Global Non Pvc Iv Bags Market

Market Size in USD Billion

CAGR :

%

USD

2.08 Billion

USD

4.40 Billion

2024

2032

USD

2.08 Billion

USD

4.40 Billion

2024

2032

| 2025 –2032 | |

| USD 2.08 Billion | |

| USD 4.40 Billion | |

|

|

|

|

Non-PVC IV Bags Market Size

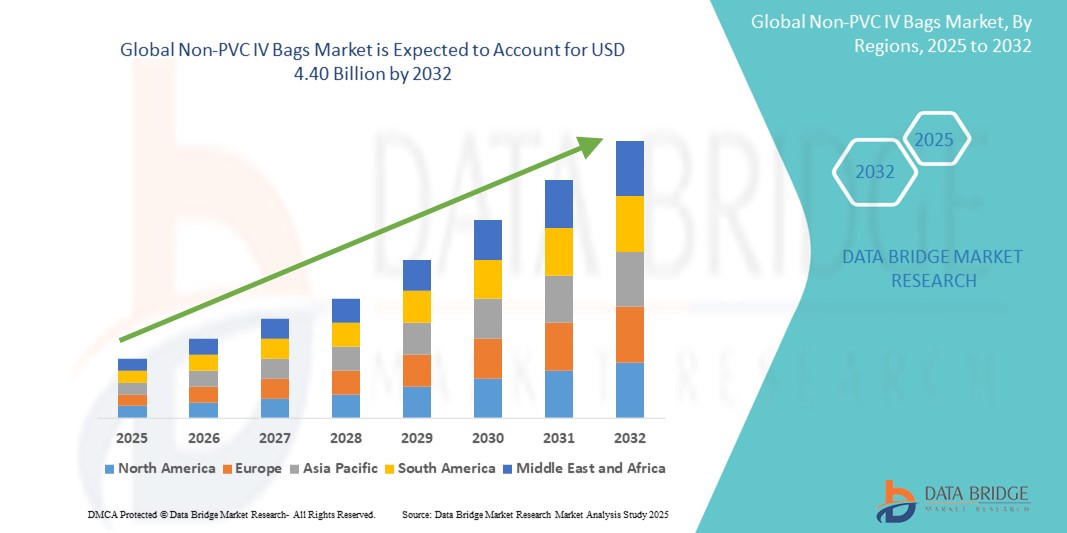

- The global Non-PVC IV bags market size was valued at USD 2.08 billion in 2024 and is expected to reach USD 4.40 billion by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within parenteral drug delivery systems and intravenous (IV) therapy technology, leading to increased digitalization and safety enhancement in both hospital and ambulatory care settings

- Furthermore, rising healthcare provider demand for safer, more sustainable, and biocompatible IV bag materials—free from harmful plasticizers like DEHP—has positioned Non-PVC IV Bags as the preferred alternative to traditional PVC-based solutions. These converging factors are accelerating the uptake of Non-PVC IV Bags, thereby significantly boosting the industry’s growth

Non-PVC IV Bags Market Analysis

- Non-PVC IV bags, offering a safer and more environmentally friendly alternative to traditional PVC-based intravenous solutions, are becoming increasingly vital in modern healthcare settings due to their reduced risk of plasticizer leaching, biocompatibility, and enhanced patient safety. These bags are widely used for chemotherapy, parenteral nutrition, and other sensitive drug formulations

- The escalating demand for Non-PVC IV bags is primarily fueled by the growing awareness of the health risks associated with DEHP-containing PVC bags, the increasing preference for eco-friendly medical packaging, and the rising number of hospitalizations requiring IV therapies globally

- Europe dominated the Non-PVC IV bags Market with the largest revenue share of 38.6% in 2024, attributed to stringent regulatory policies discouraging PVC usage, high healthcare standards, and rapid adoption of sustainable medical products. Countries like Germany and France are leading in transitioning toward DEHP-free IV solutions

- Asia-Pacific is expected to witness the fastest growth, registering a CAGR of 7.8% from 2025 to 2032, driven by increasing healthcare expenditure, expanding patient population, and government initiatives to modernize medical infrastructure, especially in India, China, and Southeast Asia

