Global High Throughput Screening Market

Market Size in USD Billion

CAGR :

%

USD

39.66 Billion

USD

72.59 Billion

2024

2032

USD

39.66 Billion

USD

72.59 Billion

2024

2032

| 2025 –2032 | |

| USD 39.66 Billion | |

| USD 72.59 Billion | |

|

|

|

High Throughput Screening Market Analysis

The high throughput screening market is experiencing significant growth, driven by its essential role in accelerating the drug discovery process. High throughput screening technology allows researchers to rapidly test a large number of biological or chemical substances, which has become crucial in identifying potential drug candidates. As pharmaceutical companies and research institutions continue to focus on the development of novel therapies, the demand for high throughput screening methods is increasing. The market is also witnessing the integration of advanced technologies such as automation, robotics, and artificial intelligence, which are enhancing the efficiency and accuracy of screenings. This integration is helping to streamline the entire process, making it faster and more cost-effective.

The growing focus on personalized medicine, along with the rise in chronic diseases and infectious diseases, is further fuelling the market's expansion. In addition, the increasing adoption of high throughput screening in academic research and biotechnology sectors is contributing to market growth. Research organizations and pharmaceutical companies are increasingly investing in these technologies to improve research outcomes and bring new treatments to market more quickly. With continued advancements in technology and a shift towards more efficient drug discovery methods, the high throughput screening market is expected to maintain its growth trajectory in the coming years.

High Throughput Screening Market Size

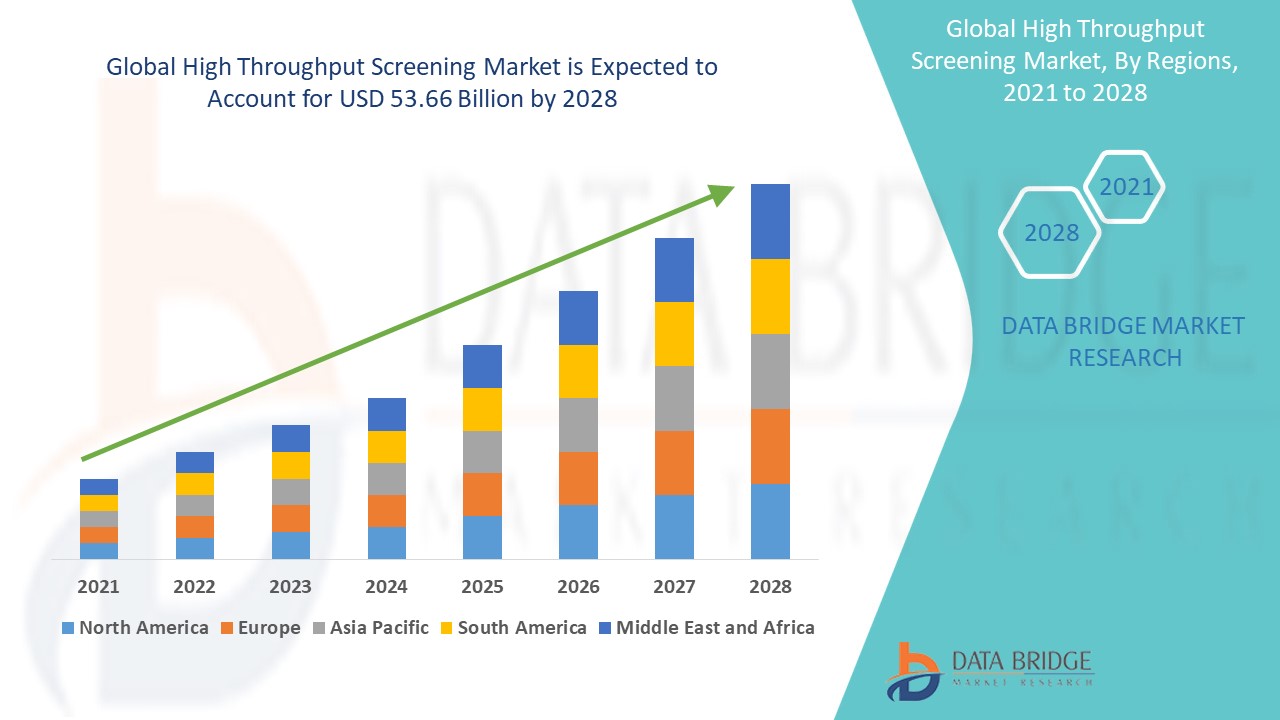

The high throughput screening market size was valued at USD 39.66 billion in 2024 and is projected to reach USD 72.59 billion by 2032, with a CAGR of 7.85 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

High Throughput Screening Market Trends

"Increasing Adoption of Advanced Infusion Devices”

The increasing automation in screening processes is a key trend in the high throughput screening market. Automation technologies are being integrated into laboratory settings to streamline the screening of compounds, allowing for faster, more accurate, and more efficient processes. Robotic systems are particularly at the forefront of this trend, enabling high-speed handling of large volumes of samples with minimal human intervention. These automated systems can perform repetitive tasks such as liquid handling, sample preparation, and data collection with high precision, which reduces the risk of errors and improves consistency.

