Global Needle-Free Injection System Market, By Type (Liquid-Based Needle-Free Injectors, Projectile/Depot-Based Needle-Free Injectors, Powder-Based Needle-Free Injectors), Product (Fillable Needle-Free Injectors, Prefilled Needle-Free Injectors), Technology (Jet-Based Needle-Free Injectors, Spring-Based Needle-Free Injectors, Laser-Powered Needle-Free Injectors, Vibration-Based Needle-Free Injectors), Source of Power (Spring-Based Needle-Free Injectors, Gas Propelled/ Air Forced Injector Systems), Usability (Disposable Needle-Free Injectors, Reusable Needle-Free Injectors), Delivery Site (Subcutaneous Injectors, Intramuscular Injectors, Intradermal Injectors), Application (Vaccine Delivery, Insulin Delivery, Oncology, Pain Management, Others), End-User (Hospitals, Clinics, Home Care Settings, Research Laboratories, Pharmaceutical and Biotechnological Companies, Others) – Industry Trends and Forecast to 2029

Market Analysis and Size

Needle-free injection system are steadily developing technology that promises to make the administration of medicine more efficient and less painful. The needle-free injection technique allows doctors to administer medications to patients without piercing their skin with a needle. Needle-free technology has a number of advantages, including lowering patient anxiety over needle use. Needle-free injections are very effective and bioequivalent to syringe and needle injections for a wide range of medicines. It has a lower pain threshold and is strongly preferred by patients. In comparison to conventional needles, the injection is much faster, and there are no needle disposal difficulties. The pharmaceutical sector not only benefits from increased product sales, but it also has the potential to improve compliance with dosing regimens and outcomes.

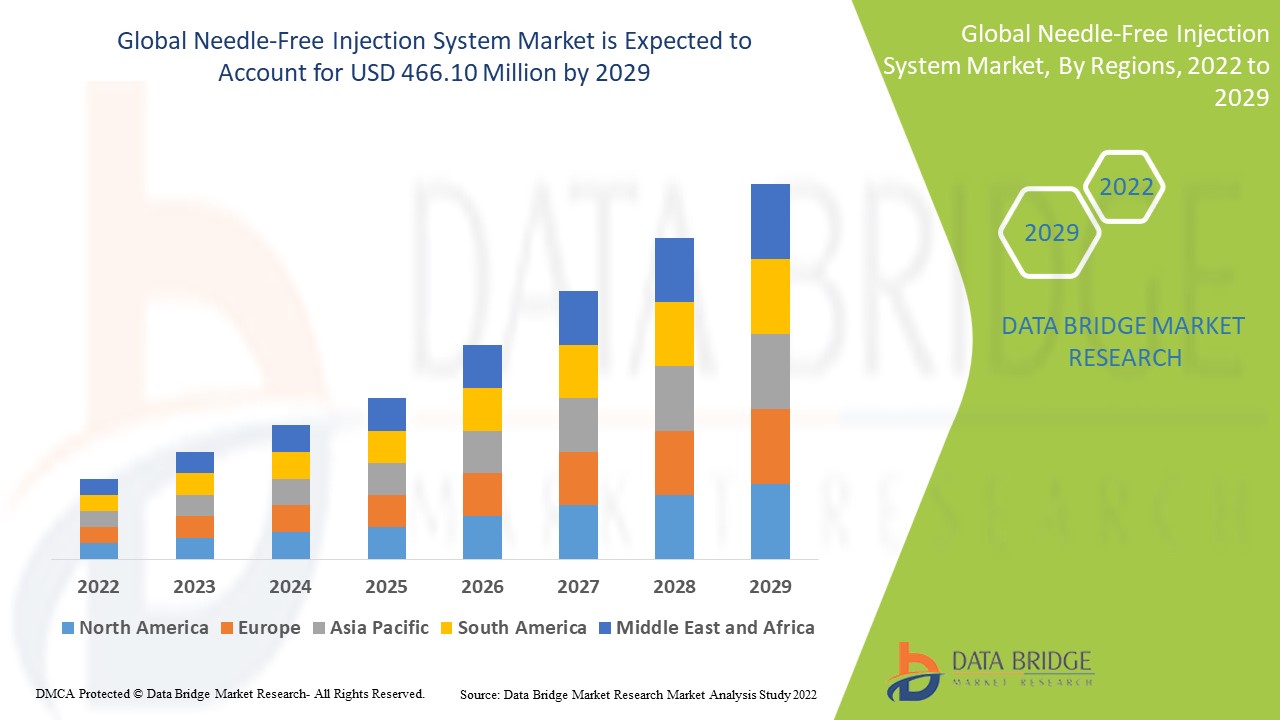

Data Bridge Market Research analyses that the needle-free injection system market which was USD 124 million in 2021, would rocket up to USD 466.10 million by 2029, and is expected to undergo a CAGR of 18.0% during the forecast period 2022-2029. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Market Definition

