Global Military Drones Market

Market Size in USD Billion

CAGR :

%

USD

15.59 Billion

USD

45.41 Billion

2024

2032

USD

15.59 Billion

USD

45.41 Billion

2024

2032

| 2025 –2032 | |

| USD 15.59 Billion | |

| USD 45.41 Billion | |

|

|

|

|

Military Drones Market Size

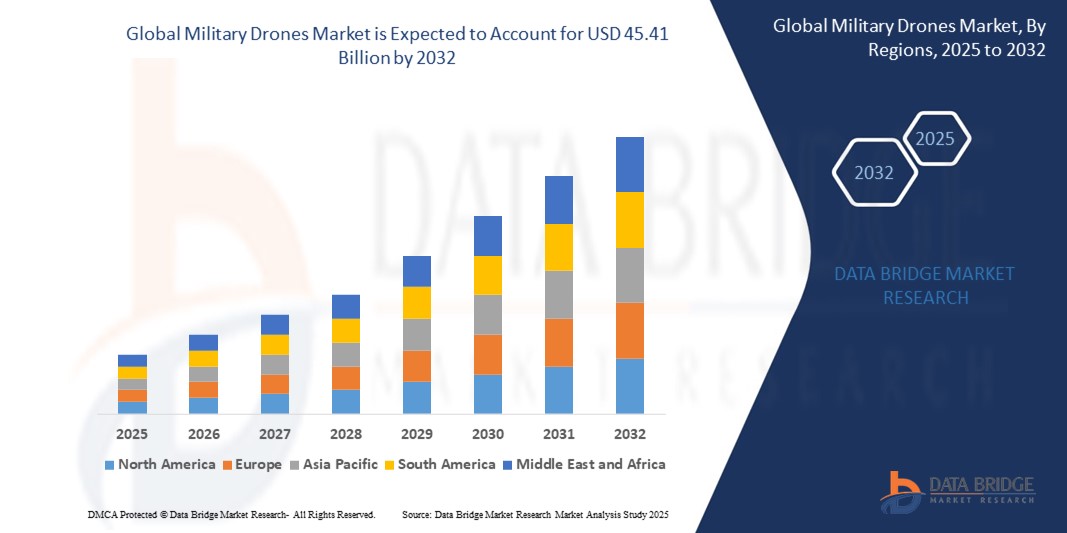

- The global military drones market size was valued at USD 15.59 billion in 2024 and is expected to reach USD 45.41 billion by 2032, at a CAGR of 14.3% during the forecast period

- The market growth is largely fueled by increasing defense expenditures and rapid advancements in drone technology, including artificial intelligence, autonomous navigation, and data link systems. These innovations are enabling military drones to perform a wider range of strategic, tactical, and surveillance missions with greater efficiency and accuracy across diverse combat scenarios

- Furthermore, rising geopolitical tensions, cross-border conflicts, and the growing demand for real-time intelligence, surveillance, and reconnaissance (ISR) are accelerating the global adoption of UAVs by defense forces. The integration of drones into multi-domain operations is significantly boosting the development and deployment of unmanned aerial systems across both developed and emerging economies

Military Drones Market Analysis

- Military drones are unmanned aerial vehicles (UAVs) used by armed forces for missions such as surveillance, target acquisition, intelligence gathering, combat operations, and logistical support. These systems vary in range, size, endurance, and capability, and are often equipped with sensors, cameras, munitions, and communication systems for autonomous or remotely piloted missions

- The surging demand for military drones is driven by their effectiveness in reducing human risk, improving operational precision, and supporting real-time decision-making in both peacetime and conflict scenarios. Growing investments in drone swarm technologies, stealth UAVs, and combat-proven platforms are further contributing to the expansion of this market

- North America dominated the military drones market with a share of 40.5% in 2024, due to robust defense budgets, advanced technological infrastructure, and the increasing deployment of UAVs for surveillance, border security, and combat missions

- Asia-Pacific is expected to be the fastest growing region in the military drones market during the forecast period due to rising defense expenditures, escalating territorial disputes, and the increasing adoption of unmanned systems across countries such as China, India, Japan, and South Korea

- Subsonic segment dominated the market with a market share of 63.3% in 2024, due to their extensive use in intelligence, surveillance, and reconnaissance (ISR) operations where long flight endurance, fuel efficiency, and stable navigation are critical. These drones are well-suited for persistent monitoring missions over vast areas and are favored for their quieter operation, lower development costs, and compatibility with existing defense infrastructure, making them the preferred choice among armed forces globally

