Global Feed Additives Market

Market Size in USD Billion

CAGR :

%

USD

57.82 Billion

USD

94.26 Billion

2024

2032

USD

57.82 Billion

USD

94.26 Billion

2024

2032

| 2025 –2032 | |

| USD 57.82 Billion | |

| USD 94.26 Billion | |

|

|

|

|

Feed Additives Market Size

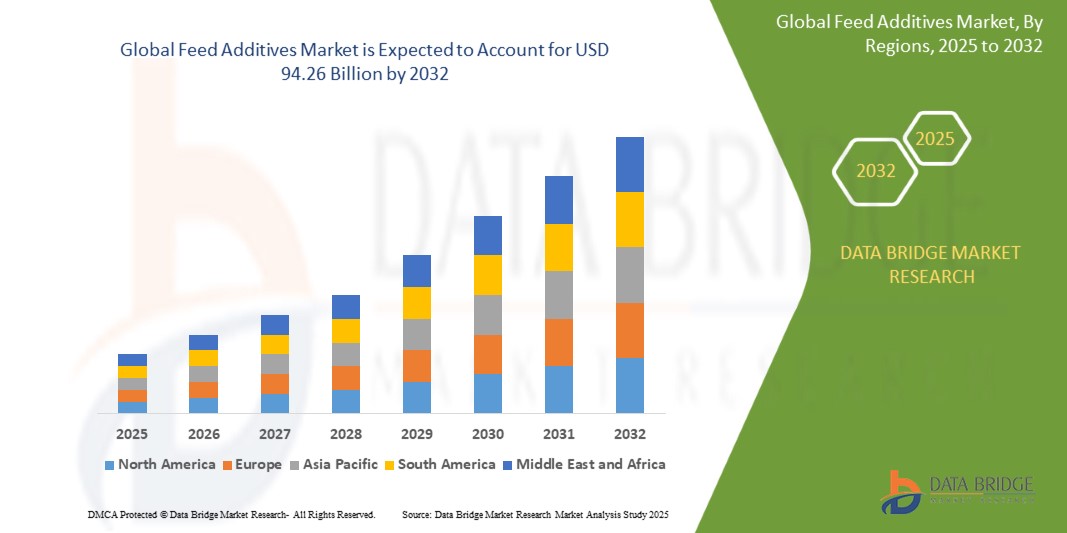

- The global feed additives market was valued at USD 57.82 billion in 2024 and is expected to reach USD 94.26 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.30%, primarily driven by industrial livestock production

- This growth is driven by factors such as high stocking density and automation & precision feeding

Feed Additives Market Analysis

- Feed additives refer to a range of nutritional and non-nutritional substances incorporated into animal feed to enhance animal health, growth performance, feed efficiency, and product quality. These additives include vitamins, amino acids, enzymes, probiotics, antioxidants, and more, aimed at improving overall livestock productivity

- The market is witnessing significant growth due to rising global demand for animal protein, increasing awareness of animal health and nutrition, and the need for enhanced feed efficiency. Producers are turning to feed additives to support intensive livestock farming, reduce production costs, and comply with stringent food safety and animal welfare regulations

- The feed additives market is evolving with a focus on natural and functional ingredients, such as phytogenics, organic acids, and enzyme blends, driven by the global phase-out of antibiotic growth promoters. In addition, advancements in precision feeding, sustainable farming practices, and innovations in additive delivery technologies are reshaping the market landscape

- For instance, companies such as Nutreco, Kemin Industries, Novus International, and Biomin are actively developing cost-effective and species-targeted solutions. These include encapsulated vitamins, toxin binders, and gut health modulators tailored to the needs of poultry, swine, and aquaculture producers in both developed and emerging markets

- The feed additives market is projected to grow steadily, supported by the expansion of industrial livestock production, especially in emerging markets. With the growing emphasis on efficient feed utilization, animal welfare, and antibiotic alternatives, the market is expected to see sustained demand across poultry, swine, ruminant, and aquaculture sectors in the years ahead

Report Scope and Feed Additives Market Segmentation

|

Attributes |

Feed Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Feed Additives Market Trends

“Rising Demand for Animal Protein”

