Global Personal Health Devices Market

Market Size in USD Billion

CAGR :

%

USD

17.51 Billion

USD

37.28 Billion

2024

2032

USD

17.51 Billion

USD

37.28 Billion

2024

2032

| 2025 –2032 | |

| USD 17.51 Billion | |

| USD 37.28 Billion | |

|

|

|

|

Personal Health Devices Market Analysis

The personal health devices market is experiencing significant growth, driven by advancements in technology, increasing health awareness, and the rising prevalence of chronic diseases. Recent developments in wearable technology, such as smartwatches and fitness trackers, have transformed how individuals monitor their health. Companies such as Apple and Fitbit are continuously enhancing their devices with features that track vital signs, sleep patterns, and physical activity, promoting a proactive approach to health management. In addition, the integration of artificial intelligence (AI) and machine learning in personal health devices is revolutionizing data analysis, enabling users to receive personalized health insights and recommendations. Furthermore, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring solutions, leading to a surge in demand for personal health devices that facilitate health tracking from home. As consumers prioritize their health and well-being, the market for personal health devices continues to expand, presenting numerous opportunities for manufacturers and healthcare providers alike.

Personal Health Devices Market Size

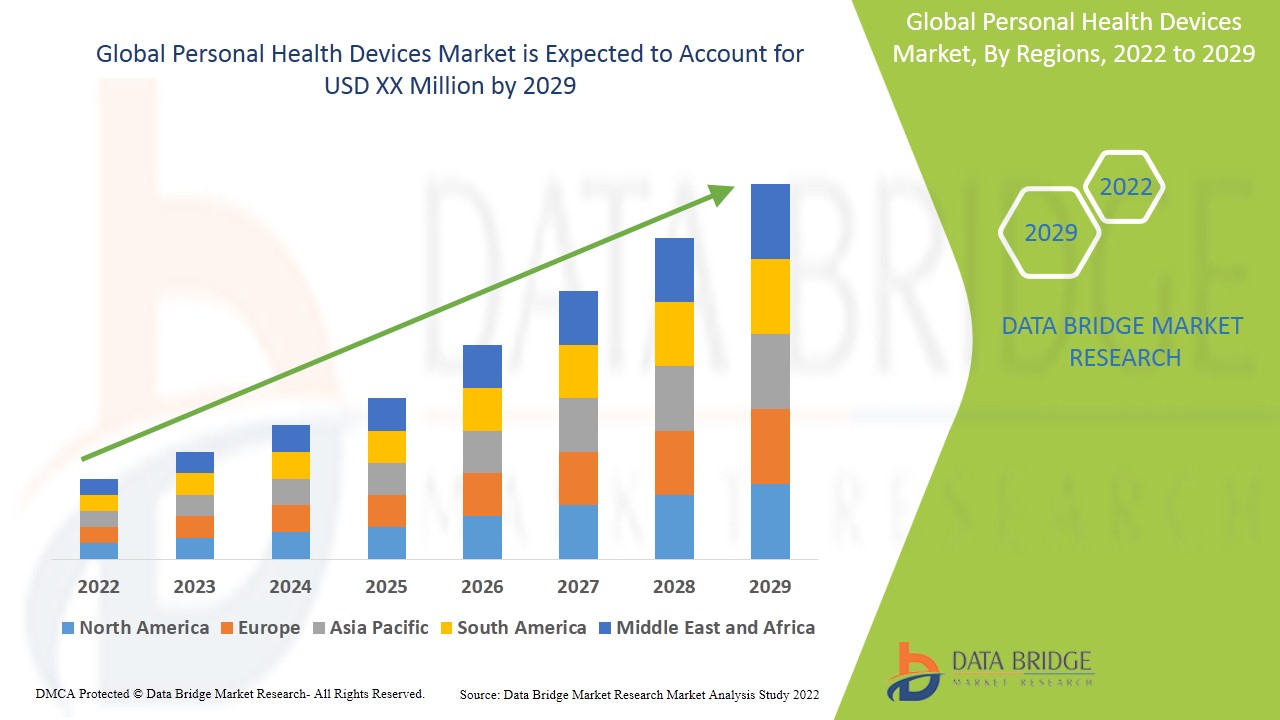

The global personal health devices market size was valued at USD 17.51 billion in 2024 and is projected to reach USD 37.28 billion by 2032, with a CAGR of 8.60% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Personal Health Devices Market Trends

“Increasing Integration of Artificial Intelligence (AI)”

The global personal health devices market is experiencing significant growth, driven by increasing consumer demand for personal health monitoring devices and wellness management solutions. One prominent trend in this market is the integration of artificial intelligence (AI) in personal health devices, enhancing their functionality and user experience. For instance, devices such as the Fitbit Sense leverage AI algorithms to provide personalized insights into users' health metrics, such as stress levels and sleep quality, based on real-time data analysis. This integration allows users to receive tailored recommendations, helping them make informed lifestyle choices to improve their overall well-being. In addition, the rise of telehealth services has further propelled the demand for personal health devices, as individuals seek remote monitoring options to manage chronic conditions effectively. As consumers increasingly prioritize health and wellness, the market for personal health devices is set to expand, with innovations that cater to personalized health management becoming the norm.

