Global Organic Soaps Market

Market Size in USD Million

CAGR :

%

USD

340.59 Million

USD

598.01 Million

2024

2032

USD

340.59 Million

USD

598.01 Million

2024

2032

| 2025 –2032 | |

| USD 340.59 Million | |

| USD 598.01 Million | |

|

|

|

|

Organic Soaps Market Size

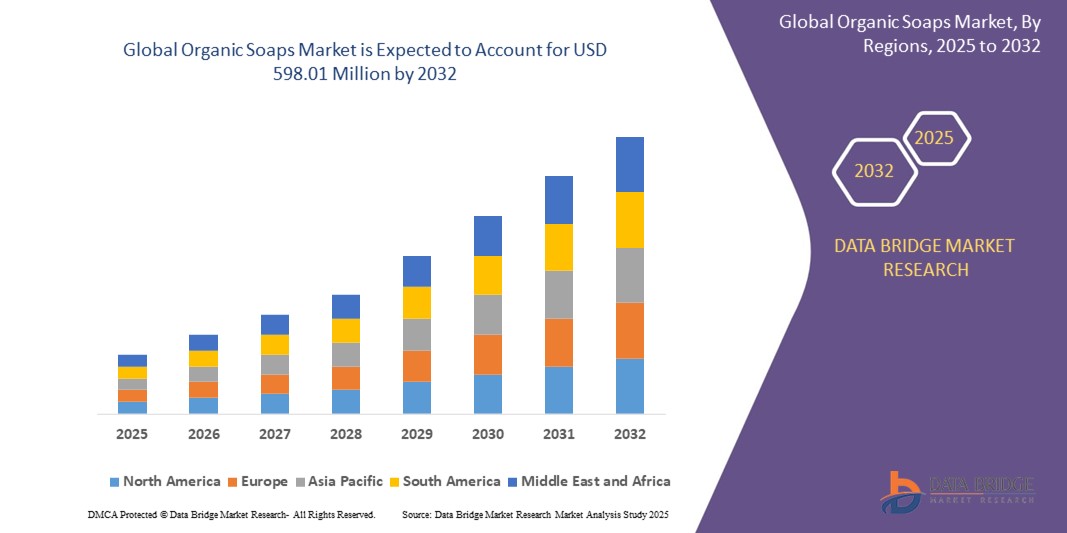

- The global organic soaps market was valued at USD 340.59 million in 2024 and is expected to reach USD 598.01 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.29%, primarily driven by rising consumer awareness of natural and chemical-free personal care products

- This growth is driven by factors such as an increasing preference for eco-friendly and sustainable products, rising health consciousness, and the shift toward organic skincare solutions

Organic Soaps Market Analysis

- Organic soaps are gaining popularity as essential personal care products, known for their natural ingredients and chemical-free formulations. These soaps are often enriched with plant-based oils, herbs, and essential oils, making them a preferred choice for consumers seeking eco-friendly and skin-friendly alternatives to conventional soaps

- The demand for organic soaps is primarily driven by the increasing consumer awareness of the harmful effects of synthetic chemicals in personal care products. As more people opt for sustainable and natural options, the organic soaps market has witnessed significant growth

- North America and Europe are the dominant regions in the organic soaps market, driven by a high awareness of environmental and health-conscious issues, coupled with a strong preference for organic and sustainable products

- For instance, the U.S. and European countries have seen a marked increase in organic soap adoption, with both large and niche brands promoting organic and cruelty-free products that appeal to health-conscious consumers

- Globally, organic soaps have become an essential part of personal care routines, ranking among the top-selling beauty and skincare items, as they contribute to healthier skin, environmental sustainability, and ethical production practices

Report Scope and Organic Soaps Market Segmentation

|

Attributes |

Organic Soaps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Soaps Market Trends

“Growing Popularity of Clean Beauty and Eco-Friendly Products”

- One prominent trend in the global organic soaps market is the rising consumer preference for clean beauty and sustainable personal care products

- Consumers are increasingly seeking products with natural, organic ingredients that are free from harmful chemicals like parabens, sulfates, and synthetic fragrances

- For instance, organic soaps made with ingredients such as shea butter, coconut oil, essential oils, and herbal extracts are gaining popularity among health-conscious and environmentally aware buyers

- This shift is driven by growing awareness about skin health, environmental impact, and cruelty-free product sourcing

