Global Non Dispersive Infrared Market

Market Size in USD Million

CAGR :

%

USD

4.92 Million

USD

1,103.53 Million

2024

2032

USD

4.92 Million

USD

1,103.53 Million

2024

2032

| 2025 –2032 | |

| USD 4.92 Million | |

| USD 1,103.53 Million | |

|

|

|

|

Non-Dispersive Infrared Market Size

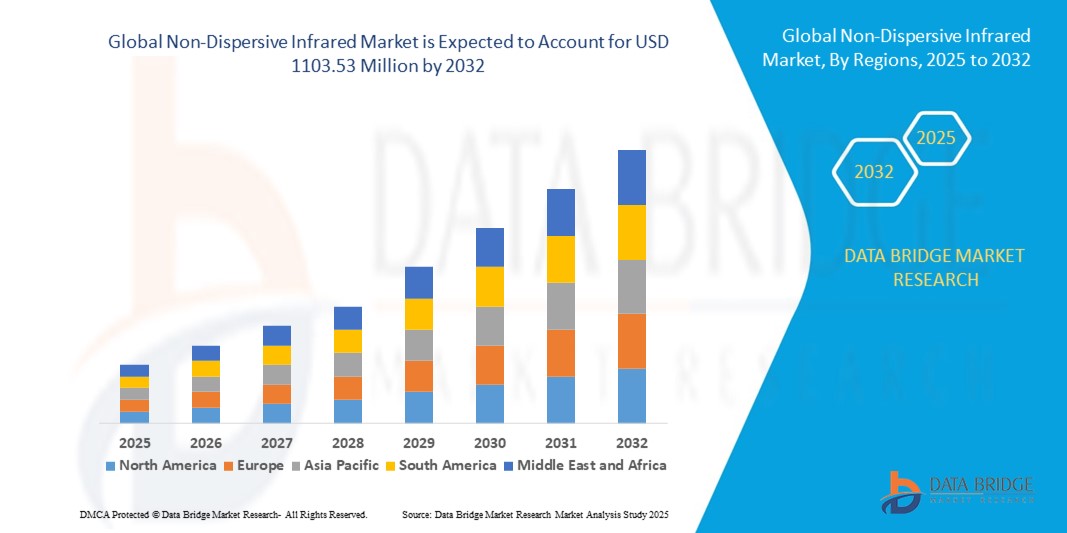

- The global Non-Dispersive Infrared market size was valued at USD 4.92 Million in 2024 and is expected to reach USD 1103.53 Million by 2032, at a CAGR of6.38% during the forecast period

- Market growth is largely driven by the rising use of NDIR sensors in environmental monitoring, industrial safety, and medical diagnostics, supported by the need for accurate and reliable gas detection technologies

- In addition, the increasing emphasis on air quality monitoring, emission control, and energy efficiency is accelerating demand for NDIR solutions across industries. These converging factors are significantly propelling the expansion of the NDIR market globally

Non-Dispersive Infrared Market Analysis

- Non-Dispersive Infrared sensors, which measure gas concentrations using infrared absorption principles, are becoming vital in applications such as automotive emissions testing, HVAC systems, industrial process control, and healthcare devices. Their reliability, sensitivity, and long operational life make them highly suitable for critical safety and environmental uses

- The growing demand for portable, low-power, and highly accurate sensors is driving widespread adoption across both consumer and industrial sectors. Moreover, strict environmental regulations and the global shift toward sustainability and cleaner air initiatives further enhance the market outlook

- These trends establish NDIR technology as a cornerstone for future-ready sensing solutions, ensuring strong and sustained market growth over the coming years

- North America dominated the Non-Dispersive Infrared market with the largest revenue share of 42.31% in 2024, supported by strong demand across automotive, industrial, and smart home applications

- The Asia-Pacific Non-Dispersive Infrared market is expected to grow at the fastest CAGR of 7.25% between 2025 and 2032, propelled by rapid urbanization, rising disposable incomes, and government-led digitalization initiatives

- The carbon dioxide (CO₂) segment dominated the market with the largest revenue share of 39.7% in 2024, primarily due to its widespread use in indoor air quality monitoring, HVAC systems, and industrial emission control

Report Scope and Non-Dispersive Infrared Market Segmentation

|

Attributes |

Non-Dispersive Infrared Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Dispersive Infrared Market Trends

Rising Adoption in Environmental Monitoring and Industrial Safety

- A major trend shaping the global Non-Dispersive Infrared (NDIR) market is the growing adoption of NDIR sensors for air quality monitoring, industrial safety, and emission control applications. Their ability to detect gases with high precision and stability positions them as the preferred solution across multiple industries

- For instance, Senseair AB, a leading NDIR provider, offers advanced CO₂ sensors widely deployed in HVAC systems and indoor air monitoring to support energy efficiency and healthier environments. Similarly, Honeywell International Inc. continues to expand its NDIR product portfolio for industrial safety and environmental compliance

- The trend is also reinforced by stricter global regulatory frameworks on greenhouse gas emissions and the need for reliable detection technologies in medical devices such as capnography systems