Report Scope and Military Drones Market Segmentation

|

Attributes |

Military Drones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Military Drones Market Trends

“Rising Adoption of Advanced Avionics Technologies”

- The military drones market is witnessing a major technological shift as defense agencies enhance drone capabilities with advanced avionics, AI-driven flight controls, multi-spectral sensors, and encrypted communications to meet the needs of modern warfare

- For instance, Northrop Grumman’s RQ-4 Global Hawk and General Atomics’ MQ-9 Reaper are equipped with state-of-the-art avionics systems, offering real-time surveillance, autonomous navigation, and integrated data-sharing with command centers during high-risk operations

- Defense forces are increasingly deploying drones with autonomous flight capabilities and electronic warfare resistance to ensure mission success in GPS-denied and contested environments

- Miniaturized tactical UAVs are rising in prominence—featuring advanced stabilization, thermal imaging, and AI-based object recognition—enabling infantry-level units to conduct localized reconnaissance and threat detection

- Companies such as Elbit Systems, Thales Group, and Turkish Aerospace Industries are investing heavily in upgrading UAV platforms with next-gen targeting, radar deflection, and adaptive flight systems, supporting growing global defense demand

- The adoption of manned-unmanned teaming, electronic countermeasure integration, and next-generation autonomy make advanced avionics central to modern UAV design and deployment strategies

Military Drones Market Dynamics

Driver

“Growing Demand for Intelligence, Surveillance, and Reconnaissance (ISR)”

- Increasing geopolitical tensions, asymmetric warfare, and border security concerns have made ISR the most strategic application in drone operations, propelling military forces to adopt platforms capable of 24/7 tracking and reconnaissance

- For instance, General Atomics’ MQ-1 Predator and MQ-9 Reaper, as well as Israel Aerospace Industries' Heron TP, are extensively used by the U.S. Air Force, Indian Armed Forces, and Israeli Defense Forces (IDF) for high-altitude, long-endurance ISR missions

- These drones provide persistent aerial surveillance, real-time imagery, and precision targeting capabilities, enabling defense forces to make faster strategic decisions while reducing dependence on manned reconnaissance aircraft

- AI-enhanced ISR systems—available in platforms such as BAE Systems’ PHASA-35 and Leonardo’s Falco EVO—allow faster intelligence processing, object classification, and predictive threat monitoring across dynamic battlefield environments

- Many nations are prioritizing drone-based ISR systems in modernization programs, including India’s Project Cheetah and Europe’s MALE RPAS (Eurodrone) initiative, driving constant innovation in military UAV technology. ISR drones are now also advancing into maritime surveillance roles, with platforms such as the Boeing MQ-25 Stingray set to support naval operations for the U.S. Navy

Restraint/Challenge

“Dependency on Satellite Connectivity”

- The operational effectiveness of military drones—particularly for beyond visual line of sight (BVLOS), strategic reconnaissance, and strike missions—is highly dependent on reliable satellite communication systems, which present both operational and security vulnerabilities

- For instance, forces using Northrop Grumman’s RQ-4 Global Hawk and General Atomics’ MQ-9 Reaper have reported mission disruptions due to temporary Satcom failure or jamming, especially in conflict zones where adversaries deploy sophisticated electronic warfare (EW) systems

- High bandwidth applications—such as real-time HD video streaming, telemetry, and ISR sensor fusion—require stable satellite links, increasing the complexity and cost of deployment, particularly in remote or underdeveloped regions

- Leading satellite service providers such as Viasat, Inmarsat, and Iridium Communications play a critical role in sustaining drone operations, but the dependency on third-party infrastructure makes these systems more susceptible to external threats or service outages

- Manufacturers are exploring hybrid communication systems—such as LEO satellite networks (e.g., Starlink Military by SpaceX) and multi-band failovers—to reduce latency and combat signal interference, but these solutions are still being operationally tested

Military Drones Market Scope

The market is segmented on the basis of platform, speed, service type, propulsion type, launching mode, range, application, operation mode, endurance, and MTOW.

- By Platform

On the basis of platform, the military drones market is segmented into strategic, tactical, and small. The strategic segment held the largest revenue share in 2024, accounting for its vital role in long-range missions and high-altitude surveillance across geopolitical hotspots. Strategic drones are valued for their ability to carry sophisticated payloads, including sensors, radar, and communication equipment, supporting extended-duration operations for intelligence gathering and threat monitoring. Governments worldwide prioritize these drones for border surveillance, early warning systems, and deep-strike capabilities due to their superior endurance and high operational ceiling.