Report Scope and Personal Health Devices Market Segmentation

|

Attributes |

Personal Health Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

OMRON Healthcare, Inc. (Japan), MCKESSON CORPORATION (U.S.), Koninklijke Philips N.V. (Netherlands), GE Healthcare (U.S.), Drägerwerk AG & Co. KGaA (Germany), Abbott (U.S.), Medtronic (U.S.), Aerotel Medical Systems (Israel), Boston Scientific Corporation (U.S.), Garmin Ltd. (Switzerland), Microlife Corporation (Switzerland), Masimo (U.S.), AgaMatrix (U.S.), Apple, Inc. (U.S.), Qualcomm Technologies, Inc. (U.S.), Honeywell International Inc. (U.S.), Securitas Healthcare LLC (U.S.), NXP Semiconductors (Netherlands), and BodyMedia (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Personal Health Devices Market Definition

Personal health devices are wearable or portable technologies designed to monitor, track, and manage individual health and wellness. These devices can include fitness trackers, smartwatches, blood pressure monitors, glucose meters, and heart rate monitors, among others. They typically collect data on various health metrics, such as physical activity, sleep patterns, vital signs, and nutritional intake, allowing users to gain insights into their health status and make informed decisions about their lifestyle. In addition, many personal health devices can connect to mobile applications or health platforms, enabling users to access and analyze their data over time, set health goals, and receive personalized feedback and recommendations.

Personal Health Devices Market Dynamics

Drivers

- Rising Prevalence of Chronic Diseases

The rise in chronic diseases is a significant driver for the personal health devices market, as the increasing prevalence of conditions such as diabetes, hypertension, and obesity creates a heightened demand for effective monitoring solutions. For instance, according to the World Health Organization (WHO), around 422 million people worldwide have diabetes, a number that has nearly quadrupled since 1980. Such surge underscores the need for personal health devices that can help individuals track their blood glucose levels and manage their condition effectively. Similarly, the Centers for Disease Control and Prevention (CDC) reports that nearly half of all adults in the U.S. have high blood pressure, which is often asymptomatic and requires continuous monitoring to prevent severe health complications. The demand for devices such as continuous glucose monitors and blood pressure cuffs is thus driven by the necessity for regular health tracking and management among patients with chronic conditions. As these health issues continue to rise, the personal health devices market is positioned for significant growth

- Increasing Health Awareness

Increasing health awareness among consumers has emerged as a significant driver in the personal health devices market, leading individuals to invest in tools that enable active health monitoring. A survey conducted by the International Health, Racquet & Sportsclub Association (IHRSA) found that U.S. health club membership is up by 28% since 2010. Such rising consciousness is reflected in the growing popularity of personal health devices such as fitness trackers, smartwatches, and mobile health applications, which empower users to track their physical activity, sleep patterns, and vital signs. Furthermore, the Global Wellness Institute reported that the wellness economy reached $4.5 trillion in 2021, indicating a robust consumer shift toward health and well-being. As individuals increasingly seek ways to improve their overall health and longevity, the demand for personal health devices continues to surge, driving innovation and growth in the market.

Opportunities

- Increasing Personal Disposable Income Levels

The surge in personal disposable income levels presents a substantial opportunity for the Personal Health Devices Market, as consumers are increasingly willing to invest in health and wellness technologies. According to the OECD, the average household disposable income in the United States is USD 51,147 per year, allowing individuals to allocate more funds toward personal health solutions. With the rising health consciousness, consumers are gravitating toward innovative devices such as smart scales and blood pressure monitors. Such trend aligns with the increasing emphasis on preventive healthcare, prompting consumers to purchase devices that monitor vital signs and track wellness metrics, ultimately creating opportunities in the market.

- Rising Integration with Mobile Health Applications

The integration of personal health devices with mobile health applications presents a significant market opportunity, as it transforms how individuals manage their health and wellness by offering a seamless user experience that enhances engagement and retention. For instance, devices such as the Apple Watch can synchronize with the Apple Health app, enabling users to monitor various metrics, including heart rate, physical activity, and sleep quality, all in one convenient platform. Such integration empowers users to set personalized health goals, such as daily step counts or calorie intake, and receive tailored feedback based on their progress. In addition, features such as medication adherence reminders or alerts for irregular heart rates further encourage proactive health management. By providing comprehensive insights and real-time feedback, the synergy between personal health devices and mobile health applications fosters a more engaged user base and creates an opportunity for companies to enhance customer loyalty and drive sales.

