Global Pipeline Safety Market

Market Size in USD Billion

CAGR :

%

USD

11.60 Billion

USD

23.54 Billion

2024

2032

USD

11.60 Billion

USD

23.54 Billion

2024

2032

| 2025 –2032 | |

| USD 11.60 Billion | |

| USD 23.54 Billion | |

|

|

|

|

Pipeline Safety Market Size

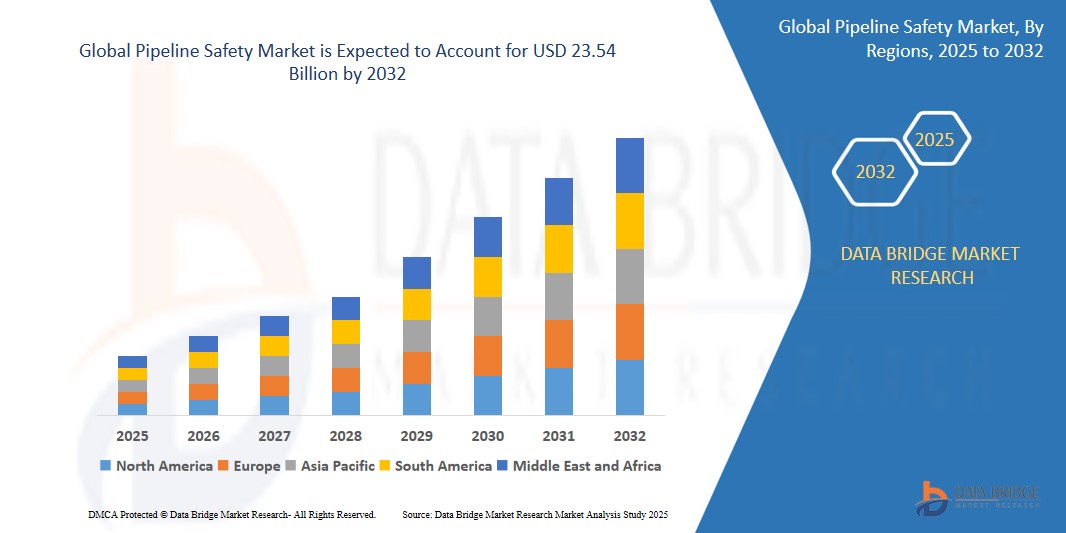

- The Global Pipeline Safety market size was valued at USD 11.6 billion in 2024 and is expected to reach USD 23.54 billion by 2032, at a CAGR of 9.25% during the forecast period

- This growth is driven by factors such as digitization and increasing adoption of IoT and AI technologies

Pipeline Safety Market Analysis

- The Pipeline Safety market is crucial for ensuring the integrity and safety of pipeline infrastructure, which is essential for the transportation of oil, gas, and other fluids across vast distances. Advanced monitoring systems, leak detection technologies, and automatic shut-off mechanisms are key components that help prevent accidents, reduce environmental risks, and ensure regulatory compliance in pipeline operations.

- Market growth is primarily driven by the increasing need for enhanced safety measures in pipeline operations, rising concerns over environmental hazards, and stricter regulatory requirements for pipeline maintenance and monitoring.

- Asia Pacific is expected to dominate and the highest market share during the forecast period. With the rising awareness about the increase in business productivity, supplemented with competently designed pipeline safety platforms offered by vendors present in this region, Asia Pacific is becoming a highly potential market

- North America is projected to experience the fastest growth, driven by the rapid expansion of pipeline networks in countries as well as increasing government initiatives to enhance pipeline safety standards and improve infrastructure reliability

- The Offshore pipelines segment holds the largest market share of 40.80%. Offshore pipelines are critical elements of the subsea transportation system for the transportation and delivery of carbon products from the resource sites to end-users and markets.

Report Scope and Pipeline Safety market Segmentation

|

Attributes |

Pipeline Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pipeline Safety market Trends

“Integration of Advanced Monitoring and Leak Detection Technologies”

- A key trend shaping the global pipeline safety market is the increasing adoption of advanced monitoring systems, including IoT sensors, real-time leak detection technologies, and AI-powered predictive analytics.

