Global Methanol Market

Market Size in USD Billion

CAGR :

%

USD

33.49 Billion

USD

48.73 Billion

2024

2032

USD

33.49 Billion

USD

48.73 Billion

2024

2032

| 2025 –2032 | |

| USD 33.49 Billion | |

| USD 48.73 Billion | |

|

|

|

|

Methanol Market Size

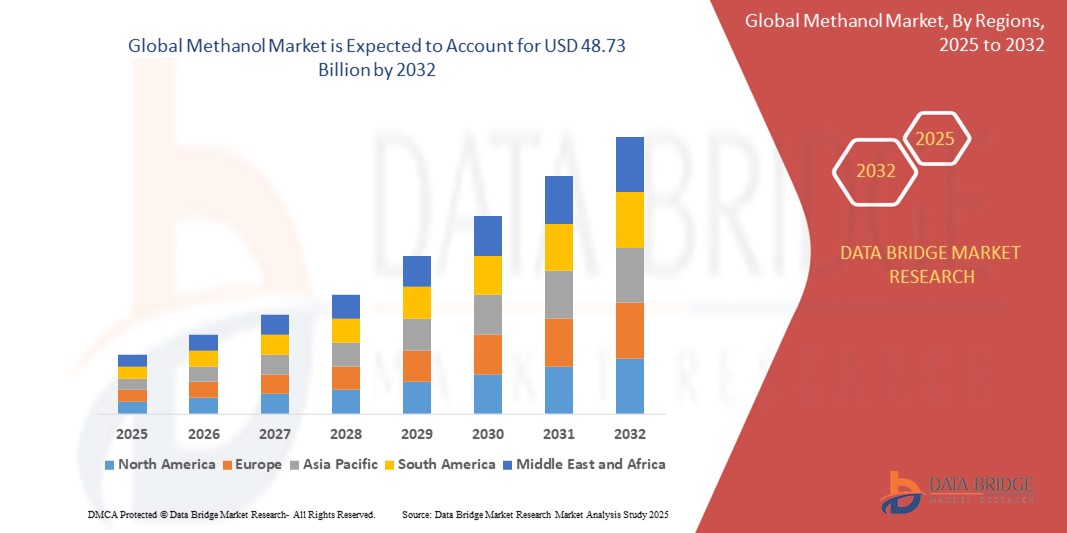

- The methanol market size was valued at USD 33.49 billion in 2024 and is expected to reach USD 48.73 billion by 2032, at a CAGR of 4.8% during the forecast period

- The market growth is largely fueled by the increasing demand for methanol as an alternative fuel and feedstock in various industries such as automotive, construction, and chemicals, driven by sustainability trends and energy diversification efforts

- Furthermore, the rise in formaldehyde-based resins and methanol-to-olefins (MTO) production, especially in Asia-Pacific economies, is strengthening global demand. These developments are accelerating the deployment of methanol in both traditional and emerging applications, thereby significantly boosting the industry's growth

Methanol Market Analysis

- Methanol, a widely used chemical and energy source, serves as a fundamental building block in the production of formaldehyde, acetic acid, and various petrochemical derivatives, and is increasingly used as an alternative fuel in marine and automotive sectors

- The escalating demand for methanol is primarily driven by its applications in energy, automotive, construction, and chemical manufacturing, alongside rising adoption of methanol-to-olefins (MTO) technology and clean fuel initiatives globally

- North America dominates the methanol market with the largest revenue share of 36.4% in 2025, led by the U.S., where abundant shale gas reserves have fueled significant methanol production capacity, making the region a key exporter and consumer of methanol across both fuel and non-fuel segments

- Asia-Pacific is expected to be the fastest-growing region in the methanol market during the forecast period, supported by rapid industrialization, expanding chemical manufacturing, and surging methanol consumption in countries like China and India, particularly in formaldehyde and MTO applications

- The formaldehyde segment is expected to lead the methanol application market with a share of 38.2% in 2025, owing to its continued demand in the production of resins used across construction, automotive, and furniture industries worldwide

Report Scope and Methanol Market Segmentation

|

Attributes |

Methanol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Methanol Market Trends

“Expansion of Methanol-to-Olefins (MTO) Technology and Green Methanol Adoption”

- A major and accelerating trend in the global methanol market is the growing deployment of Methanol-to-Olefins (MTO) technology, particularly in China. This trend is driven by the increasing need to diversify feedstocks for olefin production and reduce dependency on traditional crude oil-derived naphtha

- For instance, in May 2024, China’s Jiutai Energy Group announced the successful ramp-up of its 1.8 million tons/year MTO plant in Inner Mongolia, utilizing coal-based methanol as feedstock to produce ethylene and propylene, which are vital building blocks for plastics and synthetic materials

