Global Mining Lubricants Market

Market Size in USD Billion

CAGR :

%

USD

6.79 Billion

USD

7.95 Billion

2024

2032

USD

6.79 Billion

USD

7.95 Billion

2024

2032

| 2025 –2032 | |

| USD 6.79 Billion | |

| USD 7.95 Billion | |

|

|

|

|

Mining Lubricants Market Size

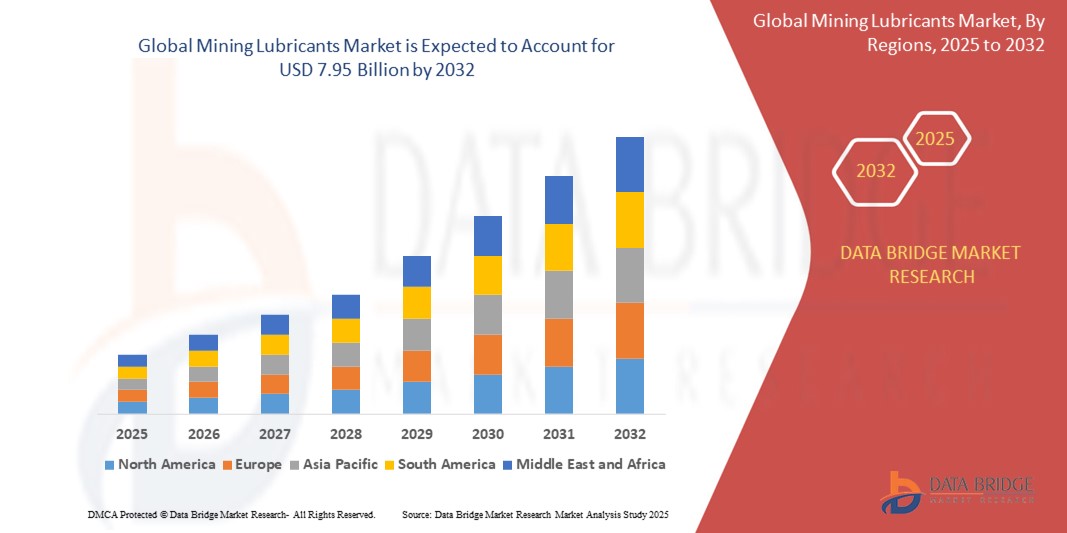

- The global mining lubricants market size was valued at USD 6.79 billion in 2024 and is expected to reach USD 7.95 billion by 2032, at a CAGR of 2.00% during the forecast period

- This growth is driven by factors such as the rising demand for heavy-duty mining equipment, increasing mineral exploration activities, and the need for high-performance lubricants that enhance equipment efficiency, reduce downtime, and extend machinery life in harsh mining environments

Mining Lubricants Market Analysis

- The global mining lubricants market is experiencing growth due to the increasing demand for high-performance lubricants that can withstand extreme temperatures and pressures, ensuring the efficient operation of mining equipment

- The shift towards synthetic and bio-based lubricants is gaining momentum as mining companies seek environmentally friendly and sustainable solutions to meet regulatory requirements and reduce their environmental footprint

- North America is expected to dominate the mining lubricants market due to the presence of major mining companies, advanced infrastructure, and a well-established market for lubricants. The high demand for efficient mining operations in the region, combined with technological advancements, is expected to drive the market's dominance

- Asia-Pacific is expected to be the fastest growing region in the mining lubricants market during the forecast period due to rapid industrialization, increased mining activities, and rising demand for minerals in countries such as China, India, and Australia. This growth is further fuelled by investments in mining technology and infrastructure

- The synthetic mining lubricants segment is expected to dominate the mining lubricants market with the largest share of 53.54% in 2025 due to its superior performance in extreme operating conditions, extended equipment life, and reduced maintenance needs, which make it ideal for demanding mining environments

Report Scope and Mining Lubricants Market Segmentation

|

Attributes |

Mining Lubricants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mining Lubricants Market Trends

“Rising Shift Toward Bio-Based and Synthetic Lubricants in Mining”

- The mining industry is increasingly adopting synthetic lubricants due to their ability to withstand extreme temperatures and provide longer equipment life, helping reduce operational downtime

- Bio-based lubricants are gaining traction as eco-friendly alternatives that meet stringent environmental regulations, particularly in regions with fragile ecosystems such as Western Australia and parts of Canada