The automation trend is also driving the scalability of screening efforts. Researchers can now process thousands of samples simultaneously, which would have been impractical with manual methods. This capacity allows pharmaceutical companies and research institutions to accelerate the drug discovery process, identifying potential candidates for treatment faster than ever before.

In addition, automation systems are being designed to work seamlessly with advanced data analysis tools. This integration allows for real-time data collection and analysis, further enhancing the overall speed and efficiency of the screening process. By reducing manual labour and optimizing workflow, automation is making the screening process not only faster but also more cost-effective, driving significant advancements in drug discovery and development.

Report Scope High Throughput Screening Market Segmentation

|

Attributes |

High Throughput Screening Key Market Insights |

|

Segments Covered

|

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), PerkinElmer (U.S.), Tecan Trading AG (Switzerland), Axxam S.p.A. (Italy), Merck KGaA, Darmstadt (Germany), Hamilton Company (U.S.), Corning Incorporated (U.S.), Aurora Biomed Inc. (Canada), General Electric Company (U.S.), Beckman Coulter, Inc. (U.S.), DiaSorin S.p.A. (Italy), Charles River Laboratories (U.S.), AstraZeneca (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

High Throughput Screening Market Definition

High throughput screening is a scientific method used to quickly and efficiently test large numbers of biological or chemical substances to identify potential candidates for drug development or other therapeutic purposes. It involves the automated process of screening thousands to millions of compounds, biological samples, or genetic materials to evaluate their effects on specific targets, such as proteins or cells. This approach allows researchers to rapidly identify promising substances that may have the potential to become new treatments, speeding up the drug discovery process. By automating and optimizing the screening process, high throughput screening improves the efficiency, accuracy, and scalability of research efforts.

High Throughput Screening Market Dynamics

Drivers

- Rising Demand for Drug Discovery and Development

The growing global demand for new and effective drugs to combat a wide range of diseases, including chronic conditions and infectious diseases, is a significant driver for the high throughput screening (HTS) market. As pharmaceutical companies and research institutions focus more on developing innovative drugs and treatments, the need for efficient, high-volume testing becomes increasingly important. HTS enables researchers to test thousands of compounds in a short time, which speeds up the drug discovery process and accelerates the identification of promising drug candidates. This process is crucial for addressing the increasing prevalence of diseases worldwide and reducing the time it takes to bring new treatments to market.

- Technological Advancements in Automation and Artificial Intelligence

The integration of automation technologies and artificial intelligence (AI) is revolutionizing the HTS process. Automation has drastically improved the speed, accuracy, and efficiency of screening processes, reducing human error and allowing for the testing of vast numbers of compounds simultaneously. Moreover, AI and machine learning algorithms are being employed to analyze large datasets, identify patterns, and make more informed predictions about which compounds could be most effective. These technological advancements not only enhance the capabilities of HTS but also reduce operational costs, making the process more cost-effective and accessible to a wider range of organizations.

Opportunities

- Expansion of Personalized Medicine

Personalized medicine is an area of growing interest and a promising opportunity for the high throughput screening market. As healthcare shifts toward more customized treatment approaches, HTS can play a vital role in identifying compounds that are tailored to an individual's genetic makeup, lifestyle, and specific disease conditions. By using HTS to identify more precise therapeutic candidates for individual patients, healthcare providers can offer treatments that are more effective and have fewer side effects. This approach is expected to drive the demand for HTS services, particularly in the development of personalized cancer therapies and targeted treatments for other chronic diseases.

- Growth in Biotechnology and Academic Research

The increasing investment in biotechnology research and academic institutions presents a significant opportunity for the HTS market. Many biotech firms and academic research labs are increasingly adopting HTS techniques for drug discovery, genetic research, and biomarker development. As the biotechnology sector continues to expand, the demand for advanced screening technologies is expected to grow, providing a significant opportunity for HTS providers. In addition, collaborations between pharmaceutical companies and academic research institutions to discover new drugs and therapies are likely to further drive the need for HTS systems. As these sectors continue to develop, HTS technology will be crucial for exploring a wider range of compounds and biological targets.

