Global Medical Image Analysis Software Market

Market Size in USD Billion

CAGR :

%

USD

3.87 Billion

USD

7.10 Billion

2024

2032

USD

3.87 Billion

USD

7.10 Billion

2024

2032

| 2025 –2032 | |

| USD 3.87 Billion | |

| USD 7.10 Billion | |

|

|

|

|

Medical Image Analysis Software Market Size

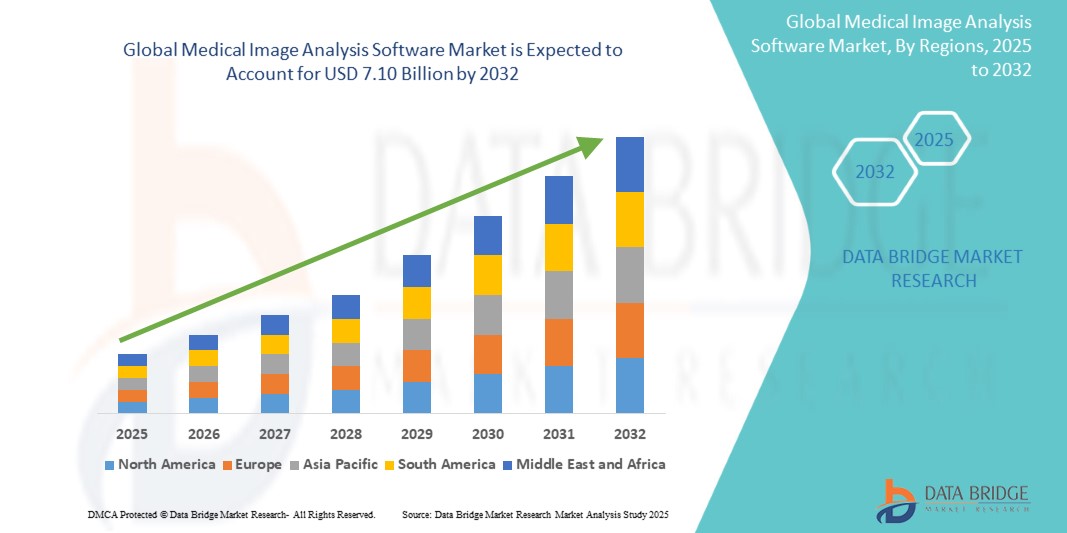

- The global medical image analysis software market was valued at USD 3.87 billion in 2024 and is expected to reach USD 7.10 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.9%, primarily driven by the anticipated development of new image analysis software

- This growth is driven by factors such as the New technological advancements in medical imaging systems, and rise in usage of medical imaging systems

Medical Image Analysis Software Market Analysis

- Medical image analysis software is a crucial tool in modern healthcare, enabling the visualization, interpretation, and quantification of medical imaging data from modalities such as MRI, CT, PET, ultrasound, and X-ray. These software systems support diagnostic accuracy, treatment planning, and research applications across various medical specialties, including radiology, cardiology, oncology, and neurology

- The demand for medical image analysis software is largely driven by the rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, which require accurate and early diagnosis

- The North America region dominates the medical image analysis software market due to its robust healthcare infrastructure, high volume of diagnostic imaging procedures, and widespread integration of AI and machine learning technologies in radiology departments. The presence of leading software vendors and strong regulatory support further strengthen the region’s market position

- For instance, in the U.S., radiologists increasingly rely on AI-enhanced image analysis tools to streamline workflow, improve diagnostic precision, and reduce manual errors, particularly in large hospital networks and imaging centers

- Globally, medical image analysis software is regarded as one of the most transformative tools in healthcare, second only to imaging modalities themselves. It plays a key role in automating image interpretation, enhancing diagnostic confidence, and supporting personalized treatment approaches, especially in complex disease cases

Report Scope and Medical Image Analysis Software Market Segmentation

|

Attributes |

Medical Image Analysis Software Key Market Insights |

|

Segments Covered |

By Type: Integrated Software and Standalone Software |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Image Analysis Software Market Trends

