Global Molded Fiber Packaging Market, By Product (Trays, Clamshell Containers, Boxes, End Cap, and Others), Type (Thick-Wall, Transfer Molded, Thermoformed Fiber, and Processed Pulp), Source (Wood Pulp, and Non-Wood Pulp), End-User (Food and Beverage, Electronics, Personal Care, Healthcare, and Others) – Industry Trends and Forecast to 2031.

Molded Fiber Packaging Market Analysis and Size

Processed pulp in the molded fiber packaging market refers to pulp that has undergone specific treatment and processing to achieve desired characteristics such as strength, durability, and moldability. This segment caters to diverse industries due to its eco-friendly nature and ability to be molded into various shapes and sizes for packaging purposes. The processed pulp segment plays a crucial role in driving the growth of the molded fiber pulp packaging market, offering sustainable solutions for packaging needs across different sectors.

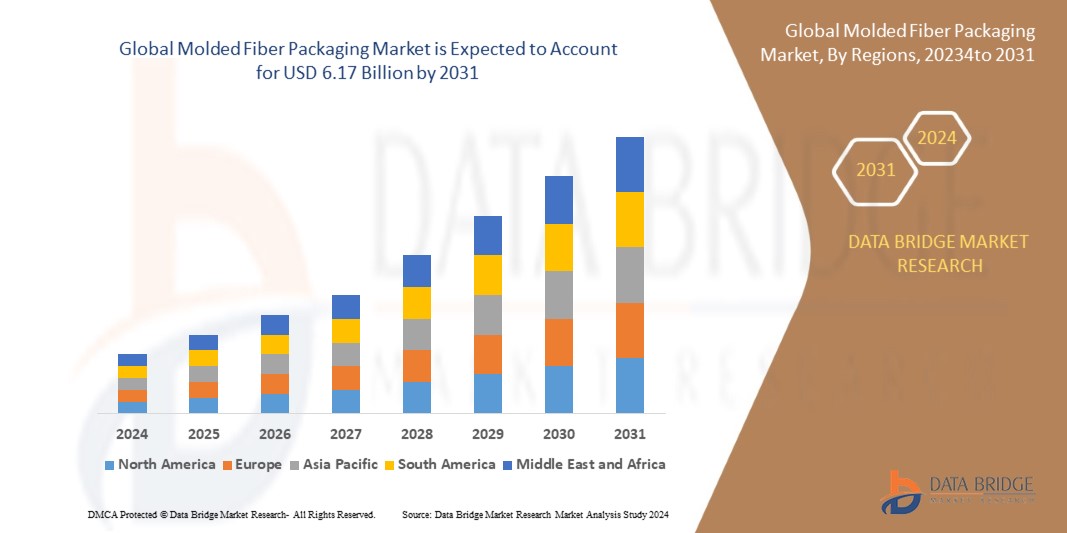

Global molded fiber packaging market size was valued at USD 4.23 billion in 2023 and is projected to reach USD 6.17 billion by 2031, with a CAGR of 4.82% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Air Pillow Cushion, Bubble Wrap Machine), Functionality (Void Filling, Blocking and Bracing, Wrapping, Corner Protection), End User (Consumer Electronics and Appliances, Home Decor and Furnishings, Beauty and Personal Care, Food and Beverages, Pharmaceutical and Medical Devices, Others)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E., Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

|

|

Market Players Covered

|

BRØDRENE HARTMANN A/S (Denmark), UFP Technologies, Inc. (U.S.), Sonoco Products Company (U.S.), Genpak LLC (U.S.), Pro-Pac Packaging Limited (Australia), PrimeWare (U.S.), Henry Molded Product Inc, (U.S.), EnviroPAK (U.S.), Pacific Pulp Molded Inc, (U.S.), Sabert Corporation (U.S.), Protopak Engineering Corporation (U.S.), Pactiv Evergreen Inc. (U.S.), Spectrum Lithograph (U.S.), Keiding, Inc. (U.S.), DFM Packaging Solutions (South Africa), Orcon Industries (U.S.), ESCO Technologies Inc. (U.S.)

