Asia Pacific Road Safety Market

Market Size in USD Billion

CAGR :

%

USD

693.80 Billion

USD

1.74 Billion

2024

2032

USD

693.80 Billion

USD

1.74 Billion

2024

2032

| 2025 –2032 | |

| USD 693.80 Billion | |

| USD 1.74 Billion | |

|

|

|

|

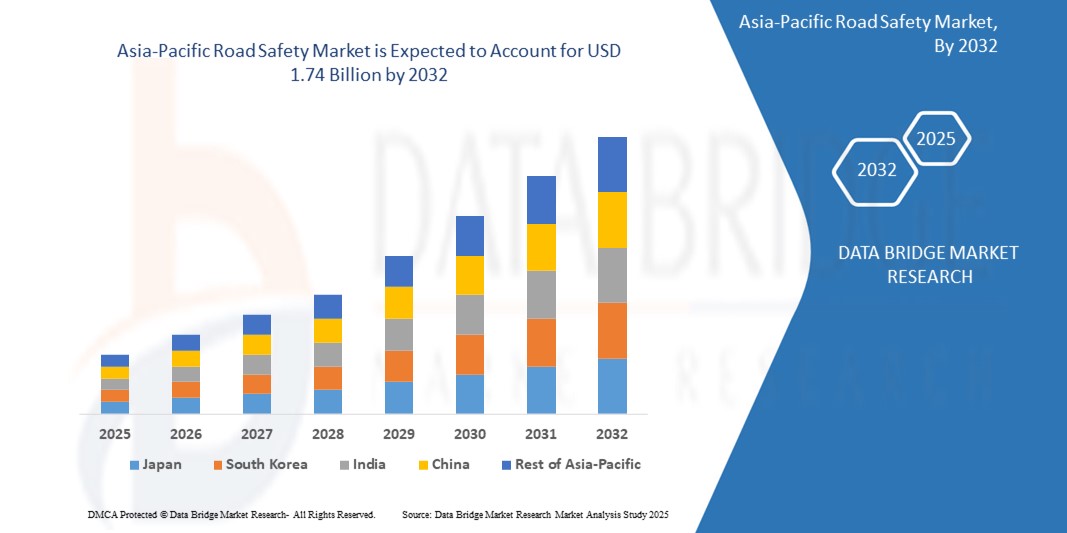

Asia-Pacific Road Safety Market Size

- The Asia-Pacific Road Safety Market size was valued at USD 693.8 million in 2024 and is expected to reach USD 1.74 billion by 2032, at a CAGR of 12.20% during the forecast period.

- This growth is driven by Growing concerns over traffic fatalities are prompting stricter laws and demand for safety tech.

Asia-Pacific Road Safety Market Analysis

- Expansion of smart city infrastructure is fuelling demand for intelligent traffic systems. Cubic Corporation deployed advanced traffic management in major U.S. cities like San Diego.

- AI-powered surveillance and real-time monitoring are enhancing safety capabilities. Axis Communications and Verra Mobility have introduced smart camera systems with license plate recognition since 2022.

- China holds a significant market share due to Technological Advancements.

- China is expected to register the fastest growth, fuelled by Increasing Investments in Infrastructure.

- The Solutions segment is projected to account for a significant market share of approximately 66.2% in 2025, driven by growth in Smart City Development.

Report Scope and Asia-Pacific Road Safety Market Segmentation

|

Attributes |

Asia-Pacific Road Safety Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Road Safety Market Trends

“Cloud-Based Solutions”

- The shift towards cloud deployment offers enhanced scalability and flexibility. Cloud-based road safety solutions allow for rapid adjustments in response to changing traffic conditions, ensuring optimal performance and reliability.

- The incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT) into road safety systems is revolutionizing traffic management. AI algorithms analyze data from IoT devices to provide real-time insights, enabling predictive maintenance and proactive incident response.

- In April 2024, FLIR introduced the Trafibot AI camera to enhance interurban traffic flow and road safety.

- The Middle East and Africa Union mandated the inclusion of Intelligent Speed Assistance systems in all new vehicles to enhance road safety by limiting speeding, a significant cause of accidents.

Asia-Pacific Road Safety Market Dynamics

Driver

“Technological Advancements”

- The adoption of advanced technologies such as AI, IoT, and cloud computing is driving the implementation of intelligent traffic systems, enhancing road safety measures across Middle East and Africa.

- Governments are enforcing strict safety standards and investing in smart infrastructure projects, compelling industries to implement comprehensive road safety measures to ensure compliance and public safety.