- The single-chambered segment dominated the market with the largest revenue share of 67.4% in 2024, owing to its widespread usage in standard fluid and electrolyte administration across hospitals and emergency care centers. These bags are easier to manufacture and are cost-effective, making them a popular choice for general applications

Report Scope and Non-PVC IV Bags Market Segmentation

|

Attributes |

Non-PVC IV Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-PVC IV Bags Market Trends

“Growing Shift Toward Environmentally Safer and Patient-Friendly Solutions”

- A significant and accelerating trend in the global Non-PVC IV bags market is the increasing shift from traditional PVC-based bags to non-PVC alternatives due to growing environmental and health concerns. Non-PVC IV bags are free from harmful plasticizers like DEHP, which are associated with leaching risks and adverse health effects, especially in sensitive patient populations such as neonates and oncology patients

- For instance, non-PVC bags made from materials like polypropylene, polyethylene, and EVA are being widely adopted in hospitals and clinics for parenteral nutrition, chemotherapy, and antibiotic delivery. These bags offer improved chemical compatibility and reduced interaction with the infused drug, enhancing patient safety

- The global push for sustainability in healthcare packaging and stricter regulatory frameworks—particularly in Europe and North America—are propelling hospitals to switch to eco-friendly and recyclable IV solutions. Regulatory authorities such as the U.S. FDA and European Medicines Agency (EMA) are encouraging the use of non-toxic and non-leaching materials, thus supporting the market’s expansion

- In addition, pharmaceutical companies and IV bag manufacturers are increasingly investing in the development of multi-chamber and oxygen-impermeable non-PVC bags that provide extended drug stability and storage capabilities. These innovations are proving especially useful in critical care settings, emergency kits, and portable healthcare solutions

- The rising incidence of chronic illnesses, growing demand for home infusion therapies, and increasing surgical procedures worldwide are further driving the adoption of safe, durable, and flexible non-PVC IV bags

- The market is also benefiting from strategic partnerships, mergers, and acquisitions aimed at expanding production capacities and geographic reach. Companies are collaborating with hospitals and healthcare organizations to transition from legacy PVC systems to advanced non-PVC bag solutions in compliance with green healthcare initiatives

Non-PVC IV Bags Market Dynamics

Driver

“Growing Need Due to Rising Environmental and Health Safety Concerns”

- The increasing awareness regarding the harmful effects of polyvinyl chloride (PVC) and phthalates (especially DEHP) in medical devices is significantly driving the demand for Non-PVC IV bags globally. These bags offer a safer, DEHP-free alternative, reducing the risk of chemical leaching into IV solutions—particularly critical for vulnerable populations like neonates, oncology patients, and the elderly

- For instance, in recent years, healthcare regulatory authorities such as the U.S. FDA and European Medicines Agency have highlighted safety concerns related to PVC-based medical devices. This is encouraging hospitals and manufacturers to shift toward biocompatible materials such as polypropylene (PP), ethylene-vinyl acetate (EVA), and copolyester ether in IV bag manufacturing. These regulatory pressures are expected to fuel the Non-PVC IV Bags industry growth during the forecast period

- As hospitals, clinics, and emergency centers increasingly prioritize patient safety, Non-PVC IV bags provide enhanced sterility, thermal stability, and drug compatibility, offering a compelling alternative to traditional PVC bags

- Furthermore, the growing adoption of eco-friendly healthcare products aligns with the sustainability goals of healthcare providers, driving market demand. Non-PVC bags also offer benefits like better recyclability and lower incineration emissions, supporting green initiatives in medical waste management

- The ease of customization for multi-chamber designs and targeted drug delivery in oncology, chemotherapy, and electrolyte/nutrient infusions also positions Non-PVC IV bags as an innovative solution across a broad application spectrum in both developed and developing economies

Restraint/Challenge

“High Manufacturing Costs and Material Limitations”

- Despite growing demand, the higher production costs of Non-PVC IV bags compared to traditional PVC bags pose a challenge to broader market penetration. Materials like EVA and PP require specialized equipment and cleanroom conditions, increasing the capital investment for manufacturers

- In addition, material limitations such as lower puncture resistance or reduced oxygen barrier properties in certain Non-PVC formulations may restrict adoption for specific high-risk infusion therapies unless enhanced with composite layers or coatings—adding further cost

- In price-sensitive regions or low-income healthcare systems, the initial cost differential can be a major barrier, limiting bulk procurement of Non-PVC IV bags despite their safety advantages

- Moreover, limited awareness among smaller healthcare facilities and a lack of standardized regulatory mandates in some regions also hinder full-scale transition away from PVC

- Overcoming these challenges will require continued R&D, material innovation, and strategic cost optimization to make Non-PVC IV bags affordable and scalable, especially in emerging markets

Non-PVC IV Bags Market Scope

The market is segmented on the basis of type, material, application, and end user.

