Global Mining Dewatering Aids Market

Market Size in USD Million

CAGR :

%

USD

465.90 Million

USD

748.20 Million

2024

2032

USD

465.90 Million

USD

748.20 Million

2024

2032

| 2025 –2032 | |

| USD 465.90 Million | |

| USD 748.20 Million | |

|

|

|

|

Mining Dewatering Aids Market Size

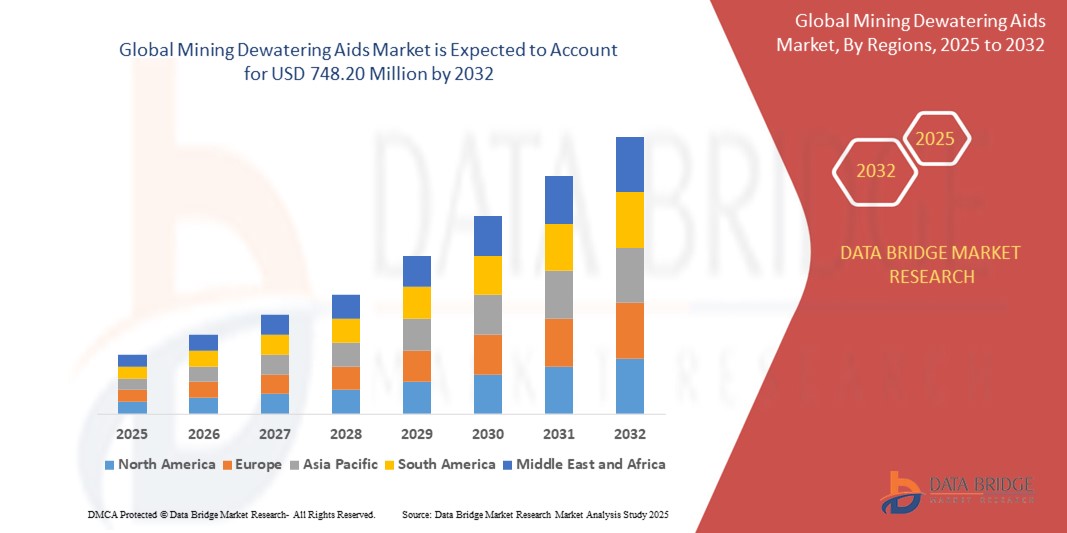

- The global mining dewatering aids market size was valued at USD 465.90 million in 2024 and is expected to reach USD 748.20 million by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by the rising emphasis on water conservation, operational efficiency, and environmental compliance across the global mining sector, leading to increased adoption of chemical dewatering aids to enhance solid-liquid separation and reduce freshwater usage

- Furthermore, technological advancements in flocculants, surfactants, and hybrid polymers are enabling improved performance in mineral processing, especially for fine particle recovery, thus accelerating the demand for high-efficiency dewatering solutions in both developed and emerging markets

Mining Dewatering Aids Market Analysis

- Mining dewatering aids are specialized chemical formulations such as flocculants, surfactants, and polymers used to improve water removal from mineral slurries during processing. These aids enhance filtration efficiency, reduce moisture content in tailings, and support dry stacking, contributing to safer and more sustainable mining operations

- The increasing demand for these aids is driven by the growing need for cost-effective water management, tighter environmental regulations, and rising global mining activity, especially in coal, copper, and rare earth extraction industries

- North America dominated the mining dewatering aids market with a share of 51.5% in 2024, due to high levels of mining activity and the presence of well-established mining operations, especially for coal, copper, and precious metals

- Asia-Pacific is expected to be the fastest growing region in the mining dewatering aids market during the forecast period due to increasing mining investments, rising demand for minerals, and government-driven infrastructure expansion across China, India, and Australia

- Organic segment dominated the market with a market share of 57.9% in 2024, due to its high efficiency, eco-friendly nature, and compatibility with a wide range of mineral processing operations. Organic dewatering aids, such as natural polymers and biodegradable surfactants, are preferred in mining environments seeking to reduce environmental impact and comply with stricter sustainability regulations. Their effectiveness in enhancing water removal while minimizing chemical residue makes them suitable for long-term adoption in both developed and emerging markets

