Global Peptide Synthesis Market

Market Size in USD Billion

CAGR :

%

USD

4.70 Billion

USD

8.82 Billion

2022

2030

USD

4.70 Billion

USD

8.82 Billion

2022

2030

| 2023 –2030 | |

| USD 4.70 Billion | |

| USD 8.82 Billion | |

|

|

|

|

Peptide Synthesis Market Analysis and Size

Peptide synthesis is the process of chemically creating peptides by combining amino acids in a specific order. It is used in pharmaceutical research for developing new drugs and studying their interactions. It enables the production of custom-designed peptides for studying protein structure and function, as well as creating peptide-based therapies and diagnostics. Peptide synthesis also aids in high-throughput screening and drug discovery efforts.

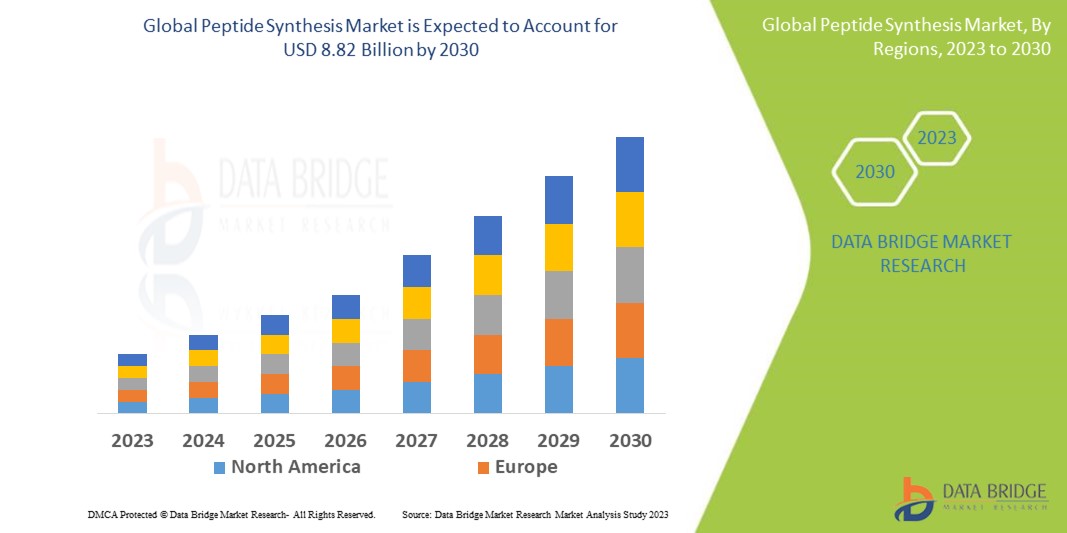

Data Bridge Market Research analyses that the Peptide synthesis Market which was USD 4.7 billion in 2022, would rocket up to USD 8.82 billion by 2030, and is expected to undergo a CAGR of 8.20% during the forecast period. “Therapeutics” dominates the application segment of the peptide synthesis market owing to the growing use of peptides for various disease conditions. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Peptide Synthesis Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Under 75%, 75-85%, Above 85%), Product (Equipment, Reagents and Consumables, Others), Technology (Solid-Phase Peptide Synthesis (SPPS), Solution-Phase Synthesis (SPS), Liquid-Phase Peptide Synthesis (LPPS), Hybrid and Recombinant), Application (Therapeutics, Diagnosis and Research), End User (Pharmaceutical and Biotechnology Companies, Contract Manufacturing Organization (CMO) or Contract Research Organization (CRO), Academic and Research Institutes) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

PolyPeptide Group (Belgium), Merck KGaA (Germany), Thermo Fisher Scientific (U.S.), Enamine Ltd (Ukraine), Alfa Chemistry (China), CEM Corporation (U.S.), GenScript (U.S.), AAPPTec (U.S.), Bachem Holding (Switzerland), AnaSpec, Inc. (U.S.), Biotage (Sweden), GYROS PROTEIN TECHNOLOGIES AB (Sweden), Advanced ChemTech (U.S.), New England Peptide, Inc. (U.S.), Guizhou Xinbang Pharmaceutical Co., Ltd. (China), Hybio Pharmaceutical Co., Ltd. (China), USV Private Limited (India), ScinoPharm Taiwan (Taiwan), CPC Scientific Inc. (U.S.). |

|

Market Opportunities |

|

Market Definition

Peptide synthesis refers to the chemical process of creating peptides, which are short chains of amino acids linked together by peptide bonds. It involves the stepwise assembly of amino acids in a specific order and often requires the protection of certain functional groups to control the reaction. Peptide synthesis can be achieved through various methods, such as solid-phase synthesis, solution-phase synthesis, or recombinant DNA technology. The goal of peptide synthesis is to produce peptides with precise sequences and desired modifications for various applications, including research, drug development, diagnostics, and therapeutics.

