Global Plant-Based Meat Market Segmentation, By Source (Soy, Wheat, Pea, Mycoprotein, Gluten, and Others), Type (Pork, Beef, Chicken, Fish, Tofu, Tempeh, Quorn, Mushroom, Seitan, RTC/RTE, Natto, and Others), Product Type (Burger Patties, Sausages, Strips and Nuggets, Meatballs, Tenders and cutlets, Grounds, and Others), Process (Grinding, Mixing, Blending, Forming/Shaping, Freezing Systems, and Storage), Distribution Channel (Online platforms and Offline platforms), Storage (Refrigerated plant-based meat, Frozen peas based meat, and Shelf stable plant-based meat), End User (Households, Food Industry, and HORECA) – Industry Trends and Forecast to 2031

Plant-Based Meat Market Analysis

The plant-based meat market is experiencing rapid growth, driven by advancements in technology and methods for creating meat alternatives. Recent innovations include extrusion technology, which enhances texture and flavor, making products more palatable. Companies such as Beyond Meat and Impossible Foods are using advanced food science techniques such as hemo-protein integration, which mimics the taste and juiciness of animal meat.

Moreover, 3D printing is emerging as a novel method, allowing for customizable shapes and textures, enhancing consumer appeal. This technology not only improves production efficiency but also caters to diverse dietary preferences. The market is bolstered by a growing awareness of health, environmental concerns, and animal welfare, prompting consumers to shift toward plant-based diets. Retailers are increasingly expanding their plant-based product lines, and partnerships between food manufacturers and tech companies are paving the way for innovative solutions, further driving market growth.

Plant-Based Meat Market Size

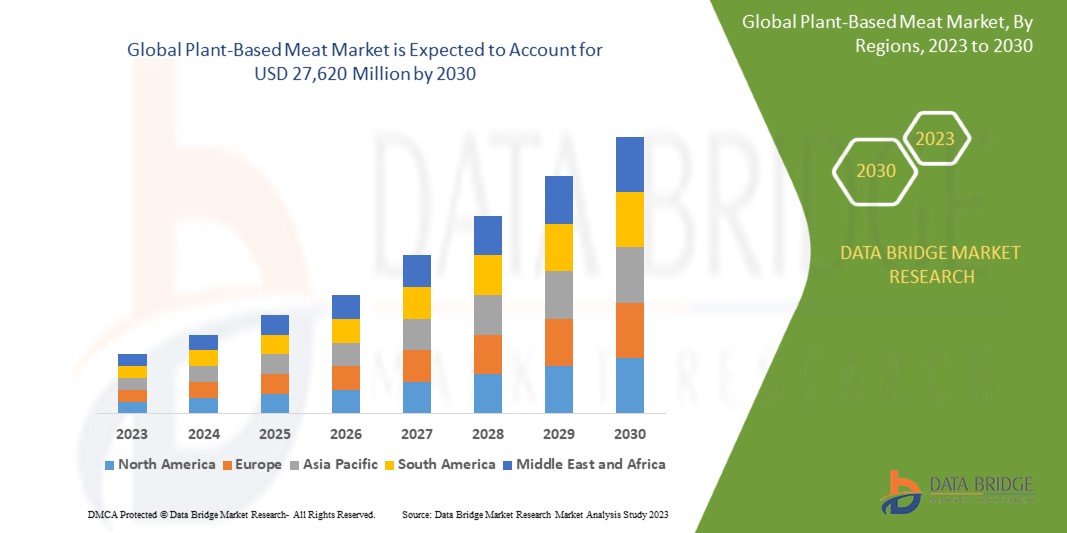

The global plant-based meat market size was valued at USD 11.27 billion in 2023 and is projected to reach USD 33.85 billion by 2031, with a CAGR of 12.74% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Plant-Based Meat Market Trends

“Growing Popularity of Flexitarian Diets”

The plant-based meat market is witnessing significant growth due to the rising popularity of flexitarian diets, which encourage a primarily vegetarian lifestyle while allowing occasional meat consumption. This trend appeals to health-conscious consumers and those concerned about environmental sustainability. Major food companies, such as Beyond Meat and Impossible Foods, have capitalized on this trend by launching new products that mimic the taste and texture of traditional meat. For instance, in October 2022, Beyond Meat, Inc., a trailblazer in the plant-based meat industry, introduced Beyond Steak, an innovative product designed to replicate the juicy, succulent experience of seared steak tips. This plant-based option not only provides a satisfying taste but also delivers health and environmental benefits over traditional meat products. By appealing to meat lovers and health-conscious consumers, Beyond Meat continues to lead the charge in the alternative protein market.

