Global Micro Motor Market

Market Size in USD Billion

CAGR :

%

USD

45.18 Billion

USD

73.11 Billion

2024

2032

USD

45.18 Billion

USD

73.11 Billion

2024

2032

| 2025 –2032 | |

| USD 45.18 Billion | |

| USD 73.11 Billion | |

|

|

|

|

Micro Motor Market Size

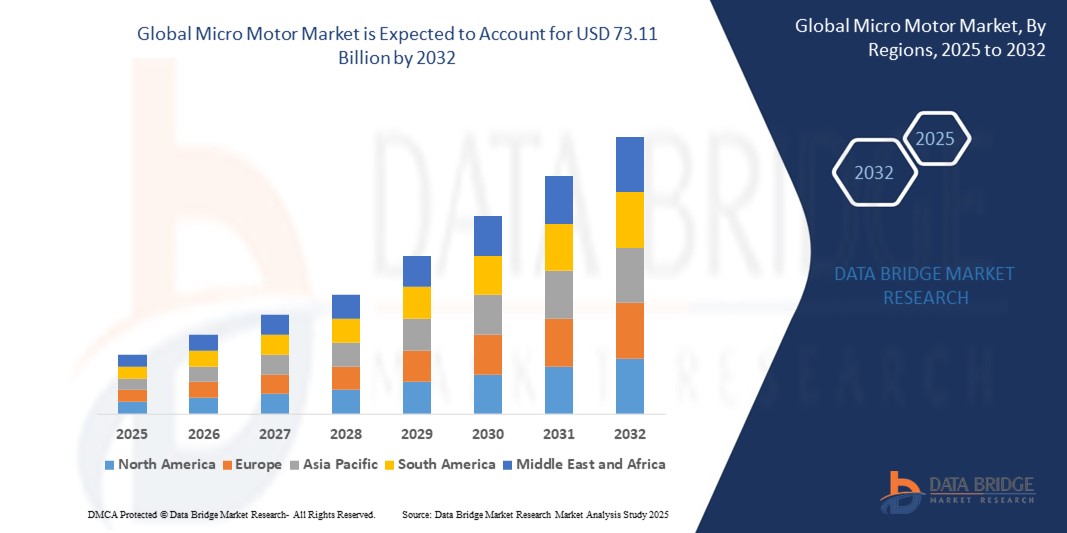

- The global micro motor market size was valued at USD 45.18 billion in 2024 and is expected to reach USD 73.11 billion by 2032, at a CAGR of 6.20% during the forecast period

- Market expansion is primarily driven by the increasing use of automation across industries including automotive, healthcare, aerospace, and consumer electronics, where compact and efficient motor solutions are essential

- In addition, rising demand for minimally invasive medical devices, robotic systems, and electric vehicles is fueling the demand for high-performance micro motors, positioning them as integral components of modern engineering solutions

Micro Motor Market Analysis

- Micro Motors, known for their compact size, high efficiency, and precision, are critical in applications requiring miniaturization and high torque performance, making them ideal for sectors such as medical devices, automotive systems, and industrial automation

- The growing emphasis on energy efficiency, combined with the rising adoption of electric mobility and robotic automation, continues to boost market demand for brushless DC motors, servo motors, and stepper motors in compact designs

- Furthermore, rapid developments in IoT devices and portable electronics have accelerated the need for innovative micro motor technologies, further enhancing market opportunities and global penetration

- Asia Pacific dominates the micro motor market with the largest revenue share of 34.81% in 2024, driven by rapid urbanization, increasing adoption of smart home technology, and expanding industrial automation across the region

- Asia-Pacific micro motor market is expected to grow at the fastest CAGR of 8.22% throughout the forecast period, driven by rapid industrialization, increasing adoption of automation, and the growing consumer electronics and automotive sectors in countries such as China, Japan, and India

- The DC micro motor segment holds the largest market revenue share of 62.11% in 2024, due to its high efficiency, compact design, and cost-effectiveness across a broad range of applications such as automotive systems and consumer electronics

Report Scope and Micro Motor Market Segmentation

|

Attributes |

Micro Motor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Micro Motor Market Trends

“Growing Demand for Miniaturization and Efficiency”

- A significant trend in the global micro motor market is the increasing demand for miniaturized motors that offer high power density and efficiency. This trend is driven by the need for smaller and lighter devices across various applications, including medical equipment, consumer electronics, and robotics

- Another prominent trend is the rising adoption of brushless DC (BLDC) motors. BLDC motors offer advantages such as higher efficiency, longer lifespan, and lower noise compared to brushed motors, making them increasingly popular in applications requiring precise control and reliability

- Advancements in materials and manufacturing technologies are leading to the development of more durable and high-performance micro motors. Innovations in magnetic materials and motor design are enabling the production of smaller yet more powerful motors

- The integration of micro motors with smart technologies and control systems is also a growing trend. This includes the use of advanced sensors and microcontrollers to enhance motor performance, provide feedback, and enable more sophisticated control functionalities

