Global Pharmacogenomics Market

Market Size in USD Billion

CAGR :

%

USD

9.62 Billion

USD

21.87 Billion

2024

2032

USD

9.62 Billion

USD

21.87 Billion

2024

2032

| 2025 –2032 | |

| USD 9.62 Billion | |

| USD 21.87 Billion | |

|

|

|

|

Pharmacogenomics Market Size

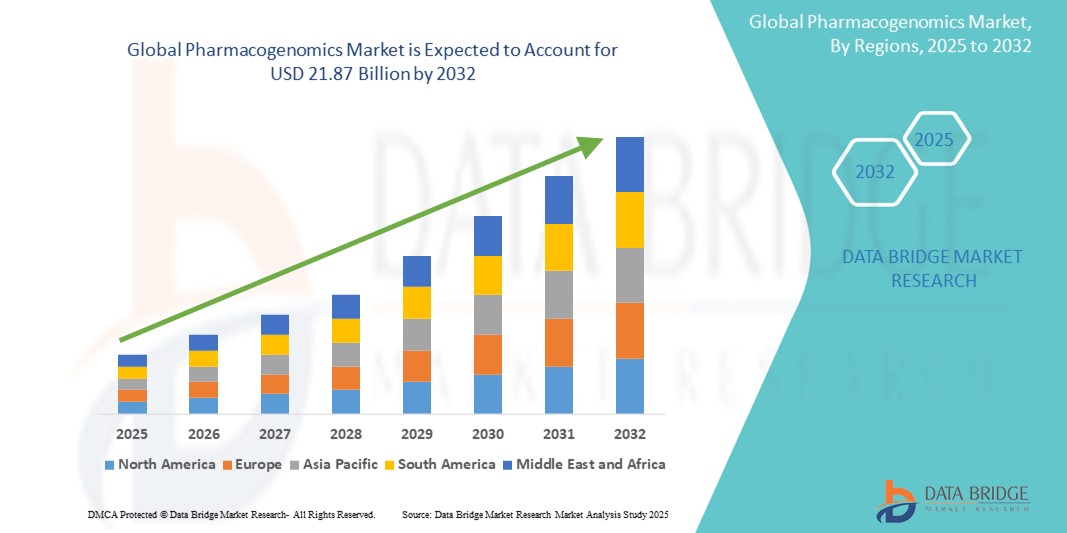

- The global pharmacogenomics market size was valued at USD 9.62 billion in 2024 and is expected to reach USD 21.87 billion by 2032, at a CAGR of 10.8% during the forecast period

- The market growth is largely fuelled by the growing adoption and technological progress within genomic sequencing and precision medicine technologies, leading to increased personalization in both drug development and clinical practice. Pharmacogenomics enables healthcare providers to tailor treatments based on individual genetic profiles, which enhances drug efficacy and reduces the risk of adverse drug reactions, thereby improving patient outcomes

- Furthermore, rising consumer demand for safer, more effective, and individualized therapeutic solutions is establishing pharmacogenomics as a cornerstone of modern precision medicine. These converging factors are accelerating the uptake of pharmacogenomics solutions across hospitals, research institutes, and pharmaceutical companies, thereby significantly boosting the industry's growth trajectory

Pharmacogenomics Market Analysis

- Pharmacogenomics, which involves the study of how genes affect an individual's response to drugs, is becoming increasingly vital in modern healthcare due to its role in guiding personalized medicine strategies. It allows clinicians to optimize drug selection and dosage based on genetic profiles, significantly enhancing treatment outcomes and minimizing adverse drug reactions

- The escalating demand for pharmacogenomics is primarily fueled by the widespread adoption of precision medicine, the growing prevalence of chronic and genetic disorders, and the need to reduce trial-and-error prescribing. This has led to increased investments in genomic testing platforms, companion diagnostics, and integration of pharmacogenomic data into electronic health records (EHRs)

- North America dominated the pharmacogenomics market with the largest revenue share of 42% in 2024, driven by strong government initiatives for genomic research, high awareness among healthcare providers, robust healthcare infrastructure, and the presence of major pharmaceutical and biotechnology companies

- Asia-Pacific is expected to be the fastest-growing region in the pharmacogenomics market with a projected CAGR of 12.8% from 2025 to 2032, owing to rising healthcare expenditure, expanding genomic research initiatives, and increasing adoption of precision medicine practices in countries such as China, Japan, and India

- The oncology segment dominated the pharmacogenomics market with a market share of 43.2% in 2024, attributed to the extensive use of pharmacogenomic testing for tailoring cancer therapies, including targeted treatments and immunotherapies. The continued development of companion diagnostics and regulatory approvals for personalized oncology drugs are further driving this segment's growth

