Global Printing Technology Market

Market Size in USD Billion

CAGR :

%

USD

40.53 Billion

USD

56.33 Billion

2024

2032

USD

40.53 Billion

USD

56.33 Billion

2024

2032

| 2025 –2032 | |

| USD 40.53 Billion | |

| USD 56.33 Billion | |

|

|

|

|

Printing Technology Market Size

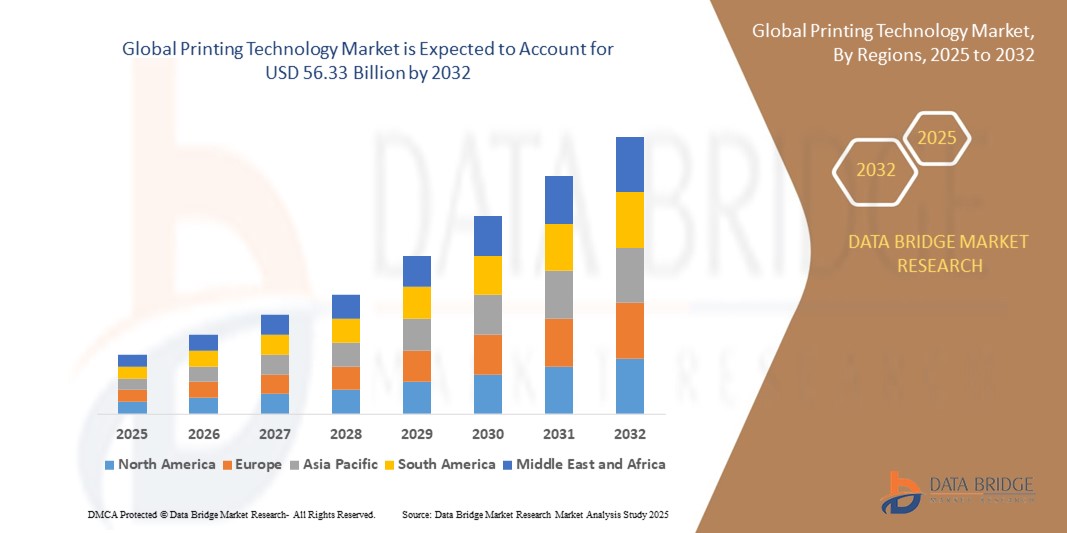

- The global printing technology market size was valued at USD 40.53 billion in 2024 and is expected to reach USD 56.33 billion by 2032, at a CAGR of 4.20% during the forecast period

- The market growth is driven by increasing demand for sustainable and high-quality printing solutions, advancements in digital printing technologies, and growing applications in packaging across various industries

- Rising consumer preference for eco-friendly inks and customized packaging solutions is positioning printing technologies as a critical component of modern manufacturing, further accelerating market expansion

Printing Technology Market Analysis

- Printing technologies, encompassing flexographic, rotogravure, offset, and digital methods, are essential for producing high-quality packaging, labels, and promotional materials across industries such as food and beverage, cosmetics, and healthcare

- The surge in demand is primarily fueled by the growth of e-commerce, increasing need for sustainable packaging, and advancements in digital printing for short-run and customized production

- Asia-Pacific dominated the printing technology market with the largest revenue share of 42.5% in 2024, driven by robust manufacturing hubs, high demand for packaged goods, and investments in advanced printing technologies, particularly in China and India

- North America is expected to be the fastest-growing region during the forecast period due to rapid adoption of digital printing technologies and increasing focus on sustainable packaging solutions

- The digital segment dominated the market with the largest revenue share of 45.1% in 2024, driven by its versatility, cost-effectiveness for short runs, and ability to deliver high-quality, customizable prints

Report Scope and Printing Technology Market Segmentation

|

Attributes |

Printing Technology Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Printing Technology Market Trends

“Enhanced Efficiency through Digital Integration and Automation”

- A significant and accelerating trend in the global printing technology market is the deepening integration of digital printing technologies and automation with traditional printing methods such as flexographic, rotogravure, and offset