- As a result, brands are innovating with biodegradable packaging, plastic-free alternatives, and certifications (such as USDA Organic, EcoCert), aligning with ethical consumerism trends and boosting market demand

Organic Soaps Market Dynamics

Driver

“Increasing Health Awareness and Demand for Chemical-Free Products”

- The growing awareness of health and wellness is a major driver propelling the global organic soaps market forward

- Consumers are becoming increasingly cautious about the ingredients in personal care products, shifting preferences toward chemical-free, organic alternatives that are gentler on the skin

- Conventional soaps often contain synthetic additives, preservatives, and fragrances that can cause skin irritation, dryness, or allergic reactions, prompting a surge in demand for natural options

- Organic soaps, made with plant-based oils, herbal extracts, and essential oils, are perceived as safer and more skin-friendly, appealing to consumers with sensitive skin or specific dermatological concerns

- The clean label movement and rising trust in transparency regarding product sourcing, production methods, and ingredient lists are also strengthening this shift toward organic formulations

For instance,

- In April 2023, a study published by the Organic Trade Association revealed that nearly 82% of U.S. households regularly purchase organic products, with skincare and bath items showing consistent growth as a top-performing segment

- As health consciousness continues to rise globally, the demand for organic soaps is expected to grow substantially, making it a key driver of market expansion

Opportunity

“Growing Popularity of Personalized Organic Skincare Products”

- The increasing trend toward personalized skincare solutions presents a significant market opportunity for the global organic soaps market

- Consumers are seeking more customized products that cater to their specific skin types, concerns, and preferences, such as organic soaps designed for sensitive skin, acne-prone skin, or anti-aging benefits

- Personalized organic soaps can be formulated with targeted natural ingredients, such as aloe vera for soothing, tea tree oil for acne, or chamomile for calming, to meet individual needs

- As consumers prioritize health and wellness, they are also looking for skincare products that align with their values, including sustainability, cruelty-free, and eco-conscious packaging

For instance,

- In June 2024, according to a report from Mintel, 41% of U.S. consumers expressed interest in personalized skincare products, with a growing preference for items tailored to their unique needs and natural ingredients

- In October 2023, an article by Forbes highlighted that personalized beauty products are a major trend, with brands leveraging artificial intelligence and customer data to create bespoke organic soap formulations that meet specific skincare goals

- The increasing demand for tailored skincare, combined with the desire for natural ingredients, offers a valuable opportunity for organic soap brands to expand their product lines and better serve consumers seeking personalized solutions

Restraint/Challenge

“High Cost of Organic Raw Materials Affecting Price Competitiveness”

- The high cost of organic raw materials, such as sustainably sourced oils, herbs, and essential oils, poses a significant challenge for the organic soaps market, impacting both production costs and retail prices

- Organic ingredients are often more expensive to procure and require more labor-intensive farming methods, which can increase the overall production cost of organic soaps compared to conventional alternatives

- This price premium can make organic soaps less affordable for price-sensitive consumers, particularly in emerging markets or among budget-conscious buyers, limiting market penetration

For instance,

- In January 2024, according to a report by the Organic Trade Association, the increased demand for organic raw materials, combined with supply chain disruptions, has led to higher costs for ingredients such as organic coconut oil and shea butter, making it challenging for soap manufacturers to maintain competitive pricing

- In December 2023, an article published by Grand View Research highlighted that while organic soap sales are growing, the higher cost of natural ingredients remains a key barrier for new and smaller players entering the market

- As a result, this price disparity can restrict the growth of the organic soap market, particularly in regions where cost is a significant factor in purchasing decisions, and hinder the broader adoption of organic products

Organic Soaps Market Scope

The market is segmented on the basis of product, process type, organic level, skin type, category, packaging, distribution channel, application, and end use

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Process Type |

|

|

By Organic Level |

|

|

By Skin Type |

|

|

By Category |

|

|

By Packaging |

|

|

By Distribution Channel |

|

|

By Application |

|

|

By End Use |

|

Organic Soaps Market Regional Analysis

“North America is the Dominant Region in the Organic Soaps Market”

- North America leads the global organic soaps market, driven by increasing consumer demand for natural and organic personal care products, along with rising health and wellness awareness

- The U.S. holds a significant share, propelled by the high adoption of clean beauty products, a growing trend toward sustainability, and strong consumer preference for cruelty-free, eco-friendly brands