Needle-free injection systems are an innovative approach to provide a variety of medications to patients without piercing their skin with a needle. Needle-free technology has the apparent advantage of minimizing patient anxiety about needle use. Needle-free injection technology is a broad concept that encompasses a wide range of drug delivery devices that propel pharmaceuticals through the skin utilizing forces such as Lorentz, shock waves, gas pressure, or electrophoresis, effectively eliminating the need for a hypodermic needle.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2019 - 2014)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Type (Liquid-Based Needle-Free Injectors, Projectile/Depot-Based Needle-Free Injectors, Powder-Based Needle-Free Injectors), Product (Fillable Needle-Free Injectors, Prefilled Needle-Free Injectors), Technology (Jet-Based Needle-Free Injectors, Spring-Based Needle-Free Injectors, Laser-Powered Needle-Free Injectors, Vibration-Based Needle-Free Injectors), Source of Power (Spring-Based Needle-Free Injectors, Gas Propelled/ Air Forced Injector Systems), Usability (Disposable Needle-Free Injectors, Reusable Needle-Free Injectors), Delivery Site (Subcutaneous Injectors, Intramuscular Injectors, Intradermal Injectors), Application (Vaccine Delivery, Insulin Delivery, Oncology, Pain Management, Others), End-User (Hospitals, Clinics, Home Care Settings, Research Laboratories, Pharmaceutical and Biotechnological Companies, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Antares Pharma (US), INOVIO Pharmaceuticals (US), THE NATIONAL MEDICAL PRODUCTS CO., LTD (Saudi Arabia), Valeritas, Inc. (Denmark), InsuJet (Netherland), PenJet (Netherland), Amico Group (UAE), MedImmune (U.S), Mystic Pharmaceuticals (U.S), OptiNose US, Inc. (U.S), Zogenix (U.S.A), PharmaJet (US), Portal Instruments (US), Medical International Technology, Inc (MIT) (US), NuGen Medical Devices (Canada), Crossject SA (US), Bioject Medical Technologies (US)

|

|

Market Opportunities

|

|

Needle-Free Injection System Market Dynamics

Drivers

- High incidence of infectious diseases globally

Despite tremendous advancements in sanitation and medicine, infectious illness prevalence remains high over the world. Despite the fact that non-communicable diseases are the leading causes of morbidity and mortality, infectious diseases remain a serious public health concern around the world. According to the National Institute of Allergy and Infectious Diseases, infectious diseases claim the lives of more than 15 million people each year. Despite the fact that non-communicable diseases are the leading causes of morbidity and mortality, infectious diseases remain a serious public health concern around the world. According to the National Institute of Allergy and Infectious Diseases, infectious diseases claim the lives of more than 15 million people each year.

- Growing incidence of transmissible diseases

Most healthcare providers are concerned about needlestick injuries caused by infected needles. Needle stick injuries are most dangerous hazards to people’s health and safety. Because injections are one of the most commonly used procedures for administering pharmaceuticals, healthcare workers are at a high risk of contracting blood-borne diseases through needlestick injuries, which can happen by accident. Every year, some 385,000 health-care workers inadvertently poke themselves with needles, according to the CDC. Needlestick injuries can spread infectious diseases like hepatitis B, hepatitis C, and the human immunodeficiency virus (AIDS) to healthcare workers.

Increase in demand for self-injection devices

Self-injection technologies are a faster and more repeatable technique of providing pharmaceuticals than invasive drug administration methods. Self-injections lower medicine dosage requirements, resulting in improved patient compliance, particularly among the elderly.

- Increased number of technological developments

E- and prescription, and other new technology can assist doctors and pharmacists in a variety of ways, including storing professionals to deliver high-quality, effective medicines. It also helps patients comprehend the majority scheduled proceedings and data and smoothing immunisation progress. Information Technology (IT) has improved safety and patients health, allowing pharmaceutical industry specialists to better understand the effects of their products.

Opportunities

- Increasing demand for biosimilars and immunization procedures

Biosimilars are becoming more widely employed to treat diseases such as cancer, diabetes, hepatitis, anaemia, and a variety of other acute and chronic illnesses. The need for biosimilars is growing in tandem with the rising prevalence of these diseases. There is a substantial opportunity for pharmaceutical and medical device companies to create innovative biosimilar delivery options. Injections are used to provide a variety of biosimilars and vaccines; in this case, needle-free technology provides an easy-to-use and safe method of giving biosimilars without the requirement for a standard injection apparatus or trained people.

- Increasing number of emerging markets

In the future years, the needle-free injection system market in emerging countries is predicted to rise significantly. This is due to an increase in the prevalence of chronic diseases, strong economic growth, and rising purchasing power. The presence of numerous individuals suffering from chronic diseases and the availability of competent labour at a reduced cost characterise growing economies such as India and China.

Restraints/Challenges

- Higher cost of development as associated to conventional injection systems

The complexity of these gadgets increases development expenses. The high cost of units is a result of the significant investment in development, which reduces patient acceptance of these devices. Due to additional associated expenditures such as high infrastructural and personnel costs, the overall development cost of a needle-free injection system is significantly greater.

