Global Non Invasive Glucose Meter Market

Market Size in USD Million

CAGR :

%

USD

195.26 Million

USD

379.19 Million

2024

2032

USD

195.26 Million

USD

379.19 Million

2024

2032

| 2025 –2032 | |

| USD 195.26 Million | |

| USD 379.19 Million | |

|

|

|

|

Non-Invasive Glucose Meter Market Size

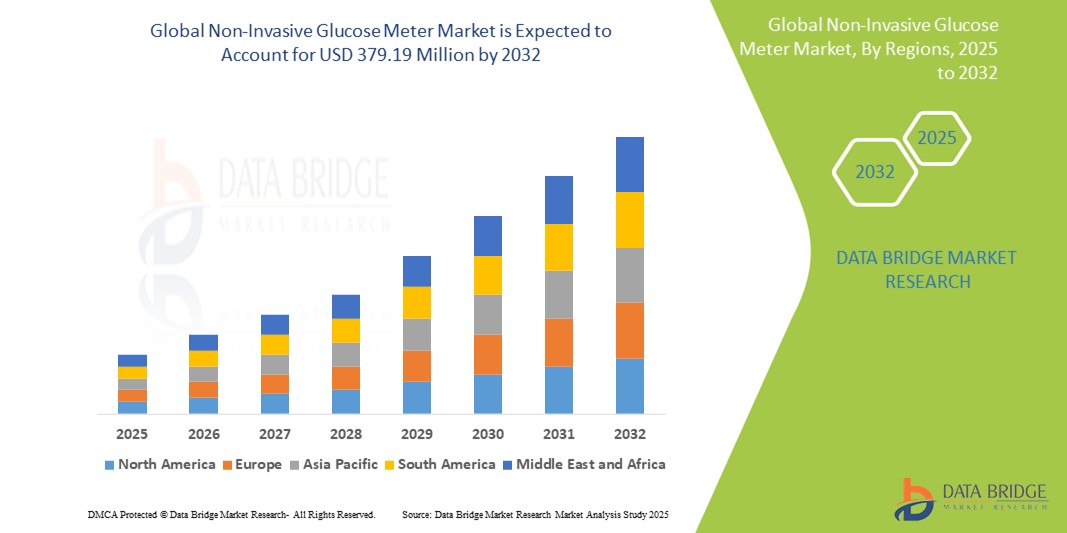

- The global non-invasive glucose meter market was valued at USD 195.26 million in 2024 and is expected to reach USD 379.19 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.65%, primarily driven by technological advancements and increasing product approvals

- This growth is driven by factors such as the rising global prevalence of diabetes, growing demand for painless and convenient glucose monitoring solutions, and increasing awareness around continuous glucose management systems

Non-Invasive Glucose Meter Market Analysis

- Non-invasive glucose meters are innovative diagnostic tools designed to measure blood glucose levels without the need for skin puncture or blood samples. These devices utilize technologies such as near-infrared spectroscopy, electromagnetic sensing, and optical techniques for continuous and painless monitoring

- The market demand is significantly driven by the rising global diabetes burden, which affects over 500 million individuals worldwide. Patients are increasingly seeking pain-free and convenient glucose monitoring alternatives, pushing manufacturers toward innovation in wearable and real-time monitoring devices

- The North America region holds a dominant position in the global non-invasive glucose meter market, owing to high diabetes prevalence, favorable reimbursement policies, advanced healthcare systems, and the strong presence of leading medical technology companies

- For instance, in the U.S., an estimated 38.4 million people are living with diabetes (CDC, 2023), creating a substantial market for advanced monitoring solutions like non-invasive glucose meters. Moreover, increasing investment in research and clinical trials further supports market growth in this region

- Globally, non-invasive glucose meters are becoming a critical component of diabetes management, especially in homecare settings. They are increasingly adopted as patient-centric tools for real-time glucose monitoring, thereby reducing reliance on conventional invasive finger-prick tests and improving quality of life