|

|

Market Opportunities

|

|

Market Definition

Molded fiber packaging, also known as molded pulp packaging, is a type of protective packaging made from recycled paper and cardboard materials. It involves shaping a slurry of fibers into various molds to create packaging products such as trays, containers, and cushioning materials. Molded fiber packaging is known for its versatility, as it can be formed into different shapes and sizes to suit various product packaging needs. It offers excellent protection for fragile items during transportation and storage, while also being biodegradable and environmentally friendly.

Molded Fiber Packaging Market Dynamics

Drivers

- Increasing Focus on Brand Identity Incorporating Design into Packaging Solutions

Brands are leveraging molded fiber's versatility to create unique and visually appealing packaging designs that resonate with their target audience. This trend enables companies to differentiate themselves in a competitive market landscape while also aligning with sustainability goals. Moreover, customizable molded fiber packaging allows for tailored solutions to meet specific product requirements, enhancing both functionality and aesthetics. As consumers increasingly prioritize eco-conscious brands with strong visual appeal, the demand for molded fiber packaging continues to grow, driven by its ability to marry sustainability with innovative design.

- Growing Advancements in Technology Meets the Escalating Demand for Sustainable Packaging

Innovations such as automation, precision molding techniques, and improved machinery have streamlined manufacturing, reducing production costs and lead times. Additionally, technological developments have enabled the creation of more complex and customizable packaging designs, catering to diverse product needs and branding requirements. Enhanced efficiency translates to higher production volumes and consistent quality, meeting the escalating demand for sustainable packaging solutions in the food and beverage industry. Consequently, these technological advancements serve as a key driver propelling the growth of the molded fiber packaging market.

PulPac's collaboration with Matrix Pack, a leading food and beverage packaging producer, signifies a strategic move towards sustainable packaging solutions. By leveraging PulPac's innovative technology, Matrix Pack will produce lids for both hot and cold takeout drinks, demonstrating a joint commitment to eco-friendly alternatives in the packaging industry.

Opportunities

- Growing E-Commerce Industry Increases the Demand for Molded Fiber Packaging

As more consumers turn to online shopping for convenience, the need for efficient and sustainable packaging solutions grows. Molded fiber packaging offers several advantages in this context, including lightweight construction, eco-friendly materials, and customizable designs to fit various product shapes and sizes. Its shock-absorbing properties also ensure the safe transportation of goods, reducing the risk of damage during shipping. Moreover, the rise of direct-to-consumer brands and subscription services further amplifies the demand for innovative packaging solutions such as molded fiber, positioning the market for substantial growth and adoption in the e-commerce ecosystem.

- Expansion into New Markets due to Molded Fiber’s Adaptable Nature

Molded fiber packaging's versatility allows it to cater to a wide range of industries beyond food and beverage, such as electronics, healthcare, and consumer goods. Its ability to be molded into various shapes and sizes makes it ideal for protecting diverse products during shipping and storage. Moreover, the increasing emphasis on sustainability across industries enhances the appeal of molded fiber packaging, as it is made from renewable and recyclable materials. This adaptability positions the market for substantial growth as businesses seek eco-friendly packaging solutions to meet evolving consumer demands while expanding into new sectors.

Restraints/Challenges

- High Costs of Production for Smaller Manufacturers

As larger counterparts, smaller manufacturers may lack economies of scale, facing higher per-unit production costs due to limited production volumes. Additionally, initial investments in specialized equipment and technology required for molded fiber production can be prohibitively expensive for smaller players. These challenges often lead to difficulties in achieving price competitiveness and profitability, hindering the market entry and growth of smaller manufacturers. Consequently, despite the market's potential, the dominance of larger players may persist, limiting diversity and innovation within the molded fiber packaging market.

