Global Plasma Feed For Swine Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.37 Billion

2024

2032

USD

1.52 Billion

USD

2.37 Billion

2024

2032

| 2025 –2032 | |

| USD 1.52 Billion | |

| USD 2.37 Billion | |

|

|

|

|

Plasma Feed for Swine Market Size

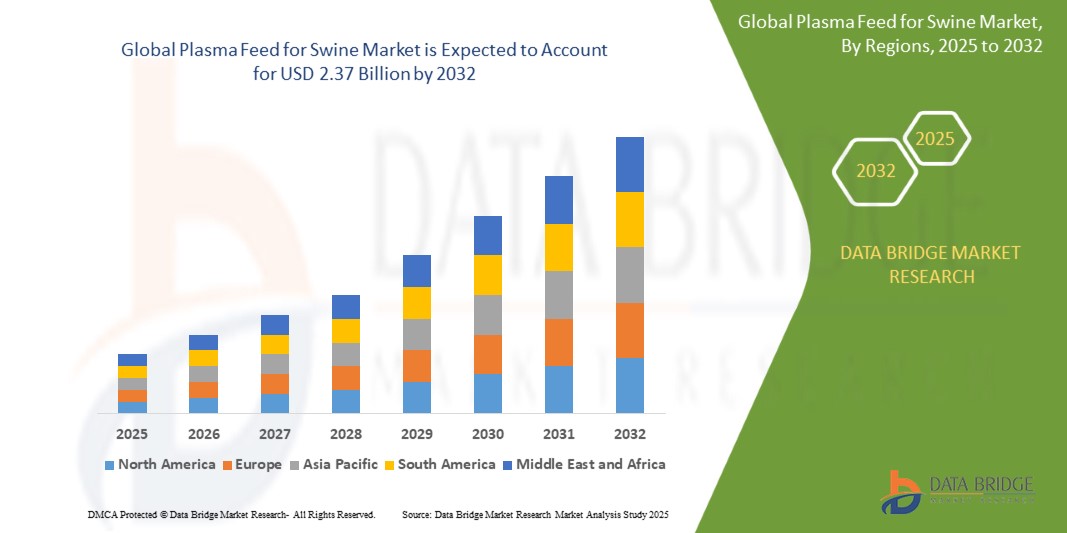

- The global plasma feed for swine market size was valued at USD 1.52 billion in 2024 and is expected to reach USD 2.37 billion by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance animal nutrition solutions, rising awareness about the benefits of plasma protein in improving swine immunity and growth, and the shift toward antibiotic alternatives in livestock production

- In addition, increasing pork consumption worldwide, particularly in emerging economies, is driving the need for efficient and health-boosting feed ingredients, further propelling the growth of the plasma feed for swine market

Plasma Feed for Swine Market Analysis

- The use of plasma feed in swine nutrition is gaining traction due to its superior digestibility and functional bioactive components that enhance feed efficiency and animal health

- Swine producers are adopting plasma feed to reduce post-weaning stress in piglets, improve gut health, and achieve better weight gain, especially in the early stages of growth

- Asia-Pacific dominated the plasma feed for swine market with the largest revenue share of 45.26% in 2024, driven by the region’s high swine population, rising meat consumption, and increasing demand for efficient and sustainable animal nutrition

- North America region is expected to witness the highest growth rate in the global plasma feed for swine market, driven by well-established swine farming infrastructure, growing investments in animal nutrition research, and strong adoption of value-added feed products among commercial pig producers

- The porcine segment dominated the market with the largest market revenue share in 2024, driven by the high digestibility and nutrient density of porcine plasma proteins, which are particularly effective in supporting gut health and growth performance in weaning pigs. Farmers often prefer porcine-derived plasma due to its palatability and proven role in reducing post-weaning stress and mortality. The segment continues to benefit from advancements in processing technologies that preserve the functional bioactive components essential for piglet development

Report Scope and Plasma Feed for Swine Market Segmentation

|

Attributes |

Plasma Feed for Swine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plasma Feed for Swine Market Trends

“Increasing Adoption of Spray-Dried Plasma (SDP) in Starter Diets”

- Swine producers are increasingly turning to spray-dried plasma as a key functional protein source in piglet starter diets due to its high digestibility and immune-supportive properties

- SDP is proving effective in enhancing feed intake and daily weight gain during the vulnerable post-weaning phase, reducing reliance on antibiotic growth promoters

- The functional proteins in SDP help improve intestinal morphology and support gut barrier integrity, which is critical in weaned piglets prone to digestive disorders