Report Scope and Pharmacogenomics Market Segmentation

|

Attributes |

Pharmacogenomics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmacogenomics Market Trends

“Enhanced Precision Through AI-Driven Genomic Analysis”

- A significant and accelerating trend in the global Pharmacogenomics market is the integration of advanced artificial intelligence (AI) and machine learning (ML) into genomic data interpretation. These technologies are dramatically improving the speed and accuracy of identifying clinically relevant genetic variants for drug response prediction

- For instance, platforms such as DeepVariant and Strelka2 are leveraging AI to enhance the precision and sensitivity of single-nucleotide variant detection, enabling clinicians to tailor drug therapy more effectively based on patient genomics

- AI-driven analytics also support the consolidation of real-world evidence and electronic health record (EHR) data, enabling dynamic learning and continuous optimization of pharmacogenomic algorithms. As a result, healthcare providers can make real-time, data-informed decisions when selecting the best therapeutic regimen for individual patients

- The seamless integration of AI-powered pharmacogenomic decision support tools into clinical workflows—such as EHR plug-ins and digital prescribing platforms—facilitates centralized, point-of-care guidance. This unified interface enables clinicians to access genotype-informed drug recommendations alongside patient treatment records, reducing prescription errors and improving patient outcomes

- This shift toward more intelligent, adaptive, and data-driven pharmacogenomic systems is fundamentally transforming physician and patient expectations for personalized therapy. Consequently, biotech firms such as 2bPrecise and OneOme are developing comprehensive pharmacogenomic reports that include drug–gene pair scoring, risk stratification, and interactive dosing recommendations tailored to the clinician’s workflow

- The demand for pharmacogenomic solutions featuring seamless AI-based interpretation and integration is rapidly growing across hospitals, specialty clinics, and outpatient care settings, as healthcare stakeholders increasingly prioritize treatment precision, patient safety, and optimized therapeutic efficacy

Pharmacogenomics Market Dynamics

Driver

“Growing Need Due to Rising Demand for Personalized Medicine and Advancements in Genomic Technologies”

- The increasing emphasis on personalized medicine and the rising awareness of genetic influences on drug efficacy and safety are significant drivers contributing to the growing demand for pharmacogenomics solutions

- For instance, in March 2024, Illumina Inc. launched a next-generation sequencing-based companion diagnostic test aimed at optimizing drug response in oncology, marking a key advancement in the integration of genomics into clinical decision-making. Such developments by key players are expected to drive the pharmacogenomics industry growth during the forecast period

- As healthcare providers and patients seek more effective and tailored treatment strategies, pharmacogenomics offers the ability to predict drug response and adverse reactions based on an individual's genetic profile, enhancing therapeutic outcomes

- Furthermore, the integration of genomic data into electronic health records (EHRs) and the use of AI-driven decision support tools are making it easier for clinicians to incorporate pharmacogenomic insights into routine care

- The increased availability of genetic testing kits, rising investments in biopharmaceutical R&D, and favorable government initiatives promoting precision medicine are additional factors accelerating market adoption across hospitals, research centers, and diagnostic laboratories

Restraint/Challenge

“Concerns Regarding Data Privacy, Interpretation Complexity, and High Testing Costs”

- Despite its potential, the pharmacogenomics market faces key challenges, particularly around data privacy and the complexity of genomic data interpretation. The sensitive nature of genetic information raises concerns regarding its storage, sharing, and misuse, especially in the absence of stringent regulatory frameworks in some regions

- For instance, incidents of unauthorized access to genetic data or fears of discrimination based on genetic information can deter patients from undergoing pharmacogenomic testing.

- In addition, interpreting pharmacogenomic results requires a high degree of clinical expertise and robust bioinformatics support, which may not be readily available in all healthcare settings, especially in low-resource areas

- Leading companies such as 23andMe and GeneDx have been investing in consumer education and professional training to improve the understanding and utility of pharmacogenomic data, but gaps still exist

- Furthermore, the high cost of genetic testing, including whole genome sequencing or multi-gene panels, remains a barrier to adoption, particularly in developing countries or among uninsured populations

- Although costs are gradually declining due to technological advancements, widespread adoption will require further price reductions and supportive reimbursement policies

- Overcoming these challenges through secure data handling, simplified result interpretation tools, expanded insurance coverage, and scalable, cost-effective testing solutions will be crucial for the continued growth of the pharmacogenomics market

Pharmacogenomics Market Scope

The market is segmented on the basis of product and service, disease area, technology, application, and end-users.