- One prominent trend in the global feed additives market is the rising demand for animal protein

- This trend is driven by the increasing global population, urbanization, and changing dietary preferences, leading to higher consumption of meat, dairy, and aquaculture products. Producers are focusing on improving livestock productivity, feed efficiency, and product quality to meet this growing protein demand

- For instance, companies such as Kemin Industries and Novozymes are developing performance-enhancing additives such as enzymes, amino acids, and probiotics that support faster growth, better nutrient absorption, and overall animal health

- The demand for high-quality animal protein is expected to intensify, prompting livestock producers to adopt advanced feed formulations and functional additives that ensure optimal yield while adhering to food safety and sustainability standards

- As the competition in the protein supply chain increases, feed additive manufacturers will continue to innovate in product formulation, delivery systems, and species-specific solutions. The rising demand for animal protein, coupled with pressure to maximize efficiency and reduce environmental impact, will further solidify feed additives as a critical component of modern animal nutrition strategies

Feed Additives Market Dynamics

Driver

“Growing Focus on Animal Health and Nutrition”

- The growing emphasis on animal health and nutrition is a key driver of growth in the feed additives market. As livestock producers aim to enhance productivity, improve feed conversion ratios, and reduce disease outbreaks, feed additives are becoming essential components in modern animal husbandry practices

- This impact is particularly evident in sectors such as poultry, swine, ruminants, and aquaculture, where feed additives support optimal growth, gut health, immune function, and overall animal performance

- With producers prioritizing efficient nutrient utilization, disease prevention, and high-quality end products, the demand for scientifically formulated additives such as probiotics, enzymes, amino acids, and organic acids, has seen rapid growth

- Additives that enhance digestion, promote beneficial gut flora, and strengthen immune response are reshaping feeding strategies, enabling producers to meet consumer expectations for safe, sustainable, and antibiotic-free animal protein

- Companies are increasingly investing in advanced animal nutrition solutions to support preventive health strategies, improve livestock resilience, and comply with tightening food safety and welfare standards

For instance,

- Enterprises such as Delacon Biotechnik GmbH, Nutreco, and Natural Remedies offer phytogenic and herbal-based feed additives that promote gut integrity and reduce reliance on antibiotics

- Kemin Industries, Adisseo, and Novus International provide targeted enzyme blends, amino acids, and antioxidants that enhance nutrient absorption and optimize animal performance across species

- With continuous innovations in functional feed additives, growing regulatory support for natural growth promoters, and rising awareness of animal well-being, the feed additives market is poised for sustained expansion, reinforcing its role as a cornerstone of modern livestock nutrition and health management

Opportunity

“Growing Demand for Specialty and Functional Additives”

- The growing demand for specialty and functional additives presents a significant opportunity for market growth. As livestock producers seek more targeted nutritional solutions, there is increasing interest in feed additives that offer specific health benefits, performance enhancements, and lifecycle support

- Specialty additives such as prebiotics, postbiotics, enzymes, immune enhancers, and heat stress reducers are gaining momentum due to their ability to address species-specific needs, improve feed efficiency, and enhance overall animal health and welfare

- The ability of functional additives to support gut integrity, boost immunity, reduce oxidative stress, and optimize nutrient absorption is driving adoption, as producers aim to improve productivity and minimize the use of antibiotics

For instance,

- Delacon Biotechnik is offering phytogenic formulations that help improve gut health and support immune response in poultry and swine

- Ajinomoto Co., Inc. is developing amino acid solutions that enhance protein synthesis and metabolic efficiency in monogastric animals

- As demand for precision feeding and animal welfare compliance increases, investments in specialty and functional feed additives will continue to grow. Collaborations between nutrition experts, additive manufacturers, and producers will drive innovation, positioning functional additives as a key enabler of next-generation animal nutrition strategies

Restraint/Challenge

“Animal Welfare Considerations”

- Animal welfare considerations pose a significant challenge for the feed additives market. As consumer awareness around ethical livestock farming grows, producers are under increasing pressure to align with welfare standards that often limit the use of certain additives