Report Scope and Non-Invasive Glucose Meter Market Segmentation

|

Attributes |

Non-Invasive Glucose Meter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Non-Invasive Glucose Meter Market Trends

“Integration of Smart Technology and Wearables”

- A prominent trend in the global non-invasive glucose meter market is the integration of smart technology and wearable devices, which offer a more convenient and efficient method for continuous glucose monitoring

- These advanced features enable real-time tracking of glucose levels, providing users with instant data and insights through mobile apps or connected devices, improving daily diabetes management

- For instance, wearable glucose meters can sync with smartphones and smartwatches, alerting users to fluctuations in blood sugar levels and facilitating proactive health management

- The ability to track glucose levels continuously and seamlessly through non-invasive methods enhances the quality of life for diabetic patients and creates a growing demand for non-invasive glucose meters in the market

- This trend is expected to drive market growth as it aligns with the increasing demand for more personalized, user-friendly, and non-invasive solutions for diabetes management

Non-Invasive Glucose Meter Market Dynamics

Driver

“Rising Prevalence of Diabetes and Demand for Continuous Monitoring”

- The increasing prevalence of diabetes, particularly type 2 diabetes, is significantly driving the demand for non-invasive glucose meters, as individuals require regular and accurate blood glucose monitoring for effective disease management

- As the global population ages and unhealthy lifestyles become more common, the number of people diagnosed with diabetes continues to grow, making non-invasive glucose monitoring essential for daily management

For instance,

- In 2019, according to the World Health Organization, diabetes is one of the leading causes of death globally, which further emphasizes the need for innovative solutions to manage the condition

- The shift toward non-invasive glucose meters is largely driven by patients' demand for more convenient, pain-free, and efficient alternatives to traditional finger-pricking methods, which encourages the growth of this market

- As the awareness around diabetes management improves and the demand for continuous, real-time glucose monitoring increases, non-invasive glucose meters are becoming a crucial tool in improving patient compliance, overall health outcomes, and quality of life

Opportunity

“Advancing Non-Invasive Glucose Monitoring with Artificial Intelligence Integration”

- AI-powered non-invasive glucose meters can enhance accuracy, automate data analysis, and provide real-time insights, enabling patients and healthcare providers to make informed decisions regarding diabetes management

- AI algorithms can analyze continuous glucose data, offering personalized recommendations for managing blood glucose levels and helping detect early signs of abnormalities, such as diabetic ketoacidosis or hypoglycemia

- Additionally, AI-powered systems can improve predictive capabilities, allowing for more proactive management of glucose levels and reducing the risk of complications associated with diabetes

For instance,

- In January 2025, an article published in the Journal of Diabetes Science and Technology highlighted that AI algorithms in non-invasive glucose monitoring systems can significantly improve the accuracy and speed of blood glucose measurements, particularly for individuals with fluctuating glucose levels, reducing the need for fingerstick testing

- In December 2023, a study published by the National Institutes of Health showed that AI integration in glucose meters could help healthcare providers predict glucose trends more effectively, assisting in better diabetes management and optimizing treatment plans

- The integration of AI in non-invasive glucose meters has the potential to improve patient outcomes, enhance convenience, and reduce healthcare costs by offering real-time, accurate, and personalized insights for diabetes care

Restraint/Challenge

“High Equipment Costs Hindering Market Penetration”

- The high cost of non-invasive glucose meters remains a significant challenge for the market, particularly affecting adoption rates in low-income regions and among uninsured individuals

- These devices, which are essential for regular glucose monitoring without the need for traditional blood samples, can often be priced higher than conventional invasive devices, making them inaccessible to many patients and healthcare facilities

- This financial barrier may slow the widespread adoption of non-invasive glucose meters, especially in developing countries where affordability is a major concern