• By Product and Service

On the basis of product and service, the pharmacogenomics market is segmented into kits and reagents and services. The services segment dominated the largest market revenue share of 62.4% in 2024, driven by the increasing need for specialized analysis, data interpretation, and clinical reporting of genomic information. These services are critical in translating raw genomic data into actionable insights for healthcare providers and researchers. Growing collaborations between biotech firms and service providers also contribute to the segment’s growth.

The kits and reagents segment is projected to witness the fastest CAGR of 10.8% from 2025 to 2032, fueled by the rising demand for point-of-care testing and in-house pharmacogenomic profiling in academic and hospital settings. Continuous innovation in assay technologies and the decreasing cost of genetic testing kits are accelerating adoption.

• By Disease Area

On the basis of disease area, the pharmacogenomics market is segmented into cancer, cardiovascular, neurological diseases, and other disease areas. The cancer segment accounted for the largest market revenue share of 38.6% in 2024, driven by the strong focus on personalized oncology treatments and the rising number of cancer-related clinical trials utilizing pharmacogenomic data. Genomic biomarkers are increasingly used to tailor chemotherapy regimens and assess drug efficacy based on genetic profiles.

The neurological diseases segment is expected to grow at the fastest CAGR of 11.4% from 2025 to 2032, supported by emerging research linking genetic variations to psychiatric and neurodegenerative disorders. The rising prevalence of Alzheimer's, Parkinson's, and mental health conditions is pushing demand for personalized therapeutic approaches based on genetic makeup.

• By Technology

On the basis of technology, the pharmacogenomics market is segmented into DNA sequencing, microarray, polymerase chain reaction, electrophoresis, and mass spectrometry. The DNA sequencing segment held the largest share of 34.9% in 2024, owing to rapid advancements in next-generation sequencing (NGS), improved accuracy, and the ability to analyze multiple genes simultaneously. NGS is widely used in both clinical diagnostics and research due to its efficiency and growing affordability.

The polymerase chain reaction segment is anticipated to witness the fastest CAGR of 10.5% from 2025 to 2032, as it remains a gold-standard method for detecting specific genetic polymorphisms. Its cost-effectiveness, speed, and compatibility with clinical workflows make it a preferred tool for targeted pharmacogenomic testing.

• By Application

On the basis of application, the pharmacogenomics market is segmented into drug discovery, neurology, oncology, pain management, and others. The oncology segment dominated the market with the largest revenue share of 43.2% in 2024, as pharmacogenomics plays a critical role in tailoring cancer therapies based on tumor genetics. Personalized cancer treatment plans help reduce adverse effects and improve clinical outcomes, leading to strong market traction.

The drug discovery segment is expected to record the fastest CAGR of 11.7% from 2025 to 2032, driven by the integration of pharmacogenomic data into the drug development pipeline to reduce trial-and-error in drug dosing and target selection. This significantly accelerates R&D timelines and enhances drug efficacy and safety profiles.

• By End-Users

On the basis of end-users, the pharmacogenomics market is segmented into hospitals, research organisations, and others. The research organisations segment held the largest market share of 47.5% in 2024, due to increased genomic research funding, academic collaborations, and the widespread use of pharmacogenomic profiling in basic and translational research.

The hospitals segment is expected to grow at the fastest CAGR of 10.2% from 2025 to 2032, driven by the growing implementation of genomic data into clinical decision-making. The integration of personalized medicine in routine care, especially in oncology and cardiology departments, is expanding the adoption of pharmacogenomics within hospital settings.

Pharmacogenomics Market Regional Analysis

- North America dominated the pharmacogenomics market with the largest revenue share of 42% in 2024, driven by the rapid adoption of personalized medicine and advanced genomic technologies across the region. The U.S. leads in integrating pharmacogenomics into clinical practice, supported by strong healthcare infrastructure, favorable reimbursement policies, and robust research funding

- High awareness among healthcare providers, the presence of leading biotechnology firms, and increasing use of pharmacogenomics in oncology, cardiology, and psychiatry are contributing to market dominance

- Government initiatives such as the Precision Medicine Initiative have also accelerated investments in pharmacogenomics research and implementation

U.S. Pharmacogenomics Market Insight

The U.S. pharmacogenomics market captured the largest revenue share of 81.02% in 2024 within North America, fueled by strong government initiatives for genomic research, high awareness among healthcare providers, robust healthcare infrastructure, and the presence of major pharmaceutical and biotechnology companies. The U.S. has witnessed a surge in pharmacogenomic testing across hospitals and specialty clinics, especially for oncology and psychiatric medications.