Restraints/Challenges

- High Initial Setup Costs

One of the main restraints for the high throughput screening market is the high cost associated with the initial setup of HTS systems. The sophisticated equipment, automation systems, and specialized software required for HTS can be expensive to acquire and maintain. For smaller research institutions, biotech companies, and academic labs with limited budgets, the high upfront investment may be a significant barrier. These costs, coupled with ongoing maintenance and operational expenses, may hinder the adoption of HTS in smaller settings. Consequently, the capital-intensive nature of HTS systems can slow the growth of the market in some regions or sectors.

- Data Management and Analysis Complexity

One of the primary challenges faced by the high throughput screening market is the complexity of managing and analyzing the massive amounts of data generated during the screening process. HTS involves testing thousands to millions of compounds, each of which can produce vast amounts of data that need to be processed, stored, and analyzed efficiently. The sheer volume of data can overwhelm traditional data management systems, and even advanced systems may struggle to provide accurate insights in real-time. In addition, the interpretation of data requires sophisticated algorithms and skilled analysts to identify relevant patterns and make decisions. This complexity in data management and analysis can create bottlenecks, slow down the process, and limit the effectiveness of HTS in some cases.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

High Throughput Screening Market Scope

The market is segmented on the basis of product and services, technology, application, and end users growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product and Services

- Reagents and Assay Kits

- Instruments

- Consumables and Accessories

- Software

- Services

Technology

- Cell-Based Assays

- Lab-On-A-Chip

- Ultra-High-Throughput Screening

- Bioinformatics

- Label-Free Technology

Application

- Target Identification and Validation

- Primary and Secondary Screening

- Toxicology Assessment

- Other

End Users

- Pharmaceutical and Biotechnology Companies

- Academic and Government Institutes

- Contract Research Organizations

- Others

High Throughput Screening Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product and services, technology, application, and end users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the high throughput screening market, primarily driven by technological advancements in the U.S. The region is home to numerous pharmaceutical companies and research institutions that heavily invest in drug discovery processes. With a focus on innovative technologies, automation, and artificial intelligence in screening systems, North America has established itself as a leader in the HTS market. In addition, the presence of key players and strong healthcare infrastructure further supports the dominance of the region. The ongoing research activities, combined with favourable government initiatives, continue to foster growth in North America’s HTS market, positioning it as the largest market share holder globally.

Asia-Pacific is expected to be the fastest-growing region in the high throughput screening market. The region is experiencing significant growth driven by the increasing efforts for new pharmaceutical molecule development, especially in countries such as China and India. In addition, the adoption of newer technologies and an expanding biotechnology sector are key factors accelerating the demand for high throughput screening solutions. As the region continues to improve its research capabilities and infrastructure, coupled with a growing focus on drug discovery, Asia-Pacific is anticipated to see rapid growth and become a major player in the global HTS market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

High Throughput Screening Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

High Throughput Screening Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- PerkinElmer (U.S.)

- Tecan Trading AG (Switzerland)

- Axxam S.p.A. (Italy)

- Merck KGaA, Darmstadt (Germany)

- Hamilton Company (U.S.)

- Corning Incorporated (U.S.)

- Aurora Biomed Inc. (Canada)

- General Electric Company (U.S.)

- Beckman Coulter, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- Charles River Laboratories (U.S.)

- AstraZeneca (U.S.)

Latest Developments in High Throughput Screening Market

- In April 2024, Metrion Biosciences enhanced its High Throughput Screening (HTS) services by adding access to Enamine’s vast compound libraries. This collaboration will allow Metrion to offer greater flexibility and efficiency in screening and target identification. By utilizing Enamine’s largest compound library, researchers can access specialized screening sets for drug discovery, optimizing hit expansion and structure-activity relationship studies. This integration will improve diversity and cost-efficiency in drug development, allowing Metrion to support its global clients more effectively

- In February 2023, PerkinElmer launched the EnVision Nexus Multimode Plate Reader, a cutting-edge research and discovery tool designed to improve research workflows. This new multimode plate reader will enhance research efficiency and accelerate scientific discovery by providing precise and versatile detection capabilities across various research applications. The technology aims to streamline processes, offering faster and more reliable results that can drive innovation in drug discovery, disease research, and other scientific fields

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.