Report Scope and Mining Dewatering Aids Market Segmentation

|

Attributes |

Mining Dewatering Aids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mining Dewatering Aids Market Trends

Increasing Demand for Minerals and Metals

- The mining dewatering aids market is expanding rapidly as global demand for minerals and metals grows, fueled by infrastructure development, clean energy technologies, and industrial expansion

- For instance, leading mining projects in South America and Africa are increasingly deploying advanced dewatering aids—including high-performance flocculants and polymers—enabling efficient water removal and higher productivity to meet surges in demand for critical minerals such as lithium and cobalt

- The adoption of automated dewatering systems, advanced filtration technologies, and electrocoagulation is on the rise, as mining companies seek solutions that lower operational costs, enhance water recovery rates, and comply with stricter environmental standards

- Environmental sustainability is a priority, driving the shift toward eco-friendly dewatering aids and water recycling systems; these help mining companies align with regulatory requirements and stakeholder expectations around minimized water waste

- Recent advancements include polymer-based aids that deliver superior solid-liquid separation, quicker settlement of sludge, and improved efficiency for tailings and slurry dewatering in both base metals and coal mining

- Technology integration—such as real-time monitoring, IoT, and digital process control—is enhancing the efficiency, reliability, and data visibility of dewatering operations in mines globally

Mining Dewatering Aids Market Dynamics

Driver

Increasing Mining Activities

- Global growth in mineral extraction and the development of new mining projects—especially in rapidly industrializing economies—are primary drivers of demand for mining dewatering aids

- For instance, the World Mining Congress reports a notable 5.5% rise in mineral production in 2020, prompting higher adoption of dewatering aids for efficient water management as mines scale up throughout Asia-Pacific, North America, and Latin America

- Stricter water management standards and the larger scale of modern mining operations necessitate the use of efficient dewatering solutions to ensure operational continuity, safety, and compliance

- Rising mining waste and heightened awareness around sludge management are prompting adoption of innovative dewatering aids to handle growing volumes of processing water and tailings

- Leading chemical manufacturers and engineering service providers are investing in R&D for more effective, sustainable aids, further propelling market growth and technology uptake in mining hubs around the world

Restraint/Challenge

Water Scarcity Issues

- Water scarcity in key mining regions—including Australia, Chile, South Africa, and the southwestern United States—poses significant challenges for mining operations reliant on dewatering aids

- For instance, operational disruptions and rising costs can result when mines face regulatory restrictions, limited water availability, or community opposition over freshwater use, directly impacting dewatering strategies and market growth

- Mining projects in arid or drought-prone areas require highly efficient, closed-loop water recycling systems to minimize freshwater withdrawal; this raises technical complexity and capital investment needs

- Variability in water chemistry, quality, and contamination levels across mining sites complicates the selection and performance of dewatering aids, increasing operational risks and the need for site-specific solutions

- Heightened scrutiny over environmental impact, tighter permitting processes, and supply chain pressures for sustainable water management further constrain widespread adoption and force companies to innovate or seek alternative dewatering technologies

Mining Dewatering Aids Market Scope

The market is segmented on the basis of material, type, and application.

- By Material

On the basis of material, the mining dewatering aids market is segmented into organic and inorganic. The organic segment held the largest market revenue share of 57.9% in 2024, driven by its high efficiency, eco-friendly nature, and compatibility with a wide range of mineral processing operations. Organic dewatering aids, such as natural polymers and biodegradable surfactants, are preferred in mining environments seeking to reduce environmental impact and comply with stricter sustainability regulations. Their effectiveness in enhancing water removal while minimizing chemical residue makes them suitable for long-term adoption in both developed and emerging markets.

The inorganic segment is projected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand in high-volume mining operations requiring cost-effective and robust dewatering agents. Inorganic aids, including metal salts and mineral-based compounds, offer durability and thermal stability under extreme conditions, which is particularly beneficial in large-scale mineral extraction activities involving high temperatures or pH fluctuations.