- These technologies enable continuous monitoring of pipeline conditions, early detection of potential issues like leaks or corrosion, and predictive maintenance, thus enhancing pipeline integrity and minimizing environmental and safety risks.

- For Instance, In March 2024: A major pipeline operator in the U.S. implemented AI-based analytics and IoT sensors to monitor pipeline health in real-time, improving early detection and reducing pipeline failure rates.

- The integration of these advanced technologies also supports compliance with safety regulations and environmental standards by providing more accurate data for reporting and decision-making.

Pipeline Safety market Dynamics

Driver

“Rising Concerns over Environmental Safety and Regulatory Compliance”

- Increased environmental concerns and stricter regulatory requirements are driving the growth of the pipeline safety market. Governments and regulatory bodies worldwide are imposing stricter safety and environmental standards to prevent pipeline leaks, spills, and accidents.

- As pipeline infrastructure expands globally, companies are focusing on implementing comprehensive safety measures, including automated shut-off systems, corrosion monitoring, and early leak detection, to minimize environmental risks and comply with evolving regulations.

- For Instance, In January 2023, The European Union introduced more stringent pipeline safety standards, prompting operators to upgrade their leak detection and monitoring technologies.

- Compliance with local and international environmental regulations is pushing pipeline operators to adopt more advanced safety measures and cutting-edge technologies to ensure operational safety and sustainability.

Opportunity

“Growth in Smart Pipeline Infrastructure and Remote Monitoring Solutions”

- The increasing demand for smart pipeline infrastructure, capable of integrating real-time data analytics, remote monitoring, and automated decision making, presents significant opportunities for growth in the pipeline safety market

- Remote monitoring solutions, leveraging IoT devices and cloud-based platforms, allow operators to detect issues in real-time, reducing the need for manual inspections and enhancing overall safety

- For Instance, In February 2024, A leading pipeline operator in Canada adopted a cloud based pipeline monitoring solution that enabled remote monitoring, real-time leak detection, and predictive analytics for better safety management

- These smart systems not only improve operational efficiency but also reduce operational costs and prevent accidents, creating an opportunity for technology providers to expand their offerings in the pipeline safety space

Restraint/Challenge

“High Capital Costs and Complexity of Retrofitting Existing Pipelines”

- A key challenge in the pipeline safety market is the high capital costs associated with upgrading or retrofitting existing pipelines with advanced safety technologies. Many operators face significant financial constraints when trying to implement state the art safety systems, particularly in aging infrastructure that requires substantial modifications

- Retrofitting older pipelines with modern leak detection, corrosion monitoring, and automation technologies involves both high costs and technical complexities

- For Instance, In November 2023, A major pipeline operator in the Middle East faced challenges in upgrading its existing infrastructure due to the high cost of retrofitting and the need for detailed regulatory approvals. These factors led to delays in the implementation of safety upgrades

- Despite the long term benefits, these high upfront costs and complex installation processes can slow down the pace of market adoption and require significant financial investments from pipeline operators

Pipeline Safety market Scope

The market is segmented on the basis component, Solution, Application, Vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Solution |

|

|

By Application |

|

|

By Deployment Mode |

|

|

By Vertical |

|

In 2025, The offshore segment is expected to hold the largest market share and dominate the market

Offshore pipelines are critical elements of the subsea transportation system for the transportation and delivery of carbon products from the resource sites to end-users and markets. The design, construction, and operation of offshore pipelines require risk management elements to mitigate potential adverse effects from the perspective of technical, business, environmental, and societal factors.

The services segment is expected to account for the largest share in the components segment during the forecast period.

Services are a key component in the pipeline safety market, this is due to the increasing demand for expert guidance, system integration, and support to manage and maintain pipeline safety systems. As pipeline operators face complex safety challenges, regulatory requirements, and the need for ongoing monitoring, proactive maintenance, and incident response services, the services segment will experience significant growth.