• By Type

On the basis of type, the Non-PVC IV Bags market is segmented into single-chambered and multi-chambered. The single-chambered segment dominated the market with the largest revenue share of 67.4% in 2024, owing to its widespread usage in standard fluid and electrolyte administration across hospitals and emergency care centers. These bags are easier to manufacture and are cost-effective, making them a popular choice for general applications.

The multi-chambered segment is expected to witness the fastest growth rate of 21.3% from 2025 to 2032, driven by increasing demand for compartmentalized drug delivery, especially in chemotherapy and parenteral nutrition therapies. Their ability to separate and mix components at the point of use adds significant value in personalized and critical care treatment settings.

• By Material

On the basis of material, the market is segmented into Polypropylene (PP) IV Bags, Polyethylene (PE) IV Bags, Copolyester Ether IV Bags, Ethylene-Vinyl Acetate (EVA) IV Bags, and Others. The Polypropylene (PP) IV Bag segment held the largest market share of 39.8% in 2024, attributed to its strong chemical resistance, heat tolerance, and compatibility with a wide range of medications.

The Ethylene-Vinyl Acetate (EVA) IV Bag segment is projected to register the fastest CAGR of 23.6% from 2025 to 2032, due to its flexibility, transparency, and growing preference in nutrition therapy and oncology care, where non-reactive and durable packaging is essential.

• By Application

On the basis of application, the market is segmented into chemotherapy, targeted drug delivery, glucose injection, sodium chloride solution, electrolyte injection, nutrient injection, and others. The sodium chloride solution segment dominated the market with a revenue share of 32.1% in 2024, due to the high frequency of saline administration for hydration, dilution, and medication delivery in hospitals.

The chemotherapy segment is projected to grow at the highest CAGR of 24.5% from 2025 to 2032, driven by rising cancer prevalence and the need for non-reactive, DEHP-free IV bags that ensure drug stability during administration.

• By End User

On the basis of end user, the Non-PVC IV Bags market is segmented into hospitals, clinics, emergency service centers, ambulatory surgical centers, and others. The hospitals segment captured the largest revenue share of 56.7% in 2024, owing to the high volume of surgeries, chronic disease treatments, and emergency care procedures requiring IV administration.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 22.1% from 2025 to 2032, fueled by the global shift toward outpatient care models, cost-efficiency, and demand for safe infusion systems in same-day procedures.

Non-PVC IV Bags Market Regional Analysis

- Europe dominated the Non-PVC IV bags market with a significant revenue share of 25.7% in 2024, driven by rising demand for eco-friendly and DEHP-free IV solutions, as well as regulatory push towards phthalate-free medical products

- The region benefits from a strong healthcare infrastructure, increasing incidence of chronic diseases, and widespread hospital adoption of safer infusion solutions

- European consumers and healthcare providers prioritize sustainability, patient safety, and regulatory compliance, leading to rapid growth in demand for non-PVC IV bags, especially in chemotherapy and parenteral nutrition applications

U.K. Non-PVC IV Bags Market Insight

The U.K. Non-PVC IV Bags market accounted for 5.8% of the global share in 2024 and is projected to grow at a CAGR of 11.3% during the forecast period. The surge is driven by a combination of regulatory reforms, rising chronic disease burden, and NHS-supported initiatives promoting safe intravenous solutions. High cancer incidence and government-led sustainability goals are accelerating the adoption of non-DEHP and PVC-free bags in hospitals and clinics.

Germany Non-PVC IV Bags Market Insight

The Germany Non-PVC IV bags market held a 4.5% share of the global market in 2024, with revenue expected to more than double by 2030. The market is expanding at a CAGR of 11.6%, supported by robust R&D, stringent EU healthcare regulations, and the growing usage of multi-chamber IV bags in hospitals. The demand is especially notable in oncology and geriatric care, where safety and compatibility with sensitive drugs are top priorities.