“Integration of Artificial Intelligence Enhancing Diagnostic Precision”

- A notable trend in medical image analysis is the incorporation of artificial intelligence (AI) and machine learning algorithms

- These technologies improve diagnostic accuracy by enabling automated detection and characterization of abnormalities across various imaging modalities

- For instance, deep learning models have demonstrated high efficacy in identifying patterns in medical images, facilitating early disease detection and personalized treatment planning

- The integration of AI also streamlines workflow efficiency, allowing for real-time analysis and reducing the burden on radiologists

Medical Image Analysis Software Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases Necessitating Advanced Imaging Solutions”

- The increasing incidence of chronic diseases such as cancer and cardiovascular conditions is propelling the demand for sophisticated medical image analysis software

- Early and accurate diagnosis is crucial for effective management of these diseases, underscoring the need for advanced imaging technologies

For instance,

- The surge in cancer cases has led to a heightened reliance on imaging modalities such as MRI and CT scans, which require robust analysis software to interpret complex data accurately

- According to a various articles published by National Center for Biotechnology Information and other sources, aging is a strong risk factor for many chronic diseases. And, the impact of an aging population on the prevalence of chronic diseases are also increases

- Therefore, the aging global population contributes to the increased prevalence of chronic conditions, further driving the market for medical image analysis solutions

Opportunity

“Cloud-Based Solutions Expanding Accessibility and Collaboration”

- The growing adoption of cloud-based medical image analysis software is one of the most promising opportunities in the market. These solutions are transforming the way medical images are stored, accessed, analyzed, and shared

- Cloud-based platforms enable healthcare professionals to access imaging data and analysis tools remotely, allowing for real-time collaboration between radiologists, physicians, and specialists across different locations. This is particularly valuable in rural or underserved areas where access to expert diagnostics is limited

- Cloud infrastructure streamlines the process of image sharing, storage, and retrieval, significantly reducing turnaround time

For instance,

- According to a study published in Frontiers in Digital Health (2023), cloud-based PACS (Picture Archiving and Communication Systems) paired with AI tools led to a 25% improvement in early-stage cancer detection in community hospitals in Southeast Asia, highlighting their potential in improving public health outcomes.

- Cloud platforms facilitate the integration of AI and machine learning tools for advanced diagnostics. For instance, cloud-based AI algorithms can process large image datasets, detect anomalies (such as tumors, fractures, vessel blockages), and even prioritize urgent cases for immediate attention. Hence, all these factors boost the growth of market during the forecast period

Restraint/Challenge

“High Costs and Data Privacy Concerns Limiting Adoption”

- Advanced image analysis software, especially those with AI capabilities—requires substantial investment in hardware, software licenses, integration services, and staff training. Smaller hospitals, clinics, and diagnostic centers may find it financially difficult to implement such systems without external funding or government support

- To maintain optimal performance, these systems often require regular software updates, cybersecurity protocols, and IT infrastructure maintenance, further adding to operational costs

For instance,

- According to a study published in Frontiers in Digital Health (2023), cloud-based PACS (Picture Archiving and Communication Systems) paired with AI tools led to a 25% improvement in early-stage cancer detection in community hospitals in Southeast Asia, highlighting their potential in improving public health outcomes

- A 2023 article in the Journal of Biomedical Informatics addresses security measures for EHR-based precision medicine research, highlighting the importance of robust data access procedures to minimize privacy risks

- Medical imaging systems handle highly sensitive patient data. Any breach or unauthorized access can lead to significant ethical, legal, and financial repercussions. Concerns over HIPAA compliance (in the U.S.), GDPR (in Europe), and other local data protection laws create barriers for cloud adoption, particularly when using third-party servers. Hence, all these factors ultimately hindering the overall growth of the market

Medical Image Analysis Software Market Scope

The market is segmented on the basis type, image type, modality, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Image Type |

|

|

By Modality |

|

|

By Application

|

|

|

By End User |

|

Medical Image Analysis Software Market Regional Analysis

“North America is the Dominant Region in the Medical Image Analysis Software Market”

- North America dominates the medical image analysis software market, primarily due to its well-established healthcare infrastructure, high healthcare expenditure, and widespread adoption of advanced imaging technologies.