- Limited Shelf Life Compared of Molded Fiber Packaging Hampers its Adoption

Molded fiber's biodegradability can lead to degradation over time, particularly in humid or moist environments, impacting its structural integrity and protective capabilities. This restriction may deter industries requiring extended product shelf life or long-distance transportation, such as certain perishable foods or pharmaceuticals. Additionally, the need for specialized equipment and processes for manufacturing molded fiber packaging can pose challenges and increase production costs, further constraining its widespread adoption despite its eco-friendly benefits.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- In 2023, UFP Technologies, Inc., represented by CEO R. Jeffrey Bailly and CFO Ron Lataille, highlights its prowess in crafting molded fiber packaging for the medical sector during the Midwest IDEAS Investor Conference. Their focus on sustainability and performance aligns with evolving market demands

- In 2022, Huhtamaki bolsters its presence in the molded fiber packaging market by expanding its Hammond, Indiana facility, emphasizing sustainable, recyclable solutions sourced from 100% recycled North American materials. This expansion reinforces Huhtamaki's commitment to environmental responsibility while enhancing product performance

- In 2022, Huhtamaki commences construction on an enlarged molded fiber production facility in North America, reflecting its dedication to meeting the rising demand for sustainable packaging solutions across various industries. This investment underscores Huhtamaki's proactive approach to addressing evolving market needs

- In 2021, Huhtamaki demonstrates its commitment to the molded fiber packaging market by investing in a cutting-edge manufacturing unit in Malaysia. Initially focused on paper cup production, this facility serves as a hub for launching new sustainable paper-based technologies, expanding Huhtamaki's product portfolio to cater to diverse market segments

Molded Fiber Packaging Market Scope

The market is segmented on the basis of products, type, source and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Trays

- Clamshell Containers

- Boxes

- End Cap

- Others

Type

- Thick-Wall

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

Source

- Wood Pulp

- Non-Wood Pulp

End-User

- Food and Beverage

- Electronics

- Personal Care

- Healthcare

- Others

Molded Fiber Packaging Market Regional Analysis/Insights

The market is analysed and market size insights and trends are provided by country, products, type, source and end-user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia and New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa

North America dominates the market, propelled by a growing emphasis on sustainability. Both consumers and businesses in the region prioritize eco-friendly packaging solutions, spurring demand for molded fiber. This preference not only reflects a shift towards environmental consciousness but also highlights North America's leadership in driving sustainable practices within the broader packaging industry. As awareness continues to rise and environmental concerns remain paramount, North America is poised to maintain its dominance in promoting and adopting sustainable packaging solutions like molded fiber.

The Asia-Pacific is expected for significant growth in the molded fiber packaging market due to several key factors. Rising environmental consciousness among consumers and businesses alike is driving demand for sustainable packaging solutions. The booming e-commerce sector, coupled with increasing urbanization and disposable income, is fueling the need for reliable and eco-friendly packaging options. This trend indicates a promising forecast period for the industry, as companies increasingly prioritize environmentally responsible practices and cater to the evolving preferences of the Asia-Pacific market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Molded Fiber Packaging Market Share Analysis

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Some of the major players operating in the market are:

- BRØDRENE HARTMANN A/S (Denmark)

- UFP Technologies, Inc. (U.S.)

- Sonoco Products Company (U.S.)

- Genpak LLC (U.S.)

- Pro-Pac Packaging Limited (Australia)

- PrimeWare (U.S.)

- Henry Molded Product Inc (U.S.)

- EnviroPAK (U.S.)

- Pacific Pulp Molded Inc (U.S.)

- Sabert Corporation (U.S.)

- Protopak Engineering Corporation (U.S.)

- Pactiv Evergreen Inc. (U.S.)

- Spectrum Lithograph (U.S.)

- Keiding, Inc. (U.S.)

- DFM Packaging Solutions (South Africa)

- Orcon Industries (U.S.)

- ESCO Technologies Inc. (U.S.)

SKU-