still pose logistical and cost challenges

- In addition, merchant resistance due to transaction fees and complex onboarding processes can slow adoption. Small businesses, in particular, face challenges in integrating high-tech payment gateways without adequate support or funding

- Addressing these concerns with stronger security measures, transparent pricing, and consumer education will be essential to unlock the market’s full potential and ensure its sustainable growth

How is the Digital Payment Processing Market Segmented?

The market is segmented on the basis of deployment type, organization size, and vertical..

• By Deployment Type

On the basis of deployment type, the digital payment processing market is segmented into On-Premises and Cloud. The Cloud segment dominated the Digital Payment Processing market with the largest revenue share of 68.4% in 2024, owing to its flexibility, scalability, and cost-effectiveness. Cloud-based payment processing platforms enable real-time updates, automatic backups, and seamless integration with third-party applications, which are highly valued by organizations with dynamic operations. In addition, the rising popularity of SaaS models among SMEs and large enterprises asuch as further fuels the demand for cloud deployment.

The On-Premises segment is projected to witness moderate growth during the forecast period as certain institutions—particularly in regulated sectors such as banking—continue to prefer on-premise systems for enhanced control, data privacy, and security customization.

• By Organization Size

On the basis of organization size, the digital payment processing market is segmented into Small and Medium-sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment accounted for the largest market revenue share of 57.6% in 2024, driven by high transaction volumes, the need for advanced fraud protection, and integration with legacy ERP and CRM systems. Large enterprises benefit from multi-layered security, AI-based fraud detection, and centralized management offered by leading payment platforms.

Meanwhile, the SMEs segment is expected to register the fastest CAGR of 22.3% from 2025 to 2032, bolstered by increasing digital adoption, support from government initiatives for digital transformation, and the emergence of low-cost, plug-and-play payment solutions that cater to small businesses.

• By Vertical

On the basis of vertical, the digital payment processing market is segmented into Banking, Financial Services and Insurance (BFSI), Retail and E-commerce, Healthcare, Travel and Hospitality, Transportation and Logistics, Media and Entertainment, and Other Verticals. The Retail and E-commerce segment dominated the market with the largest revenue share of 34.1% in 2024, owing to the explosive growth of online shopping, mobile payments, and demand for seamless checkout experiences. Retailers are increasingly adopting omnichannel payment systems, offering customers flexibility through QR codes, digital wallets, and BNPL (Buy Now, Pay Later) options.

The Healthcare segment is anticipated to grow at the fastest CAGR over the forecast period, driven by the digitalization of billing processes, telehealth expansion, and the need for secure and compliant transaction methods in medical service delivery.

Which Region Holds the Largest Share of the Digital Payment Processing Market?

- North America dominated the digital payment processing market with the largest revenue share of 35.78% in 2024, fueled by the widespread adoption of contactless payments, digital wallets, and e-commerce platforms. The region benefits from robust financial infrastructure, high internet penetration, and early adoption of advanced payment technologies

- Consumers in the region increasingly rely on real-time payment systems, mobile banking, and seamless integration between online and in-store transactions. The rapid shift toward omnichannel commerce and the rise of fintech startups are further stimulating the digital payment ecosystem

- This dominance is further strengthened by regulatory support for cashless transactions, innovative partnerships between banks and technology firms, and a consumer base that prioritizes speed, convenience, and security in financial transactions

U.S. Digital Payment Processing Market Insight

The U.S. market captured the largest share within North America in 2024, propelled by growing demand for secure, fast, and contactless transactions. The proliferation of digital wallets such as Apple Pay, Google Pay, and PayPal, coupled with increased usage of point-of-sale (POS) systems across small businesses, has reinforced the country’s leadership in the space. The rise in online shopping, subscription services, and peer-to-peer payment apps is also contributing to market growth. Moreover, significant investment in cybersecurity and AI-powered fraud detection tools is helping to build consumer trust and expand usage.

Europe Digital Payment Processing Market Insight

The European market is expected to expand at a substantial CAGR during the forecast period, driven by government-led initiatives promoting a cashless economy and secure payment infrastructure. The PSD2 directive and growing adoption of open banking are transforming payment experiences across the continent. Consumers are embracing digital wallets, instant payment platforms, and embedded finance services as alternatives to traditional methods. The demand for cross-border payment solutions and increased e-commerce penetration across countries such as France, Germany, and Italy are propelling regional growth.

U.K. Digital Payment Processing Market Insight

The U.K. market is projected to witness significant growth, supported by the rapid shift toward digital banking, mobile commerce, and contactless card usage. A strong fintech ecosystem, supported by innovation-friendly regulations and consumer trust in mobile financial services, is accelerating adoption. In addition, the popularity of Buy Now, Pay Later (BNPL) services and real-time payment networks such as Faster Payments is reshaping how both consumers and businesses manage transactions.