- A well-established retail infrastructure, including both physical stores and e-commerce platforms, facilitates easy access to organic soaps across the region

- In addition, North American consumers are increasingly concerned about product ingredients, which is pushing demand for soaps that are free from harmful chemicals, artificial fragrances, and preservatives

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the organic soaps market, driven by rising middle-class populations, increasing disposable incomes, and growing awareness about the harmful effects of synthetic chemicals in personal care products

- Countries like China, India, and Japan are emerging as key markets due to the increasing adoption of organic and natural personal care products among health-conscious consumers

- In particular, India is witnessing a shift toward organic personal care, driven by traditional Ayurvedic practices and the growing popularity of natural skincare solutions

- Japan, with its sophisticated beauty and skincare market, is experiencing a surge in demand for organic soaps as consumers increasingly prefer products with gentle, skin-friendly ingredients

- China, with its large consumer base and rapid urbanization, is seeing increased demand for premium organic personal care products, supported by higher awareness and governmental regulations around safety and sustainability in cosmetics

Organic Soaps Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dr. Bronner’s (U.S.)

- The Body Shop (U.K.)

- Khadi Natural (India)

- Puracy (U.S.)

- Tru Earth (Canada)

- Forest Essentials (India)

- Paul Penders (Malaysia)

- Shea Moisture (U.S.)

- Method Products (U.S.)

- Burt’s Bees (U.S.)

- L’Occitane en Provence (France)

- Nature’s Gate (U.S.)

- One With Nature (U.S.)

- Erbaviva (U.S.)

- Soultree (India)

- Soapworks (Canada)

- Castile Soap (U.S.)

- Desert Essence (U.S.)

- Avalon Organics (U.S.)

- Gaia Skin Naturals (Australia)

Latest Developments in Global Organic Soaps Market

- In June 2024, Lush introduced Bath Bot, a cutting-edge, water-resistant device designed to enhance the bathroom experience through synchronized lighting and sound. Developed by Lush's in-house technology team, the Bath Bot is sustainable, vegan, and built for long-term reuse. Manufactured in the UK, this innovative product aims to elevate the sensory experience of bathing while aligning with Lush’s commitment to environmental sustainability and cruelty-free practices. This launch is highly relevant to the global organic soap market as it highlights the increasing trend of integrating technology with wellness and personal care

- In September 2023, EO Naturals unveiled its premium product line in India, emphasizing the use of natural ingredients, essential oils, and eco-friendly packaging. The brand is dedicated to providing high-quality, luxurious skincare solutions while upholding a strong commitment to environmental sustainability. EO Naturals also focuses on community empowerment, ensuring that its operations contribute positively to society. This launch holds significant relevance to the global organic soap market, as it reflects the growing consumer demand for premium, sustainable personal care products

- In 2021, Neal's Yard Remedies launched its "Beauty Box" for the winter season, offering a comprehensive collection of all-natural and organic skincare products designed to support and maintain healthy skin. This curated set features a selection of products formulated with high-quality, sustainable ingredients, aimed at enhancing the skin's natural radiance and vitality. This initiative is particularly relevant to the global organic soap market, as it highlights the increasing consumer demand for bundled organic skincare solutions that prioritize natural ingredients and holistic wellness

- In 2020, Johnson & Johnson Pharmaceutical Company launched its "CottonTouch" line, a comprehensive range of bath products specifically designed for infants. This product line is formulated with ultra-gentle ingredients, carefully crafted to provide a soothing and safe bathing experience for delicate baby skin. This launch is relevant to the global organic soap market, as it reflects the increasing consumer preference for gentle, skin-friendly, and natural formulations, particularly in the baby care segment

- In 2019, The Procter & Gamble Company launched a new plant-based product line, encompassing fabric softeners, laundry detergents, multipurpose cleaners, hand soaps, and dish soaps. This range is formulated with sustainably sourced ingredients, offering eco-friendly solutions for everyday cleaning and personal care needs. This product launch is highly relevant to the global organic soap market, as it reflects the growing consumer demand for environmentally conscious and plant-based alternatives in the personal care and household sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ORGANIC SOAPS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ORGANIC SOAPS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 GLOBAL ORGANIC SOAPS MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICING ANALYSIS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL ORGANIC SOAPS MARKET, BY PRODUCT, 2018-2032 (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 BAR SOAPS