- Simultaneously, the global push for carbon neutrality is fueling the adoption of green methanol, which is produced from renewable sources like biomass, green hydrogen, and captured CO₂. This shift is supported by the maritime industry’s pivot to low-carbon fuels to meet IMO decarbonization targets

- In April 2024, Maersk took delivery of the world’s first dual-fuel container ship powered by green methanol and announced partnerships with European and Asian suppliers to establish a global green methanol supply chain

- Mitsubishi Gas Chemical Company, in March 2024, began pilot production of e-methanol using renewable electricity and captured CO₂ in Japan, reflecting a broader industry movement toward sustainable production pathways

- These developments highlight the growing emphasis on circular carbon solutions and alternative feedstocks within the methanol market. As industries transition to greener operations, methanol’s adaptability positions it as a cornerstone in decarbonization strategies across chemicals, fuels, and shipping

- The integration of advanced MTO processes and sustainable methanol initiatives is fundamentally reshaping the methanol market landscape. Companies like OCI, Proman, and Methanex are investing in low-carbon methanol plants, positioning themselves to lead in a future-focused, clean chemical economy

Methanol Market Dynamics

Driver

“Rising Demand for Cleaner Fuels and Petrochemical Feedstocks”

- The increasing global focus on clean energy transition and the need for more efficient petrochemical feedstocks are key drivers accelerating the demand for methanol across various industries

- For instance, in April 2024, OCI Global announced the launch of a low-carbon methanol product line, including bio-methanol and e-methanol, to meet the growing demand from shipping and fuel blending sectors. This move supports global decarbonization goals and offers industries a viable alternative to fossil-based fuels

- Methanol is gaining traction as a marine fuel due to International Maritime Organization (IMO) regulations aiming to reduce greenhouse gas emissions by 50% by 2050. Companies like Maersk and Proman are investing in methanol-powered ships, fueling upstream demand for clean methanol production

- In addition, methanol’s role as a key feedstock in formaldehyde, acetic acid, and olefin production supports its rising use in construction materials, paints, adhesives, and packaging. This demand is further amplified by post-pandemic industrial recovery and infrastructure investments in emerging economies

- The ability to produce methanol from various feedstocks—including natural gas, coal, and renewable resources—makes it a versatile and strategic chemical, appealing to both energy and chemical industries. This flexibility is crucial for markets seeking supply chain security and cost efficiency

- Furthermore, the adoption of MTO (Methanol-to-Olefins) technology is expanding rapidly in Asia, especially China, as petrochemical producers seek alternative pathways to produce high-value olefins. This trend not only boosts methanol consumption but also underpins the strategic importance of the molecule in modern chemical production

Restraint/Challenge

“Price Volatility of Feedstock and Environmental Concerns from Fossil-Based Methanol”

- A major challenge for the methanol market is the price volatility of key feedstocks such as natural gas and coal, which directly impacts production costs and profit margins. This volatility is particularly pronounced in regions where methanol production is heavily dependent on fossil fuels

- For instance, in October 2023, high natural gas prices in Europe prompted several methanol producers, including BASF and OCI, to temporarily curtail or scale down production, citing unsustainable operating costs. This kind of unpredictability in energy markets poses a constraint to stable methanol supply and investment planning

- In addition, coal-based methanol production, prevalent in China, faces increasing scrutiny due to its high carbon footprint. In March 2024, the Chinese government issued new environmental guidelines mandating emissions reduction for coal-to-chemical projects, directly impacting coal-based methanol producers like Yankuang Energy

- The environmental sustainability of methanol is also under debate. While green and blue methanol are gaining traction, the majority of global methanol production is still fossil-fuel-based, raising concerns among regulators and environmental groups about its long-term viability as a “clean fuel”

- Furthermore, establishing large-scale green methanol infrastructure remains capital-intensive, requiring significant investment in renewable hydrogen, carbon capture, and distribution systems. For example, in April 2024, Maersk acknowledged that limited green methanol availability could delay their fleet-wide transition unless supply chains scale rapidly

- Overcoming these restraints will require policy support, technological innovation, and collaboration across the energy, chemical, and maritime sectors to reduce production emissions and ensure a reliable, cost-effective supply of low-carbon methanol

Methanol Market Scope

The market is segmented on the basis of type, derivatives, sub-derivatives, end-user industry, and feedstock.

- By Type

On the basis of type, the methanol market is segmented into natural gas, coal, and others. The natural gas segment dominates the largest market revenue share in 2025, driven by its cost-effectiveness and widespread availability in key production regions such as North America, the Middle East, and parts of Asia. Natural gas-based methanol is widely favored due to its relatively lower carbon footprint compared to coal-based methods, supporting its role in clean fuel strategies and petrochemical feedstock applications.

