Global Pharmaceutical Plastic Packaging Market

Market Size in USD Million

CAGR :

%

USD

4,407.50 Million

USD

7,860.68 Million

2021

2029

USD

4,407.50 Million

USD

7,860.68 Million

2021

2029

| 2022 –2029 | |

| USD 4,407.50 Million | |

| USD 7,860.68 Million | |

|

|

|

|

Market Analysis and Size

A suitable selection of raw materials is very important for the packaging of the product. Plastic is the best option for pharmaceutical product packaging because it is highly hygienic.

On the other hand, this material is very safe in case of the break because plastic material minimizes possible cuttings and injuries unlike other materials like glass. One of the most important purposes of plastic packaging is to protect the products from the damaging effects from the outer environment. Manufacturers of the plastic packaging are evolving the packaging solutions which possess anti-counterfeiting features, tamper-evident and particularly for the pharma industry.

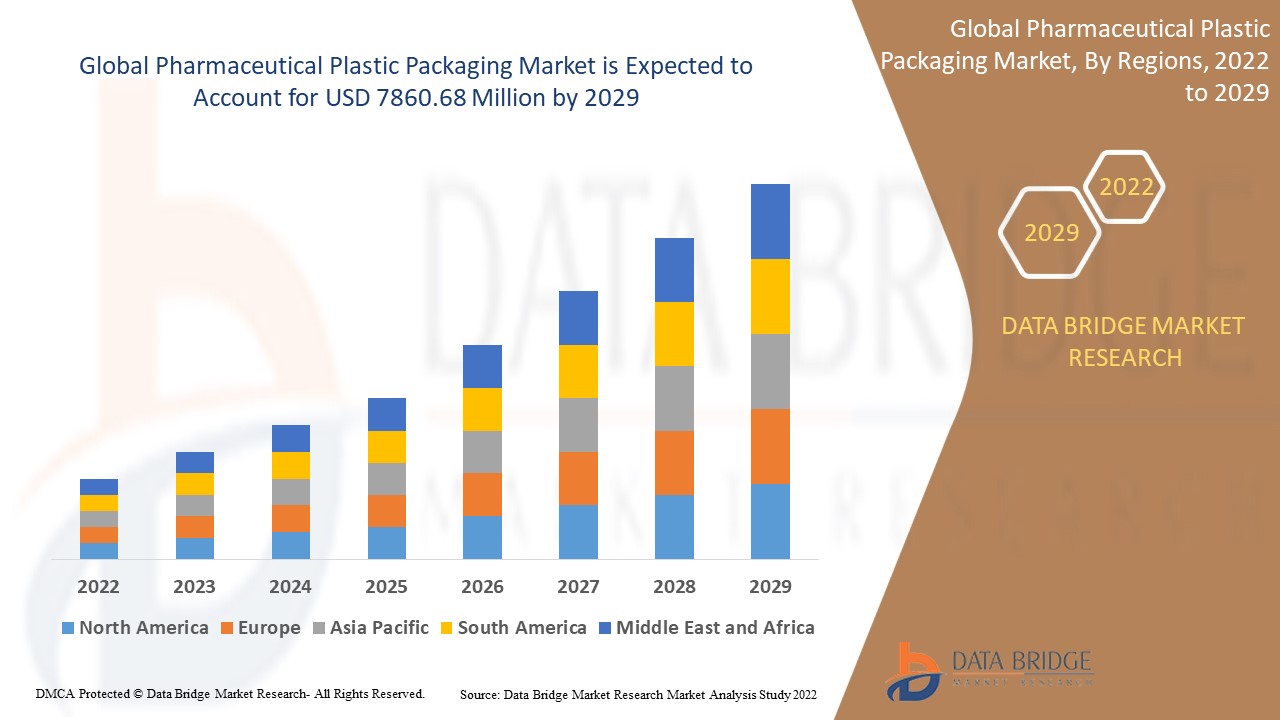

Data Bridge Market Research analyses that the pharmaceutical plastic packaging market was valued at USD 4407.50 million in 2021 and is expected to reach USD 7860.68 million by 2029, registering a CAGR of 7.50 % during the forecast period of 2022 to 2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, patent analysis and technological advancements.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Material (Polyethylene, Polypropylene, Polyethylene terephthalate (PET), Polyvinyl Chloride (PVC)), Packaging (Flexible Packaging, Rigid Packaging), Product (Ampoules and Vials, Bottles, Blister Packs, Trays) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Gerresheimer AG (Germany), SCHOTT AG (Germany), Alpha Packaging (US), Klöckner Pentaplast (Germany), Amcor Plc (Switzerland), Berry Global, Inc (US), BD (US), Parekhplast India Ltd (India), West Pharmaceutical Services, Inc (US), Wipak Group (Finland), Mondi (UK), Sealed Air (US), Constantia Flexibles (Austria), Clondalkin Group (The Netherlands), Huhtamaki (Finland), Transcontinental Inc. (Canada), Crown (US), Westrock company (US), Drug plastics Group (US), SGD Pharma (India) |

|

Market Opportunities |

|

Market Definition

Packaging is an essential part of the pharmaceutical product. Packaging is often involved in dosing, and the use of pharmaceutical products. Communication of cautionary labels and proper use are also regulated. There are numerous types of plastic packaging for a pharmaceutical products. Manufacturers are often used to create shielding layers for other packaging materials such as closures and lids, durable pharmaceutical casing for plastic packaging, and more. The most frequently used plastic is thermoset plastics, including epoxy resins, melamine-formaldehyde, and phenol-formaldehyde.