- Sterilizable needles and conventional needle injections

Needle-free injections, need significant upfront investments and are expected to be more expensive as manufacturers spends more on quality control and device production standards. Needle-free injection starter kits from AdvantaJet, Injex 30, and Medi-Jector cost around USD 165, 260, and 300, respectively. Because needle-free injection devices are more expensive than typical needle injections, their affordability becomes a major challenge.

This needle-free injection system market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the needle-free injection system market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Needle-Free Injection System Market

In the most hopeful scenario, the COVID-19 epidemic has had a favorable impact on the needle-free injection system market as a whole. The COVID-19 pandemic has had a favorable impact on the needle-free injection system market, as the necessity for mass vaccination and self-injectable devices has been a priority since the epidemic began in December 2019. As the number of instances has grown across the globe, the majority of the leading needle-free injection system market players have invested in RandD and formed collaborations and agreements with other industry players and government agencies to create a needle-free injection system for the condition.

Recent Development

- In December 2021, Nykode Therapeutics, a PharmaJet partner, will launch a phase 1/2 clinical study using next-generation DNA-based COVID-19 vaccine candidates. PharmaJet, a company that develops needle-free injection technology, announced today that Nykode Therapeutics (previously Vaccibody), one of its pharmaceutical partners, has started a phase 1/2 clinical trial to address developing SARS-CoV-2 variations. In the clinical trial, the DNA-based vaccinations will be administered intramuscularly only utilizing the PharmaJet Stratis Needle-free Injection System.

- In August 2021, Zydus Cadila, a PharmaJet partner, has received Emergency Use Authorization for the world's first plasmid DNA COVID-19 vaccination delivered via needle-free injection. PharmaJet, a pioneer in needle-free injection technology, said today that Zydus Cadila, one of its partners, has acquired an Emergency Use Authorization (EUA) from the Drug Controller General of India (DCGI) for ZyCoV-D, the world's first Plasmid DNA Vaccine for COVID-19. The ZyCoV-D vaccination is only available through the PharmaJet Tropis Needle-free Injection System.

Global Needle-Free Injection System Market Scope

The needle-free injection system market is segmented on the basis of type, product, and technology, source of power, usability, delivery site, application and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Liquid-Based Needle-Free Injectors

- Projectile/Depot-Based Needle-Free Injectors

- Powder-Based Needle-Free Injectors

Product

- Fillable Needle-Free Injectors

- Prefilled Needle-Free Injectors

Technology

- Jet-Based Needle-Free Injectors

- Spring-Based Needle-Free Injectors

- Laser-Powered Needle-Free Injectors

- Vibration-Based Needle-Free Injectors

Source of Power

- Spring-Based Needle-Free Injectors

- Gas Propelled/ Air Forced Injector Systems

Usability

- Disposable Needle-Free Injectors

- Reusable Needle-Free Injectors

Delivery Site

- Subcutaneous Injectors

- Intramuscular Injectors

- Intradermal Injectors

Application

- Vaccine Delivery

- Insulin Delivery

- Oncology

- Pain Management

- Others

End-User

- Hospitals

- Clinics

- Home Care Settings

- Research Laboratories

- Pharmaceutical and Biotechnological Companies

- Others

Needle-Free Injection System Market Regional Analysis/Insights

The needle-free injection system market is analysed and market size insights and trends are provided by country, type, product, technology, source of power, usability, delivery site, application and end-user as referenced above.

The countries covered in the needle-free injection system market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Rising prevalence of chronic diseases such as cancer and diabetes, North America represents the highest share of the worldwide needleless injection system market. Furthermore, the growing desire among patients for self-administration of medications via needle-free injections is propelling the regional market forward.

Due to the increased propensity of patients toward innovative technologies and growing demand for biologics and needle-free injection for self-administration of pharmaceuticals, Asia Pacific is expected to develop rapidly throughout the forecast period 2022-2029. Furthermore, the regional market will benefit from increased investments to reinforce the region's healthcare expenditures, as well as increased research and development operations to produce more modern needle-free methods for proper and effective drug administration.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure growth Installed base and New Technology Penetration

The needle-free injection system market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for needle-free injection system market, impact of technology using lifeline curves and changes in healthcare regulatory scenarios and their impact on the needle-free injection system market. The data is available for historic period 2010-2020.

Competitive Landscape and Needle-Free Injection System Market Share Analysis

The needle-free injection system market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to needle-free injection system market.

Some of the major players operating in the needle-free injection system market are:

- Antares Pharma (US)

- INOVIO Pharmaceuticals (US)

- THE NATIONAL MEDICAL PRODUCTS CO., LTD (Saudi Arabia)

- Valeritas, Inc. (Denmark)

- InsuJet (Netherland)

- PenJet (Netherland)

- Amico Group (UAE)

- MedImmune (U.S)

- Mystic Pharmaceuticals (U.S)

- OptiNose US, Inc. (U.S)

- Zogenix (U.S.A)

- PharmaJet (US)

- Portal Instruments (US)

- Medical International Technology, Inc (MIT) (US)

- NuGen Medical Devices (Canada)

- Crossject SA (US)

- Bioject Medical Technologies (US)

SKU-