Peptide Synthesis Market Dynamics

Drivers

- Increasing demand for peptide-based therapeutics

Peptides offer unique advantages as therapeutics, such as high specificity, low toxicity, and favorable pharmacokinetic properties. The growing prevalence of chronic diseases, including cancer, diabetes, and cardiovascular disorders, is driving the demand for peptide-based drugs. The development of innovative peptide therapeutics and the need for efficient peptide synthesis methods are key drivers for the market.

- Expanding applications in diagnostics and imaging

Peptides play a crucial role in diagnostic applications, including the development of peptide-based biosensors, imaging agents, and biomarker. The rising demand for non-invasive and targeted diagnostic tools, such as peptide-based imaging agents for molecular imaging and peptide-based biosensors for disease detection, is driving the market growth.

Opportunities

- Advancement in therapeutics for rare diseases

Peptides offer potential solutions for treating rare genetic disorders and orphan diseases. The growth of the peptide synthesis market provides an opportunity to develop and manufacture peptide-based therapeutics targeting these conditions. Companies can focus on designing and synthesizing peptides that address specific molecular targets associated with rare diseases, thereby catering to unmet medical needs.

- Personalized medicine and precision therapeutics

Peptides can be tailored to specific patient profiles, leading to the concept of personalized medicine. With advances in genomics, proteomics, and bioinformatics, there is an opportunity for peptide synthesis companies to develop customized peptide therapies that match individual patient characteristics, such as genetic mutations or protein expression patterns. This approach can lead to more effective and targeted treatment strategies.

Restraints/Challenges

- Purification and quality control

Obtaining peptides of high purity is crucial for their successful application in research and therapeutics. Purification methods, such as high-performance liquid chromatography (HPLC), can be time-consuming and require optimization for each peptide sequence. Quality control measures are essential to ensure the accuracy, consistency, and safety of synthesized peptides. Maintaining high-quality standards and efficient purification processes can be a challenge for the peptide synthesis market.

This peptide synthesis market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the peptide synthesis market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In May 2023, PolyPeptide, a focused global CDMO for peptide- and oligonucleotide-based active pharmaceutical ingredients (APIs), and Numaferm, a German biotech company specialized in process development and production of peptides and proteins, have signed a Preferred Partner Collaboration Agreement for peptide development and production, leveraging PolyPeptide’s cGMP manufacturing capacities, regulatory know-how and market access and Numaferm’s biochemical production platform and expertise in sustainable peptide manufacturing.

- In June 2023, IRBM, an innovative contract research organization, today announced it has signed a new agreement with Merck & Co. Inc., Rahway NJ USA, known as MSD outside the USA and Canada, to continue their collaboration in the peptide therapeutics area.

Global Peptide synthesis Market Scope

The peptide synthesis market is segmented on the basis of type, product, technology, application, end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Under 75%

- 75-85%

- Above 85%

Product

- Equipment

- Reagents and Consumables

- Others

Technology

- Solid-Phase Peptide Synthesis (SPPS)

- Solution-Phase Synthesis (SPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid and Recombinant

Application

- Therapeutics

- Diagnosis

- Research

End-User

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organization (CMO) or Contract Research Organization (CRO)

- Academic and Research Institutes

Peptide synthesis Market Regional Analysis/Insights

The peptide synthesis market is analysed and market size insights and trends are provided by country, type, product, technology, application, and end user referenced above.

The countries covered in the peptide synthesis market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to dominate the peptide synthesis market due to the sturdy occurrence of major key players. Furthermore, the rise in the alertness regarding the accessible peptide synthesis technologies and the rising attention on moving the peptide drugs on a commercial scale will further boost the growth of the peptide synthesis market in the region during the forecast period.