- For instance, In January 2021, Cubic Corporation announced the launch of UMO platform for mobility service providers, transit agencies and riders. UMO is composed of various suites of products that help the riders to access real-time information to optimize their mobility experience, earn rewards for riding public transit, plan trips across public and private modes and conveniently pay fares. The new product increased the product portfolio of the company.

- Tristar Group Achieved over 500 million kilometers driven without a single fatality by employing advanced fatigue detection systems and participating in Dubai’s "Golden Rules for Generational Safety" campaign.

Opportunity

“Expansion in Emerging Markets”

- Rapid urbanization and increasing vehicle ownership in emerging markets present significant opportunities for road safety solution providers to expand their footprint and address the growing demand for traffic management systems.

- The incorporation of analytics capabilities such as predictive analytics and data mining into road safety platforms enables organizations to derive actionable insights from vast datasets, supporting data-driven decision-making.

- For instance, As of May 2025, Automakers like Volkswagen, Subaru, and Hyundai are reintroducing physical buttons in vehicles, moving away from touchscreens to reduce driver distraction and improve safety.

- AI-powered surveillance and real-time monitoring are enhancing safety capabilities. Axis Communications and Verra Mobility have introduced smart camera systems with license plate recognition since 2022.

Restraint/Challenge

“Integration with Legacy Infrastructure”

- Many cities have outdated traffic systems that are incompatible with modern software solutions, leading to challenges in integrating new technologies such as incident detection systems and automated enforcement software.

- The initial investment required for advanced road safety systems, including software, hardware, and professional services, can be substantial, posing a barrier for small and medium-sized municipalities.

- For instance, Limited financial resources in certain regions hinder the deployment of comprehensive road safety solutions. Integrating various systems from different vendors, like Sensys Gatso and FLIR Systems, remains a technical bottleneck.

Asia-Pacific Road Safety Market Scope

The market is segmented based on Component, Technology, and Road Type

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Technology |

|

|

By Road Type |

|

In 2025, Surveillance segment is projected to dominate the Technology segment

The Surveillance segment is expected to hold a market share of approximately 41.3% in 2025, driven by Technological Advancements.

The Cities segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Cities segment is projected to account for a market share of 27.8%, driven by Growth in Smart City Development.

“China Holds the Largest Share in the Asia-Pacific Road Safety Market”

- China dominates the market due to Rapid urbanization and increasing vehicle ownership in emerging markets present significant opportunities for road safety solution providers to expand their footprint and address the growing demand for traffic management systems.

- The China holds a significant share, driven by Smart City and IoT Initiatives.

- In April 2024, FLIR introduced the Trafibot AI camera to enhance interurban traffic flow and road safety through advanced detection performance.

“China is Projected to Register the Highest CAGR in the Asia-Pacific Road Safety Market”

- China growth is driven by Growth of IoT and Smart Devices.

- China is projected to exhibit the highest CAGR due to Growth of Semiconductor Industry.

- AI-powered surveillance and real-time monitoring are enhancing safety capabilities. Axis Communications and Verra Mobility have introduced smart camera systems with license plate recognition since 2022.

Asia-Pacific Road Safety Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- JENOPTIK AG,

- Sensys Gatso Group AB,

- INFORMATION ENGINEERING GROUP INC.,

- Kapsch TrafficCom AG,

- Redflex Holdings,

- FLIR Systems, Inc.,

- Cubic Corporation,

- VITRONIC Dr.-Ing.

- Stein Bildverarbeitungs systeme GmbH,

- Optotraffic, LLC,

- Laser Technology, Inc.,

- Motorola Solutions, Inc.,

- Verra Mobility, Siemens,

- Dahua Technology Co., Ltd,

Latest Developments in Asia-Pacific Road Safety Market

- In April 2023, In February 2021, Acusensus developed AI-enabled mobile cameras to detect drivers using phones. The technology led to a 20% reduction in fatalities in NSW over two years, compared to an 8% increase nationwide.

- In February 2021, Motorola Solutions, Inc Launched a bundled service combining body-worn cameras, cloud support, and digital evidence management software for law enforcement agencies.

- In January 2025, Cubic Corporation Introduced the UMO platform, offering real-time information, trip planning, and fare payment solutions to enhance mobility experiences.

- As of May 2025, automakers like Volkswagen, Subaru, and Hyundai are reintroducing physical buttons in vehicles to reduce driver distraction caused by touchscreens.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.