- For instance, advanced digital presses such as the HP Indigo 100K and FUJIFILM’s Jet Press FP790 integrate with flexographic and offset systems, allowing for high-resolution, short-run printing with minimal setup times

- Digital integration enables features such as variable data printing (VDP) for personalized packaging and AI-driven quality control to optimize print consistency. For example, Canon’s digital presses incorporate AI to detect print defects in real time, improving output reliability

- The integration of printing technologies with Industry 4.0 platforms facilitates centralized control over production lines, enabling manufacturers to manage printing processes alongside other automated systems, such as packaging and logistics, for a streamlined workflow

- This trend towards intelligent, automated, and interconnected printing systems is reshaping industry expectations for efficiency and scalability. Companies such as Xeikon are developing hybrid printing solutions that combine flexography and digital printing to offer versatility for applications such as flexible packaging and labels

- The demand for printing technologies offering seamless digital integration and automation is growing rapidly across food and beverage, cosmetics, healthcare, and other sectors, as businesses prioritize operational efficiency and tailored packaging solutions

Printing Technology Market Dynamics

Driver

“Rising Demand Due to Growth in Packaging Industry and E-Commerce”

- The increasing demand for innovative packaging solutions, driven by the booming e-commerce sector and consumer preference for visually appealing packaging, is a significant driver for the global printing technology market

- For instance, in March 2024, FUJIFILM Corporation launched the Jet Press FP790, a water-based digital inkjet press designed for flexible packaging, enhancing productivity for food and household product applications

- As brands seek to differentiate through customized packaging, printing technologies such as flexography and digital printing offer high-quality, vibrant designs on various substrates, including flexible packaging, paperboard, and metal, surpassing traditional printing limitations

- The rapid growth of e-commerce, particularly in Asia-Pacific, has increased the need for efficient, high-volume printing for labels, corrugated boxes, and flexible packaging, with China producing tons of packaging paper in 2024

- The versatility of printing technologies, such as rotogravure for high-quality food packaging and digital printing for short-run labels, supports applications across food and beverage, cosmetics, and healthcare sectors

Restraint/Challenge

“Environmental Concerns and High Initial Investment Costs”

- Environmental concerns surrounding volatile organic compound (VOC) emissions from solvent-based inks and the high initial costs of advanced printing technologies pose significant challenges to market growth

- Solvent-based inks, widely used in flexographic and gravure printing, emit VOCs during drying, raising environmental and regulatory concerns, particularly in food and beverage packaging. Reports highlight stringent regulations, such as those from the U.S. Food and Drug Administration, limiting the use of toxic solvents, which impacts market adoption

- Addressing these concerns through eco-friendly inks, such as water-based and UV-curable inks, and sustainable printing practices, such as process-free plates, is critical for compliance and consumer trust. Companies such as Sun Chemical emphasize low-VOC inks to mitigate environmental impact

- In addition, the high upfront costs of advanced printing systems, such as digital presses or automated flexographic machines, can deter small and medium enterprises, especially in developing regions. While affordable options such as water-based flexographic inks are gaining traction, premium features such as UV-curable ink systems or hybrid presses often carry a higher price tag

- Overcoming these challenges through innovations in sustainable inks, cost-effective printing solutions, and education on environmental best practices will be essential for sustained market growth

Printing Technology market Scope

The market is segmented on the basis of printing technology, type of ink, application, and packaging type.

- By Printing Technology

On the basis of printing technology, the global printing technology market is segmented into flexographic, rotogravure, offset, and digital. The digital segment dominated the market with the largest revenue share of 45.1% in 2024, driven by its versatility, cost-effectiveness for short runs, and ability to deliver high-quality, customizable prints. Digital printing's compatibility with modern design software and its minimal setup time make it a preferred choice for industries seeking rapid production and personalization.

The flexographic segment is anticipated to witness the fastest CAGR of 18.4% from 2025 to 2032, fueled by its increasing adoption in flexible packaging for food and beverage industries. Flexographic printing offers high-speed production, cost efficiency for large volumes, and compatibility with a wide range of substrates, making it ideal for sustainable packaging solutions.