Germany Digital Payment Processing Market Insight

The German market is expected to expand at a strong CAGR during the forecast period, driven by growing demand for digital financial services, enhanced security frameworks, and digital identity solutions. While traditionally a cash-preferred society, Germany is now experiencing a paradigm shift as retailers and banks asuch as prioritize contactless and online payment capabilities Increased investment in local fintech and support for instant payments under the European Payments Initiative (EPI) are helping transform the payment landscape.

Which Region is the Fastest Growing Region in the Digital Payment Processing Market?

Asia-Pacific digital payment processing market is poised to grow at the fastest CAGR of 24.56% from 2025 to 2032, fueled by the proliferation of smartphones, rapid internet adoption, and strong government backing for cashless economies. Countries such as China, India, Japan, and South Korea are leading the charge with innovative mobile payment platforms, QR code payments, and super apps that integrate banking, shopping, and peer-to-peer transfers. In addition, the rise of digital banks and embedded finance in e-commerce platforms is expanding the reach of payment services to underserved and unbanked populations.

Japan Digital Payment Processing Market Insight

Japan’s digital payment processing market is accelerating due to its push toward a cashless society, especially ahead of major global events and its aging population’s growing comfort with mobile apps. The country’s retailers and service providers are integrating QR code and NFC-based systems to offer secure and convenient transactions. Initiatives such as “Cashless Japan” and collaborations between tech companies and financial institutions are further strengthening this growth trend.

China Digital Payment Processing Market Insight

China held the largest market share in Asia-Pacific in 2024, thanks to the dominance of platforms such as Alipay and WeChat Pay, which have revolutionized mobile transactions across every demographic. With its advanced digital ecosystem, government support for digital yuan trials, and the integration of payments into social, gaming, and retail platforms, China continues to set global benchmarks in digital payment innovation.

Which are the Top Companies in Digital Payment Processing Market?

The digital payment processing industry is primarily led by well-established companies, including:

- Fiserv, Inc. (U.S.)

- FIS (U.S.)

- PayPal Payments Private Limited (Singapore)

- Global Payments Inc. (U.S.)

- Square Capital, LLC (U.S.)

- Visa Inc. (U.S.)

- Mastercard (U.S.)

- WEX Inc. (U.S.)

- ACI Worldwide, Inc. (U.S.)

- JPMorgan Chase & Co. (U.S.)

- Intuit Inc. (U.S.)

- Stripe (U.S.)

- Due Inc. (U.S.)

- Adyen (Netherlands)

- PayTrace (U.S.)

- Apple Inc. (U.S.)

- ALIANT PAYMENTS (U.S.)

- Aurus Inc. (U.S.)

- Fattmerchant Inc. (U.S.)

- 2Checkout (U.S.)

- Paysafe Holdings UK Limited (U.K.)

- PayU (Netherlands)

- SPREEDLY, INC. (U.S.)

What are the Recent Developments in Global Digital Payment Processing Market?

- In September 2024, PayPal Holdings Inc. introduced its PayPal Complete Payments (PPCP) platform in Hong Kong, offering businesses a comprehensive and adaptable payment solution aimed at strengthening global e-commerce capabilities. The PPCP platform empowers merchants to accept diverse payment methods, including PayPal, Apple Pay, Google Pay, Alipay, and major credit/debit cards such as Visa and Mastercard. This strategic expansion marks a significant step in PayPal’s mission to streamline cross-border digital transactions and enhance merchant flexibility worldwide

- In December 2023, Visa Inc. announced a definitive agreement to acquire a majority stake in Prosa, a leading payments processor in Mexico, to accelerate the adoption of secure and innovative digital payments across the country. While Prosa will maintain its operational independence and existing technology infrastructure, Visa aims to enrich its offerings by deploying new digital payment solutions. This move highlights Visa’s commitment to growing digital infrastructure and driving financial inclusion in emerging markets

- In November 2023, PayU, a major digital payment service provider in India, launched three new mobile app SDKs to deliver frictionless and efficient payment experiences on smartphones. These SDKs are purpose-built to enhance user experience and have reportedly improved transaction success rates by up to 56%. This development reinforces PayU’s position as an innovator in mobile-centric payment solutions for emerging digital economies

- In November 2022, Conduent Incorporated, a global technology firm, unveiled its Digital Integrated Payments Hub, designed to offer secure, rapid, and streamlined capabilities for sending, receiving, or requesting payments. The hub is tailored to serve both businesses and public sector agencies, helping modernize payment systems across various industries. This initiative signifies Conduent’s continued focus on digital transformation and financial efficiency for enterprise and government clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.