Asia-Pacific is projected to observe significant amount of growth of the peptide synthesis market due to the rise in the investments by major key players. Moreover, the increasing consciousness regarding the novel peptide treatments and the growing healthcare expenditure is further anticipated to propel the growth of the peptide synthesis market in the region in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The Peptide synthesis Market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for Peptide synthesis Market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the Peptide synthesis Market. The data is available for historic period 2010-2020.

Competitive Landscape and Peptide synthesis Market Share Analysis

The peptide synthesis market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the peptide synthesis market are:

- PolyPeptide Group (Belgium)

- Merck KGaA (Germany)

- Thermo Fisher Scientific (U.S.)

- Enamine Ltd (Ukraine)

- Alfa Chemistry (China)

- CEM Corporation (U.S.)

- GenScript (U.S.)

- AAPPTec (U.S.)

- Bachem Holding (Switzerland)

- AnaSpec, Inc. (U.S.)

- Biotage (Sweden)

- GYROS PROTEIN TECHNOLOGIES AB (Sweden)

- Advanced ChemTech (U.S.)

- New England Peptide, Inc. (U.S.)

- Guizhou Xinbang Pharmaceutical Co., Ltd. (China)

- Hybio Pharmaceutical Co., Ltd. (China)

- USV Private Limited (India)

- ScinoPharm Taiwan (Taiwan)

- CPC Scientific Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PEPTIDE SYNTHESIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PEPTIDE SYNTHESIS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PEPTIDE SYNTHESIS MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