For instance,

- In December 2024, according to a report by the International Diabetes Federation, the high cost of advanced non-invasive glucose monitoring technologies is a major obstacle in increasing access to diabetes management tools, particularly in lower-income countries where diabetes rates are rising

- As a result, these cost limitations can prevent many individuals from benefiting from advanced monitoring solutions, leading to lower adoption rates and slower growth of the market

Non-Invasive Glucose Meter Market Scope

The market is segmented on the basis of component outlook, site outlook, application outlook, and end-user outlook

|

Segmentation |

Sub-Segmentation |

|

By Component Outlook |

|

|

By Site Outlook |

|

|

By Application Outlook |

|

|

By End-User Outlook |

|

Non-Invasive Glucose Meter Market Regional Analysis

“North America is the Dominant Region in the Non-Invasive Glucose Meter Market”

- North America dominates the non-invasive glucose meter market, driven by advanced healthcare infrastructure, high adoption of innovative healthcare technologies, and strong presence of key market players

- The U.S. holds a significant share due to increased demand for more efficient and painless glucose monitoring solutions, the rising prevalence of diabetes, and continuous advancements in non-invasive monitoring technologies

- The availability of well-established reimbursement policies, increasing healthcare awareness, and growing investments in research & development by leading medical device companies further strengthen the market

- Additionally, the widespread adoption of health-conscious lifestyles, coupled with the expanding diabetes patient pool, is fueling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the non-invasive glucose meter market, driven by rapid expansion in healthcare infrastructure, rising awareness about diabetes, and increasing healthcare investments

- Countries such as China, India, and Japan are emerging as key markets due to the growing number of diabetes cases and a shift toward advanced medical devices for better disease management

- Japan, with its advanced medical technology and high healthcare standards, remains a crucial market for non-invasive glucose meters. The country continues to lead in the adoption of innovative health solutions and devices

- China and India, with their large populations and increasing prevalence of diabetes, are witnessing significant government and private sector investments in modern medical technologies. The improving healthcare infrastructure and expanding access to advanced non-invasive glucose monitoring solutions further contribute to market growth in these countries

Non-Invasive Glucose Meter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Masimo (U.S.)

- Medtronic (Ireland)

- Beurer (Germany)

- Nemaura Medical (U.K.)

- Transtek Medical (China)

- Abbott Laboratories (U.S.)

- Dexcom (U.S.)

- Senseonics (U.S.)

- ForaCare (U.S.)

- Omron Healthcare (Japan)

- Roche Diabetes Care (Switzerland)

- Terumo Corporation (Japan)

- LifeScan (U.S.)

- Sanofi (France)

- Medisana (Germany)

- GlucoMe (Israel)

- iHealth Labs (U.S.)

- Biolinq (U.S.)

- GlucoSense (U.K.)

- Glysure (U.K.)

Latest Developments in Global Non-Invasive Glucose Meter Market

- In August 2024, Dexcom unveiled its next-generation Continuous Glucose Monitoring (CGM) system, incorporating advanced optical sensors designed to enhance the accuracy of non-invasive glucose monitoring. This development signifies a major advancement in diabetes management, offering more precise and reliable glucose readings without the need for invasive procedures

- In July 2024, Abbott has received FDA clearance for its advanced FreeStyle Libre 4 continuous glucose monitoring system, featuring enhanced sensor technology, extended battery life, and more accurate real-time glucose monitoring without the need for calibration. This breakthrough represents a significant advancement in non-invasive diabetes management, providing users with more precise and reliable glucose monitoring capabilities

- In June 2024, GlucoTrack broadened its product portfolio with the introduction of a new non-invasive glucose monitoring device across European markets. This device incorporates an advanced transdermal sensor, tailored for both home care and clinical applications. The launch signifies a pivotal development in wearable health technologies, which is increasingly relevant to the global Motorcycle Apparel Market, where the integration of health-monitoring devices into apparel and accessories is gaining traction