The small drone segment is projected to witness the fastest growth from 2025 to 2032, propelled by rapid adoption in urban warfare and localized battlefield intelligence missions. Their portability, cost-efficiency, and ease of deployment make them ideal for tactical units and special forces. The growing integration of AI-based object detection, swarm coordination, and stealth technology in small drones enhances their suitability for real-time reconnaissance and targeted missions in complex terrain.

- By Speed

On the basis of speed, the market is segmented into subsonic and supersonic drones. Subsonic drones dominated the market in 2024 with a substantial share of 63.3%, driven by their extensive use in intelligence, surveillance, and reconnaissance (ISR) operations where long flight endurance, fuel efficiency, and stable navigation are critical. These drones are well-suited for persistent monitoring missions over vast areas and are favored for their quieter operation, lower development costs, and compatibility with existing defense infrastructure, making them the preferred choice among armed forces globally.

Supersonic drones are expected to register the fastest growth rate from 2025 to 2032 due to increasing investment in high-speed, next-generation combat drones capable of penetrating advanced enemy defense systems. Their application in decoy deployment, electronic warfare, and rapid strike delivery is expanding with defense modernization programs emphasizing faster response capabilities in dynamic conflict zones.

- By Service Type

On the basis of service type, the market is divided into fixed-wing, rotary-wing, and hybrid/transitional drones. The fixed-wing segment secured the highest market share in 2024, largely attributed to its aerodynamic efficiency and longer flight endurance, making it the preferred configuration for long-range surveillance and combat operations. These platforms are favored by defense agencies for missions requiring high-altitude coverage and payload flexibility.

The hybrid/transitional segment is expected to grow at the fastest CAGR between 2025 and 2032, driven by rising demand for versatile UAVs that combine vertical take-off capabilities with the extended range of fixed-wing designs. These drones are particularly valuable in regions with limited runway infrastructure or for missions requiring rapid deployment followed by long-duration flight.

- By Propulsion Type

On the basis of propulsion type, the military drones market is categorized into hybrid fuel cell, battery-powered, and others. The battery-powered segment led the market in 2024, owing to advancements in lithium-ion and solid-state battery technologies, which provide longer mission times and lighter UAV designs. Battery systems are preferred for tactical drones due to their lower acoustic signature and reduced heat emissions, supporting covert operations.

The hybrid fuel cell segment is anticipated to exhibit the fastest growth rate through 2032, fueled by its ability to combine energy density with lower refueling times, making it ideal for high-endurance missions. Defense sectors increasingly favor hybrid fuel cell drones to extend mission range while reducing logistical support and environmental footprint.

- By Launching Mode

On the basis of launching mode, the market is segmented into catapult launcher, automatic take-off and landing (ATOL), hand launched, and vertical take-off. The automatic take-off and landing (ATOL) segment captured the largest market share in 2024 due to its operational precision and reduced need for skilled pilot input, which enhances deployment reliability in remote or hostile environments. These systems are widely used in strategic and fixed-wing drones requiring consistent autonomous control.

Vertical take-off is forecast to grow at the fastest rate during 2025–2032, spurred by the growing deployment of rotary-wing and hybrid drones in urban surveillance, marine operations, and restricted terrain. Their capability to launch and recover without traditional infrastructure is critical for modern military logistics and quick-response missions.

- By Range

On the basis of range, market is segmented into beyond line of sight (BLOS), extended visual line of sight (EVLOS), and visual line of sight (VLOS). The BLOS segment held the largest share in 2024, underpinned by its necessity for strategic operations across borders and deep into adversarial territory. These drones are essential for persistent intelligence gathering and support via satellite communication systems, making them central to global defense operations.

The EVLOS segment is projected to expand at the highest CAGR, supported by the growing integration of real-time telemetry, AI-driven analytics, and encrypted data relay within tactical and small drones. EVLOS capabilities bridge the gap between short-range operations and deep surveillance, offering flexibility in battlefield intelligence.

- By Application

On the basis of application, the market is segmented into reconnaissance, surveillance and target acquisition (ISRT), intelligence, combat operations, delivery and transportation, unmanned combat aerial vehicles (UCAVs), and battle damage management. The ISRT segment dominated the market in 2024, owing to the military's growing reliance on drones for round-the-clock intelligence gathering and threat detection. Drones are critical assets in monitoring enemy movement, providing targeting data, and assisting in precision strikes.