- By Type of Ink

On the basis of type of link, the global printing technology market is segmented into water-based, solvent-based, UV-curable Ink, Aqueous Ink, latex ink, dye sublimation inks, and hot melt inks. The uv-curable Ink segment held the largest market revenue share in 2024, driven by its fast curing times, durability, and eco-friendly properties. UV-curable inks are widely used in high-quality packaging and labeling applications due to their resistance to fading and scratching.

The Water-Based Ink segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing environmental concerns and regulations promoting sustainable printing practices. Water-based inks are favored for their low volatile organic compound (VOC) emissions and suitability for food-safe packaging.

- By Application

On the basis of application, the global printing technology market is segmented into food and beverage industry, cosmetics and toiletries, healthcare, and others. The food and beverage Industry segment accounted for the largest market revenue share in 2024, driven by the rising demand for attractive, sustainable, and informative packaging. Printing technologies enable high-quality labeling and branding, which are critical for consumer engagement in this sector.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing need for precise and durable labeling for pharmaceutical products and medical devices. Advanced printing technologies ensure compliance with stringent regulatory requirements for traceability and safety.

- By Packaging Type

The market is segmented into flexible packaging, rigid packaging, paper and paperboard packaging, glass, metal, and others. The flexible packaging segment dominated the market in 2024, driven by its lightweight, cost-effective, and sustainable characteristics, particularly in the food and beverage sector. Flexible packaging's adaptability to various printing technologies enhances its appeal for branding and product protection.

The paper and paperboard packaging segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the global push for eco-friendly and recyclable packaging solutions. The rise in e-commerce and consumer preference for sustainable materials further boosts demand for paper-based packaging.

Printing Technology Market Regional Analysis

- Asia-Pacific dominated the printing technology market with the largest revenue share of 42.5% in 2024, driven by robust manufacturing hubs, high demand for packaged goods, and investments in advanced printing technologies, particularly in China and India

- North America is expected to be the fastest-growing region during the forecast period due to rapid adoption of digital printing technologies and increasing focus on sustainable packaging solutions

U.S. Printing Technology Market Insight

The U.S. printing technology market holds a significant share in North America, driven by the rapid adoption of digital and 3D printing technologies in industries such as packaging, textiles, and healthcare. The growing trend of personalized printing and the integration of advanced software for print management are key growth drivers. Additionally, the increasing demand for eco-friendly printing solutions, such as water-based inks and energy-efficient printers, is boosting the market. The U.S. benefits from a strong technological infrastructure and widespread adoption of automation in printing processes.

Europe Printing Technology Market Insight

The Europe printing technology market is projected to grow at a substantial CAGR during the forecast period, driven by stringent environmental regulations and the demand for sustainable printing solutions. The rise in e-commerce and packaging industries, coupled with advancements in digital printing technologies, is fostering market growth. European consumers and businesses are increasingly adopting high-quality, energy-efficient printing systems for applications in advertising, publishing, and industrial manufacturing.

U.K. Printing Technology Market Insight

The U.K. printing technology market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the increasing demand for customized and on-demand printing solutions. The rise in e-commerce and the need for high-quality packaging are driving the adoption of advanced printing technologies. Additionally, concerns about sustainability and waste reduction are encouraging businesses to invest in eco-friendly printing systems, further stimulating market growth.

Germany Printing Technology Market Insight

The Germany printing technology market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s focus on innovation, precision manufacturing, and sustainability. Germany’s advanced industrial base and emphasis on eco-conscious printing solutions, such as UV-curable inks and energy-efficient printers, are promoting market growth. The integration of printing technologies with Industry 4.0 and smart manufacturing systems is also gaining traction in both commercial and industrial applications.

Asia-Pacific Printing Technology Market Insight

The Asia-Pacific printing technology market is the dominating region, poised to grow at a robust CAGR of 24% during the forecast period of 2025 to 2032. This growth is driven by rapid industrialization, increasing demand for packaging, and technological advancements in countries such as China, Japan, and India. Government initiatives promoting digitalization and the rise of e-commerce are accelerating the adoption of advanced printing technologies. The region’s role as a manufacturing hub for printing equipment and consumables further enhances affordability and market expansion.