- In May 2024, Integrity Applications revealed a strategic partnership with Medtronic to integrate its GlucoTrack device into Medtronic’s diabetes care platform, facilitating seamless glucose data transmission and enabling remote patient monitoring. This collaboration underscores a significant advancement in the digital health space, which holds particular relevance to the global Motorcycle Apparel Market. As the demand for wearable health technologies grows, the integration of such devices into motorcycle apparel is poised to enhance rider safety and performance

- In March 2024, Philips Healthcare launched a non-invasive glucose monitoring patch specifically designed for use in intensive care units (ICUs). Utilizing near-infrared spectroscopy, this patch enables the monitoring of glucose levels in critically ill patients without the need for blood sampling. This innovation is particularly relevant to the global Motorcycle Apparel Market, as the integration of advanced health-monitoring technologies, such as non-invasive glucose monitoring, into motorcycle gear could offer riders enhanced safety

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NON-INVASIVE GLUCOSE METER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NON-INVASIVE GLUCOSE METER MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL NON-INVASIVE GLUCOSE METER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 MANUAFCTURING AND R&D ANALYSIS

16.1 R&D ANALYSIS

16.2 BLOOD-SUGAR DETECTION VIA MONITORING

16.2.1 ACETONE CONTENTS IN BREATH

16.2.2 KETONE CONTENTS IN BREATH

16.2.3 OTHERS

16.3 MANUFACTURING PROCESS NONINVASIVE GLUCOMETERS

16.3.1 ACETONE CONTENTS IN BREATH

16.3.2 KETONE CONTENTS IN BREATH

16.3.3 OTHERS

17 EPIDEMIOLOGY

17.1 PREVALENCE AND INCIDENCE OF DIABETES, BY COUNTRY

17.2 PREVALENCE AND INCIDENCE OF DIABETES, BY AGE GROUP

18 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY PRODUCT TYPE

18.1 OVERVIEW

18.2 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

18.2.1 BY TYPE

18.2.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

18.2.1.1.1. MONITORING PATCHES

18.2.1.1.1.1 FABRIC PATCHES

18.2.1.1.1.2 OTHERS

18.2.1.1.2. CONTINUOUS MONITORING SENSORS

18.2.1.1.3. SMART LENSES

18.2.1.1.4. SMART WATCHES

18.2.1.1.5. OTHERS

18.2.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

18.2.1.2.1. TABLE TOP

18.2.1.2.2. HANDHELD

18.2.1.2.3. OTHERS

18.2.2 BY TECHNOLOGY

18.2.2.1. NEAR-INFRARED REFLECTANCE SPECTROSCOPY (NIRS)

18.2.2.2. POLARIZED OPTICAL ROTATION

18.2.2.3. RAMAN SPECTROSCOPY

18.2.2.4. FLUORESCENCE

18.2.2.5. OPTICAL COHERENCE TOMOGRAPHY (OCT)

18.2.2.6. OTHERS

18.3 NONINVASIVE FLUID SAMPLING (NIFS-GM)

18.3.1 BY TYPE

18.3.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

18.3.1.1.1. MONITORING PATCHES

18.3.1.1.1.1 FABRIC PATCHES

18.3.1.1.1.2 OTHERS

18.3.1.1.2. CONTINUOUS MONITORING SENSORS

18.3.1.1.3. SMART LENSES

18.3.1.1.4. SMART WATCHES

18.3.1.1.5. OTHERS

18.3.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