- For instance, mining firms in Ontario have begun using biodegradable hydraulic fluids to minimize soil contamination, while companies in Queensland have shifted to plant-based gear oils in remote mining zones

- Global lubricant manufacturers such as Shell and Fuchs have introduced advanced bio-lubricant lines specifically designed for mining equipment, enhancing sustainability without compromising performance

- The trend reflects a broader push by mining companies to align with corporate environmental goals and investor expectations on green operations, supporting long-term market transformation

Mining Lubricants Market Dynamics

Driver

“Increasing Demand for Heavy-Duty Mining Equipment Across Surface and Underground Mining Operations”

- Growing global demand for minerals such as copper, iron, coal, and rare earth elements is increasing mining activities, which in turn drives the need for more heavy-duty mining equipment

- Surface and underground mining machinery operates in extreme conditions, such as high pressure, intense heat, and constant friction, requiring specialized lubricants to maintain performance

- Proper lubrication plays a crucial role in minimizing equipment wear and tear, reducing maintenance costs, and improving overall operational efficiency and safety

- For instance, large excavators used in Chilean copper mines rely on high-load greases to prevent gear failures under continuous operation, while deep-drilling rigs in South African gold mines use synthetic gear oils to handle extreme depth pressures

- The rising investment by mining companies in quality lubricants ensures higher uptime and reduces the total cost of ownership, making lubrication a key component in mining productivity strategies

Opportunity

“Growing Adoption of Automation and Digitalization in Mining Operations”

- The rise of automation and digitalization in mining is creating demand for advanced lubricants that can support uninterrupted operation of autonomous and sensor-equipped machinery

- Smart mining systems, such as predictive maintenance platforms and autonomous haul trucks, require lubricants with long life, thermal stability, and low residue buildup to perform efficiently

- Lubricant manufacturers are responding with innovations such as sensor-compatible formulations and integrated monitoring solutions that align with intelligent equipment systems

- For instance, some mining companies in Australia are using IoT-enabled lubrication systems that provide real-time oil condition updates, while North American suppliers have launched smart greases that trigger alerts when performance drops

- These developments offer significant growth opportunities by allowing mining firms to reduce downtime, improve efficiency, and meet evolving technological standards through intelligent lubricant use

Restraint/Challenge

“Volatility of Raw Material Prices Used in Lubricant Formulations”

- The mining lubricants market faces a key challenge in the form of raw material price volatility, especially for base oils and chemical additives linked to crude oil market fluctuations

- Sharp increases in crude prices or global supply chain disruptions can significantly raise production costs, affecting the affordability and availability of quality lubricants

- Smaller mining companies in emerging markets often struggle to absorb these higher costs, sometimes compromising on lubricant quality or extending service intervals, which can harm equipment efficiency

- Environmental regulations on lubricant disposal and spill control further increase operational expenses, requiring companies to invest in safer and often costlier handling practices

- For instance, firms operating in Indonesia have faced higher lubricant import costs due to regional supply issues, while mining operators in Brazil have had to upgrade their waste management systems to comply with stricter eco-regulations, both adding financial pressure to operations

Mining Lubricants Market Scope

The market is segmented on the basis of product and application.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

In 2025, the synthetic mining lubricants is projected to dominate the market with a largest share in application segment

The synthetic mining lubricants segment is expected to dominate the mining lubricants market with the largest share of 53.54% in 2025 due to its superior performance in extreme operating conditions, extended equipment life, and reduced maintenance needs, which make it ideal for demanding mining environments

The iron ore mining is expected to account for the largest share during the forecast period in technology market

In 2025, the iron ore mining segment is expected to dominate the market with the largest market share of 20.57% due to its high global demand for steel production, where iron ore is a key raw material, and the large-scale operations in top mining countries such as Australia, Brazil, and China

Mining Lubricants Market Regional Analysis

“North America Holds the Largest Share in the Mining Lubricants Market”

- North America is expected to dominate the mining lubricants market with the largest market share of approximately 33%. This dominance is due to the high demand for mining equipment, advanced lubricants, and the strong presence of key market players in the region.