The UCAV segment is projected to experience the fastest growth over the forecast period, propelled by increasing demand for unmanned offensive capabilities that reduce pilot risk. Advancements in autonomous weapon systems, stealth technology, and multi-role payloads are making UCAVs central to modern aerial warfare doctrines.

- By Operation Mode

On the basis of operation mode, the market is divided into remotely piloted, optionally piloted, and fully autonomous. The remotely piloted segment led the market in 2024, driven by its widespread adoption in both combat and surveillance missions where real-time human decision-making is critical. Military operators prefer these systems for their proven reliability and tactical adaptability.

The fully autonomous segment is set to grow at the fastest pace through 2032, driven by rapid developments in AI, onboard computing, and sensor fusion. These systems are being deployed for tasks that demand continuous operation without manual intervention, such as border patrol, ISR, and automated targeting.

- By Endurance

On the basis of endurance, the market is segmented into >6 hours, 2–6 hours, and <1–2 hours. The >6 hours segment captured the largest market share in 2024, supported by increasing deployment of strategic drones for prolonged missions. These long-endurance UAVs are essential for persistent surveillance, electronic warfare, and secure communication relays across extended theaters of operation.

The <1–2 hours segment is expected to grow most rapidly, particularly driven by demand for lightweight tactical drones used in short-duration reconnaissance and urban combat support. These drones offer rapid deployment, ease of control, and suitability for time-sensitive battlefield intelligence.

- By MTOW

On the basis of MTOW, the market is segmented into >150 kilograms, 25–150 kilograms, and <25 kilograms. The >150 kilograms segment led the market in 2024, dominated by heavy-lift drones capable of carrying advanced ISR systems, heavy munitions, and multi-sensor payloads. These platforms are extensively used in strategic missions and long-range operations.

The <25 kilograms segment is anticipated to register the fastest CAGR between 2025 and 2032, driven by the rising deployment of micro and mini drones in close-quarter combat, special ops, and border patrol. Their lightweight nature allows for hand-launch capabilities and rapid mobility, making them ideal for agile, real-time military applications.

Military Drones Market Regional Analysis

- North America dominated the military drones market with the largest revenue share of 40.5% in 2024, driven by robust defense budgets, advanced technological infrastructure, and the increasing deployment of UAVs for surveillance, border security, and combat missions

- The region benefits from a strong defense industrial base and government-led modernization programs focusing on autonomous systems, AI integration, and high-endurance drones

- The growing emphasis on intelligence, surveillance, and reconnaissance (ISR) capabilities and the rapid pace of innovation in UAV technologies continue to solidify North America’s leadership in the global military drone landscape

U.S. Military Drones Market Insight

The U.S. military drones market accounted for the largest revenue share within North America in 2024, driven by significant investment from the Department of Defense and a comprehensive roadmap for drone integration across all military branches. The U.S. is actively pursuing advanced capabilities such as swarm drones, loyal wingman concepts, and unmanned combat aerial vehicles (UCAVs) for precision strike missions. The country’s continued focus on modernizing its aerial defense infrastructure, combined with increasing emphasis on autonomous systems and real-time ISR, is reinforcing its dominance in the global military drone market.

Europe Military Drones Market Insight

Europe is expected to witness substantial growth in the military drones market over the forecast period, supported by rising geopolitical instability, cross-border threats, and growing demand for tactical and strategic UAVs across NATO-aligned nations. European governments are increasingly allocating defense budgets towards indigenous drone development, joint ventures, and international collaborations such as the Eurodrone program. ISR and surveillance applications remain a top priority across military operations, particularly in border security and peacekeeping missions. The integration of drones into multi-domain operations and national defense modernization plans is a key factor driving the European market forward.

U.K. Military Drones Market Insight

The U.K. military drones market is anticipated to expand at a healthy CAGR during the forecast period, driven by the Ministry of Defence’s strategic investments in next-generation UAV systems and the integration of drones into the Future Combat Air System (FCAS). The U.K. is focusing on developing loyal wingman drones and deploying UAVs for maritime surveillance, battlefield reconnaissance, and autonomous air support roles. These initiatives align with the country’s broader defense transformation goals, which prioritize innovation, interoperability, and rapid-response capabilities in modern warfare.

Germany Military Drones Market Insight

Germany’s military drones market is expected to grow steadily as the government continues to emphasize defense innovation and multilateral cooperation within the European Union. The country is playing a significant role in joint defense projects such as the Eurodrone, which aim to reduce reliance on non-European platforms. Germany’s Bundeswehr is incorporating tactical and MALE-class drones into its defense framework for ISR, surveillance, and situational awareness operations. Evolving security challenges and sustained investment in drone procurement are projected to support market expansion throughout the forecast period.