5.3 DETAILS OF CMO (CDMO)

5.4 PEPTIDE DRUG TRENDS

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL PEPTIDE SYNTHESIS MARKET , BY PRODCUCT TYPE

16.1 OVERVIEW

16.2 EQUIPMENT

16.2.1 PEPTIDE SYNTHESIZER

16.2.1.1. MANUAL PEPTIDE SYNTHESIZER

16.2.1.1.1. MARKET VALUE (USD MILLION)

16.2.1.1.2. MARKET VOLUME (UNIT)

16.2.1.1.3. AVERAGE SELLING PRICE (USD)

16.2.1.2. AUTOMATED PEPTIDE SYNTHESIZER

16.2.1.2.1. BATCH SYNTHESIZERS

16.2.1.2.1.1 MARKET VALUE (USD MILLION)

16.2.1.2.1.2 MARKET VOLUME (UNIT)

16.2.1.2.1.3 AVERAGE SELLING PRICE (USD)

16.2.1.2.2. CONTINUOUS FLOW SYNTHESIZERS

16.2.1.2.2.1 MARKET VALUE (USD MILLION)

16.2.1.2.2.2 MARKET VOLUME (UNIT)

16.2.1.2.2.3 AVERAGE SELLING PRICE (USD)

16.2.1.2.3. LIBRARY SYNTHESIZERS

16.2.1.2.3.1 MARKET VALUE (USD MILLION)

16.2.1.2.3.2 MARKET VOLUME (UNIT)

16.2.1.2.3.3 AVERAGE SELLING PRICE (USD)

16.2.2 CHROMATOGRAPHY EQUIPMENT

16.2.2.1. RP-HPLC CHROMATOGRAPHY

16.2.2.2. FLASH CHROMATOGRAPHY

16.2.2.3. ION-EXCHANGE CHROMATOGRAPHY

16.2.2.4. HYDROPHOBIC INTERACTION CHROMATOGRAPHY

16.2.2.5. GEL FILTRATION CHROMATOGRAPHY

16.2.2.6. SIZE EXCLUSION CHROMATOGRAPHY

16.2.2.7. HYDROPHILIC INTERACTION CHROMATOGRAPHY

16.2.2.8. OTHERS

16.2.3 LYOPHILIZER

16.2.3.1. NON-STERILE FREEZE DRYERS

16.2.3.2. STERILIZABLE FREEZE DRYERS

16.3 REAGENTS AND CONSUMABLES

16.3.1 RESINS

16.3.2 AMINO ACID

16.3.3 DYES

16.3.4 COUPLING REAGENTS

16.3.5 DYES & FLUORESCENT LABELING REAGENTS

16.3.6 OTHERS

16.4 SERVICES

16.4.1 MINIMIZE AMINO ACID OXIDATION

16.4.2 DYE-LABELLED PEPTIDE SERVICES

16.4.3 PEPTIDE SERVICES

16.4.4 TFA REMOVAL

16.4.5 ANALYTICAL HPLC

16.4.6 CHECK PURITY LEVEL

16.4.7 MODIFICATION OF SYNTHETIC PEPTIDES

16.4.8 OTHERS

16.5 OTHERS

17 GLOBAL PEPTIDE SYNTHESIS MARKET , BY TECHNOLOGY

17.1 OVERVIEW

17.2 SOLID-PHASE

17.3 SOLUTION-PHASE

17.4 HYBRID

17.5 RECOMBINANT

18 GLOBAL PEPTIDE SYNTHESIS MARKET , BY APPLICATION

18.1 OVERVIEW

18.2 THERAPEUTICS

18.2.1 CANCER

18.2.1.1. BY EQUIPMENT

18.2.1.1.1. PEPTIDE SYNTHESIZER

18.2.1.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.1.1.3. LYOPHILIZERS

18.2.1.2. BY TECHNOLOGY

18.2.1.2.1. SOLID-PHASE

18.2.1.2.2. SOLUTION-PHASE

18.2.1.2.3. HYBRID

18.2.1.2.4. RECOMBINANT

18.2.2 METABOLIC DISORDER

18.2.2.1. BY EQUIPMENT

18.2.2.1.1. PEPTIDE SYNTHESIZER

18.2.2.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.2.1.3. LYOPHILIZERS

18.2.2.2. BY TECHNOLOGY

18.2.2.2.1. SOLID-PHASE

18.2.2.2.2. SOLUTION-PHASE

18.2.2.2.3. HYBRID

18.2.2.2.4. RECOMBINANT

18.2.3 CARDIOVASCULAR DISORDER

18.2.3.1. BY EQUIPMENT

18.2.3.1.1. PEPTIDE SYNTHESIZER

18.2.3.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.3.1.3. LYOPHILIZERS

18.2.3.2. BY TECHNOLOGY

18.2.3.2.1. SOLID-PHASE

18.2.3.2.2. SOLUTION-PHASE

18.2.3.2.3. HYBRID

18.2.3.2.4. RECOMBINANT

18.2.4 RESPIRATORY DISORDER

18.2.4.1. BY EQUIPMENT

18.2.4.1.1. PEPTIDE SYNTHESIZER

18.2.4.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.4.1.3. LYOPHILIZERS

18.2.4.2. BY TECHNOLOGY

18.2.4.2.1. SOLID-PHASE

18.2.4.2.2. SOLUTION-PHASE

18.2.4.2.3. HYBRID

18.2.4.2.4. RECOMBINANT

18.2.5 GIT (GASTROINTESTINAL DISORDERS)

18.2.5.1. BY EQUIPMENT