Pharmaceutical Plastic Packaging Market Dynamics

Drivers

- Rise the demand of polyethylene terephthalate (PET) plastic material

Pharma packaging will shift towards the more ecological materials by moving away from the use of plastic, the industry traditionally has been mainly depend on the design and manufacturing. But, the industry would continue the application of polyethylene terephthalate (PET) due to its high capability of breaking down its molecular level back into PET.

- Rise the adoption due to different properties

Increase the demand for plastic packaging is witnessing important growth from the pharmaceutical industry because of its unmatched capability to be form both flexible and rigid containers. Additional features that led to increase the adoption in pharma is barrier property against high dimensional stability, high impact strength, moisture, resistance to strain, transparency, resistance to heat and flame, low water absorption, and extension of expiry dates.

- Growing the demand of child resistant packaging

Mainly plastic bottles are used for pharmaceutical packaging which consist of child-resistant closure and caps. According to the US FDA, pharmaceutical plastic packaging manufacturers have to use the label to highlight the “child-resistant packaging” on the product to apprise the customer. Pouches and Ziplock bags are also gaining substantial pull in the global pharmaceutical plastic packaging market because it requires a skill to slide a zipper and access the product, which helps to keeping the package product away from the children.

Opportunities

Technological advancements in the pharmaceutical plastic packaging industry and enhancing the pressure to dispatch sensitive and novel medicines, especially those product which having less shelf life are pushing demand for active packaging solutions. Inventory tracking and Supply chain drama a dynamic role in safe drug delivery from lab to the market. The growth of advanced healthcare and better infrastructure, coupled with the growth of pharmaceutical companies through partnerships and alliances, is set to increase the growth of the pharmaceutical plastic packaging market during the forecast period. Furthermore, increase in emerging new market and strategic collaborations will also act as market drivers and further increase advantageous opportunities for the market's growth rate.

Restraints/ Challenges

Government imposed stringent regulations for using plastic packaging which may act as a restriction but to a lower extent. It has negatively impacted the manufacturer’s profit. The regulatory authorities ensure that the raw material which is used for the pharmaceutical packaging is biodegradable. The packaging industry needs to make sure that the packaging will be sustainable while also ensuring low costs. The use of biodegradable raw materials prices higher than their non-biodegradable which increase the production costs, additional growing the cost pressure and restraining the growth of the pharmaceutical plastic packaging market.

This pharmaceutical plastic packaging market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the pharmaceutical Plastic Packaging market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Pharmaceutical Plastic Packaging Market

COVID-19 pandemic era of prevalent packaging industries were responding to the rapid challenges arising from the need to change the business process and disruption in the supply chain. The outbreak of COVID-19 has considerably augmented the demand for several pharmaceutical drugs overall the globe. This boosts the demand for pharmaceutical manufacturing and their packaging, which helps grow the pharmaceutical plastic packaging market. Rapid production and development of the vaccine in the last few years are anticipated to upsurge pharmaceutical manufacturing, which primarily increases the demand for plastic packaging in the pharmaceutical sector in the upcoming period.

Recent Development

- In April 2021, Amcor launched a new-fangled AmSky blister system which comes across to thermoform blister packaging it is based on recyclable polyethylene for adhering the demand of pharmaceutical packaging.

- In January 2020, Gerresheimer AG extended its production capacities in plants based out of India and China to manufacture pharmaceutical plastic packaging.

Global Pharmaceutical Plastic Packaging Market Scope

The pharmaceutical plastic packaging market is segmented on the basis of materials, packaging and products. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Polyethylene

- Polypropylene

- Polyethylene terephthalate (PET)

- Polyvinyl Chloride (PVC))

Packaging

- Flexible Packaging

- Rigid Packaging

Product

- Ampoules and Vials

- Bottles

- Blister Packs

- Trays

Pharmaceutical Plastic Packaging Market Regional Analysis/Insights

The pharmaceutical plastic packaging market is analysed and market size insights and trends are provided by country, materials, packaging and products as referenced above.

The countries covered in the pharmaceutical plastic packaging market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

During the forecast period, Asia-Pacific dominates the pharmaceutical plastic packaging market in terms of revenue and market share. This is due to the growing demand for pharmaceutical plastic packaging in this region. The Asia-Pacific region leads the pharmaceutical plastic packaging market due to growth in awareness of environmental issues, new packaging material expansion, and the adoption of new regulatory requirements on recycling packages in this region.

During the projected period, North America is anticipated to be the fastest developing region due to the Presence of a large number of major market players in this region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Pharmaceutical Plastic Packaging Market Share Analysis

The pharmaceutical plastic packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to pharmaceutical plastic packaging market.

Some of the major players operating in the pharmaceutical plastic packaging market are:

- Gerresheimer AG (Germany)

- SCHOTT AG (Germany)

- Alpha Packaging (US)

- Klöckner Pentaplast (Germany)

- Amcor Plc (Switzerland)

- Berry Global, Inc (US)

- BD (US)

- Parekhplast India Ltd (India)

- West Pharmaceutical Services, Inc (US)

- Wipak Group (Finland)

- Mondi (UK)

- Sealed Air (US)

- Constantia Flexibles (Austria)

- Clondalkin Group (Netherlands)

- Huhtamaki (Finland)

- Transcontinental Inc. (Canada)

- Crown (US)

- Westrock company (US)

- Drug plastics Group (US)

- SGD Pharma (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pharmaceutical Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.