- Increased global pressure to adopt antibiotic-free animal husbandry practices is further accelerating the inclusion of SDP in early-stage diets

- For instance, a commercial farm in Spain observed a 20% reduction in piglet mortality and a 15% improvement in average daily gain after incorporating SDP into its feed regimen

Plasma Feed for Swine Market Dynamics

Driver

“Rising Focus on Swine Health and Productivity in Antibiotic-Free Systems”

- Growing consumer awareness and regulatory restrictions are pushing swine producers toward sustainable and antibiotic-free meat production

- Plasma feed is gaining traction as a natural alternative that promotes immune function and reduces gut inflammation in young pigs

- Its bioactive components, including immunoglobulins and growth factors, contribute to higher feed efficiency and overall swine productivity

- The inclusion of plasma feed supports animal welfare while maintaining economic performance, particularly in intensive farming setups

- For instance, farms in Denmark that shifted to plasma-based diets in weaning programs reported a 25% reduction in post-weaning diarrhea without sacrificing growth rates

Restraint/Challenge

“High Production Costs and Supply Chain Limitations”

- The processing of plasma feed involves advanced technologies, including centrifugation, sterilization, and spray-drying, which significantly increase manufacturing costs

- Small and mid-sized farms in cost-sensitive regions often struggle to afford plasma-based products, opting for less expensive protein alternatives

- The dependency on abattoir-derived raw materials poses risks; disruptions in slaughterhouse operations can severely affect plasma supply

- Disease outbreaks, such as African Swine Fever (ASF), not only reduce animal populations but also trigger restrictions on blood collection, halting feed production

- For instance, during the ASF crisis in China, many plasma suppliers were forced to suspend operations, leading to a sharp increase in prices and limited availability in the region

Plasma Feed for Swine Market Scope

The market is segmented on the basis of source type and end user.

• By Source Type

On the basis of source type, the plasma feed for swine market is segmented into porcine, bovine, and others. The porcine segment dominated the market with the largest market revenue share in 2024, driven by the high digestibility and nutrient density of porcine plasma proteins, which are particularly effective in supporting gut health and growth performance in weaning pigs. Farmers often prefer porcine-derived plasma due to its palatability and proven role in reducing post-weaning stress and mortality. The segment continues to benefit from advancements in processing technologies that preserve the functional bioactive components essential for piglet development.

The bovine segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by its rising adoption as a cost-effective alternative to porcine plasma in certain regions. Bovine plasma is gaining traction in markets with religious or cultural preferences, and its expanding availability is driving interest among feed manufacturers looking for diversified protein sources. Its proven benefits in immunity enhancement and nutrient absorption also support its growing acceptance.

• By End User

On the basis of end user, the plasma feed for swine market is segmented into farmers, farming organizations, feed additive companies, and users of animal feed for pets. The farmers segment held the largest market share in 2024 due to the direct integration of plasma feed into weaning programs to reduce mortality and boost productivity. Individual swine farmers are the primary consumers, seeking efficient feed ingredients that offer health and performance benefits at competitive costs.

The feed additive companies segment is expected to witness the fastest growth rate from 2025 to 2032, driven by their role in formulating advanced feed blends incorporating plasma proteins. These companies are responding to increasing demand for functional feed solutions that comply with antibiotic-free regulations while ensuring animal growth and well-being. Strategic collaborations with plasma producers are further expanding their influence across the global feed supply chain.

Plasma Feed for Swine Market Regional Analysis

- Asia-Pacific dominated the plasma feed for swine market with the largest revenue share of 45.26% in 2024, driven by the region’s high swine population, rising meat consumption, and increasing demand for efficient and sustainable animal nutrition

- Countries such as China and Vietnam are key contributors, where plasma feed is being increasingly utilized to improve piglet immunity, feed efficiency, and gut health, particularly in post-weaning stages

- Government support for livestock health, rapid urbanization, and a growing focus on protein-rich diets further drive market growth, positioning Asia-Pacific as a leading consumer and manufacturer of plasma-based feed additives

China Plasma Feed for Swine Market Insight

The China plasma feed for swine market accounted for the largest revenue share in Asia-Pacific in 2024, owing to the country’s massive pig farming industry and rising focus on swine health management. With the aftermath of African swine fever outbreaks, there is greater emphasis on using functional feed ingredients to reduce antibiotic reliance and support piglet survival rates. In addition, China's push towards advanced farming practices, increasing demand for high-quality pork, and a strong domestic supply chain are key contributors to the growth of plasma-based feed in the region.