18.2.5.1.1. PEPTIDE SYNTHESIZER

18.2.5.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.5.1.3. LYOPHILIZERS

18.2.5.2. BY TECHNOLOGY

18.2.5.2.1. SOLID-PHASE

18.2.5.2.2. SOLUTION-PHASE

18.2.5.2.3. HYBRID

18.2.5.2.4. RECOMBINANT

18.2.6 INFECTIOUS DISEASES

18.2.6.1. BY EQUIPMENT

18.2.6.1.1. PEPTIDE SYNTHESIZER

18.2.6.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.6.1.3. LYOPHILIZERS

18.2.6.2. BY TECHNOLOGY

18.2.6.2.1. SOLID-PHASE

18.2.6.2.2. SOLUTION-PHASE

18.2.6.2.3. HYBRID

18.2.6.2.4. RECOMBINANT

18.2.7 PAIN MANAGEMENT

18.2.7.1. BY EQUIPMENT

18.2.7.1.1. PEPTIDE SYNTHESIZER

18.2.7.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.7.1.3. LYOPHILIZERS

18.2.7.2. BY TECHNOLOGY

18.2.7.2.1. SOLID-PHASE

18.2.7.2.2. SOLUTION-PHASE

18.2.7.2.3. HYBRID

18.2.7.2.4. RECOMBINANT

18.2.8 DERMATOLOGY DISORDER

18.2.8.1. BY EQUIPMENT

18.2.8.1.1. PEPTIDE SYNTHESIZER

18.2.8.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.8.1.3. LYOPHILIZERS

18.2.8.2. BY TECHNOLOGY

18.2.8.2.1. SOLID-PHASE

18.2.8.2.2. SOLUTION-PHASE

18.2.8.2.3. HYBRID

18.2.8.2.4. RECOMBINANT

18.2.9 CNS DISORDER

18.2.9.1. BY EQUIPMENT

18.2.9.1.1. PEPTIDE SYNTHESIZER

18.2.9.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.9.1.3. LYOPHILIZERS

18.2.9.2. BY TECHNOLOGY

18.2.9.2.1. SOLID-PHASE

18.2.9.2.2. SOLUTION-PHASE

18.2.9.2.3. HYBRID

18.2.9.2.4. RECOMBINANT

18.2.10 RENAL DISORDER

18.2.10.1. BY EQUIPMENT

18.2.10.1.1. PEPTIDE SYNTHESIZER

18.2.10.1.2. CHROMATOGRAPHY EQUIPMENTS

18.2.10.1.3. LYOPHILIZERS

18.2.10.2. BY TECHNOLOGY

18.2.10.2.1. SOLID-PHASE

18.2.10.2.2. SOLUTION-PHASE

18.2.10.2.3. HYBRID

18.2.10.2.4. RECOMBINANT

18.2.11 OTHERS

18.3 DIAGNOSIS

18.3.1 BY EQUIPMENT

18.3.1.1. PEPTIDE SYNTESIZER

18.3.1.2. CHROMATOGRAPHY EQUIPMENT

18.3.1.3. LYOPHILIZERS

18.3.2 BY TECHNOLOGY

18.3.2.1. SOLID-PHASE

18.3.2.2. SOLUTION-PHASE

18.3.2.3. HYBRID

18.3.2.4. RECOMBINANT

18.4 RESEARCH

18.4.1 BY EQUIPMENT

18.4.1.1. PEPTIDE SYNTESIZER

18.4.1.2. CHROMATOGRAPHY EQUIPMENT

18.4.1.3. LYOPHILIZERS

18.4.2 BY TECHNOLOGY

18.4.2.1. SOLID-PHASE

18.4.2.2. SOLUTION-PHASE

18.4.2.3. HYBRID

18.4.2.4. RECOMBINANT

19 GLOBAL PEPTIDE SYNTHESIS MARKET , BY END USER

19.1 OVERVIEW

19.2 CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS AND CONTRACT RESEARCH ORGANIZATIONS

19.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

19.4 ACADEMIC AND GOVERNMENT RESEARCH INSTITUTES

19.5 OTHERS

20 GLOBAL PEPTIDE SYNTHESIS MARKET , BY DISTRIBUTION CHANNEL

20.1 OVERVIEW

20.2 DIRECT TENDER

20.3 RETAIL SALES

20.4 OTHERS

21 GLOBAL PEPTIDE SYNTHESIS MARKET , SWOT AND DBMR ANALYSIS

22 GLOBAL PEPTIDE SYNTHESIS MARKET , COMPANY LANDSCAPE

22.1 COMPANY SHARE ANALYSIS: GLOBAL

22.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

22.3 COMPANY SHARE ANALYSIS: EUROPE

22.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

22.5 MERGERS & ACQUISITIONS

22.6 NEW PRODUCT DEVELOPMENT & APPROVALS

22.7 EXPANSIONS

22.8 REGULATORY CHANGES

22.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

23 GLOBAL PEPTIDE SYNTHESIS MARKET , BY REGION

Global Peptide synthesis market , (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 U.K.