- By Type

On the basis of type, the mining dewatering aids market is segmented into surfactants, flocculants, polymers, sulfonates, and sulfates. The flocculants segment dominated the largest market share in 2024, owing to their vital role in aggregating fine particles and improving solid-liquid separation in mineral slurry. Flocculants are widely used across sulfide and non-sulfide ore processing plants for their efficiency in speeding up sedimentation and enhancing water recycling, which directly reduces operational costs and supports regulatory compliance.

The surfactants segment is expected to register the fastest CAGR from 2025 to 2032, driven by their growing adoption in coal and fine-particle mineral processing. Surfactants reduce surface tension, enabling faster water drainage and drier filter cakes, which are critical in improving throughput and minimizing moisture content in the final product. Their versatility and ability to improve process efficiency without compromising the quality of extracted materials make them increasingly attractive for modern mining operations.

- By Application

On the basis of application, the mining dewatering aids market is segmented into sulfide mineral processing, non-sulfide mineral processing, and coal cleaning. The sulfide mineral processing segment accounted for the largest market revenue share in 2024, primarily due to the extensive use of dewatering aids in the extraction of valuable metals such as copper, lead, and zinc. The complex nature of sulfide ores often necessitates the use of advanced chemical agents to achieve efficient separation and water removal, making dewatering aids indispensable in optimizing flotation and filtration stages.

The coal cleaning segment is anticipated to grow at the fastest rate from 2025 to 2032, fueled by increasing global emphasis on cleaner coal technologies and environmental compliance. Dewatering aids improve the moisture reduction process during coal preparation, making coal more energy-efficient and easier to handle during storage and transport. The ability of these aids to enhance productivity while meeting regulatory standards positions them as a key enabler in modernizing the coal beneficiation process.

Mining Dewatering Aids Market Regional Analysis

- North America dominated the mining dewatering aids market with the largest revenue share of 51.5% in 2024, driven by high levels of mining activity and the presence of well-established mining operations, especially for coal, copper, and precious metals

- The demand for dewatering aids in the region is strengthened by the growing focus on operational efficiency, environmental compliance, and water management strategies

- A strong regulatory framework mandating the use of advanced water treatment and discharge solutions, along with investments in modernizing aging mining infrastructure, supports widespread adoption of dewatering aids across North America

U.S. Mining Dewatering Aids Market Insight

The U.S. mining dewatering aids market captured the largest revenue share in 2024 within North America, fueled by technological advancements in mineral processing and a growing emphasis on sustainable mining practices. Mining companies are increasingly investing in performance-enhancing chemical agents to improve water recovery rates and reduce tailings pond usage. The rising cost of water treatment and stricter discharge regulations have positioned dewatering aids as a vital component of efficient mine operation strategies.

Europe Mining Dewatering Aids Market Insight

The Europe mining dewatering aids market is projected to grow at a steady CAGR over the forecast period, primarily driven by stringent environmental policies and the EU’s strong stance on sustainable resource extraction. The growing adoption of flocculants and eco-friendly reagents aligns with the region’s sustainability goals. As mining activities in Eastern Europe ramp up, and Western Europe focuses on reclamation and efficiency upgrades, demand for dewatering solutions continues to rise, particularly in coal and base metal mining applications.

U.K. Mining Dewatering Aids Market Insight

The U.K. mining dewatering aids market is expected to expand steadily, supported by the resurgence of domestic mining operations and a shift toward greener extraction methods. The need to meet national environmental targets is encouraging the adoption of biodegradable and high-performance dewatering agents. Government incentives for modernizing mineral processing facilities and the country’s focus on water conservation are also stimulating market interest.

Germany Mining Dewatering Aids Market Insight

The Germany mining dewatering aids market is anticipated to grow at a notable CAGR during the forecast period, driven by the integration of advanced chemical technologies in resource recovery and sludge management. Germany’s commitment to industrial innovation, paired with a strong environmental protection agenda, is accelerating the shift toward efficient water separation methods in mining. The country’s high-tech mining equipment and emphasis on process automation further enhance the appeal of advanced dewatering formulations.