Japan Printing Technology Market Insight

The Japan printing technology market is gaining momentum due to the country’s high-tech culture and demand for precision printing solutions. The adoption of digital and 3D printing technologies is driven by their applications in electronics, automotive, and healthcare sectors. Japan’s focus on innovation and automation, combined with the integration of IoT-enabled printing systems, is fueling market growth. Additionally, the aging population is driving demand for user-friendly and efficient printing solutions in both commercial and residential applications.

China Printing Technology Market Insight

The China printing technology market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and widespread adoption of digital printing technologies. China’s dominance in manufacturing and its push toward smart cities are key factors propelling the market. The availability of cost-effective printing solutions and strong domestic production of printing equipment are expanding the market across packaging, advertising, and industrial applications.

Printing Technology Market Share

The printing technology industry is primarily led by well-established companies, including:

- Fuji Electric Co., Ltd. (Japan)

- Hewlett Packard Enterprise Development LP (U.S.)

- R.R. Donnelley & Sons Company (U.S.)

- Xerox Corporation (U.S.)

- Materialise (Belgium)

- Stratasys Ltd (U.S.)

- voxeljet AG (Germany)

- SLM Solutions (Germany)

- EnvisionTEC (U.S.)

- Optomec, Inc. (U.S.)

- Ultimaker BV (Netherlands)

- Global Printing (Thailand)

- Halaman Printing and Packaging Corp. (Philippines)

- Shree Arun Packaging Company Private Limited (India)

- Oliver Inc. (U.S.)

What are the Recent Developments in Global Printing Technology Market?

- In April 2024, Xerox Holdings Corporation announced a strategic partnership with Productive Business Solutions Limited (PBS) to transition its operations in Peru and Ecuador to PBS. This move enhances Xerox’s distribution network for printers and multifunction printers, leveraging PBS’s regional expertise to expand market presence and support hybrid workplace printing needs. The transaction is expected to close in the second quarter of 2024, pending authorization from the Ecuadorian competition authority

- In March 2024, Control Print Ltd. acquired a 50.49% stake in UK-based Codeology Group Ltd., expanding its global footprint in advanced printing technologies. Codeology specializes in high-capacity inkjet printers for large-surface printing, including exterior cases. The acquisition, facilitated through Control Print’s Netherlands subsidiary, strengthens its presence in the UK market, unlocking new growth opportunities. The partnership aims to diversify product offerings, leveraging Codeology’s expertise in print and apply systems

- In September 2023, ARC Document Solutions LLC partnered with Canon Solutions America to acquire Arizona and Colorado printing systems, enhancing its digital color printing capabilities. This collaboration strengthens ARC’s visual marketing and document workflow services, making it the largest operator of Colorado and Arizona printers in North America. The Arizona 2300 and 6100 series deliver high-quality graphics and signage printing, while Colorado M-series printers offer FLXfinish+ technology and White Ink capabilities for vibrant output. The integration of Colex cutting systems further refines precision finishing

- In July 2023, Epson Co., Ltd. partnered with the Australian Fashion Council (AFC) to advance digital printing and projection technologies in the clothing and textile industry. This collaboration establishes Epson as AFC’s exclusive Digital Print and Projection Partner, supporting onshore manufacturing, sustainability initiatives, and circular economy goals. The partnership integrates Epson’s Monna Lisa direct-to-fabric textile printer series, enabling customization, efficiency, and reduced environmental impact. The initiative strengthens Epson’s presence in the global digital printing market, fostering innovation in fashion production

- In April 2022, Canon Europe launched the imagePRESS V1000, a cut-sheet digital color press designed to tackle commercial printing challenges. This next-generation device enhances productivity, automation, and media versatility, ensuring high-quality, reliable output for print service providers. The imagePRESS V1000 features POD-SURF fixing technology, maintaining consistent print speeds across various media types. Its advanced registration system and inline spectrophotometer optimize color accuracy and efficiency, reinforcing Canon’s commitment to innovation in the printing technology sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Printing Technology Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Printing Technology Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Printing Technology Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.