Report Scope and Plant-Based Meat Market Segmentation

|

Attributes

|

Plant-Based Meat Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Key Market Players

|

Beyond Meat. (U.S.), Impossible Foods Inc. (U.S.), Maple Leaf Foods. (Canada), Unilever. (Netherlands), Conagra Brands, Inc U.S.), Kellogg Co. (U.S.), Tofurky (U.S.), Valio Oy(Finland), Sunfed (New Zealand), VBites Foods Ltd (U.K), The Kraft Heinz Company. (U.S.), Yves Veggie Cuisine (U.S), Ojah B.V. (Netherlands), Moving Mountains Foods (U.S.), Eat Just, Inc. (U.S.), LIVEKINDLY Collective (Germany), Gooddot (India), No Evil Foods (U.S.)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework

|

Plant-Based Meat Market Definition

Plant-based meat refers to meat alternatives made primarily from plant ingredients designed to mimic the taste, texture, and nutritional profile of traditional meat products. Common sources include legumes, grains, soy, and peas, often enhanced with flavors, oils, and binding agents. These products cater to vegetarians, vegans, and flexitarians, addressing concerns about health, environmental sustainability, and animal welfare. Popular instances include veggie burgers, plant-based sausages, and meatless nuggets. The plant-based meat market has experienced significant growth, driven by increasing consumer demand for healthier, eco-friendly options and innovations in food technology that enhance the sensory experience of these alternatives.

Plant-Based Meat Market Dynamics

Drivers

- Growing Soy's Demand and Benefits

All standard (nine) amino acids necessary for the development of the human body are present in soy when it is raw. The demand for soy in plant-based meat products will increase over the coming years due to its capacity to improve the finished product's water absorption, solubility, emulsification, viscosity, anti-oxidation, and texture. The popularity of various plant-based meat alternatives keeps rising, expanding, and diversifying the category. Along with plant-based beef, there is a growing demand for plant-based chicken, pork, and seafood. Over the forecast period, the exponential growth of chilled plant-based meat will continue. It reflects a change in the plant-based industry's approach to product innovation and marketing tactics.

- Increasing Vegetarian Population

The ability of these products to mimic animal-based meat products is a significant factor driving the growth of the plant-based meat market. These goods, for instance, imitate the texture, flavor, aroma, and appearance of animal meat products. The plant-based meat alternatives have lower levels of saturated fat than ground beef and are a great source of fiber, iron, and folate. The plant-based meat substitutes are made of coconut oil, beet juice, and vegetable protein extract. In the upcoming years, it is anticipated that the popularity of the plant-based meat industry will increase due to the shift in consumer preferences toward meat alternatives made possible by the rise in the vegetarian population and the flexitarian diet.

Opportunities

- Innovative Product Development

Innovative product development is creating significant opportunities in the plant-based meat market. Recent advancements in food technology, such as 3D printing and fermentation processes, have led to the creation of more authentic and flavorful plant-based meats. For instance, in January 2022, in response to India's increasing appetite for meatless meals, ITC announced plans to develop a range of plant-based meat products, including vegan burgers and chicken-flavored patties. This initiative positions ITC to tap into the largest market for plant-based substitutes in India, catering to a growing demographic seeking healthier options. With this launch, ITC aims to become a key player in the evolving meat alternatives sector.

- Diverse Culinary Options

The versatility of plant-based meats enhances their appeal across diverse cuisines, presenting significant market opportunities. Consumers increasingly seek flavorful meal options that cater to various dietary preferences, including vegan, vegetarian, and flexitarian diets. For instance, in May 2021, Charoen Pokphand Foods PCL launched the “MEAT ZERO” product line, offering high-quality, entirely plant-based meat alternatives. This initiative aligns with the growing consumer trend towards healthier and more environmentally friendly diets. By focusing on creating meat-such as textures and flavors, MEAT ZERO aims to attract consumers looking for sustainable dietary choices, reinforcing Charoen Pokphand's commitment to innovation in plant-based food production.

Restraints/Challenges

- Taste and Texture

The taste and texture of plant-based meats present a significant challenge for market acceptance. Many consumers still struggle to embrace these products due to their inability to replicate the flavor and mouthfeel of traditional meat accurately. Despite advancements in food technology, achieving the same juiciness, chewiness, and overall sensory experience of animal-derived meats remains elusive. This sensory gap can deter potential buyers who are accustomed to the taste of conventional meat, hindering the growth of the plant-based meat market. Consequently, consumer skepticism persists, limiting broader adoption and making it difficult for brands to compete effectively with traditional meat products.