The coal segment is anticipated to witness significant growth in regions like China where coal reserves are abundant and integrated coal-to-methanol processes are well established. However, growing environmental regulations may impact the long-term outlook of this segment, prompting investments in cleaner production technologies.

• By Derivatives

On the basis of derivatives, the methanol market is segmented into formaldehyde, acetic acid, MTBE, MMA, gasoline blending, biodiesel, DME, TAME, DMT, MTO/MTP, and others. The formaldehyde segment held the largest market revenue share in 2025, owing to its wide use in construction materials, adhesives, and wood products. The consistent demand for formaldehyde in producing resins like UF and PF supports its continued dominance.

The MTO/MTP (Methanol-to-Olefins/Methanol-to-Propylene) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing number of MTO plants in China as producers seek alternative routes to olefins amid crude oil volatility. This segment is gaining strategic relevance for its role in petrochemical integration.

• By Sub-Derivatives

On the basis of sub-derivatives, the methanol market is segmented into gasoline additives, olefins, UF/PF resins, VAM, polyacetals, MDI, PTA, acetate esters, acetic anhydride, fuels, and others. The UF/PF resins segment accounted for the largest market share in 2025, due to their extensive use in plywood, particle board, and laminates. These resins are critical in the construction and furniture sectors, particularly in Asia-Pacific.

The olefins segment is projected to grow rapidly through 2032, driven by demand for ethylene and propylene in plastics manufacturing, especially via MTO processes. Methanol's flexibility as a feedstock for olefin production enhances its value in petrochemical pathways.

• By End-User Industry

On the basis of end-user industry, the methanol market is segmented into construction, automotive, electrical and electronics, pharmaceuticals, packaging, paints and coatings, agriculture, and others. The construction segment accounted for the largest market revenue share in 2025, supported by the demand for methanol-derived formaldehyde resins used in engineered wood and insulation products. Urbanization and infrastructure growth across emerging economies further reinforce this trend.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the use of methanol in fuel blending and biodiesel production, especially in regions promoting alternative fuels to reduce carbon emissions.

• By Feedstock

On the basis of feedstock, the methanol market is segmented into coal, natural gas, and others. Natural gas dominated the market share in 2025, owing to its cleaner production process and greater availability in developed economies. It is the preferred choice for sustainable methanol synthesis and supports the production of low-carbon variants such as blue and green methanol.

The coal segment continues to be significant in China due to its integration with local energy policies and abundant reserves, although tightening environmental norms may impact its long-term viability.

Methanol Market Regional Analysis

- North America dominates the methanol market with the largest revenue share of 36.4% in 2024, driven by a strong presence of natural gas-based methanol production facilities and the rising demand for methanol in formaldehyde, acetic acid, and fuel blending applications

- Producers in the region benefit from the abundance of low-cost shale gas, which supports efficient and cleaner methanol manufacturing, making North America a key exporter to other global markets, particularly Europe and Asia

- This dominance is further supported by high levels of industrial activity, growing investments in methanol-based fuel alternatives such as biodiesel and MTBE, and strategic expansions by leading companies seeking to strengthen their supply chain resilience and meet rising domestic and international demand

U.S. Methanol Market Insight

The U.S. methanol market captured the largest revenue share of 81% within North America in 2025, fueled by the abundance of low-cost natural gas feedstock and the presence of major production facilities. The country is a key exporter of methanol to Europe and Asia, supported by its advanced infrastructure and favorable regulatory environment. The rising use of methanol in formaldehyde and MTBE production, along with increasing interest in methanol as a cleaner alternative fuel, continues to drive demand. Moreover, investments in methanol-to-gasoline (MTG) and methanol-based marine fuels are contributing to long-term growth in the U.S. methanol market

Europe Methanol Market Insight

The European methanol market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region’s shift toward sustainable and low-emission fuels. Stringent environmental regulations and the growing adoption of methanol in biodiesel and formaldehyde production are key growth drivers. The demand for acetic acid and olefins derived from methanol is rising across the region’s chemical and construction sectors. Additionally, Europe is witnessing increased investments in green and bio-methanol initiatives to meet decarbonization goals, further supporting market expansion

U.K. Methanol Market Insight

The U.K. methanol market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the demand for clean-burning fuels and chemical intermediates. The country's robust chemical manufacturing industry and focus on reducing carbon emissions are promoting the adoption of methanol in biodiesel blending and other industrial applications. Increasing investments in circular and green chemistry, along with research into using methanol as a hydrogen carrier and marine fuel, are expected to create significant growth opportunities

Germany Methanol Market Insight

The German methanol market is expected to expand at a considerable CAGR during the forecast period, fueled by rising demand for methanol derivatives in plastics, coatings, and automotive applications. Germany’s emphasis on industrial innovation and sustainability is promoting research into renewable methanol production, including waste-to-methanol and CO₂-based methanol. The country’s strong automotive and chemical manufacturing base continues to support the use of methanol as a versatile feedstock across multiple applications