- The U.S. is home to leading mining companies that prioritize advanced lubrication solutions to maximize equipment efficiency and minimize downtime

- Strong investments in automation and digitalization in the region are driving the demand for synthetic and advanced lubricants

- The stringent environmental regulations in North America also contribute to the growing demand for eco-friendly and high-performance lubricants

“Asia-Pacific is Projected to Register the Highest CAGR in the Mining Lubricants Market”

- Asia-Pacific is expected to be the fastest growing region in the mining lubricants market due to rapid industrialization and growing mining activities

- Emerging markets such as China and India are investing heavily in mining infrastructure, driving the demand for lubricants in coal, iron ore, and rare earth mining

- Increased adoption of automated and technologically advanced mining equipment in the region fuels the need for high-quality lubricants

- Government initiatives and investments in mining sectors are expected to further accelerate market growth in Asia-Pacific over the forecast period

Mining Lubricants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gulf Oil International Ltd (U.K.)

- KLÜBER LUBRICATION INDIA Pvt. Ltd. (India)

- Whitmore Manufacturing, LLC. (U.S.)

- Quaker Chemical Corporation d/b/a Quaker Houghton (U.S.)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c. (U.K.)

- Total (France)

- China Petrochemical Corporation (China)

- Shell group of companies (Netherlands)

- Sinolube (China)

- Chevron Corporation (U.S.)

- LUKOIL Marine Lubricants DMCC (Russia)

- Eni S.p.A. (Italy)

- Croda International Plc (U.K.)

- Synforce Lubricants (Australia)

- Valvoline LLC (U.S.)

- Lubricon (Canada)

- PETRONAS Lubricants International (Malaysia)

- FUCHS (Germany)

- Idemitsu Kosan Co., Ltd. (Japan)

Latest Developments in Global Mining Lubricants Market

- In March 2024, FUCHS SE completed the acquisition of Swiss lubricants company STRUB Co. AG. This strategic development allows FUCHS to expand its product portfolio and strengthen its position in the global lubricants market. The acquisition will enable FUCHS to tap into new market segments and enhance its technological capabilities, particularly in high-performance lubricants. By integrating STRUB's expertise, FUCHS aims to better serve industries such as automotive, mining, and manufacturing. This move is expected to boost FUCHS' market share and competitiveness, particularly in the European and international markets

- In May 2024, ExxonMobil completed its USD 60 billion acquisition of Pioneer Natural Resources, marking the largest oil-and-gas deal in decades. This strategic move significantly enhances ExxonMobil's presence in the Permian Basin, combining over 1.4 million net acres in the Delaware and Midland basins with an estimated 16 billion barrels of oil equivalent resource. As a result, ExxonMobil's Permian production volume more than doubled to 1.3 million barrels of oil equivalent per day, with projections to reach approximately 2 million barrels per day by 2027. The merger is expected to generate double-digit returns by recovering more resources efficiently and with a lower environmental impact. In addition, ExxonMobil plans to accelerate Pioneer’s net-zero emissions goal from 2050 to 2035, leveraging advanced technologies to monitor and reduce methane emissions and increase the use of recycled water in operations

- In April 2024, FUCHS SE, a global leader in lubrication solutions, announced its acquisition of the LUBCON Group, a German manufacturer specializing in high-performance specialty lubricants. This strategic move aims to enhance FUCHS's product portfolio, particularly in industrial greases and oils, and to bolster its global competitiveness. The LUBCON Group operates 13 companies and five production sites across Germany, Poland, the Philippines, India, and the U.S., employing over 200 staff members. Their products serve various industries, including railway, roller bearings, paper, textiles, food, pharmaceuticals, and wind energy. The acquisition is expected to close in the third quarter of 2024, pending regulatory approvals, and will integrate LUBCON's expertise into FUCHS's extensive network of 55 companies and 33 production facilities worldwide

- In December 2022, Shell USA, through its subsidiary Pennzoil-Quaker State Company, acquired 100% of TFH Reliability Group, LLC, the parent company of Allied Reliability Inc. This acquisition enhances Shell's North American lubricants business by integrating Allied Reliability's industrial products and services, including asset performance management and reliability consultancy. The move allows Shell to offer a comprehensive 'products-plus-services' model, combining high-quality lubricants with reliability solutions to improve equipment performance and safety for customers across various industries. Allied Reliability operates across a wide range of industries, delivering enhancements in the efficiency and reliability of assets. The acquisition enables Shell to expand its suite of lubricants products and services, aligning with its global strategy to grow its premium product offering and presence in the industrial sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mining Lubricants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mining Lubricants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mining Lubricants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.