- The market is witnessing a rise in customized micro motor solutions tailored to specific application requirements. Manufacturers are increasingly collaborating with end-users to develop motors with specific performance characteristics, form factors, and integration features

Micro Motor Market Dynamics

Driver

“Increasing Adoption across Diverse Industries”

- The global micro motor market is primarily driven by the increasing adoption of micro motors in a wide range of industries. The growing use of micro motors in automotive applications, such as electric vehicles, power windows, and seat adjustments, is a significant driver

- The healthcare sector is a major driver for the micro motor market, with increasing demand for micro motors in medical devices such as surgical tools, insulin pumps, and dental equipment. The trend towards minimally invasive procedures and the development of advanced medical robotics further boost this demand

- The consumer electronics industry also significantly contributes to market growth, with micro motors being used in smartphones, cameras, wearable devices, and home appliances. The continuous demand for smaller and more feature-rich electronic products drives the need for compact micro motors

- The rising adoption of automation and robotics in industrial processes is another key driver for the micro motor market. Micro motors are essential components in various robotic systems, providing precise and efficient motion control

- The growing demand for micro motors in aerospace and defense applications, such as in drones, actuators, and precision instruments, further fuels the market's expansion

Restraint/Challenge

“High Initial Costs and Technical Complexities”

- The relatively high initial cost of advanced micro motor technologies, particularly BLDC motors and customized solutions, can be a restraint for broader adoption, especially in cost-sensitive applications and developing regions

- The technical complexities associated with the design, manufacturing, and control of micro motors can pose a challenge for both manufacturers and end-users. This includes the need for specialized expertise in motor design, materials science, and control systems

- Fluctuations in raw material prices, such as copper and rare earth magnets, can impact the manufacturing costs of micro motors and potentially affect market pricing and growth

- The increasing competition among a large number of micro motor manufacturers can lead to price pressures and potentially limit the profitability of some players in the market

- Ensuring the reliability and durability of micro motors in demanding operating conditions, such as extreme temperatures or high-stress environments, can be a significant challenge for manufacturers

Micro Motor Market Scope

The market is segmented on the basis of type, technology, application, and power consumption.

• By Type

On the basis of type, the micro motor market is segmented into AC and DC. The DC micro motor segment holds the largest market revenue share of 62.11% in 2024, due to its high efficiency, compact design, and cost-effectiveness across a broad range of applications such as automotive systems and consumer electronics. DC motors are particularly valued for their controllable speed and torque characteristics, making them suitable for battery-operated devices.

The AC micro motor segment is anticipated to grow at the fastest rate of 6.8% from 2025 to 2032, driven by increased usage in industrial automation, HVAC systems, and appliances. Their robustness, low maintenance, and ability to operate in harsh environments make them suitable for high-load applications.

• By Technology

On the basis of technology, the market is segmented into brushed and brushless micro motors. The brushed micro motor segment held a considerable revenue share in 2024, supported by its simple design and widespread adoption in low-cost applications such as toys, small appliances, and automotive accessories.

The brushless micro motor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its longer lifespan, better efficiency, and lower electromagnetic interference. These motors are increasingly preferred in precision-demanding applications such as medical devices, drones, and robotics.

• By Application

On the basis of application, the micro motor market is segmented into automotive, aerospace, agriculture equipment system, 3D printing, construction and mining equipment system, and medical equipment. The automotive segment accounted for the largest market revenue share of 22.41% in 2024, fueled by rising demand for compact motors in vehicle systems such as power windows, seat adjusters, and mirror controls.

The medical equipment segment is expected to grow at the fastest pace from 2025 to 2032 due to increasing use in surgical instruments, infusion pumps, and portable diagnostic equipment, where precision and reliability are paramount.

• By Power Consumption

On the basis of power consumption, the micro motor market is segmented into less than 11 volts, 12–24 volts, 25–48 volts, and more than 48 volts. The less than 11 volts segment dominates the market revenue share of 32.34% in 2024, favored for its low cost and efficiency of these micromotors have led to the increased adoption of several products that can function on low voltage.

The more than 48 volts segment is projected to grow at the fastest rate of 7.89% during the forecast period, especially in industrial and construction equipment systems, where higher power output is necessary for performance-intensive operations.

Micro Motor Market Regional Analysis

- Asia Pacific dominates the micro motor market with the largest revenue share of 34.81% in 2024, driven by rapid urbanization, increasing adoption of smart home technology, and expanding industrial automation across the region

- Consumers in the region highly value the convenience, advanced security features, and seamless integration offered by micro motors with other smart devices such as thermostats and lighting systems

- This widespread adoption is further supported by growing disposable incomes, government initiatives promoting smart cities, and the rising demand for efficient and connected solutions in both residential and commercial sectors, establishing micro motors as the preferred choice across Asia Pacific

U.S. Micro Motor Market Insight

The U.S. micro motor market holds a substantial share in North America, fueled by the extensive use of micro motors in various industries including medical, aerospace, and consumer electronics. The increasing focus on miniaturization of devices and the growing demand for energy-efficient motors drive the market in the U.S. The presence of key market players and technological advancements further contribute to the market's growth.