11.3 LIQUID SOAPS

11.4 PAPER SOAPS

12 GLOBAL ORGANIC SOAPS MARKET, BY PROCESS, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 HANDMADE

12.3 MACHINE MADE

13 GLOBAL ORGANIC SOAPS MARKET, BY ORGANIC LEVEL, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 0.7

13.3 0.95

13.4 1

14 GLOBAL ORGANIC SOAPS MARKET, BY SKIN TYPE, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 NORMAL SKIN

14.3 SENSITIVE SKIN

14.4 INFANT SKIN

14.5 DRY SKIN

14.6 OILY SKIN

14.7 MULTI-SKIN TYPE

14.8 OTHERS

15 GLOBAL ORGANIC SOAPS MARKET, BY FRAGRANCE TYPE, 2018-2032 (USD MILLION)

15.1 OVERVIEW

15.2 FRUITY

15.2.1 LEMON

15.2.2 ORANGE

15.2.3 GRAPEFRUIT

15.2.4 APPLE

15.2.5 STRAWBERRY

15.2.6 BLUEBERRY

15.2.7 CHERRY

15.2.8 OTHERS

15.3 FLORAL

15.3.1 LAVENDER

15.3.2 ROSE

15.3.3 CHAMOMILE

15.3.4 OTHERS

15.4 HERBAL AND BOTANICAL

15.4.1 TEA TREE OIL

15.4.2 PEPPERMINT

15.4.3 EUCALYPTUS

15.4.4 ROSEMARY

15.4.5 OTHERS

15.5 SWEET AND DESSERT-INSPIRED

15.6 OCEANIC AND AQUATIC

15.7 WOODY

15.7.1 SANDALWOOD

15.7.2 CEDARWOOD

15.8 SPICY

15.9 THERAPEUTIC AND AROMATHERAPY

15.1 FRESH OR GREEN

15.10.1 CUCUMBER

15.10.2 ALOE VERA

15.10.3 MINT

15.10.4 OTHERS

15.11 SEASONAL FRAGRANCES

15.12 OTHERS

16 GLOBAL ORGANIC SOAPS MARKET, BY PRICE RANGE, 2018-2032 (USD MILLION)

16.1 OVERVIEW

16.2 MASS

16.3 PREMIUM

16.4 LUXURY

17 GLOBAL ORGANIC SOAPS MARKET, BY PACKAGING, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 RIGID PACKAGING

17.3 FLEXIBLE PACKAGING

18 GLOBAL ORGANIC SOAPS MARKET, BY FUNCTION, 2018-2032 (USD MILLION

18.1 OVERVIEW

18.2 STANDARD

18.3 ANTI AGEING

18.4 ANTI BACTERIAL

18.5 SKIN WHITENING

18.6 SOOTHING & REPAIR

18.7 ANTI POLLUTION

18.8 ANTI-ACNE

18.9 ANTI-SCARS

18.1 MULTI-FUNCTIONAL

18.11 OTHERS

19 GLOBAL ORGANIC SOAPS MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

19.1 OVERVIEW

19.2 HYGIENE AND HEALTHCARE

19.3 PERSONAL AND SKINCARE

19.4 OTHERS

20 GLOBAL ORGANIC SOAPS MARKET, BY GENDER, 2018-2032 (USD MILLION)

20.1 OVERVIEW

20.2 MEN

20.3 WOMEN

20.4 UNISEX

21 GLOBAL ORGANIC SOAPS MARKET, BY AGE GROUP, 2018-2032 (USD MILLION)

21.1 OVERVIEW

21.2 KIDS (BELOW 14 YEARS)

21.3 TEENAGERS (14 TO 24 YEARS)

21.4 ADULTS (24 TO 45 YEARS)

21.5 SENIORS (ABOVE 45 YEARS)

22 GLOBAL ORGANIC SOAPS MARKET, BY END USE, 2018-2032 (USD MILLION)

22.1 OVERVIEW

22.2 HOUSEHOLD/RETAIL

22.3 COMMERCIAL

22.3.1 HOTELS

22.3.2 RESTAURANTS

22.3.3 HOSPITALS

22.3.4 SCHOOLS

22.3.5 OFFICES

22.3.6 OTHERS