Japan Plasma Feed for Swine Market Insight

The Japan plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s high standards for animal nutrition and strict regulations on antibiotic use. Japanese pig producers are increasingly turning to functional proteins such as plasma feed to ensure improved piglet survival and gut health in early-weaning phases. Moreover, Japan's focus on premium pork production and high-quality animal protein supports the adoption of plasma feed in commercial operations. Technological advancements and the availability of specialty feed products tailored to Japanese swine breeds further contribute to market growth.

North America Plasma Feed for Swine Market Insight

The North America plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of functional feed ingredients and the demand for natural growth promoters. U.S. farmers are adopting plasma feed to enhance gut health and immunity in swine, especially in early-weaning diets. Stringent regulations on antibiotic usage in livestock production also propel the need for alternative protein-rich additives such as spray-dried plasma. The presence of leading feed manufacturers and extensive R&D activities further support market growth in the region.

U.S. Plasma Feed for Swine Market Insight

The U.S. plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, bolstered by its developed pork industry, high standards in animal welfare, and advanced feed technologies. The integration of plasma feed into swine diets is increasingly viewed as a preventive health strategy, reducing morbidity and enhancing performance metrics in piglets. The rising preference for antibiotic alternatives and increasing collaboration between feed companies and research institutions are further accelerating adoption across swine farms in the country.

Europe Plasma Feed for Swine Market Insight

The Europe plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict regulations on animal nutrition and a strong emphasis on sustainable livestock production. Countries such as Spain, Germany, and Denmark are actively adopting plasma-based feed solutions due to their efficacy in improving digestive health and minimizing post-weaning stress in piglets. The European Union’s regulatory framework favoring non-antibiotic growth promoters and the region’s commitment to safe, traceable feed ingredients drive long-term market demand.

Germany Plasma Feed for Swine Market Insight

The Germany plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing focus on animal welfare and the demand for high-performance feed additives. German pig farmers are increasingly utilizing porcine plasma to address gut challenges in weaning piglets while complying with strict EU feed safety norms. The presence of established feed additive players and innovation in protein sourcing further support market expansion in the country.

U.K. Plasma Feed for Swine Market Insight

The U.K. plasma feed for swine market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for antibiotic-free pork and improved feed efficiency. British swine farmers are adopting spray-dried plasma in piglet diets to address weaning challenges and enhance growth performance without the use of antibiotics. Regulatory frameworks that encourage sustainable farming practices and promote animal health are creating a favorable environment for the use of plasma-based additives. In addition, rising consumer preference for traceable and welfare-certified meat is encouraging livestock producers to invest in high-quality nutritional inputs such as plasma feed.

Plasma Feed for Swine Market Share

The Plasma Feed for Swine industry is primarily led by well-established companies, including:

- Daka Denmark A/S (Denmark)

- Kraeber & Co GmbH (Germany)

- Sera Scandia A/S (Denmark)

- PURETEIN AGRI LLC (U.S.)

- Veos NV (Belgium)

- Rocky Mountain Biologicals (U.S.)

- Darling Ingredients Inc. (U.S.)

- APC, Inc. (U.S.)

- EccoFeed LLC (U.S.)

- Feedworks Pty Ltd. (Australia)

- NF PROTEIN (U.K.)

- EW Nutrition GmbH (Germany)

- Lican Food (Chile)

- Lihme Protein Solutions (Denmark)

- Purina Animal Nutrition LLC (U.S.)

- Vilomix (Denmark)

Latest Developments in Global Plasma Feed for Swine Market

- In October 2022, Grifols launched a state-of-the-art albumin purification and filling operation in Dublin, Ireland, significantly enhancing its global production and supply capabilities. This facility is part of Grifols’ strategic initiative to expand its footprint in the albumin market, ensuring high-quality production standards and increased efficiency in fulfilling global demand for this critical plasma-derived product

- In September 2022, The Ministry of Health, Labour, and Welfare of Japan granted CSL Behring K.K. the manufacturing and marketing approval for Berinert S.C. Injection 2000. This product is a lyophilized human C1-esterase inhibitor concentrate designed for subcutaneous injection, specifically aimed at preventing acute hereditary angioedema (HAE) attacks. The approval marks a significant advancement in treatment options available for patients suffering from HAE

- In April 2022, Takeda Pharmaceutical Company Limited completed its acquisition of Shire Plc, a strategic move that enhances Takeda's portfolio in the plasma market. This acquisition allows Takeda to expand its range of products significantly and solidifies its position within the plasma fractionation industry, aiming to improve patient outcomes through a broader offering of therapies derived from human plasma

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.