18.3.1.2.1. TABLE TOP

18.3.1.2.2. HANDHELD

18.3.1.2.3. OTHERS

18.3.1.3. NON-WEARABLE DEVICE ELECTRODE MATERIAL

18.3.1.3.1. SWNT-CS-GNP

18.3.1.3.2. PTB-GOX

18.3.1.3.3. NANO-GOLD

18.3.2 BY TECHNOLOGY

18.3.2.1. SALIVA-BASED AND BREATH ACETONE GLUCOSE MONITORING

18.3.2.2. TEAR-BASED GLUCOSE MONITORING

18.3.2.3. SWEAT-BASED GLUCOSE MONITORING

18.3.2.4. ISF-BASED GLUCOSE MONITORING

18.3.2.5. OTHERS

18.4 OTHERS

19 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY SITE

19.1 OVERVIEW

19.2 ARM/ WRIST

19.2.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

19.2.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

19.2.3 OTHERS

19.3 EAR LOBE

19.3.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

19.3.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

19.3.3 OTHERS

19.4 FOREFINGER AND THUMB

19.4.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

19.4.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

19.4.3 OTHERS

19.5 CORNEA/ EYE LID

19.5.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

19.5.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

19.5.3 OTHERS

19.6 OTHERS

20 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 INTENSIVE INSULIN THERAPY

20.2.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

20.2.1.1. BY TYPE

20.2.1.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.2.1.1.1.1 MONITORING PATCHES

20.2.1.1.1.1.1. FABRIC PATCHES

20.2.1.1.1.1.2. OTHERS

20.2.1.1.1.2 CONTINUOUS MONITORING SENSORS

20.2.1.1.1.3 SMART LENSES

20.2.1.1.1.4 SMART WATCHES

20.2.1.1.1.5 OTHERS

20.2.1.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.2.1.1.2.1 TABLE TOP

20.2.1.1.2.2 HANDHELD

20.2.1.1.2.3 OTHERS

20.2.1.2. BY TECHNOLOGY

20.2.1.2.1. NEAR-INFRARED REFLECTANCE SPECTROSCOPY (NIRS)

20.2.1.2.2. POLARIZED OPTICAL ROTATION

20.2.1.2.3. RAMAN SPECTROSCOPY

20.2.1.2.4. FLUORESCENCE

20.2.1.2.5. OPTICAL COHERENCE TOMOGRAPHY (OCT)

20.2.1.2.6. OTHERS

20.2.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

20.2.2.1. BY TYPE

20.2.2.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.2.2.1.1.1 MONITORING PATCHES

20.2.2.1.1.1.1. FABRIC PATCHES

20.2.2.1.1.1.2. OTHERS

20.2.2.1.1.2 CONTINUOUS MONITORING SENSORS

20.2.2.1.1.3 SMART LENSES

20.2.2.1.1.4 SMART WATCHES

20.2.2.1.1.5 OTHERS

20.2.2.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.2.2.1.2.1 TABLE TOP

20.2.2.1.2.2 HANDHELD

20.2.2.1.2.3 OTHERS

20.2.2.1.3. NON-WEARABLE DEVICE ELECTRODE MATERIAL

20.2.2.1.3.1 SWNT-CS-GNP

20.2.2.1.3.2 PTB-GOX

20.2.2.1.3.3 NANO-GOLD

20.2.2.2. BY TECHNOLOGY

20.2.2.2.1. SALIVA-BASED AND BREATH ACETONE GLUCOSE MONITORING

20.2.2.2.2. TEAR-BASED GLUCOSE MONITORING

20.2.2.2.3. SWEAT-BASED GLUCOSE MONITORING

20.2.2.2.4. ISF-BASED GLUCOSE MONITORING

20.2.2.2.5. OTHERS

20.2.3 OTHERS

20.3 HYPOGLYCEMIA

20.3.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

20.3.1.1. BY TYPE

20.3.1.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.3.1.1.1.1 MONITORING PATCHES