23 GLOBAL ORGANIC SOAPS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

23.1 OVERVIEW

23.2 STORE-BASED RETAILERS

23.2.1 HYPERMARKETS / DEPARTMENT STORES / SUPERMARKETS

23.2.2 SPECIALTY STORES

23.2.3 CONVENIENCE STORES

23.2.4 BRAND OUTLETS

23.2.4.1. MONO-BRAND OUTLETS

23.2.4.2. MULTI-BRAND OUTLETS

23.2.5 DISCOUNT STORES

23.2.6 DOLLAR STORES

23.2.7 TRAVEL RETAIL

23.2.8 DRUG STORES/PHARMACIES

23.2.9 OTHERS

23.3 NON-STORE RETAILERS

23.3.1 E-COMMERCE WEBSITES

23.3.2 COMPANY-OWNED WEBSITES

24 GLOBAL ORGANIC SOAPS MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (MARKET VOLUME)

24.1 GLOBAL ORGANIC SOAPS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.2 NORTH AMERICA

24.2.1 U.S.

24.2.2 CANADA

24.2.3 MEXICO

24.3 EUROPE

24.3.1 GERMANY

24.3.2 U.K.

24.3.3 ITALY

24.3.4 FRANCE

24.3.5 SPAIN

24.3.6 SWITZERLAND

24.3.7 NETHERLANDS

24.3.8 BELGIUM

24.3.9 RUSSIA

24.3.10 DENMARK

24.3.11 SWEDEN

24.3.12 POLAND

24.3.13 TURKEY

24.3.14 REST OF EUROPE

24.4 ASIA-PACIFIC

24.4.1 JAPAN

24.4.2 CHINA

24.4.3 SOUTH KOREA

24.4.4 INDIA

24.4.5 AUSTRALIA

24.4.6 SINGAPORE

24.4.7 THAILAND

24.4.8 INDONESIA

24.4.9 MALAYSIA

24.4.10 PHILIPPINES

24.4.11 NEW ZEALAND

24.4.12 VIETNAM

24.4.13 REST OF ASIA-PACIFIC

24.5 SOUTH AMERICA

24.5.1 BRAZIL

24.5.2 ARGENTINA

24.5.3 REST OF SOUTH AMERICA

24.6 MIDDLE EAST AND AFRICA

24.6.1 SOUTH AFRICA

24.6.2 EGYPT

24.6.3 UAE

24.6.4 SAUDI ARABIA

24.6.5 ISRAEL

24.6.6 OMAN

24.6.7 QATAR

24.6.8 KUWAIT

24.6.9 REST OF MIDDLE EAST AND AFRICA

25 GLOBAL ORGANIC SOAPS MARKET – SWOT ANALYSIS

26 GLOBAL ORGANIC SOAPS MARKET - COMPANY PROFILES

26.1 EO PRODUCTS

26.1.1 COMPANY SNAPSHOT

26.1.2 PRODUCT PORTFOLIO

26.1.3 REVENUE ANALYSIS

26.1.4 RECENT UPDATES

26.2 OSMIA ORGANICS

26.2.1 COMPANY SNAPSHOT

26.2.2 PRODUCT PORTFOLIO

26.2.3 REVENUE ANALYSIS

26.2.4 RECENT UPDATES

26.3 KHADI NATURAL

26.3.1 COMPANY SNAPSHOT

26.3.2 PRODUCT PORTFOLIO

26.3.3 REVENUE ANALYSIS

26.3.4 RECENT UPDATES

26.4 ERBAVIVA

26.4.1 COMPANY SNAPSHOT

26.4.2 PRODUCT PORTFOLIO

26.4.3 REVENUE ANALYSIS

26.4.4 RECENT UPDATES

26.5 LAVERANA DIGITAL GMBH & CO

26.5.1 COMPANY SNAPSHOT

26.5.2 PRODUCT PORTFOLIO

26.5.3 REVENUE ANALYSIS

26.5.4 RECENT UPDATES

26.6 BEACH ORGANICS SKIN CARE

26.6.1 COMPANY SNAPSHOT

26.6.2 PRODUCT PORTFOLIO

26.6.3 REVENUE ANALYSIS

26.6.4 RECENT UPDATES

26.7 UNILEVER

26.7.1 COMPANY SNAPSHOT

26.7.2 PRODUCT PORTFOLIO

26.7.3 REVENUE ANALYSIS

26.7.4 RECENT UPDATES

26.8 NEAL'S YARD REMEDIES

26.8.1 COMPANY SNAPSHOT