- This increasing demand for accurate, durable, and low-maintenance sensing solutions is fundamentally reshaping the NDIR market landscape, making environmental monitoring and safety-critical applications its key growth drivers

Non-Dispersive Infrared Market Dynamics

Driver

Expanding Demand for Air Quality Monitoring and Emission Control

- The surging need for air pollution tracking, industrial emission monitoring, and energy efficiency is a significant driver of NDIR market growth. These sensors are integral to applications requiring accurate gas detection, including automotive exhaust testing, medical diagnostics, and HVAC systems

- For instance, in 2023, Gas Sensing Solutions (U.K.) launched ultra-low-power NDIR CO₂ sensors, targeting portable devices for air quality monitoring. Such innovations are accelerating adoption across both consumer and industrial sectors

- Rising concerns over indoor air quality in residential and commercial spaces, coupled with government-backed clean air initiatives, are further boosting demand for NDIR technologies worldwide

Restraint/Challenge

High Cost of Sensors and Competition from Alternative Technologies

- Despite growing adoption, the relatively high cost of NDIR sensors compared to alternatives such as metal-oxide or electrochemical sensors poses a challenge for widespread deployment, particularly in cost-sensitive markets

- For instance, while Amphenol Advanced Sensors offers high-performance NDIR modules, their premium pricing limits adoption in developing economies, where lower-cost alternatives are preferred

- In addition, technological competition from photoacoustic sensors and other emerging detection methods may hinder NDIR penetration in certain niche applications. Addressing this challenge requires manufacturers to reduce costs through economies of scale, improve miniaturization, and focus on energy efficiency

- Overcoming these restraints will be crucial to ensuring the long-term competitiveness of NDIR sensors in a rapidly evolving global sensing ecosystem

Non-Dispersive Infrared Market Scope

The market is segmented on the basis of gas type, application, component, and industry.

- By Gas Type

On the basis of gas type, the Non-Dispersive Infrared market is segmented into carbon dioxide, refrigerant gases, carbon monoxide, ethylene, acetylene, hydrocarbons, sulfur hexafluoride, anesthetic gases, and others. The carbon dioxide (CO₂) segment dominated the market with the largest revenue share of 39.7% in 2024, primarily due to its widespread use in indoor air quality monitoring, HVAC systems, and industrial emission control. Growing awareness of CO₂ levels in residential, commercial, and healthcare environments has driven demand for precise and reliable NDIR sensors.

The refrigerant gases segment is projected to witness the fastest CAGR from 2025 to 2032, driven by stricter environmental regulations on greenhouse gases and the increasing need for leak detection in HVAC and refrigeration systems. With global efforts to reduce ozone-depleting substances and ensure energy efficiency, refrigerant gas monitoring is becoming a critical application, boosting rapid adoption of NDIR solutions in this segment.

- By Application

On the basis of application, the Non-Dispersive Infrared market is segmented into monitoring, HVAC, and detection and analysis. The monitoring segment accounted for the largest market share of 44.5% in 2024, supported by the extensive use of NDIR sensors in environmental monitoring, industrial safety, and air quality measurement. Their reliability in detecting harmful gases with high sensitivity makes them indispensable in industrial plants, laboratories, and smart city infrastructure.

The HVAC segment is expected to record the fastest growth rate from 2025 to 2032, fueled by the rising emphasis on energy efficiency, indoor air quality, and compliance with green building standards. With growing demand for smart and automated climate control systems in residential, commercial, and industrial facilities, NDIR sensors are increasingly integrated into HVAC solutions to optimize energy consumption while ensuring healthier air environments.

- By Component

On the basis of component, the Non-Dispersive Infrared market is segmented into IR sources, optical filters, optical gas chambers, and IR detectors. The IR detectors segment dominated the market with the largest revenue share of 36.9% in 2024, as they serve as the core sensing element in NDIR systems, ensuring accurate gas detection and measurement. Continuous advancements in miniaturization, sensitivity, and low-power operation have strengthened their adoption across medical, automotive, and environmental applications.

The IR sources segment is projected to witness the fastest CAGR from 2025 to 2032, driven by innovations in compact, energy-efficient infrared emitters. These sources are crucial for enhancing the performance of NDIR sensors, particularly in portable and battery-operated devices. With the growing demand for high-performance sensing in mobile air quality monitors and medical equipment, IR source development is becoming a key driver of future growth.

- By Industry

On the basis of industry, the Non-Dispersive Infrared market is segmented into automotive and transportation, oil and gas, industrial and manufacturing, food processing and storage, chemicals, medical, environmental, and others. The automotive and transportation segment held the largest market share of 28.4% in 2024, supported by stringent emission standards and the growing integration of NDIR sensors in exhaust analysis, cabin air quality monitoring, and safety systems.

The medical segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the expanding use of NDIR sensors in capnography, anesthetic gas monitoring, and other respiratory care devices. The rising prevalence of chronic respiratory diseases, coupled with the demand for non-invasive and accurate diagnostic solutions, is accelerating adoption. In addition, the COVID-19 pandemic reinforced the importance of reliable gas sensing in healthcare, positioning the medical segment as a key growth driver moving forward.