20.3.1.1.1.1.1. FABRIC PATCHES

20.3.1.1.1.1.2. OTHERS

20.3.1.1.1.2 CONTINUOUS MONITORING SENSORS

20.3.1.1.1.3 SMART LENSES

20.3.1.1.1.4 SMART WATCHES

20.3.1.1.1.5 OTHERS

20.3.1.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.3.1.1.2.1 TABLE TOP

20.3.1.1.2.2 HANDHELD

20.3.1.1.2.3 OTHERS

20.3.1.2. BY TECHNOLOGY

20.3.1.2.1. NEAR-INFRARED REFLECTANCE SPECTROSCOPY (NIRS)

20.3.1.2.2. POLARIZED OPTICAL ROTATION

20.3.1.2.3. RAMAN SPECTROSCOPY

20.3.1.2.4. FLUORESCENCE

20.3.1.2.5. OPTICAL COHERENCE TOMOGRAPHY (OCT)

20.3.1.2.6. OTHERS

20.3.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

20.3.2.1. BY TYPE

20.3.2.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.3.2.1.1.1 MONITORING PATCHES

20.3.2.1.1.1.1. FABRIC PATCHES

20.3.2.1.1.1.2. OTHERS

20.3.2.1.1.2 CONTINUOUS MONITORING SENSORS

20.3.2.1.1.3 SMART LENSES

20.3.2.1.1.4 SMART WATCHES

20.3.2.1.1.5 OTHERS

20.3.2.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.3.2.1.2.1 TABLE TOP

20.3.2.1.2.2 HANDHELD

20.3.2.1.2.3 OTHERS

20.3.2.1.3. NON-WEARABLE DEVICE ELECTRODE MATERIAL

20.3.2.1.3.1 SWNT-CS-GNP

20.3.2.1.3.2 PTB-GOX

20.3.2.1.3.3 NANO-GOLD

20.3.2.2. BY TECHNOLOGY

20.3.2.2.1. SALIVA-BASED AND BREATH ACETONE GLUCOSE MONITORING

20.3.2.2.2. TEAR-BASED GLUCOSE MONITORING

20.3.2.2.3. SWEAT-BASED GLUCOSE MONITORING

20.3.2.2.4. ISF-BASED GLUCOSE MONITORING

20.3.2.2.5. OTHERS

20.3.3 OTHERS

20.4 DIABETIC FOOT ULCER TRACKING

20.4.1 NONINVASIVE OPTICAL GLUCOSE MONITORING (NIO-GM)

20.4.1.1. BY TYPE

20.4.1.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.4.1.1.1.1 MONITORING PATCHES