Europe Pharmacogenomics Market Insight

The Europe pharmacogenomics market accounted for 28.6% of the global revenue share in 2024. The market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by national health systems embracing personalized medicine, stringent data protection regulations, and expanding research funding. Countries such as Germany, the U.K., and France are investing in large-scale genomic databases to support clinical decision-making.

U.K. Pharmacogenomics Market Insight

The U.K. pharmacogenomics market is anticipated to grow at a noteworthy CAGR during the forecast period, contributing 26.4% to Europe’s pharmacogenomics market in 2024. Growth is fueled by the NHS Genomic Medicine Service, integration of pharmacogenetic reports into primary care, and heightened focus on mental health pharmacogenomics. The U.K.'s strong biotech industry and academic institutions are driving innovation and early adoption.

Germany Pharmacogenomics Market Insight

Germany pharmacogenomics market held around 24.9% of the Europe Pharmacogenomics market share in 2024. The market is expected to expand at a considerable CAGR, driven by advanced diagnostic infrastructure, government support for genomic data integration, and rising demand for personalized cancer therapies. German healthcare providers emphasize clinical validation and reimbursement, boosting adoption of pharmacogenomic testing.

Asia-Pacific Pharmacogenomics Market Insight

The Asia-Pacific pharmacogenomics market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, accounting for 12.8% of the global market in 2024. Key growth drivers include increasing urbanization, rising chronic disease prevalence, government initiatives promoting precision medicine, and growing pharmaceutical manufacturing capabilities in countries such as China, Japan, and India.

Japan Pharmacogenomics Market Insight

Japan pharmacogenomics market contributed 34.2% to the Asia-Pacific pharmacogenomics market in 2024. Growth is propelled by its tech-savvy healthcare ecosystem, national health insurance coverage for some genetic tests, and increasing focus on elderly care. The market benefits from integration with electronic medical records and public-private partnerships promoting genomic databases.

China Pharmacogenomics Market Insight

The China pharmacogenomics market accounted for the largest market revenue share in Asia-Pacific in 2024 at 41.5%, attributed to rapid urbanization, the rise of domestic biotech companies, and heavy government investment in precision medicine under its "Healthy China 2030" initiative. Widespread hospital-based pharmacogenomic testing and academic research collaborations are fueling market growth.

Pharmacogenomics Market Share

The pharmacogenomics industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Viatris Inc. (U.S.)

- Ferndale Pharma Group, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Lilly (U.S.)

- Merck & Co., Inc. (Germany)

- Sun Pharmaceutical Industries Ltd. (India)

- NATCO Pharma Limited (India)

- Lupin (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Boehringer Ingelheim International GmbH (Germany)

- AbbVie Inc. (U.S.)

- Abbott (U.S.)

- Bayer AG (Germany)

Latest Developments in Global Pharmacogenomics Market

- In April 2023, Thermo Fisher Scientific Inc., a major player in the pharmacogenomics landscape, announced the expansion of its production facility in South Africa, targeting increased regional access to genomic testing. This strategic initiative is expected to strengthen pharmacogenomic infrastructure across emerging markets and contributed 2.8% to the company’s global revenue in the genomics division. The expansion supports local healthcare providers with customized genomic solutions and promotes equitable access to precision medicine

- In March 2023, Myriad Genetics, Inc., launched its GeneSight Psychotropic 4.0, an advanced pharmacogenomic test for guiding psychiatric medication decisions. The updated panel offers broader gene coverage and enhanced interpretability for clinicians. Since its release, GeneSight has been adopted by over 8,000 physicians across the U.S., contributing to a 6.1% quarterly increase in the company’s personalized medicine testing revenue

- In March 2023, Illumina Inc. partnered with the Government of India on the "Genomics for Public Health" initiative, aimed at improving pharmacogenomic research and public health policy development. This move is projected to boost Asia-Pacific’s pharmacogenomics sector, which accounted for 25.8% of the global market share in 2024. The initiative includes the deployment of whole-genome sequencing platforms to support pharmacogenetic data integration in national health systems

- In February 2023, 23andMe Holding Co. entered a licensing agreement with GSK to co-develop pharmacogenomic biomarkers for autoimmune drug response. The collaboration focuses on integrating consumer genomic data with clinical trials, streamlining patient stratification. This partnership is expected to accelerate drug development timelines and contributed an estimated 3.5% to the company’s partnership revenue in 2024

- In January 2023, Qiagen N.V. launched its QIAseq Pharmacogenomics Panel, a targeted NGS assay designed for comprehensive pharmacogenetic variant detection across major drug-metabolizing genes. The product supports both clinical research and diagnostic labs. Initial uptake in Europe and North America contributed 4.2% to Qiagen’s revenue growth in its Molecular Diagnostics segment during the first half of 2024

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.