Non-Dispersive Infrared Market Regional Analysis

- North America dominated the Non-Dispersive Infrared market with the largest revenue share of 40.01% in 2024, supported by strong demand across automotive, industrial, and smart home applications.

- The region’s advanced technological infrastructure and high awareness of air quality monitoring and greenhouse gas detection are driving adoption. Furthermore, supportive regulatory frameworks on emission control and workplace safety are boosting demand.

- The U.S. leads the regional market, benefiting from rapid deployment in HVAC systems, automotive emission monitoring, and medical devices, while Canada is increasingly focusing on industrial and environmental applications.

U.S. Non-Dispersive Infrared Market Insight

The U.S. dominated North America’s revenue share in 2024, driven by growing emphasis on smart homes, connected devices, and emission control solutions. Expanding industrial automation, combined with strong demand for real-time CO₂ monitoring in healthcare and commercial spaces, is accelerating adoption. Moreover, integration with IoT platforms such as Alexa and Google Home is fueling further market growth.

Europe Non-Dispersive Infrared Market Insight

The Europe Non-Dispersive Infrared market is projected to grow steadily at a significant CAGR during the forecast period, primarily supported by stringent emission regulations and a rising focus on workplace safety. Countries such as Germany, France, and the U.K. are prioritizing air quality monitoring and industrial safety standards, driving increased uptake of NDIR sensors. The market is also benefiting from rapid advancements in environmental monitoring technologies and growing deployment across residential, automotive, and industrial sectors.

U.K. Non-Dispersive Infrared Market Insight

The U.K. market is expected to expand at a noteworthy CAGR, supported by the increasing penetration of IoT-based air quality systems, demand for enhanced safety, and heightened environmental regulations. Rising burglary and security concerns, alongside the U.K.’s robust e-commerce infrastructure, are fueling adoption in residential and commercial buildings.

Germany Non-Dispersive Infrared Market Insight

Germany is projected to register considerable growth, attributed to its strong emphasis on sustainability, innovation, and industrial automation. Demand is particularly strong for eco-conscious air quality systems and industrial safety solutions. Growing integration of NDIR sensors with advanced automation systems in residential and commercial spaces is further supporting adoption.

Asia-Pacific Non-Dispersive Infrared Market Insight

The Asia-Pacific Non-Dispersive Infrared market is expected to grow at the fastest CAGR of 7.25% between 2025 and 2032, propelled by rapid urbanization, rising disposable incomes, and government-led digitalization initiatives. China, Japan, and India are key contributors, with demand expanding in smart homes, automotive, industrial safety, and environmental monitoring. APAC’s role as a global manufacturing hub for sensor components ensures affordability and scalability, thereby expanding accessibility across multiple industries.

Japan Non-Dispersive Infrared Market Insight

Japan’s market is experiencing robust momentum due to its tech-driven culture, urban density, and emphasis on security and convenience. Adoption is supported by integration with IoT devices such as security cameras and lighting systems. In addition, the country’s aging population is fueling demand for simplified, secure solutions in both homes and healthcare facilities.

China Non-Dispersive Infrared Market Insight

China dominated the APAC market in 2024, accounting for the largest regional revenue share. Growth is fueled by its expanding middle class, urbanization, and technological adoption. The government’s push for smart cities and stricter environmental monitoring policies are boosting adoption. Domestic manufacturers further enhance affordability, positioning China as a critical hub for market growth.

Non-Dispersive Infrared Market Share

The Non-Dispersive Infrared industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- ELT SENSOR (South Korea)

- Emerson Electric Co. (U.S.)

- Figaro Engineering Inc. (Japan)

- Gas Sensing Solutions Ltd (GSS) (U.K.)

- Yokogawa Electric Corporation (Japan)

- HORIBA, Ltd. (Japan)

- SenseAir AB – An Asahi Kasei Group Company (Sweden)

- Siemens (Germany)

- SICK AG (Germany)

What are the Recent Developments in Global Non-Dispersive Infrared Market?

- In February 2025, Sensirion and Terabee announced a collaboration to integrate infrared hardware with cloud analytics for monitoring indoor air quality in commercial buildings, a move that strengthens their position in the IAQ monitoring segment

- In February 2025, Sensirion introduced the SCD43 photoacoustic NDIR CO₂ sensor, designed to comply with ASHRAE ventilation standards, further solidifying its innovation in sensor technology

- In January 2025, Honeywell launched its Emissions Management Suite for offshore platforms, incorporating Versatilis Signal Scout hardware to enable continuous methane tracking, underscoring its commitment to sustainability and compliance

- In January 2024, Sensirion Connected Solutions partnered with Project Canary to deploy cartridge-based methane sensors for upstream operators, enhancing real-time monitoring capabilities in energy operations

- In May 2023, SmartGAS, a leading German manufacturer of NDIR gas sensors, merged with SIGAS, marking a significant step towards consolidation and strengthening of expertise in precision gas sensing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Non Dispersive Infrared Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Non Dispersive Infrared Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Non Dispersive Infrared Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.