Europe Micro Motor Market Insight

The European micro motor market is projected to experience steady growth throughout the forecast period, driven by the rising adoption of micro motors in the automotive industry, particularly in electric vehicles and ADAS (Advanced Driver Assistance Systems). Stringent regulations regarding vehicle emissions and the increasing demand for comfort and convenience features in automobiles are fostering the adoption of micro motors. The region also sees significant demand from industrial automation and medical device sectors.

U.K. Micro Motor Market Insight

The U.K. micro motor market is anticipated to grow at a considerable CAGR during the forecast period, driven by the increasing application of micro motors in medical devices and the growing trend of automation in industries. The rising demand for personalized medical equipment and advancements in surgical robotics are key factors boosting the market. The U.K.'s focus on technological innovation and a well-established industrial sector support market expansion.

Germany Micro Motor Market Insight

The German micro motor market is expected to hold a significant share in Europe, fueled by the country's strong automotive industry and its focus on precision engineering. The high adoption of micro motors in automotive applications, including power windows, seat adjustments, and fuel pumps, drives the market. In addition, the growing investments in industrial automation and robotics further contribute to the demand for micro motors in Germany.

Asia-Pacific Micro Motor Market Insight

Asia-Pacific micro motor market is expected to grow at the fastest CAGR of 8.22% throughout the forecast period, driven by rapid industrialization, increasing adoption of automation, and the growing consumer electronics and automotive sectors in countries such as China, Japan, and India. The rising disposable incomes and growing demand for electronic gadgets and vehicles are key factors propelling the market in this region. Furthermore, the presence of a large number of micro motor manufacturers in APAC contributes to the affordability and accessibility of these motors.

Japan Micro Motor Market Insight

The Japan micro motor market is a key market in Asia-Pacific, driven by the country’s strong focus on technological advancements and precision manufacturing. The high adoption of micro motors in consumer electronics, medical devices, and robotics contributes significantly to the market. Japan's emphasis on miniaturization and energy efficiency further fuels the demand for advanced micro motor technologies.

China Micro Motor Market Insight

The China micro motor market accounts for the largest revenue share in the Asia Pacific region, attributed to the country's vast manufacturing sector and its role as a global hub for electronics and automotive components. The expanding middle class and increasing demand for consumer electronics, electric vehicles, and industrial automation are key factors driving the market in China. The availability of cost-effective micro motor options from domestic manufacturers also contributes to the market's growth.

Micro Motor Market Share

The Micro Motor industry is primarily led by well-established companies, including:

- Johnson Electric Holdings Limited (Hong Kong)

- Mitsuba Corp. (Japan)

- NIDEC CORPORATION (Japan)

- Bühler Motor GmbH (Germany)

- ABB (Switzerland)

- MABUCHI MOTOR CO. LTD. (Japan)

- maxon (Switzerland)

- Constar Micromotor Co., Ltd (China)

- DENSO CORPORATION (Japan)

- Siemens (Germany)

- FAULHABER Group (Germany)

- Jiangsu Fulling Motor Technology Co., Ltd (China)

- ABShot Tecnics S.L. (Spain)

- New Guanlian Motor (China)

- Telco (India)

- Shinano Kenshi Co. Ltd. (Japan)

- Precision Microdrives Limited (U.K.)

- Printed Motor Works (U.K.)

Latest Developments in Global Micro Motor Market

- In August 2024, Johnson Electric announced the launch of its innovative Air Suspension Pump Brushless Motor, designed to set new benchmarks in vehicle performance and efficiency. This motor is ideal for manufacturers aiming to enhance air suspension systems with reliable and efficient technology, supporting advancements in automotive comfort and durability

- In March 2024, Nidec Corporation revealed the development of a new air suspension motor for automobiles, created by Nidec Motor (Dalian). The compact, durable, and highly responsive motor drives the air compressor, supplying compressed air to the air tank, enhancing the vehicle’s suspension responsiveness and reliability

- In November 2023, Portescap introduced the 60ECF brushless DC slotted flat motor, expanding its flat motor portfolio. Featuring a 38.2mm body length and an outer rotor slotted design for improved heat management, this motor delivers torque up to 298 mNm and is well-suited for aerospace, robotics, and industrial automation applications, advancing performance in these sectors

- In April 2023, Honda recognized Mitsuba Corporation for its exceptional quality and punctual delivery during 2022. Mitsuba Corporation’s role as a key motor and micromotor supplier allowed Honda to focus on expanding its manufacturing capacity, highlighting the importance of reliable supply chain partnerships in the automotive industry

- In August 2022, Johnson Electric launched its steering wheel adjuster motor to improve comfort during long drives, enabling easy ingress and egress for drivers. The automatic steering column adjuster motor features an “intelligent mode” with “welcome mode” and “one-button switching mode,” facilitating precise linear and height adjustments to optimize driving posture and comfort

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.