France Non-PVC IV Bags Market Insight

The France Non-PVC IV bags market represented 3.9% of the global market in 2024 and is projected to grow at a CAGR of 11.0% during the forecast period. The country is witnessing increasing adoption in public and private healthcare settings due to a shift toward DEHP-free materials. The expansion of chemotherapy and targeted drug delivery in ambulatory settings is a key driver.

Asia-Pacific Non-PVC IV Bags Market Insight

The Asia-Pacific Non-PVC IV Bags market is expected to grow at the fastest CAGR of 24% from 2025 to 2032. This growth is propelled by the region’s large patient population, rising chronic illness prevalence, and rapid healthcare modernization across countries such as China, India, and Japan. APAC's role as a key manufacturing hub for medical disposables also ensures cost-effectiveness and scalability.

Japan Non-PVC IV Bags Market Insight

The Japan Non-PVC IV bags market is expanding steadily, driven by a high-tech healthcare ecosystem and increasing demand for safer IV solutions for its aging population. Hospitals in Japan are increasingly favoring multi-chamber, non-PVC IV bags for parenteral nutrition and chemotherapy, aligning with patient safety and regulatory trends.

China Non-PVC IV Bags Market Insight

The China Non-PVC IV bags market captured the largest share in the Asia-Pacific market in 2024, fueled by rapid urbanization, healthcare reforms, and local production capabilities. Domestic manufacturers are capitalizing on strong demand in both urban hospitals and rural health centers. The Chinese market is also benefitting from public hospital policies that restrict the use of PVC-based medical products.

Non-PVC IV Bags Market Share

The Non-PVC IV Bags industry is primarily led by well-established companies, including:

- Coloplast Corp (Denmark)

- Pall Corporation (U.S.)

- Medline Industries, Inc. (U.S.)

- Baxter (U.S.)

- TERUMO BCT, INC. (U.S.)

- B. Braun SE (Germany)

- BD (U.S.)

- WESTFIELD MEDICAL LIMITED (U.K.)

- Nolato AB (Sweden)

- Specialty Bags Inc. (U.S.)

- Action Health (Canada)

- UNIFLEX HEALTHCARE (U.S.)

- ArmandMFG.com (U.S.)

- Macopharma (France)

- International Plastics Inc. (U.S.)

- Medisave (U.K.)

- Sippex IV bag (Australia)

- Maco PKG. (U.S.)

- Persico S.p.a. (Italy)

- DuPont (U.S.)

- Versapak International Ltd (U.K.)

Latest Developments in Global Non-PVC IV Bags Market

- In March 2023, ICU Medical, Inc. acquired Rusoma Laboratories Pvt. Ltd. — an Indian manufacturer of non‑PVC IV bags — for USD 100 million. This strategic move expands ICU Medical’s footprint in Asia and significantly enhances its product portfolio in the global non‑PVC IV bags space

- In April 2023, Fresenius Kabi AG finalized the acquisition of JW Life Science, a Korea-based manufacturer of non‑PVC IV bags, for USD 70 million. This acquisition strengthens Fresenius Kabi’s position in the fast-growing Asian market

- In August 2022, ICU Medical Inc. solidified its commitment to providing safer alternatives by partnering with Grifols to offer non-PVC/non-DEHP IV containers for 0.9% Sodium Chloride Injection in the U.S. This expansion of their product line, ranging from 50 mL to 1000 mL, reflects the industry's focus on addressing concerns about patient safety and regulatory compliance with regards to intravenous therapy

- In April 2022, Fresenius Kabi responded to the growing demand for non-PVC IV bags by introducing Calcium Gluconate Injection in freeflex bags in the U.S. This launch underscores the industry's recognition of the benefits of non-PVC materials in enhancing patient care and reflects Fresenius Kabi's commitment to offering innovative solutions to healthcare providers

- In January 2022, ICU Medical Inc.'s acquisition of Smiths Medical further bolstered its position in the market for non-PVC IV bags. With Smiths Medical's portfolio encompassing syringe and ambulatory infusion devices, vascular access, and vital care, ICU Medical expands its offerings to provide comprehensive solutions that prioritize patient safety and address the evolving needs of healthcare facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.