Asia-Pacific Mining Dewatering Aids Market Insight

The Asia-Pacific mining dewatering aids market is projected to grow at the fastest CAGR during the forecast period of 2025 to 2032, owing to increasing mining investments, rising demand for minerals, and government-driven infrastructure expansion across China, India, and Australia. The adoption of dewatering aids is being driven by a focus on improving recovery yields, reducing freshwater use, and addressing environmental concerns amid large-scale mineral processing. Growing local production and the presence of major chemical suppliers in the region are making advanced dewatering technologies more accessible to regional miners

China Mining Dewatering Aids Market Insight

The China mining dewatering aids market accounted for the largest market share in Asia-Pacific in 2024, backed by large-scale mining operations, rapid industrialization, and government emphasis on efficiency and pollution control. The country’s expansive mineral processing sector, especially in coal and rare earth mining, is adopting high-efficiency reagents to improve water separation and reduce environmental impact. Strong domestic production capacity of mining chemicals also supports affordability and scalability of dewatering aids in the Chinese market.

India Mining Dewatering Aids Market Insight

The India mining dewatering aids market is witnessing strong growth, driven by increasing mining activities across coal, iron ore, and bauxite. Government initiatives such as “Make in India” and rising investments in mineral processing plants are creating favorable conditions for chemical aid adoption. The emphasis on water management, along with rising environmental awareness, is encouraging the use of performance chemicals such as flocculants and surfactants for efficient dewatering in India’s fast-evolving mining sector.

Mining Dewatering Aids Market Share

The mining dewatering aids industry is primarily led by well-established companies, including:

- ANDRITZ (Austria)

- ALFA LAVAL (Sweden)

- FlotrendLLC (U.S.)

- Veolia (France)

- Griffin Dewatering (U.S.)

- thyssenkrupp AG (Germany)

- NLMK (Russia)

- Aqseptence Group (Germany)

- Hitachi Zosen Corporation (Japan)

- KONTEK Systems, Inc. (Italy)

- ENCON Evaporators (U.S.)

- ERA HYDROBIOTECH ENERGY PVT. LTD. (India)

- Satyam Dewatering Systems (India)

- Arihant Dewatering Systems (India)

- Elgin Separation Solutions (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- SUEZ SA (France)

- Flottweg SE (Germany)

Latest Developments in Global Mining Dewatering Aids Market

- In July 2024, Atlas Copco expanded its WEDA range of submersible dewatering pumps tailored for heavy-duty mining and construction applications. These pumps now offer improved operational efficiency of approximately 16–21% over previous models due to refined motor design and automated pump assembly. Their mobility, reliability, and low maintenance characteristics significantly reduce downtime and operational costs for mining operators. This advancement strengthens the market demand for dewatering aids by showcasing their role in enhancing productivity and cost-efficiency in mining operations

- In 2024, Veolia and ANDRITZ introduced a patented hybrid flocculant technology combining organic and inorganic agents to tackle the challenge of dewatering ultra-fine particles in mining. The new polymer achieved around 26% higher solid capture efficiency and led to a 13% increase in concentrate dry stacking capacity in major South American copper mines within one year of adoption. This innovation enhances operational performance and also supports environmental compliance, reinforcing the value of high-performance dewatering aids in modern mineral processing

- In 2023, multiple key players in the mining chemicals industry ramped up investments in R&D aimed at developing more efficient and sustainable dewatering aid solutions. These initiatives reflect a growing market focus on environmentally conscious and high-performance chemicals, reinforcing the competitive landscape and accelerating product innovation across global markets

- In 2022, BASF launched an advanced sensor technology for real-time monitoring of dewatering processes. This technology allows for more precise control and optimization of reagent usage, thereby improving process efficiency and reducing waste. The development marks a significant step toward smart mining practices, strengthening the market shift toward intelligent, data-driven dewatering solutions

- In 2021, Arkema introduced a new line of bio-based flocculants designed for mining applications. These eco-friendly products support sustainable mineral processing by reducing environmental impact without compromising performance. Their introduction reflects a broader trend toward green chemistry in mining, bolstering the market appeal of dewatering aids aligned with global sustainability goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Mining Dewatering Aids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Mining Dewatering Aids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Mining Dewatering Aids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.