Asia-Pacific Methanol Market Insight

The Asia-Pacific methanol market is poised to grow at the fastest CAGR of over 24% in 2025, driven by surging industrial demand, particularly in China, India, and Southeast Asia. The region's increasing consumption of methanol for olefins production through MTO/MTP technologies is a major driver, along with growing use in fuel blending and formaldehyde manufacturing. The presence of major coal-based methanol producers and cost-effective feedstocks in countries like China positions Asia-Pacific as the global hub for methanol production and consumption

Japan Methanol Market Insight

The Japan methanol market is gaining momentum due to growing demand in electronics, pharmaceuticals, and automotive applications. Japan's commitment to decarbonization and clean energy is spurring interest in green methanol and fuel cell technologies. The integration of methanol as a hydrogen carrier and alternative marine fuel is being actively explored to support Japan’s long-term sustainability goals. Moreover, Japan’s advanced manufacturing base is driving demand for high-purity methanol derivatives

China Methanol Market Insight

The China methanol market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country’s massive coal-based methanol capacity and its extensive use of methanol-to-olefins (MTO) technology. China is the world’s largest producer and consumer of methanol, with applications spanning construction, automotive, fuels, and chemicals. The government’s focus on alternative clean fuels and the rise of methanol-powered vehicles and marine fuels are further accelerating market growth. Strong domestic production, combined with expanding downstream applications, solidifies China’s dominant position in the global methanol market

Methanol Market Share

The methanol industry is primarily led by well-established companies, including:

- Methanex Corporation (Canada)

- Proman Infrastructure Services Pvt. Ltd. (Switzerland)

- SABIC (Saudi Arabia)

- Yankuang Energy Group Company Limited (China)

- ZPCIR (Iran)

- Celanese Corporation (Texas)

- BASF SE (Germany)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Mitsubishi Gas Chemical Company Inc. (Japan)

- Mitsui & Co., Ltd. (Japan),

- LyondellBasell Industries B.V. (U.S.)

- OCI (Netherlands)

- Metafrax Group (Russia)

- Sipchem Company (Saudi Arabia)

Latest Developments in Global Methanol Market

-

In March 2025, a German start-up launched a groundbreaking facility in Mannheim, pioneering the conversion of wastewater into clean methanol. This first-of-its-kind plant utilizes biogas from the local water treatment facility, combining it with green hydrogen to produce methanol. The German government has supported the initiative with a USD 2.2 million grant, recognizing its potential to drive demand for e-methanol in the future. The project exemplifies sustainable innovation, offering a promising alternative fuel source while reducing environmental impact. This advancement could set a precedent for similar facilities worldwide, fostering a cleaner and more efficient energy landscape

- In November 2024, Ohmium International, along with Spirare Energy, Breathe Applied Sciences, and the Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR), launched India’s first CO₂-to-green methanol facility. The plant utilizes Ohmium’s PEM electrolyzers to generate green hydrogen, which is then combined with captured CO₂ from the Singareni Thermal Power Plant to produce sustainable methanol. This initiative marks a significant step toward decarbonization and energy sustainability in India, reducing reliance on fossil fuels and advancing green hydrogen technology

- In November 2024, NTPC, India’s largest power producer, inaugurated the world’s first CO₂-to-methanol conversion plant at its Vindhyachal facility. This milestone, launched on NTPC’s 50th Raising Day, marks a significant advancement in carbon management and green fuel technologies. The plant captures CO₂ emissions from industrial processes and converts them into methanol using a specialized catalyst developed by NTPC. Additionally, NTPC deployed hydrogen-powered buses in Leh and introduced innovative green technologies, reinforcing its commitment to sustainable energy

- In July 2024, China continued expanding its methanol production capacity, with several companies increasing output to meet growing domestic and global demand. The country remains a dominant player in the methanol market, leveraging its adaptability as both a chemical feedstock and clean fuel. Despite challenges such as energy consumption policies and environmental regulations, China’s methanol capacity grew by 3.80 million metric tons per year, reaching 111.81 million metric tons. The expansion aligns with China’s broader strategy to support low-carbon energy solutions and industrial applications

- In January 2024, Celanese Corporation, in partnership with Mitsui & Co., launched carbon capture and utilization operations at its Fairway Methanol plant in Clear Lake, Texas. The facility captures 180,000 metric tons of CO₂ annually and converts it into 130,000 metric tons of methanol, marking a significant step toward sustainable methanol production. This initiative aligns with global efforts to reduce industrial emissions and promote low-carbon alternatives in the chemical industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Methanol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Methanol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Methanol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.