Restraints/Challenges

- Rising Data Privacy and Security Concerns

Data privacy and security concerns represent a significant challenge for the personal health devices market, as the rising use of these technologies raises the risk of data breaches and unauthorized access to sensitive health information. Consumers are increasingly aware of the potential vulnerabilities associated with their health data, leading to hesitance in adopting devices that lack robust security measures. For instance, the 2020 data breach of Fitbit, where unauthorized access to user accounts led to concerns over the exposure of personal health information, including heart rate and sleep patterns. Such incidents have amplified consumer skepticism and reluctance to engage with personal health devices. Consequently, impeding the overall market growth.

- High Cost of Advanced Models

Cost barriers pose a significant challenge in the personal health devices market, as high prices for advanced technologies can limit accessibility, particularly for lower-income consumers. Despite a general trend of decreasing prices for various health devices, premium models equipped with advanced features, such as continuous glucose monitoring systems or high-end smartwatches, often remain prohibitively expensive for many potential users. For instance, the Dexcom G6, a popular continuous glucose monitor for diabetes management, can cost several hundred dollars upfront, in addition to ongoing expenses for sensors and transmitters. Such high cost can deter individuals from purchasing these devices, leaving them without critical tools for managing their health conditions effectively, decreasing market base and hampering overall market expansion.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Personal Health Devices Market Scope

The market is segmented on the basis of product type and end use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Diagnostic Devices and Monitoring Devices

- Vital Sign Monitoring Devices

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

- Sleep Monitoring Devices

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

- Electrocardiographs Fetal and Obstetric Devices

- Neuromonitoring Devices

- Electroencephalographs

- Electromyographs

- Others

- Vital Sign Monitoring Devices

- Therapeutic Devices

- Pain Management Devices

- Neurostimulation Devices

- Others

- Insulin/Glucose Monitoring Devices

- Insulin Pumps

- Others

- Rehabilitation Devices

- Accelometers

- Sensing Devices

- Ultrasound Platform

- Others

- Respiratory Therapy Devices

- Ventilators

- Positive Airway Pressure (PAP) Devices

- Portable Oxygen Concentrators

- Others

- Pain Management Devices

End Use

- Hospitals

- Homecare Settings

- Others

Personal Health Devices Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type and end use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the weight scales market, driven by a robust healthcare infrastructure that supports the adoption of advanced medical technologies. The region experiences high prevalence rates of chronic conditions such as diabetes and cardiovascular diseases, which necessitate regular monitoring of weight as a critical aspect of patient management. In addition, the increasing emphasis on preventive healthcare and wellness initiatives in North America further propels the demand for weight scales, reinforcing their importance in both clinical settings and home care environments.

Asia-Pacific region is anticipated to experience substantial growth from 2024 to 2031, driven by various factors including enhanced government initiatives aimed at raising awareness, an upsurge in medical tourism, and increased research activities within the area. In addition, the rising prevalence of overweight individuals and the adoption of healthcare solutions to improve living standards will further fuel demand for quality healthcare services. This combination of elements underscores the region's commitment to advancing healthcare and addressing public health challenges.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Personal Health Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Personal Health Devices Market Leaders Operating in the Market Are:

- OMRON Healthcare, Inc. (Japan)

- MCKESSON CORPORATION (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- GE Healthcare (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- Abbott (U.S.)

- Medtronic (U.S.)

- Aerotel Medical Systems (Israel)

- Boston Scientific Corporation (U.S.)

- Garmin Ltd. (Switzerland)

- Microlife Corporation (Switzerland)

- Masimo (U.S.)

- AgaMatrix (U.S.)

- Apple, Inc. (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Securitas Healthcare LLC (U.S.)

- NXP Semiconductors (Netherlands)

- BodyMedia (U.S.)

Latest Developments in Personal Health Devices Market

- In March 2024, Google has introduced an AI-powered Fitbit chatbot at Checkup 2024, designed to act as a personal health coach for Fitbit Premium subscribers. This chatbot is part of Google's larger initiative in AI healthcare, with the goal of providing tailored insights and recommendations through the analysis of user data

- In January 2024, Oxiline has partnered with the U.S. Army to unveil the Pressure X Pro U.S. Army Edition, a specialized device designed to meet the rigorous standards of military use. This collaboration aims to enhance the performance and reliability of pressure monitoring technology for military personnel in various operational settings. The new edition is expected to provide advanced features tailored to the unique demands of the armed forces, further strengthening the commitment to health and safety in the field

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.