26.8.2 PRODUCT PORTFOLIO

26.8.3 REVENUE ANALYSIS

26.8.4 RECENT UPDATES

26.9 THE BODY SHOP

26.9.1 COMPANY SNAPSHOT

26.9.2 PRODUCT PORTFOLIO

26.9.3 REVENUE ANALYSIS

26.9.4 RECENT UPDATES

26.1 RIBANA ORGANIC

26.10.1 COMPANY SNAPSHOT

26.10.2 PRODUCT PORTFOLIO

26.10.3 REVENUE ANALYSIS

26.10.4 RECENT UPDATES

26.11 GUANGZHOU TINSUN BIOTECHNOLOGY COMPANY LIMITED

26.11.1 COMPANY SNAPSHOT

26.11.2 PRODUCT PORTFOLIO

26.11.3 REVENUE ANALYSIS

26.11.4 RECENT UPDATES

26.12 SHENZHEN MOONBIO CO., LTD.

26.12.1 COMPANY SNAPSHOT

26.12.2 PRODUCT PORTFOLIO

26.12.3 REVENUE ANALYSIS

26.12.4 RECENT UPDATES

26.13 V- HERBS

26.13.1 COMPANY SNAPSHOT

26.13.2 PRODUCT PORTFOLIO

26.13.3 REVENUE ANALYSIS

26.13.4 RECENT UPDATES

26.14 HARA NATURALS

26.14.1 COMPANY SNAPSHOT

26.14.2 PRODUCT PORTFOLIO

26.14.3 REVENUE ANALYSIS

26.14.4 RECENT UPDATES

26.15 ZOIC COSMETICS

26.15.1 COMPANY SNAPSHOT

26.15.2 PRODUCT PORTFOLIO

26.15.3 REVENUE ANALYSIS

26.15.4 RECENT UPDATES

26.16 ANUSPA HERITAGE PRODUCTS PVT LTD

26.16.1 COMPANY SNAPSHOT

26.16.2 PRODUCT PORTFOLIO

26.16.3 REVENUE ANALYSIS

26.16.4 RECENT UPDATES

26.17 CAMIA

26.17.1 COMPANY SNAPSHOT

26.17.2 PRODUCT PORTFOLIO

26.17.3 REVENUE ANALYSIS

26.17.4 RECENT UPDATES

26.18 BALI NATURAL SOAP SPECIALIST

26.18.1 COMPANY SNAPSHOT

26.18.2 PRODUCT PORTFOLIO

26.18.3 REVENUE ANALYSIS

26.18.4 RECENT UPDATES

26.19 HANOOR

26.19.1 COMPANY SNAPSHOT

26.19.2 PRODUCT PORTFOLIO

26.19.3 REVENUE ANALYSIS

26.19.4 RECENT UPDATES

26.2 BIPHA AYURVEDA

26.20.1 COMPANY SNAPSHOT

26.20.2 PRODUCT PORTFOLIO

26.20.3 REVENUE ANALYSIS

26.20.4 RECENT UPDATES

26.21 QUINTA ESSENTIA ORGANIC

26.21.1 COMPANY SNAPSHOT

26.21.2 PRODUCT PORTFOLIO

26.21.3 REVENUE ANALYSIS

26.21.4 RECENT UPDATES

26.22 SUGANDA SKINCARE

26.22.1 COMPANY SNAPSHOT

26.22.2 PRODUCT PORTFOLIO

26.22.3 REVENUE ANALYSIS

26.22.4 RECENT UPDATES

26.23 AMARA SOAPS

26.23.1 COMPANY SNAPSHOT

26.23.2 PRODUCT PORTFOLIO

26.23.3 REVENUE ANALYSIS

26.23.4 RECENT UPDATES

26.24 ANCIENT SOAPS

26.24.1 COMPANY SNAPSHOT

26.24.2 PRODUCT PORTFOLIO

26.24.3 REVENUE ANALYSIS

26.24.4 RECENT UPDATES

26.25 CAPE OF GOOD SHOP

26.25.1 COMPANY SNAPSHOT

26.25.2 PRODUCT PORTFOLIO

26.25.3 REVENUE ANALYSIS

26.25.4 RECENT UPDATES

26.26 LA FLORA ORGANICS

26.26.1 COMPANY SNAPSHOT

26.26.2 PRODUCT PORTFOLIO

26.26.3 REVENUE ANALYSIS

26.26.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 QUESTIONNAIRE

29 CONCLUSION

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.