- Feed additives such as growth promoters, synthetic enhancers, and appetite stimulants face scrutiny for their perceived impact on animal well-being, prompting shifts toward more natural and welfare-compliant alternatives

- Compliance with animal welfare certifications and guidelines—such as those from the Global Animal Partnership (GAP), Certified Humane, and EU animal welfare standards—adds operational complexity and restricts the usage of certain feed additives in specific production systems

For instance,

- Elanco Animal Health Incorporated has had to adapt its product strategies to meet stricter welfare and labeling requirements in markets emphasizing antibiotic-free and welfare-certified meat production

- As public expectations and regulatory frameworks continue to evolve, addressing animal welfare concerns while maintaining feed efficacy and productivity will remain a key challenge, requiring innovation in formulation and transparent marketing practices

Feed Additives Market Scope

The market is segmented on the basis of source, livestock, form, function, and category.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Livestock |

|

|

By Form |

|

|

By Function

|

|

|

By Category |

|

Feed Additives Market Regional Analysis

“North America is the Dominant Region in the Feed Additives Market”

- North America dominates the feed additives market, driven by the stringent meat quality regulations, advanced animal nutrition research, and strong demand for high-quality protein products. The region’s regulatory bodies, such as the FDA and USDA, enforce strict guidelines that promote the use of safe and effective feed additives, particularly for antibiotic alternatives and performance enhancers

- The U.S. holds a significant share due to its highly industrialized livestock sector, characterized by large-scale commercial farming operations that require consistent, high-performance feed formulations to maintain productivity and meet export standards

- North America’s abundant supply of raw materials, including maize, corn, and dextrose, contributes to consistent and cost-effective production of feed additives, strengthening the regional supply chain and reducing dependence on imports

- Ongoing advancements in enzyme formulations, amino acid blends, and phytogenic feed additives, combined with increased investments in livestock health and traceability systems, are expected to reinforce North America’s position as a dominant region in the global feed additives market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the feed additives market, driven by rising population, increasing meat consumption, and growing awareness of animal health and productivity. The region’s expanding middle class and changing dietary habits are intensifying the demand for high-quality animal protein, driving the need for innovative feed solutions

- China leads the regional growth, supported by large-scale livestock operations, supportive government policies, and rapid modernization of the animal farming sector. Local players and multinationals are investing in high-performance feed additives to improve feed efficiency and meet evolving food safety standard

- Southeast Asia, particularly countries such as Vietnam, Indonesia, and Thailand, is emerging as a fast-growing market due to increased adoption of compound feed, rising demand for poultry and aquaculture, and efforts to reduce the use of antibiotic growth promoters

- With investments pouring into sustainable farming practices, functional additives, and digital livestock management tools, Asia-Pacific is poised for rapid expansion, attracting attention from global feed additive manufacturers aiming to tap into the region’s growth potential

Feed Additives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- Alltech, Inc. (U.S.)

- BASF (Germany)

- Evonik Industries AG (Germany)

- dsm-firmenich (Switzerland)

- Adisseo (China)

- InVivo (France)

- Novozymes A/S (Denmark)

- Ajinomoto Co., Inc. (Japan)

- Kemin Industries, Inc. (U.S.)

- Elanco (U.S.)

- Dow (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- Natural Remedies (India)

- Synthite Industries Ltd. (India)

Latest Developments in Global Feed Additives Market

- In August 2024, UK-based animal nutrition company Volac launched a new website dedicated to its feed additives division, highlighting its commitment to sustainable livestock production. This digital initiative enhances the company's market visibility and supports its strategic positioning in the growing segment of environmentally responsible feed solutions. By emphasizing sustainability-focused products, Volac aims to strengthen its engagement with producers seeking additive solutions that align with modern environmental and animal welfare standards

- In February 2023, Evonik launched PhytriCare® IM, its first plant-based feed additive, marking a strategic move toward natural and functional solutions in the feed additives market. Designed to support the health of sows, laying hens, and dairy cows, the product features a high flavonoid content known for its anti-inflammatory properties. This launch strengthens Evonik’s position in the growing segment of phytogenic feed additives and reflects rising market demand for natural, welfare-friendly solutions that align with evolving consumer and regulatory expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.