- Supply Chain Issues

Supply chain issues significantly hinder the plant-based meat market by impacting the availability and cost of essential raw materials. The production of these products relies on specific ingredients, such as soy, pea protein, and other plant extracts, which can be affected by agricultural fluctuations, climate change, and market demand. Unexpected disruptions, such as adverse weather events or geopolitical tensions, can lead to shortages or price increases, ultimately impacting production efficiency. These fluctuations force manufacturers to adjust their pricing strategies, potentially making plant-based meats less competitive compared to traditional meat products. As a result, these supply chain challenges impede market growth and consumer adoption.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Plant-Based Meat Market Scope

The market is segmented on the basis of source, type, product type, process, distribution channel, storage, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Source

- Soy

- Wheat

- Pea

- Mycoprotein

- Gluten

- Others

Type

- Pork

- Beef

- Chicken

- Fish

- Tofu

- Tempeh

- Quorn

- Mushroom

- Seitan

- RTC/RTE

- Natto

- Others

Product Type

- Burger Patties

- Sausages

- Strips and Nuggets

- Meatballs

- Tenders and cutlets

- Grounds

- Others

Process

- Grinding

- Mixing

- Blending

- Forming/Shaping

- Freezing Systems

- Storage

Distribution Channel

- Online platforms

- E-Commerce

- Company Owned Websites

- Offline platforms

- Retail Outlets

- Food Services

Storage

- Refrigerated plant-based meat

- Frozen peas based meat

- Shelf stable plant-based meat

End User

- Households

- Food Industry

- HORECA

Plant-Based Meat Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, source, type, product type, process, distribution channel, storage, and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

Asia-Pacific is expected to dominate the plant-based meat market and will continue to flourish its trend of dominance during the forecast period. The major factors attributable to the region’s dominance are the popularity of plant-based meat products among consumers.

North America is expected to show significant growth during the forecast period due to the rapid shift in consumers' diets from meat consumption to vegan or vegetarian products. In addition, in the U.S., people are more forced towards environmental, health, and ethical consideration, thus, they are switching to alternatives such as plant-based meat.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Plant-Based Meat Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Plant-Based Meat Market Leaders Operating in the Market Are:

- Beyond Meat. (U.S.)

- Impossible Foods Inc. (U.S.)

- Maple Leaf Foods. (canada)

- Unilever. (Netherlands)

- Conagra Brands, Inc U.S.)

- Kellogg Co. (U.S.)

- Tofurky (U.S.)

- Valio Oy(Finland)

- Sunfed (New Zealand)

- VBites Foods Ltd (U.K)

- The Kraft Heinz Company. (U.S.)

- Yves Veggie Cuisine (U.S)

- Ojah B.V. (Netherlands)

- Moving Mountains Foods (U.S.)

- Eat Just, Inc. (U.S.)

- LIVEKINDLY Collective (Germany)

- Gooddot (India)

- No Evil Foods (U.S.)

Latest Developments in Plant-Based Meat Market

- In March 2024, Chunk Foods, an innovative biotechnology company, launched a new line of meat alternatives, including a 6-ounce steakhouse cut, a 4-ounce steak, and pulled meat products. These items are crafted from cultured soy and wheat protein, providing a plant-based option for meat lovers. Additionally, the products are fortified with essential nutrients such as B12 and iron, enhancing their nutritional value and appealing to health-conscious consumers

- In March 2024, Coperion, a leader in extrusion and compounding services, unveiled the latest model in its MEGAtex cooling die series, designed specifically for manufacturing high-moisture meat analogs (HMMA). This advanced cooling die enhances production efficiency and product quality, allowing manufacturers to create plant-based meat alternatives that closely mimic the texture and taste of traditional meats, thereby meeting the growing consumer demand for sustainable protein sources

- In September 2023, Novozymes A/S introduced the Vertera ProBite solution, targeting the transformation of the plant-based meat sector. This innovative product enhances the texture of meat alternatives, making them more appealing to consumers who might be hesitant to switch from conventional meat. By improving mouthfeel and sensory experience, Novozymes aims to encourage wider adoption of plant-based diets, catering to the growing interest in healthier and sustainable eating habits

- In August 2023, Nestlé launched its first shelf-stable plant-based minced meat, significantly expanding its vegan product line. This new offering responds to the increasing consumer demand for healthier and sustainable dietary options. By providing a versatile and convenient alternative to traditional minced meat, Nestlé aims to attract both dedicated vegans and those looking to reduce their meat consumption, reinforcing its commitment to sustainability and innovation in food production

- In October 2022, Beyond Meat, Inc., a trailblazer in the plant-based meat industry, introduced Beyond Steak, an innovative product designed to replicate the juicy, succulent experience of seared steak tips. This plant-based option not only provides a satisfying taste but also delivers health and environmental benefits over traditional meat products. By appealing to meat lovers and health-conscious consumers, Beyond Meat continues to lead the charge in the alternative protein market

- In March 2022, Valio Oy acquired Gold & Green Foods Oy, securing all intellectual property rights, research and development capabilities, and brand assets. This strategic acquisition enhances Valio’s position in the Finnish plant-based food market while facilitating international growth. By integrating Gold & Green’s expertise and product offerings, Valio aims to expand its portfolio of sustainable food options, responding to the rising consumer demand for healthy and eco-friendly alternatives

- In January 2022, in response to India's increasing appetite for meatless meals, ITC announced plans to develop a range of plant-based meat products, including vegan burgers and chicken-flavored patties. This initiative positions ITC to tap into the largest market for plant-based substitutes in India, catering to a growing demographic seeking healthier options. With this launch, ITC aims to become a key player in the evolving meat alternatives sector

SKU-