20.4.1.1.1.1.1. FABRIC PATCHES

20.4.1.1.1.1.2. OTHERS

20.4.1.1.1.2 CONTINUOUS MONITORING SENSORS

20.4.1.1.1.3 SMART LENSES

20.4.1.1.1.4 SMART WATCHES

20.4.1.1.1.5 OTHERS

20.4.1.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.4.1.1.2.1 TABLE TOP

20.4.1.1.2.2 HANDHELD

20.4.1.1.2.3 OTHERS

20.4.1.2. BY TECHNOLOGY

20.4.1.2.1. NEAR-INFRARED REFLECTANCE SPECTROSCOPY (NIRS)

20.4.1.2.2. POLARIZED OPTICAL ROTATION

20.4.1.2.3. RAMAN SPECTROSCOPY

20.4.1.2.4. FLUORESCENCE

20.4.1.2.5. OPTICAL COHERENCE TOMOGRAPHY (OCT)

20.4.1.2.6. OTHERS

20.4.2 NONINVASIVE FLUID SAMPLING (NIFS-GM)

20.4.2.1. BY TYPE

20.4.2.1.1. WEARABLE GLUCOSE MONITORING SYSTEMS

20.4.2.1.1.1 MONITORING PATCHES

20.4.2.1.1.1.1. FABRIC PATCHES

20.4.2.1.1.1.2. OTHERS

20.4.2.1.1.2 CONTINUOUS MONITORING SENSORS

20.4.2.1.1.3 SMART LENSES

20.4.2.1.1.4 SMART WATCHES

20.4.2.1.1.5 OTHERS

20.4.2.1.2. NON-WEARABLE GLUCOSE MONITORING SYSTEMS

20.4.2.1.2.1 TABLE TOP

20.4.2.1.2.2 HANDHELD

20.4.2.1.2.3 OTHERS

20.4.2.1.3. NON-WEARABLE DEVICE ELECTRODE MATERIAL

20.4.2.1.3.1 SWNT-CS-GNP

20.4.2.1.3.2 PTB-GOX

20.4.2.1.3.3 NANO-GOLD

20.4.2.2. BY TECHNOLOGY

20.4.2.2.1. SALIVA-BASED AND BREATH ACETONE GLUCOSE MONITORING

20.4.2.2.2. TEAR-BASED GLUCOSE MONITORING

20.4.2.2.3. SWEAT-BASED GLUCOSE MONITORING

20.4.2.2.4. ISF-BASED GLUCOSE MONITORING

20.4.2.2.5. OTHERS

20.4.3 OTHERS

20.5 OTHERS

21 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.2.1 PUBLIC

21.2.2 PRIVATE

21.3 SPECIALITY CLINICS

21.4 DIAGNOSTIC CENTRES

21.5 HOME CARE SETTINGS

21.6 AMBULATORY SURGICAL CENTERS

21.7 ACADEMIC & RESEARCH INSTITUTES

21.8 OTHERS

22 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL SALES

22.3.1 ONLINE SALES

22.3.2 OFFLINE SALES

22.4 OTHERS

23 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, BY GEOGRAPHY

GLOBAL NON-INVASIVE GLUCOSE METER MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 FRANCE

23.2.3 U.K.

23.2.4 ITALY

23.2.5 SPAIN

23.2.6 RUSSIA

23.2.7 TURKEY

23.2.8 BELGIUM

23.2.9 NETHERLANDS

23.2.10 SWITZERLAND

23.2.11 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 AUSTRALIA

23.3.6 SINGAPORE

23.3.7 THAILAND

23.3.8 MALAYSIA

23.3.9 INDONESIA

23.3.10 PHILIPPINES

23.3.11 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 SAUDI ARABIA

23.5.3 UAE

23.5.4 EGYPT

23.5.5 ISRAEL

23.5.6 REST OF MIDDLE EAST AND AFRICA

23.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

24 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, SWOT AND DBMR ANALYSIS

25 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL NON-INVASIVE GLUCOSE METER MARKET, COMPANY PROFILE

26.1 ABBOTT

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 GEOGRAPHIC PRESENCE

26.1.4 PRODUCT PORTFOLIO

26.1.5 RECENT DEVELOPMENTS

26.2 ASCENSIA DIABETES CARE HOLDINGS AG (PHC HOLDINGS CORPORATION)

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 GEOGRAPHIC PRESENCE

26.2.4 PRODUCT PORTFOLIO

26.2.5 RECENT DEVELOPMENTS

26.3 DEXCOM, INC.

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 GEOGRAPHIC PRESENCE

26.3.4 PRODUCT PORTFOLIO

26.3.5 RECENT DEVELOPMENTS

26.4 MEDTRONIC

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 GEOGRAPHIC PRESENCE

26.4.4 PRODUCT PORTFOLIO

26.4.5 RECENT DEVELOPMENTS

26.5 INTEGRITY APPLICATIONS