Pipeline Safety Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Pipeline Safety market”

- Asia Pacific is expected to dominate and the highest market share during the forecast period. With the rising awareness about the increase in business productivity, supplemented with competently designed pipeline safety platforms offered by vendors present in this region, Asia Pacific is becoming a highly potential market

- Countries such as China, India, and Australia are expanding their pipeline networks to meet rising energy demands, which increases the need for advanced safety measures. In particular, China's ambitious energy development plans and India's growing pipeline infrastructure for natural gas and oil transportation are driving the demand for pipeline safety technologies.

“North America is Projected to Register the Highest CAGR in the Pipeline Safety Market

- The North America region is anticipated to register the highest compound annual growth rate (CAGR) in the Pipeline Safety Market, due to its extensive pipeline infrastructure and advanced technological adoption. The United States, in particular, plays a key role as it has a large network of pipelines transporting natural gas, crude oil, and refined products across vast distances, both onshore and offshore.

- Moreover, the increasing need for safeguarding pipelines in high-risk environments, such as the Gulf of Mexico and in shale oil fields, further propels demand for robust pipeline safety solutions.

- Additionally, North America benefits from significant investments in pipeline infrastructure upgrades, including the adoption of smart technologies to minimize risks and ensure operational safety.

Pipeline Safety market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Siemens AG (Germany)

- Schneider Electric (France

- Baker Hughes (US)

- Honeywell (US

- Huawei Technologies (China)

- AVEVA (UK)

- PSI AG (Germany)

- BAE Systems (UK)

- TransCanada (Canada)

- Atmos International (UK)

- Clampon AS (Norway)

- FFT (Australia)

- Perma-Pipe (US)

- Senstar (Canada)

- Syrinix (UK)

- RADIOBARRIER (Russia

- Pure Technologies (Canada)

- C-Fer Technologies (Canada)

- Total Safety (US)

- Krohne Group (Germany)

- PLM CAT (US)

- Leater (Ukraine)

- TTK (France)

Latest Developments in Global Pipeline Safety market

- In March 2025, Honeywell launched its SafePipeline Monitoring System, a next generation pipeline safety solution designed to provide real time data on pipeline integrity. The system integrates advanced leak detection, corrosion monitoring, and predictive analytics powered by IoT sensors. This product aims to enhance operational safety and reduce the risk of pipeline failures, particularly in remote and offshore pipeline networks, meeting the growing demand for advanced safety technologies in the pipeline industry

- In February 2025, TransCanada and Enbridge announced a merger to create a more robust and integrated pipeline safety solution provider. The combined entity, focusing on North American and international pipeline infrastructure, will pool resources to develop and deploy state-of-the-art pipeline monitoring systems and leak detection technologies. This merger is expected to optimize pipeline safety measures and set new industry standards for monitoring, security, and real-time data analytics

- In January 2025, Siemens entered into a strategic partnership with Atmos International to deploy advanced pipeline leak detection systems across North America and Europe. The partnership combines Siemens’ expertise in industrial automation with Atmos International’s proprietary pipeline monitoring software. This collaboration aims to offer customers cutting-edge solutions for real-time leak detection, predictive maintenance, and pipeline integrity management, thus ensuring safer and more efficient pipeline operations.

- In December 2024, Honeywell acquired Senstar, a leading provider of physical security systems, including perimeter intrusion detection systems for pipeline security. The acquisition will help Honeywell expand its portfolio of pipeline safety products and strengthen its capabilities in perimeter security and surveillance. The integration of Senstar’s technology will allow Honeywell to offer more comprehensive security solutions, including monitoring and real-time response capabilities, improving pipeline protection against both physical threats and operational hazards.

- In November 2024, Schneider Electric launched an AI-driven pipeline monitoring platform that integrates machine learning and advanced analytics to detect anomalies and predict potential pipeline failures. The platform analyzes real time data from various sensors installed along pipelines to identify leaks, pressure changes, and other critical factors. The innovation is expected to significantly reduce operational costs and prevent pipeline accidents by providing operators with proactive maintenance recommendations and early warnings.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.