Asia-Pacific Military Drones Market Insight

Asia-Pacific is projected to grow at the fastest CAGR from 2025 to 2032, propelled by rising defense expenditures, escalating territorial disputes, and the increasing adoption of unmanned systems across countries such as China, India, Japan, and South Korea. The region is undergoing rapid militarization and modernization of defense forces, with drones playing a central role in border surveillance, counter-insurgency, and maritime operations. Local governments are investing heavily in domestic drone manufacturing capabilities, autonomous navigation, and high-endurance UAVs. Government-backed innovation programs, technological self-sufficiency efforts, and strategic partnerships are further strengthening Asia-Pacific's position in the global military drone market.

China Military Drones Market Insight

China accounted for the largest revenue share in the Asia-Pacific military drones market in 2024, supported by the nation’s aggressive military modernization plans, high-volume production of drones, and strategic focus on ISR and combat drone applications. The Chinese military is leveraging drones for extended border patrol, naval reconnaissance, and strike capabilities across various terrains. Government initiatives encouraging self-reliance in defense manufacturing and the global export of military UAVs are further boosting China's influence in this sector. The rapid development of AI-based swarm technologies and stealth drone systems underscores China’s ambition to become a dominant force in military drone innovation.

Japan Military Drones Market Insight

Japan's military drones market is gaining momentum due to the country’s focus on enhancing defense capabilities in response to regional security tensions and demographic constraints. With limited defense personnel, Japan is increasingly relying on unmanned systems to perform ISR missions and maritime patrols across its vast territorial waters. The Japanese government is supporting the domestic development of UAV technologies and is exploring the integration of AI, 5G, and autonomous features to improve drone functionality. Japan's strategic emphasis on self-defense, coupled with technological advancements, is expected to significantly drive the growth of its military drone market.

Military Drones Market Share

The military drones industry is primarily led by well-established companies, including:

- Safran Group (France)

- General Atomics (U.S.)

- IAI (Israel)

- Lockheed Martin Corporation. (U.S.)

- AeroVironment, Inc. (U.S.)

- Textron Inc. (U.S.)

- Teledyne FLIR LLC (U.S.)

- Northrop Grumman (U.S.)

- BAE Systems (U.K.)

- AERONAUTICS (Israel)

- Boeing (U.S.)

- Thales (France)

- Leonardo S.p.A. (Italy)

- Elbit Systems Ltd (Israel)

- SAAB (Sweden)

Latest Developments in Global Military Drones Market

- In June 2024, Thales Group launched OpenDRobotics, a cutting-edge solution aimed at enhancing collaborative combat through the integration of robotics technologies into unmanned air and ground vehicles. By leveraging Artificial Intelligence (AI), the platform enables human-in-the-loop mission capabilities and boosts the autonomy of military drones while minimizing operator workload. This innovation is expected to significantly impact the military drones market by accelerating the adoption of AI-driven, interoperable drone systems and reinforcing the shift toward more autonomous and efficient combat operations across global defense forces

- In March 2023, Northrop Grumman Corporation, in collaboration with Shield AI, was selected by the U.S. Army for the Future Tactical Unmanned Aircraft System (FTUAS) competition, Increment 2. This opportunity positions them as potential replacements for the RQ-7B Shadow tactical UAS, showcasing their cutting-edge technology and expertise in unmanned aerial systems

- In February 2023, Boeing announced that its MQ-28 drone could be a valuable addition to the U.S. Air Force's arsenal, marking a significant stride for the aerospace giant. This development opens new avenues for growth and collaboration in the defense sector, showcasing Boeing's commitment to innovation and its ability to adapt to evolving military requirements

- In March 2022, Gambit, an Autonomous Collaboration Platform (ACP), was designed through digital engineering to accelerate time to market and reduce acquisition costs. The jet-powered platform is built for air supremacy and leverages advances in artificial intelligence and autonomous systems, aiming to revolutionize future defense capabilities

- In December 2021, Mojave, an unmanned aerial vehicle (UAV) with short takeoff and landing (STOL) capabilities, was introduced. Based on the avionics and flight control systems of the MQ-9 Reaper and MQ-1C Gray Eagle Extended Range, it features a Gray Eagle airframe, enlarged wings with high-lift devices, and a Rolls-Royce 450-hp turboprop engine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.