- The United States holds the largest market share in the region, fueled by the growing prevalence of chronic diseases like cancer, cardiovascular disorders, and neurological conditions that require diagnostic imaging.

- The presence of major industry players, such as GE Healthcare, IBM Watson Health, and Agfa-Gevaert, supports innovation and adoption of AI-powered image analysis platforms.

- Favorable reimbursement policies and strong R&D investments in healthcare IT further reinforce the market position.

- The U.S. has also seen increasing integration of AI and machine learning in diagnostic imaging, leading to greater demand for software that improves image interpretation, disease detection, and clinical workflow efficiency.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to witness the fastest growth in the Medical Image Analysis Software market, driven by a surge in imaging procedure volumes and growing investments in digital health.

- Rapid improvements in healthcare infrastructure, rising government initiatives promoting early disease detection, and increased access to diagnostic services are propelling the market forward.

- Countries such as China, India, South Korea, and Japan are key contributors. China and India are benefiting from large patient populations, increasing urbanization, and improved access to healthcare facilities.

- Japan, being technologically advanced, is at the forefront of adopting AI-based diagnostic tools and hybrid imaging modalities in clinical practice.

- In addition, the rising number of private diagnostic centers and partnerships with international healthcare IT companies are accelerating the adoption of advanced image analysis software across emerging economies in Asia-Pacific.

Medical Image Analysis Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- General Electric (U.S.)

- Hitachi, Ltd. (Japan)

- Shimadzu Corporation (Japan)

- Siemens (Erlangen, Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hologic, Inc. (U.S.)

- SAMSUNG (Seoul, South Korea)

- Fujifilm Holdings Corporation (Tokyo, Japan)

- Esaote SPA (Italy)

- Canon Medical Systems Corporation (Japan)

- Shanghai United Imaging Healthcare Co., LTD. (China)

- Agfa-Gevaert Group (Belgium)

- Barco (Belgium)

- Agilent Technologies, Inc. (U.S.)

- ALMA IT SYSTEMS SL (Spain)

- Pie Medical Imaging B.V. (Netherlands)

- Ampronix (U.S.)

- Capsa Healthcare (U.S.)

- Carestream Healthcare (U.S.)

Latest Developments in Global Medical Image Analysis Software Market

- In March 2025, Siemens Healthineers announced the release of its next-generation AI-powered image analysis platform AI-Rad Companion 3.0, which integrates seamlessly with PACS systems to assist in diagnosing chest, brain, and musculoskeletal abnormalities. The new version includes multimodal support, advanced segmentation, and annotation tools powered by deep learning, enabling radiologists to detect subtle pathologies with greater precision and speed.

- In February 2025, GE HealthCare launched TrueView™, an advanced cloud-based medical image analysis software that supports 3D and 4D imaging with automated lesion detection and volume quantification. TrueView is designed to support remote diagnostics and collaborative workflows, improving the efficiency and accuracy of image interpretation, particularly in oncology and cardiology.

- In January 2025, Philips Healthcare unveiled updates to its IntelliSpace AI Workflow Suite, focusing on integrating real-time analytics and AI-assisted triage for emergency imaging. The suite now supports cross-modality image fusion and enhanced data interoperability, which streamlines decision-making in time-sensitive cases such as strokes and trauma diagnostics.

- In November 2024, Canon Medical Systems introduced Altivity, a new AI-enhanced software suite that applies machine learning algorithms to MRI and CT scans for rapid reconstruction, noise reduction, and diagnostic insight. The software was showcased at RSNA 2024 and demonstrated the capability to reduce scan times while maintaining high-resolution imaging, significantly enhancing patient throughput and diagnostic confidence.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.