23.2.3 ITALY

23.2.4 FRANCE

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 SWITZERLAND

23.2.8 TURKEY

23.2.9 BELGIUM

23.2.10 NETHERLANDS

23.2.11 DENMARK

23.2.12 SWEDEN

23.2.13 POLAND

23.2.14 NORWAY

23.2.15 FINLAND

23.2.16 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 SINGAPORE

23.3.6 THAILAND

23.3.7 INDONESIA

23.3.8 MALAYSIA

23.3.9 PHILIPPINES

23.3.10 AUSTRALIA

23.3.11 NEW ZEALAND

23.3.12 VIETNAM

23.3.13 TAIWAN

23.3.14 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 EGYPT

23.5.3 BAHRAIN

23.5.4 UNITED ARAB EMIRATES

23.5.5 KUWAIT

23.5.6 OMAN

23.5.7 QATAR

23.5.8 SAUDI ARABIA

23.5.9 REST OF MEA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL PEPTIDE SYNTHESIS MARKET , COMPANY PROFILE

24.1 THERMOFISHER SCIENTIFIC INC.

24.1.1 COMPANY OVERVIEW

24.1.2 REVENUE ANALYSIS

24.1.3 GEOGRAPHIC PRESENCE

24.1.4 PRODUCT PORTFOLIO

24.1.5 RECENT DEVELOPMENTS

24.2 MERCK KGAA

24.2.1 COMPANY OVERVIEW

24.2.2 REVENUE ANALYSIS

24.2.3 GEOGRAPHIC PRESENCE

24.2.4 PRODUCT PORTFOLIO

24.2.5 RECENT DEVELOPMENTS

24.3 BACHEM

24.3.1 COMPANY OVERVIEW

24.3.2 REVENUE ANALYSIS

24.3.3 GEOGRAPHIC PRESENCE

24.3.4 PRODUCT PORTFOLIO

24.3.5 RECENT DEVELOPMENTS

24.4 BIOTAGE

24.4.1 COMPANY OVERVIEW

24.4.2 REVENUE ANALYSIS

24.4.3 GEOGRAPHIC PRESENCE

24.4.4 PRODUCT PORTFOLIO

24.4.5 RECENT DEVELOPMENTS

24.5 CEM CORPORATION

24.5.1 COMPANY OVERVIEW

24.5.2 REVENUE ANALYSIS

24.5.3 GEOGRAPHIC PRESENCE

24.5.4 PRODUCT PORTFOLIO

24.5.5 RECENT DEVELOPMENTS

24.6 MESA LABS

24.6.1 COMPANY OVERVIEW

24.6.2 REVENUE ANALYSIS

24.6.3 GEOGRAPHIC PRESENCE

24.6.4 PRODUCT PORTFOLIO

24.6.5 RECENT DEVELOPMENTS

24.7 KANEKA CORPORATION

24.7.1 COMPANY OVERVIEW

24.7.2 REVENUE ANALYSIS

24.7.3 GEOGRAPHIC PRESENCE

24.7.4 PRODUCT PORTFOLIO

24.7.5 RECENT DEVELOPMENTS

24.8 ADVANCED CHEM TECH

24.8.1 COMPANY OVERVIEW

24.8.2 REVENUE ANALYSIS

24.8.3 GEOGRAPHIC PRESENCE

24.8.4 PRODUCT PORTFOLIO

24.8.5 RECENT DEVELOPMENTS

24.9 WUXI STA

24.9.1 COMPANY OVERVIEW

24.9.2 REVENUE ANALYSIS

24.9.3 GEOGRAPHIC PRESENCE

24.9.4 PRODUCT PORTFOLIO

24.9.5 RECENT DEVELOPMENTS

24.1 SYNGENE INTERNATIONAL LIMITED

24.10.1 COMPANY OVERVIEW

24.10.2 REVENUE ANALYSIS

24.10.3 GEOGRAPHIC PRESENCE

24.10.4 PRODUCT PORTFOLIO

24.10.5 RECENT DEVELOPMENTS

24.11 PROTEOGENIX

24.11.1 COMPANY OVERVIEW

24.11.2 REVENUE ANALYSIS

24.11.3 GEOGRAPHIC PRESENCE

24.11.4 PRODUCT PORTFOLIO

24.11.5 RECENT DEVELOPMENTS

24.12 DALTON PHARMA SERVICES

24.12.1 COMPANY OVERVIEW

24.12.2 REVENUE ANALYSIS

24.12.3 GEOGRAPHIC PRESENCE

24.12.4 PRODUCT PORTFOLIO

24.12.5 RECENT DEVELOPMENTS

24.13 BIOSYNTH

24.13.1 COMPANY OVERVIEW