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 GEOGRAPHIC PRESENCE

26.5.4 PRODUCT PORTFOLIO

26.5.5 RECENT DEVELOPMENTS

26.6 DIAMONTECH AG

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 GEOGRAPHIC PRESENCE

26.6.4 PRODUCT PORTFOLIO

26.6.5 RECENT DEVELOPMENTS

26.7 CNOGA

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 GEOGRAPHIC PRESENCE

26.7.4 PRODUCT PORTFOLIO

26.7.5 RECENT DEVELOPMENTS

26.8 BOYDSENSE SAS

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 GEOGRAPHIC PRESENCE

26.8.4 PRODUCT PORTFOLIO

26.8.5 RECENT DEVELOPMENTS

26.9 META MATERIALS INC.

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 GEOGRAPHIC PRESENCE

26.9.4 PRODUCT PORTFOLIO

26.9.5 RECENT DEVELOPMENTS

26.1 OPTICOLOGY INC.

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 GEOGRAPHIC PRESENCE

26.10.4 PRODUCT PORTFOLIO

26.10.5 RECENT DEVELOPMENTS

26.11 HAGAR TECHNOLOGY

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 GEOGRAPHIC PRESENCE

26.11.4 PRODUCT PORTFOLIO

26.11.5 RECENT DEVELOPMENTS

26.12 NEMAURA

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 GEOGRAPHIC PRESENCE

26.12.4 PRODUCT PORTFOLIO

26.12.5 RECENT DEVELOPMENTS

26.13 KNOW LABS, INC.

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 GEOGRAPHIC PRESENCE

26.13.4 PRODUCT PORTFOLIO

26.13.5 RECENT DEVELOPMENTS

26.14 NOVIOSENSE

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 GEOGRAPHIC PRESENCE

26.14.4 PRODUCT PORTFOLIO

26.14.5 RECENT DEVELOPMENTS

26.15 LIFEPLUS

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 GEOGRAPHIC PRESENCE

26.15.4 PRODUCT PORTFOLIO

26.15.5 RECENT DEVELOPMENTS

26.16 AFON TECHNOLOGY

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 GEOGRAPHIC PRESENCE

26.16.4 PRODUCT PORTFOLIO

26.16.5 RECENT DEVELOPMENTS

26.17 OCCUITY

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 GEOGRAPHIC PRESENCE

26.17.4 PRODUCT PORTFOLIO

26.17.5 RECENT DEVELOPMENTS

26.18 ESER COMPANY

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 GEOGRAPHIC PRESENCE

26.18.4 PRODUCT PORTFOLIO

26.18.5 RECENT DEVELOPMENTS

26.19 ETOUCHUS PVT LTD.

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 GEOGRAPHIC PRESENCE

26.19.4 PRODUCT PORTFOLIO

26.19.5 RECENT DEVELOPMENTS

26.2 VIVALYF INNOVATIONS

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 GEOGRAPHIC PRESENCE

26.20.4 PRODUCT PORTFOLIO

26.20.5 RECENT DEVELOPMENTS

26.21 GLUCOACTIVE LTD.

26.21.1 COMPANY OVERVIEW

26.21.2 REVENUE ANALYSIS

26.21.3 GEOGRAPHIC PRESENCE

26.21.4 PRODUCT PORTFOLIO

26.21.5 RECENT DEVELOPMENTS

26.22 RSP SYSTEMS A/S

26.22.1 COMPANY OVERVIEW

26.22.2 REVENUE ANALYSIS

26.22.3 GEOGRAPHIC PRESENCE

26.22.4 PRODUCT PORTFOLIO

26.22.5 RECENT DEVELOPMENTS

26.23 AERBETIC

26.23.1 COMPANY OVERVIEW

26.23.2 REVENUE ANALYSIS

26.23.3 GEOGRAPHIC PRESENCE

26.23.4 PRODUCT PORTFOLIO

26.23.5 RECENT DEVELOPMENTS

26.24 SINOCARE

26.24.1 COMPANY OVERVIEW

26.24.2 REVENUE ANALYSIS

26.24.3 GEOGRAPHIC PRESENCE

26.24.4 PRODUCT PORTFOLIO

26.24.5 RECENT DEVELOPMENTS

26.25 IGLUCO TECH, S.L.

26.25.1 COMPANY OVERVIEW

26.25.2 REVENUE ANALYSIS

26.25.3 GEOGRAPHIC PRESENCE

26.25.4 PRODUCT PORTFOLIO

26.25.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST RELATED REPORTS

27 CONCLUSION

28 QUESTIONNAIRE

29 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.