24.13.2 REVENUE ANALYSIS

24.13.3 GEOGRAPHIC PRESENCE

24.13.4 PRODUCT PORTFOLIO

24.13.5 RECENT DEVELOPMENTS

24.13.6

24.14 CSBIO

24.14.1 COMPANY OVERVIEW

24.14.2 REVENUE ANALYSIS

24.14.3 GEOGRAPHIC PRESENCE

24.14.4 PRODUCT PORTFOLIO

24.14.5 RECENT DEVELOPMENTS

24.15 GENSCRIPT

24.15.1 COMPANY OVERVIEW

24.15.2 REVENUE ANALYSIS

24.15.3 GEOGRAPHIC PRESENCE

24.15.4 PRODUCT PORTFOLIO

24.15.5 RECENT DEVELOPMENTS

24.16 ACES PHARMA INC.

24.16.1 COMPANY OVERVIEW

24.16.2 REVENUE ANALYSIS

24.16.3 GEOGRAPHIC PRESENCE

24.16.4 PRODUCT PORTFOLIO

24.16.5 RECENT DEVELOPMENTS

24.17 JPT PEPTIDE TECHNOLOGIES

24.17.1 COMPANY OVERVIEW

24.17.2 REVENUE ANALYSIS

24.17.3 GEOGRAPHIC PRESENCE

24.17.4 PRODUCT PORTFOLIO

24.17.5 RECENT DEVELOPMENTS

24.18 LUXEMBOURG BIO TECHNOLOGIES

24.18.1 COMPANY OVERVIEW

24.18.2 REVENUE ANALYSIS

24.18.3 GEOGRAPHIC PRESENCE

24.18.4 PRODUCT PORTFOLIO

24.18.5 RECENT DEVELOPMENTS

24.19 AMBIOPHARM INC.

24.19.1 COMPANY OVERVIEW

24.19.2 REVENUE ANALYSIS

24.19.3 GEOGRAPHIC PRESENCE

24.19.4 PRODUCT PORTFOLIO

24.19.5 RECENT DEVELOPMENTS

24.2 AURIGENE PHARMACEUTICAL SERVICES LTD

24.20.1 COMPANY OVERVIEW

24.20.2 REVENUE ANALYSIS

24.20.3 GEOGRAPHIC PRESENCE

24.20.4 PRODUCT PORTFOLIO

24.20.5 RECENT DEVELOPMENTS

24.21 CORDENPHARMA INTERNATIONAL

24.21.1 COMPANY OVERVIEW

24.21.2 REVENUE ANALYSIS

24.21.3 GEOGRAPHIC PRESENCE

24.21.4 PRODUCT PORTFOLIO

24.21.5 RECENT DEVELOPMENTS

24.22 CHEMPEP INC.

24.22.1 COMPANY OVERVIEW

24.22.2 REVENUE ANALYSIS

24.22.3 GEOGRAPHIC PRESENCE

24.22.4 PRODUCT PORTFOLIO

24.22.5 RECENT DEVELOPMENTS

24.23 CPC SCIENTIFIC INC.

24.23.1 COMPANY OVERVIEW

24.23.2 REVENUE ANALYSIS

24.23.3 GEOGRAPHIC PRESENCE

24.23.4 PRODUCT PORTFOLIO

24.23.5 RECENT DEVELOPMENTS

24.24 BIO-SYNTHESIS INC

24.24.1 COMPANY OVERVIEW

24.24.2 REVENUE ANALYSIS

24.24.3 GEOGRAPHIC PRESENCE

24.24.4 PRODUCT PORTFOLIO

24.24.5 RECENT DEVELOPMENTS

24.25 ALTA BIOSCIENCE

24.25.1 COMPANY OVERVIEW

24.25.2 REVENUE ANALYSIS

24.25.3 GEOGRAPHIC PRESENCE

24.25.4 PRODUCT PORTFOLIO

24.25.5 RECENT DEVELOPMENTS

24.26 AUSPEP

24.26.1 COMPANY OVERVIEW

24.26.2 REVENUE ANALYSIS

24.26.3 GEOGRAPHIC PRESENCE

24.26.4 PRODUCT PORTFOLIO

24.26.5 RECENT DEVELOPMENTS

24.27 ALMAC GROUP

24.27.1 COMPANY OVERVIEW

24.27.2 REVENUE ANALYSIS

24.27.3 GEOGRAPHIC PRESENCE

24.27.4 PRODUCT PORTFOLIO

24.27.5 RECENT DEVELOPMENTS

24.28 ABI SCIENTIFIC INC.

24.28.1 COMPANY OVERVIEW

24.28.2 REVENUE ANALYSIS

24.28.3 GEOGRAPHIC PRESENCE

24.28.4 PRODUCT PORTFOLIO

24.28.5 RECENT DEVELOPMENTS

25 RELATED REPORTS

26 CONCLUSION

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.